This version of the form is not currently in use and is provided for reference only. Download this version of

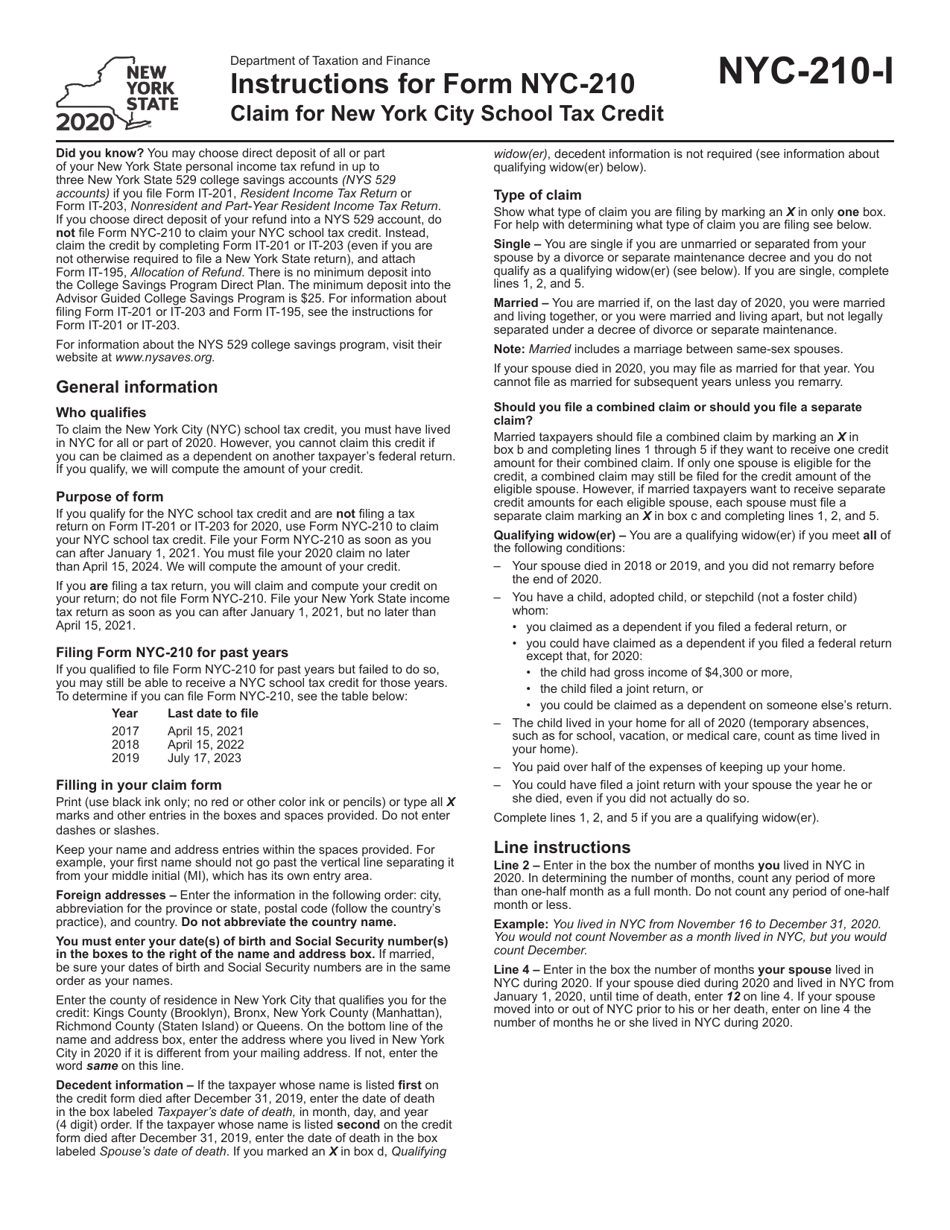

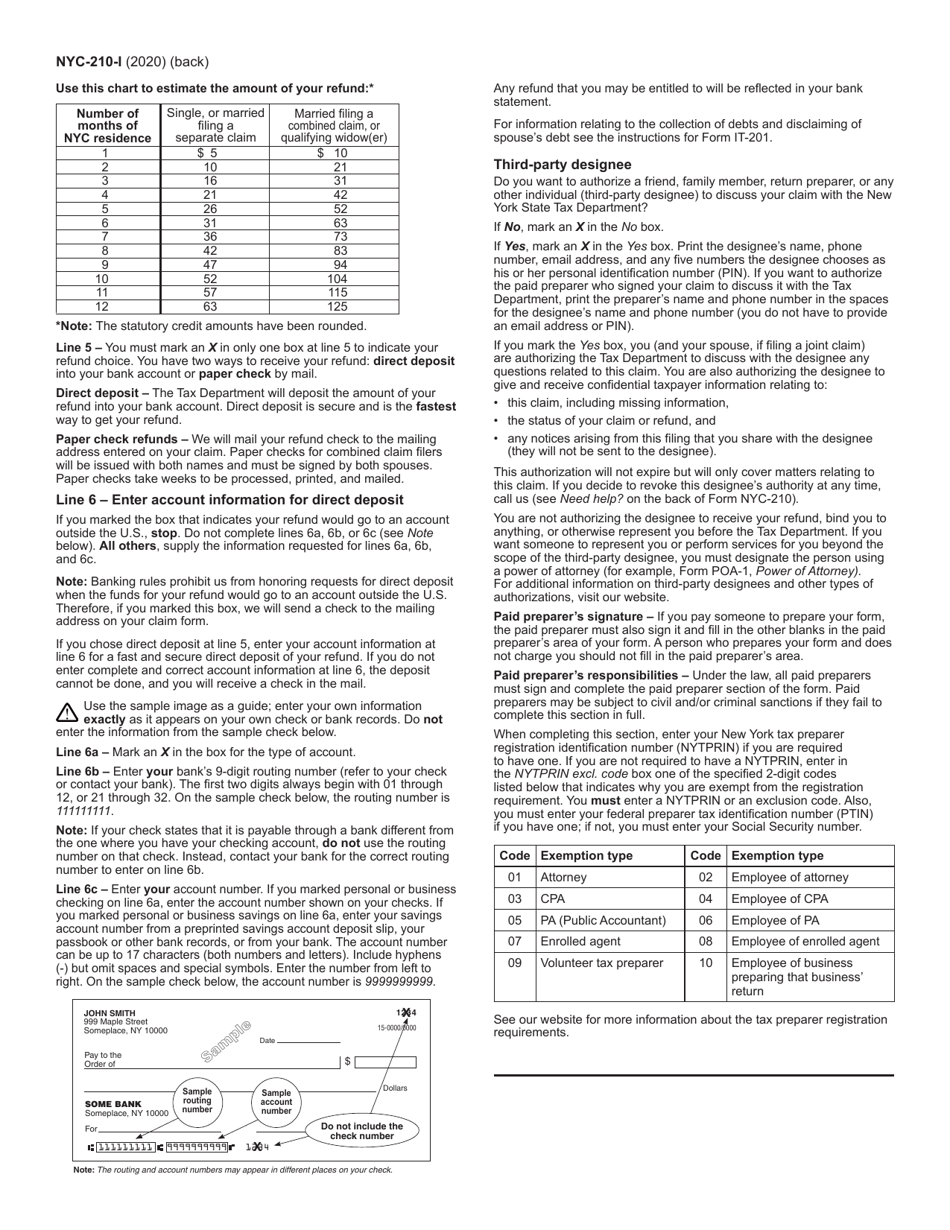

Instructions for Form NYC-210

for the current year.

Instructions for Form NYC-210 Claim for New York City School Tax Credit - New York

This document contains official instructions for Form NYC-210 , Claim for New York City School Tax Credit - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form NYC-210?

A: Form NYC-210 is a form used to claim the New York City School Tax Credit in the state of New York.

Q: Who can use Form NYC-210?

A: Residents of New York City who paid taxes to support the city's public school system can use Form NYC-210.

Q: What is the New York City School Tax Credit?

A: The New York City School Tax Credit is a credit that can be claimed by eligible residents to help offset the cost of school taxes.

Q: What expenses can be claimed on Form NYC-210?

A: Only school taxes paid in New York City can be claimed on Form NYC-210.

Q: What documents do I need to include with Form NYC-210?

A: You will need to include proof of payment of your New York City school taxes, such as a tax bill or receipt.

Q: When is the deadline to file Form NYC-210?

A: The deadline to file Form NYC-210 is generally April 15th, unless it falls on a weekend or holiday, in which case the deadline is extended.

Q: Is the New York City School Tax Credit refundable?

A: No, the New York City School Tax Credit is non-refundable, which means it can only be used to offset your tax liability.

Q: Can I claim the New York City School Tax Credit if I rent my home?

A: Yes, renters who pay school taxes as part of their rent can still claim the New York City School Tax Credit.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.