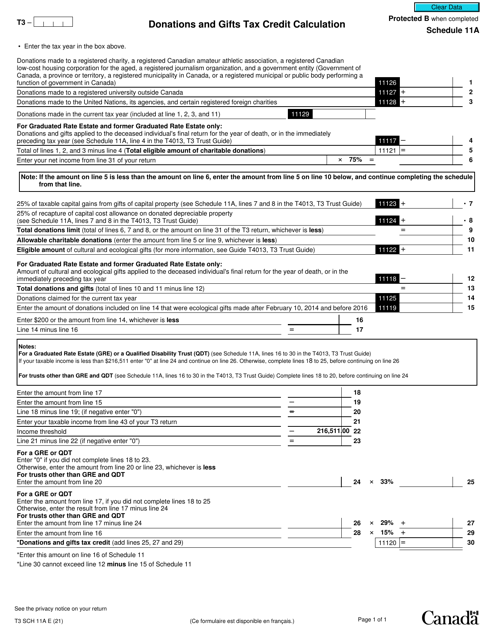

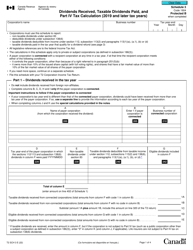

Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation - Canada

Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation in Canada is used to calculate the tax credit for donations and gifts made by the beneficiaries of a trust. It helps determine the amount of tax credit that can be claimed on their tax return.

Individuals who have made eligible donations and gifts can file the Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation in Canada.

Form T3 Schedule 11A Donations and Gifts Tax Credit Calculation - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3 Schedule 11A?

A: Form T3 Schedule 11A is a tax form used in Canada to calculate donations and gifts tax credits.

Q: How do I use Form T3 Schedule 11A?

A: You use Form T3 Schedule 11A to calculate the tax credits for donations and gifts made by a trust.

Q: What is the purpose of the donations and gifts tax credit?

A: The donations and gifts tax credit is designed to provide tax relief for individuals and trusts who make charitable donations or gifts.

Q: What types of donations and gifts are eligible for tax credits?

A: Eligible donations and gifts include cash, securities, and property given to registered charities and other qualified donees.

Q: How do I calculate the donations and gifts tax credit using Form T3 Schedule 11A?

A: The form provides instructions and worksheets to help you calculate the tax credit based on the amount of your eligible donations and gifts.

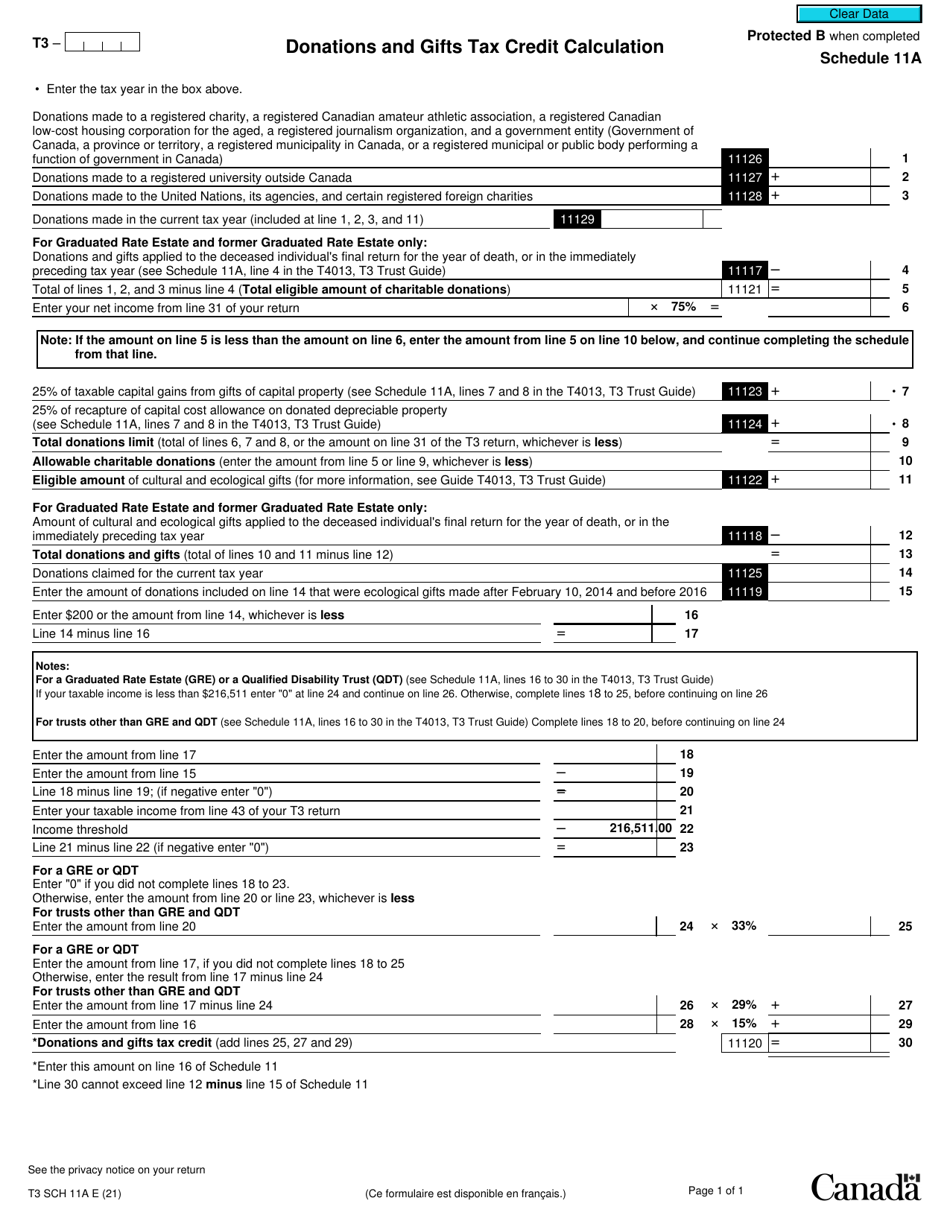

Q: Are there any limitations on the donations and gifts tax credit?

A: Yes, there are limitations on the tax credit, including a maximum limit based on your net income and the carryforward of unused credits.

Q: When is Form T3 Schedule 11A due?

A: The due date for Form T3 Schedule 11A is the same as the filing deadline for your trust's T3 return, which is generally 90 days after the trust's taxation year-end.

Q: Can I claim the donations and gifts tax credit on my personal tax return?

A: No, Form T3 Schedule 11A is specifically for trusts. Individuals can claim the donations and gifts tax credit on their personal tax returns using Form T1 Schedule 9.