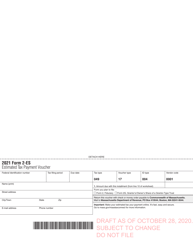

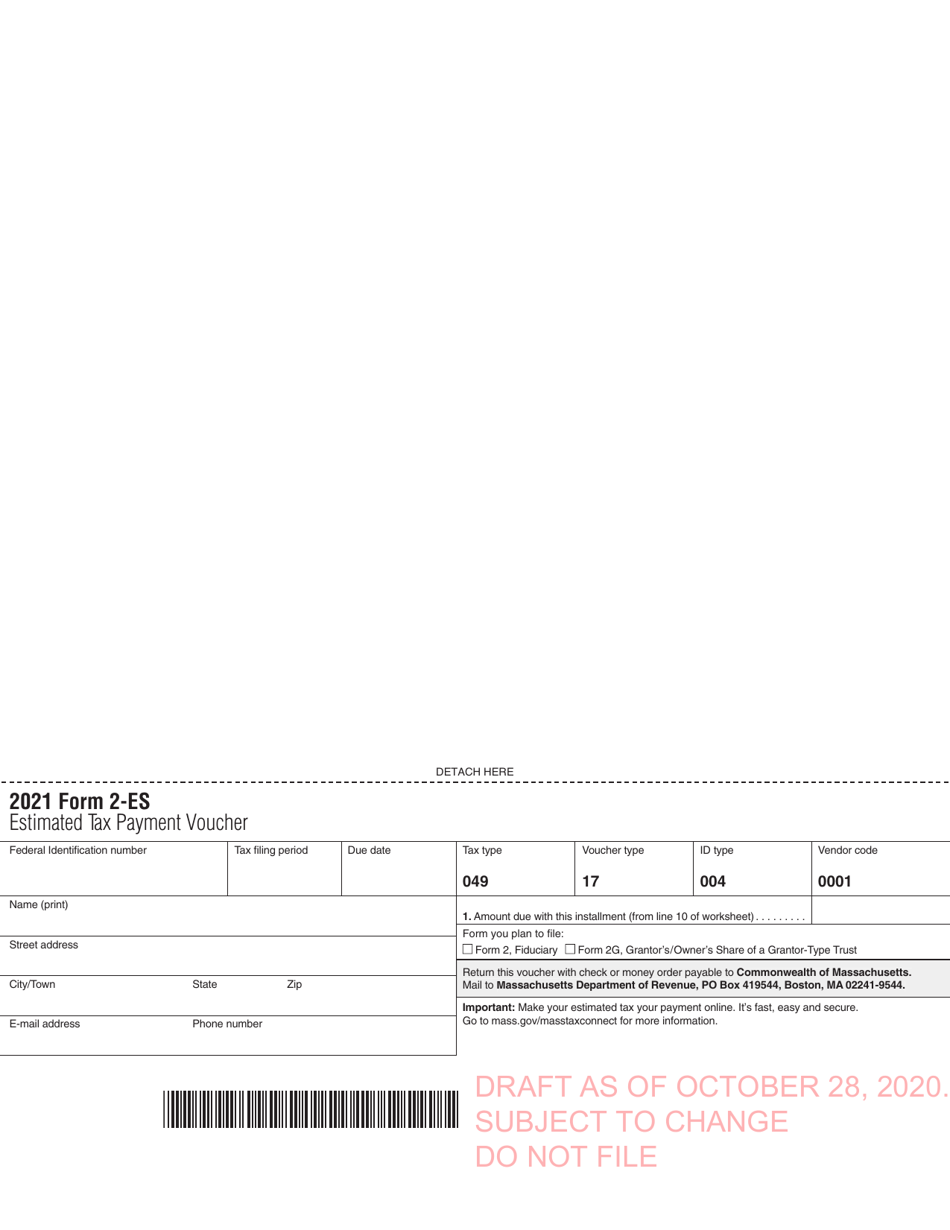

Form 2-ES Estimated Tax Payment Voucher - Draft - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2-ES?

A: Form 2-ES is an Estimated Tax Payment Voucher.

Q: What is the purpose of Form 2-ES?

A: The purpose of Form 2-ES is to make estimated tax payments to the state of Massachusetts.

Q: Who needs to file Form 2-ES?

A: Individuals or businesses who expect to owe tax to Massachusetts and meet certain income requirements must file Form 2-ES.

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made to the state to prepay income tax liability.

Q: How often do I need to make estimated tax payments?

A: Estimated tax payments for Massachusetts are generally due on a quarterly basis.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.