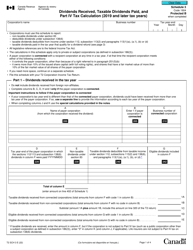

This version of the form is not currently in use and is provided for reference only. Download this version of

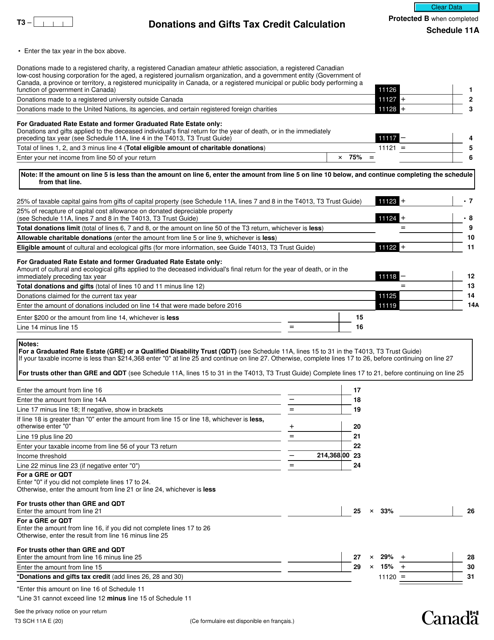

Form T3 Schedule 11A

for the current year.

Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation - Canada

Form T3 Schedule 11A is used in Canada to calculate the tax credit for donations and gifts made by an estate or trust. It helps determine the amount of tax credit that can be claimed in the tax return.

The individual or organization making donations or gifts in Canada files the Form T3 Schedule 11A.

FAQ

Q: What is Form T3 Schedule 11A?

A: Form T3 Schedule 11A is a tax form used in Canada to calculate the tax credit for donations and gifts.

Q: How is the tax credit for donations and gifts calculated?

A: The tax credit for donations and gifts is calculated using the information provided on Form T3 Schedule 11A, including the total eligible amount of donations and gifts made during the tax year.

Q: What information is required to complete Form T3 Schedule 11A?

A: To complete Form T3 Schedule 11A, you will need to know the total eligible amount of donations and gifts made during the tax year, as well as any carryforward amounts from previous years.

Q: Who is eligible to claim the tax credit for donations and gifts?

A: Any Canadian resident who has made eligible donations and gifts to qualifying charities or other qualified donees may be eligible to claim the tax credit.

Q: What is the purpose of Form T3 Schedule 11A?

A: The purpose of Form T3 Schedule 11A is to calculate the tax credit for donations and gifts, which can help reduce the amount of tax owed or increase the amount of tax refund.

Q: Is it mandatory to file Form T3 Schedule 11A?

A: Filing Form T3 Schedule 11A is only required if you have made eligible donations and gifts during the tax year and want to claim the tax credit.

Q: When is the deadline to file Form T3 Schedule 11A?

A: The deadline to file Form T3 Schedule 11A is the same as the deadline for filing your personal income tax return, which is generally April 30th of the following year.

Q: Can I claim donations and gifts made to organizations outside of Canada?

A: Yes, you may be able to claim donations and gifts made to organizations outside of Canada, as long as they qualify as foreign charitable organizations under the Canadian tax rules.

Q: How can I maximize my tax credit for donations and gifts?

A: To maximize your tax credit for donations and gifts, make sure to keep track of all eligible donations and gifts, including receipts, and claim them on your tax return using Form T3 Schedule 11A.