This version of the form is not currently in use and is provided for reference only. Download this version of

Form T746

for the current year.

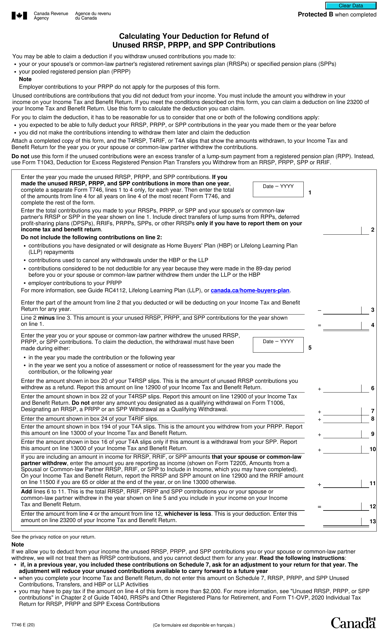

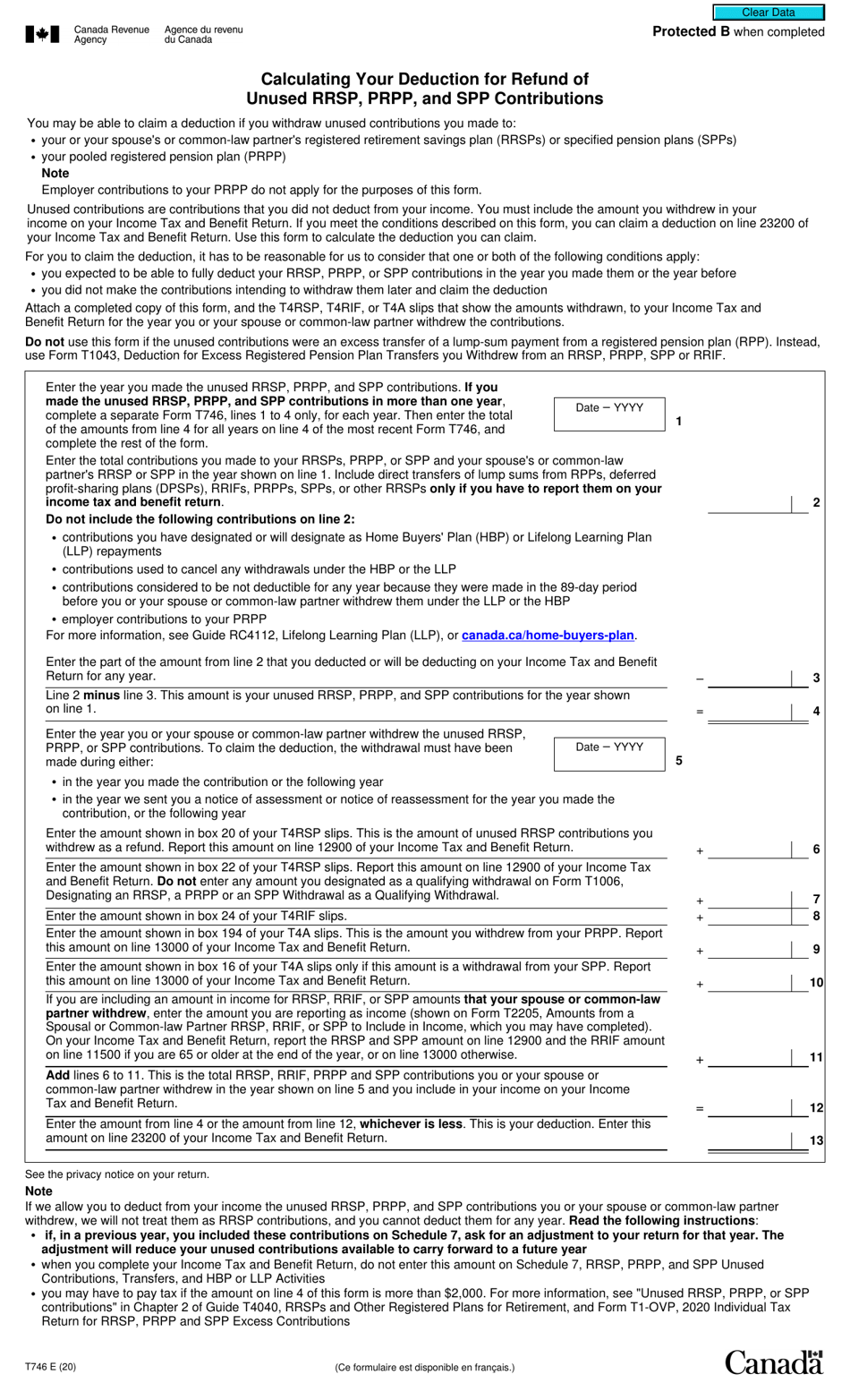

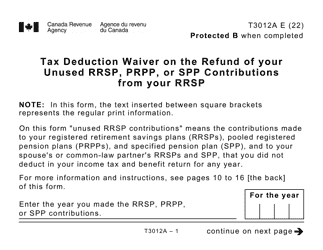

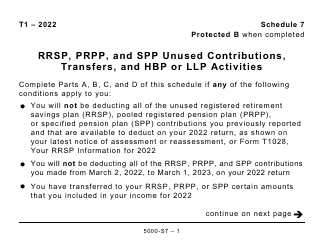

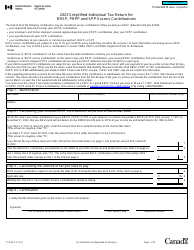

Form T746 Calculating Your Deduction for Refund of Unused Rrsp, Prpp, and Spp Contributions - Canada

Form T746, Calculating Your Deduction for Refund of Unused RRSP, PRPP, and SPP Contributions, is used in Canada for calculating the amount of deduction you can claim when you withdraw contributions from your Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP). It helps determine the portion of the withdrawn amount that can be considered as a refund of previously claimed contributions, and therefore, not subject to tax.

Individual taxpayers in Canada who want to calculate their deduction for refund of unused RRSP (Registered Retirement Savings Plan), PRPP (Pooled Registered Pension Plan), and SPP (Specified Pension Plan) contributions file the Form T746.

FAQ

Q: What is Form T746?

A: Form T746 is a form used in Canada to calculate your deduction for the refund of unused RRSP, PRPP, and SPP contributions.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan.

Q: What does SPP stand for?

A: SPP stands for Specified Pension Plan.

Q: Why would I need to calculate my deduction for refund of unused contributions?

A: You may be eligible to claim a deduction for any unused contributions to your RRSP, PRPP, or SPP.

Q: How do I complete Form T746?

A: You will need to provide your personal information and detailed information about your RRSP, PRPP, and SPP contributions.

Q: Is there a deadline to submit Form T746?

A: The deadline to submit Form T746 is typically the same as the deadline for filing your income tax return in Canada.

Q: Can I claim a deduction for unused contributions to my RRSP, PRPP, or SPP in the United States?

A: No, Form T746 and the deduction for unused contributions are specific to Canada's tax system.