This version of the form is not currently in use and is provided for reference only. Download this version of

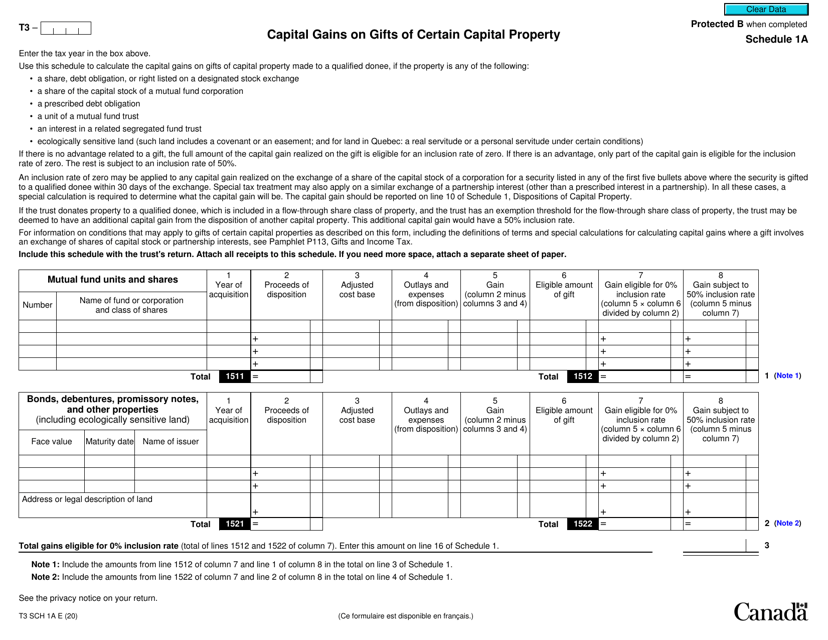

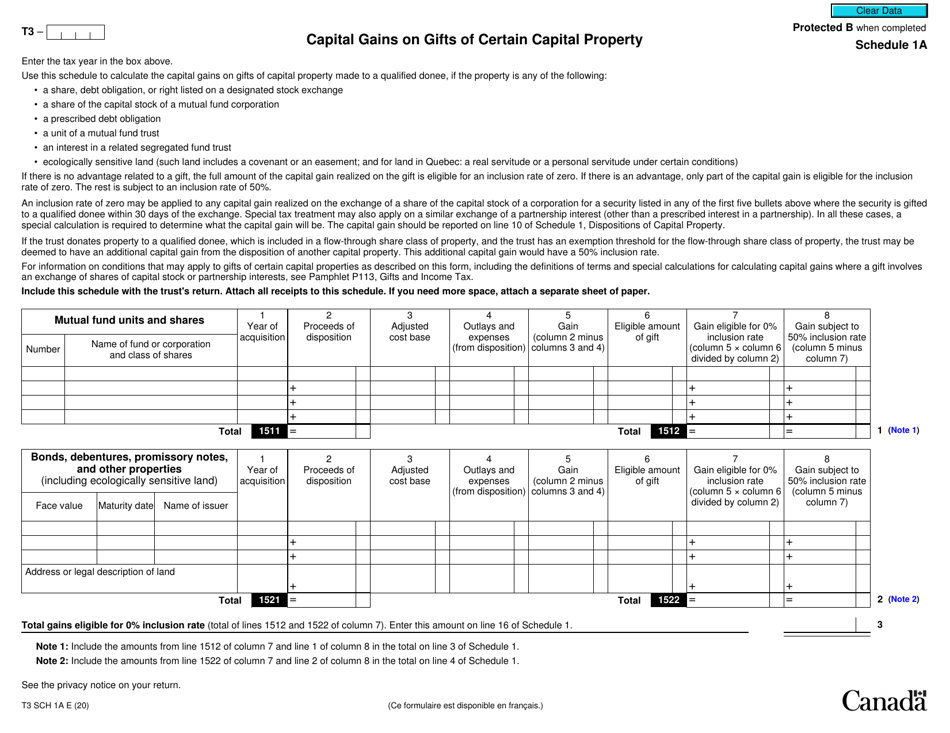

Form T3 Schedule 1A

for the current year.

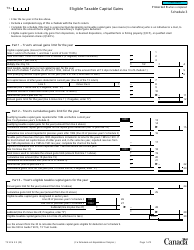

Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property - Canada

Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property in Canada is used to report the capital gains or losses from gifts of certain capital property made by a trust.

The individual or estate recipient of the gift files the Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property in Canada.

FAQ

Q: What is Form T3 Schedule 1A?

A: Form T3 Schedule 1A is a tax form used in Canada to report capital gains on gifts of certain capital property.

Q: What is capital gains?

A: Capital gains are the profits made from the sale of a capital asset, such as real estate or stocks.

Q: What is considered a gift of certain capital property?

A: A gift of certain capital property refers to the transfer of property as a gift, rather than a sale, where the property is considered to have a capital gain.

Q: Who needs to file Form T3 Schedule 1A?

A: Individuals or estates that have made a gift of certain capital property need to file Form T3 Schedule 1A.

Q: What information is required to complete Form T3 Schedule 1A?

A: To complete Form T3 Schedule 1A, you will need to provide details about the gift, including the description, fair market value, and adjusted cost base of the property.