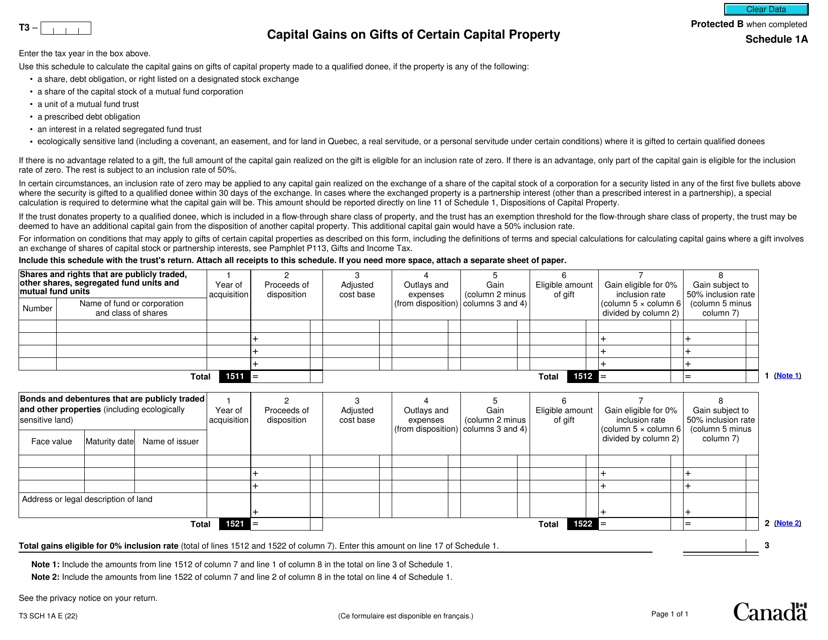

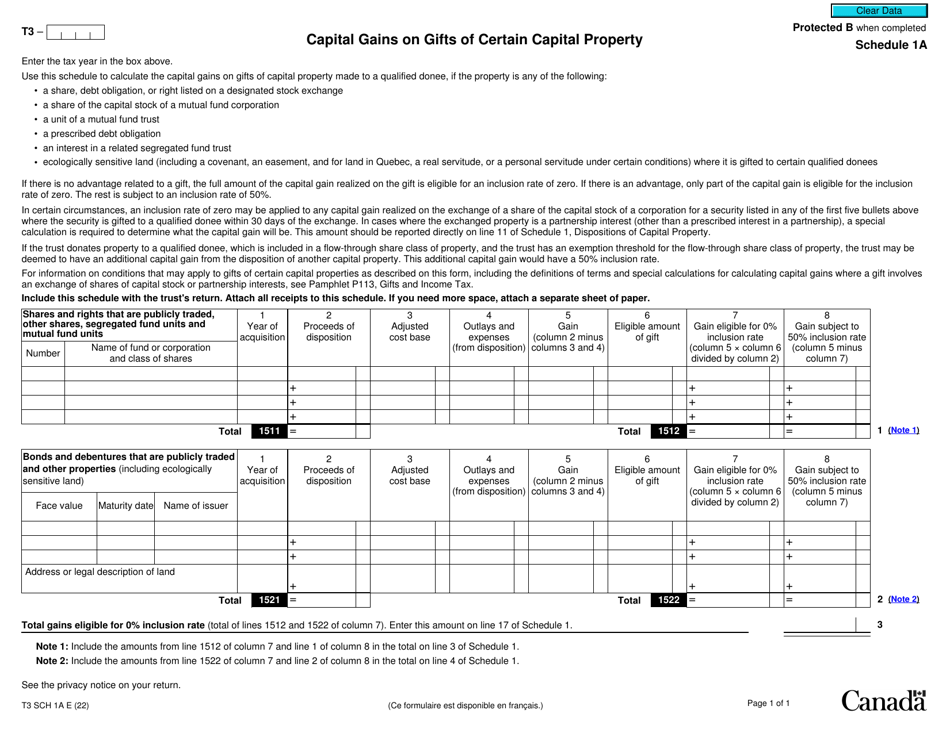

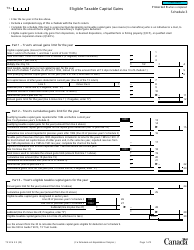

Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property - Canada

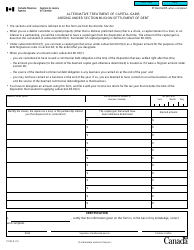

Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property - Canada is used to report capital gains on gifts of certain capital property for Canadian income tax purposes. This form helps individuals or organizations who have received gifts of capital property to calculate and report any taxable capital gains.

The individual who gives the gift files the Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property in Canada.

Form T3 Schedule 1A Capital Gains on Gifts of Certain Capital Property - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 1A?

A: Form T3 Schedule 1A is a form used in Canada to report capital gains on gifts of certain capital property.

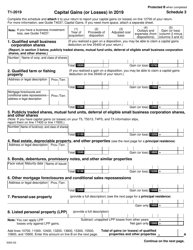

Q: What is capital gains?

A: Capital gains refer to the profit made from selling an asset at a higher price than its original purchase price.

Q: What is considered capital property?

A: Capital property includes things like stocks, bonds, real estate, and other investments.

Q: When do I need to use Form T3 Schedule 1A?

A: You need to use Form T3 Schedule 1A if you have made gifts of certain capital property and have capital gains to report.

Q: Are gifts of capital property taxable?

A: Yes, gifts of capital property may be subject to taxation if there are capital gains associated with the gift.

Q: Is there a deadline for filing Form T3 Schedule 1A?

A: Yes, the deadline for filing Form T3 Schedule 1A is the same as the deadline for filing your T3 tax return, which is usually April 30th of the following year.

Q: Are there any penalties for late filing of Form T3 Schedule 1A?

A: Yes, there may be penalties for late filing of Form T3 Schedule 1A, so it's important to submit it before the deadline.

Q: Do I need to keep a copy of Form T3 Schedule 1A?

A: Yes, it's recommended to keep a copy of your completed Form T3 Schedule 1A for your records and future reference.