This version of the form is not currently in use and is provided for reference only. Download this version of

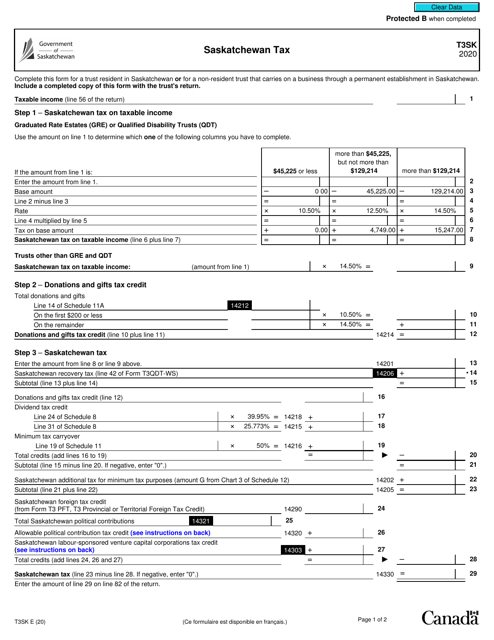

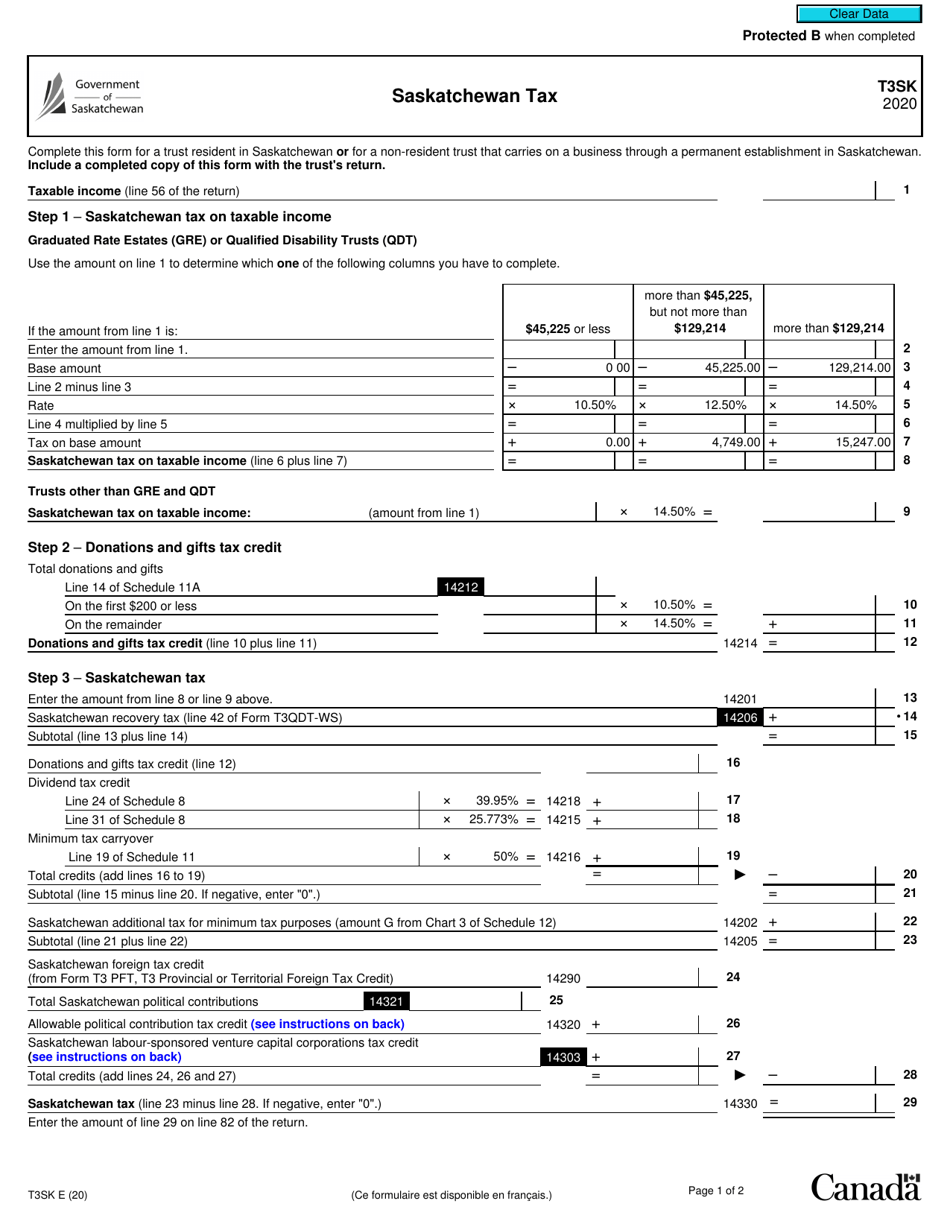

Form T3SK

for the current year.

Form T3SK Saskatchewan Tax - Canada

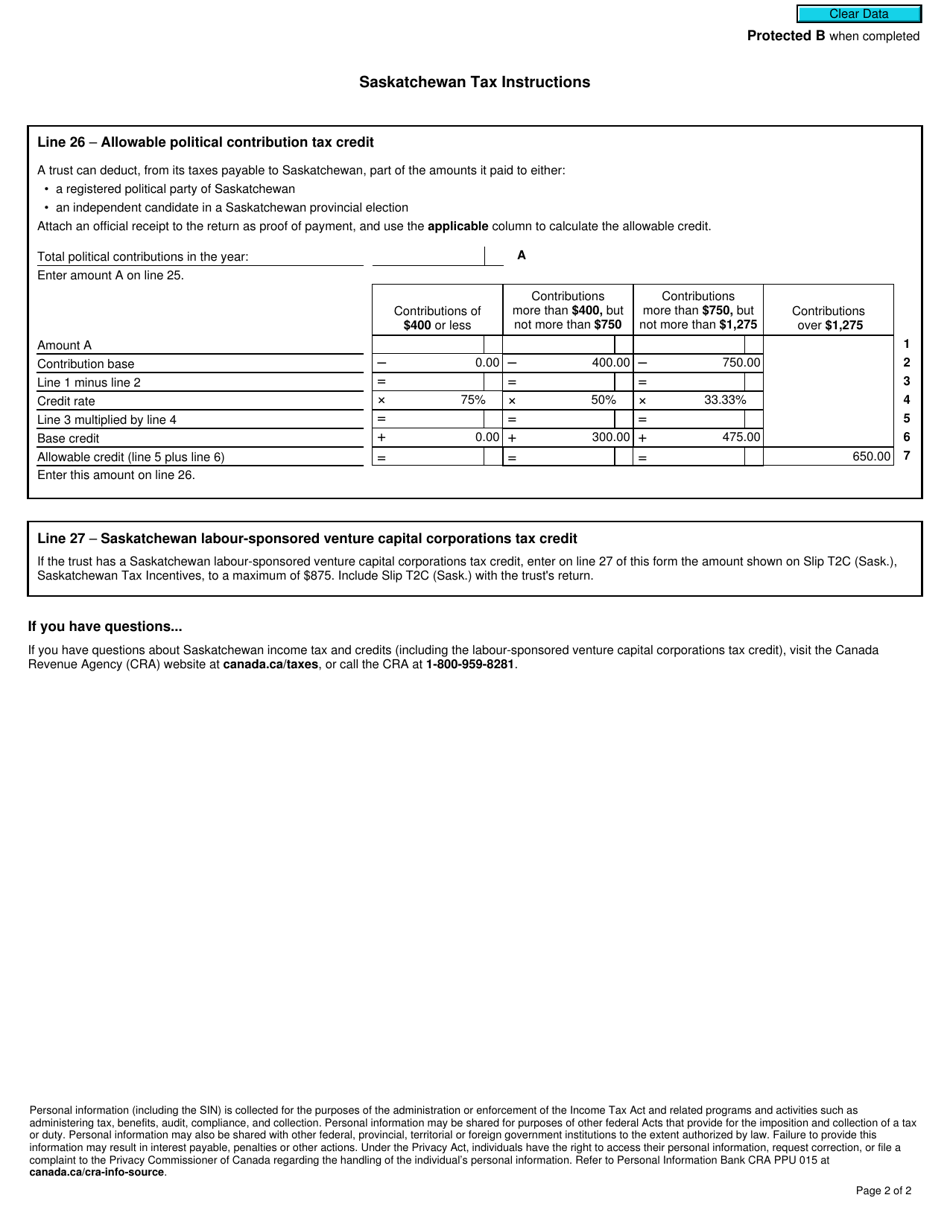

Form T3SK, also known as the "Saskatchewan Tax Schedule," is used for reporting income earned in the province of Saskatchewan, Canada. It is filed along with the T3 Trust Income Tax and Information Return to calculate the tax liability owed to the province.

The individual taxpayer in Saskatchewan, Canada, files the Form T3SK.

FAQ

Q: What is Form T3SK?

A: Form T3SK is a tax form used in the province of Saskatchewan in Canada.

Q: Who needs to file Form T3SK?

A: Individuals who are residents of Saskatchewan and have taxable income from sources in the province need to file Form T3SK.

Q: What is the purpose of Form T3SK?

A: The purpose of Form T3SK is to report and pay taxes on income earned in the province of Saskatchewan.

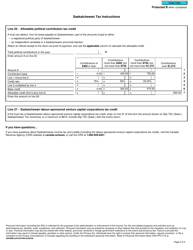

Q: What information is required to complete Form T3SK?

A: To complete Form T3SK, you will need to provide information about your income, deductions, and any other relevant tax details.

Q: When is the deadline for filing Form T3SK?

A: The deadline for filing Form T3SK is generally April 30th of the following year. However, please check with the Saskatchewan Ministry of Finance for any updates or changes to the deadline.

Q: What happens if I don't file Form T3SK?

A: If you don't file Form T3SK or file it late, you may be subject to penalties and interest charges by the Saskatchewan Ministry of Finance.

Q: Do I need to attach any documents with Form T3SK?

A: You may need to attach supporting documents, such as T4 slips or receipts, depending on your individual tax situation. Please refer to the instructions provided with Form T3SK for more information.