This version of the form is not currently in use and is provided for reference only. Download this version of

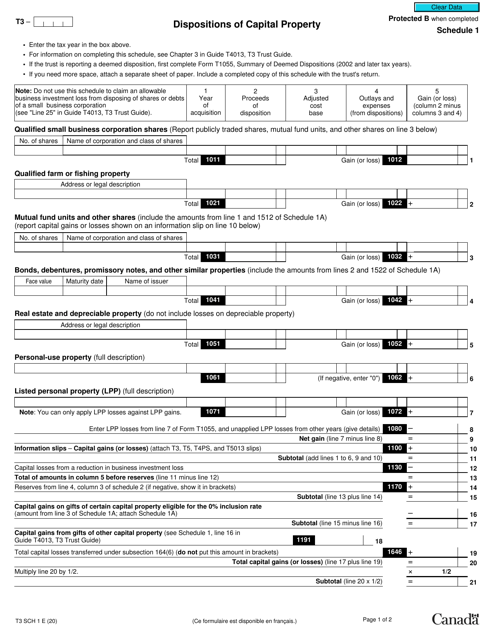

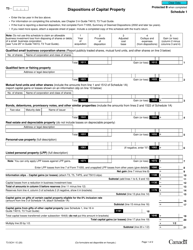

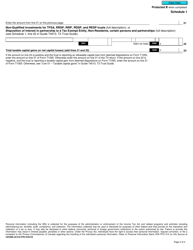

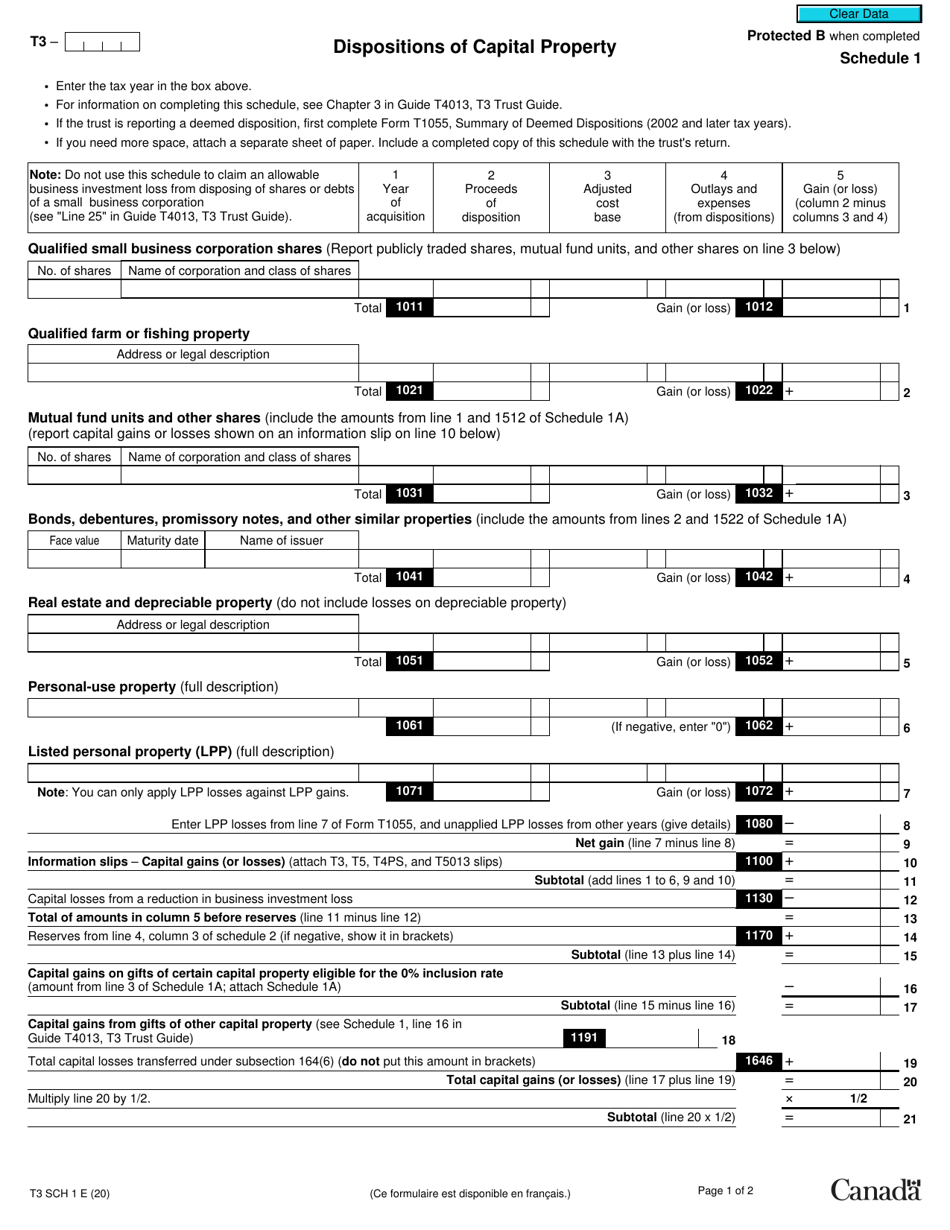

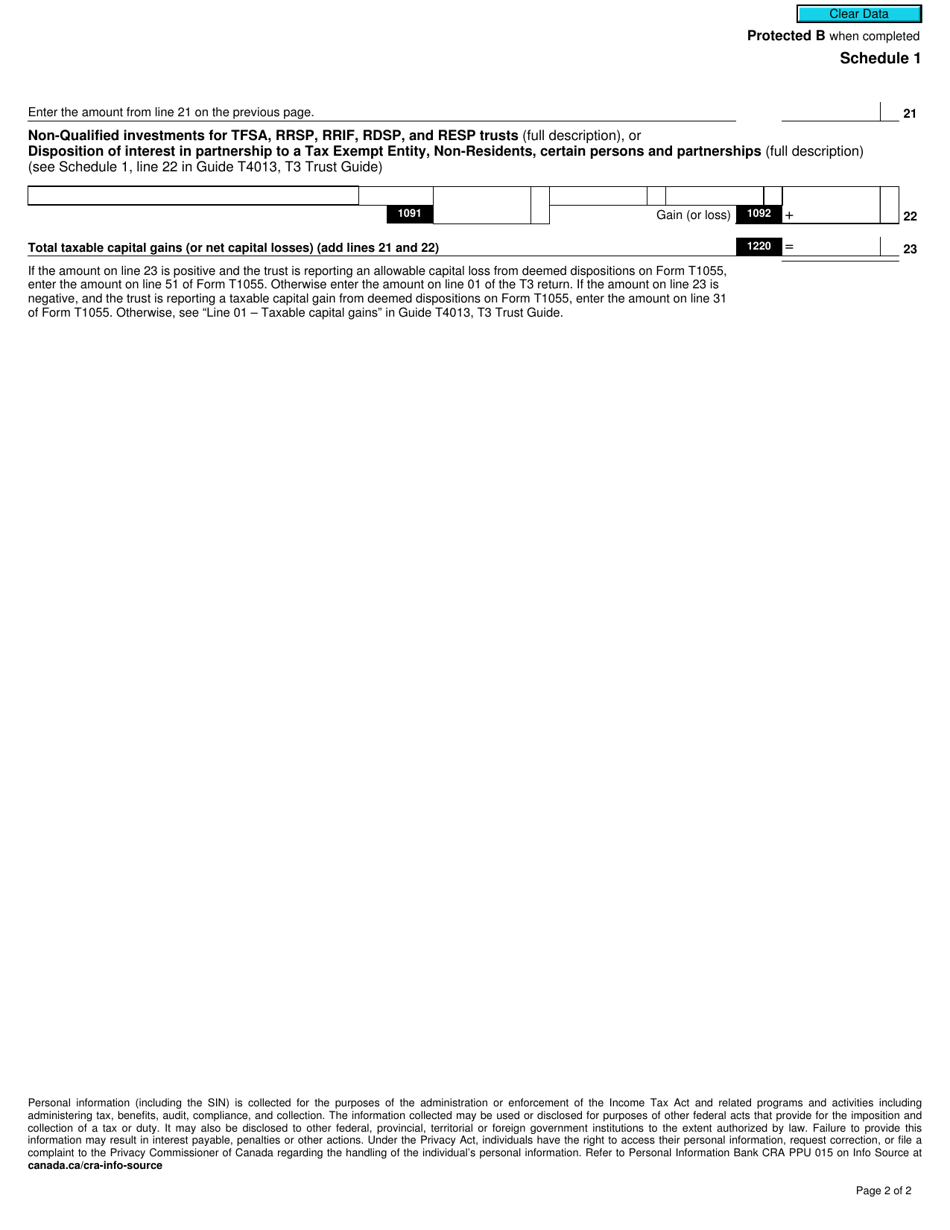

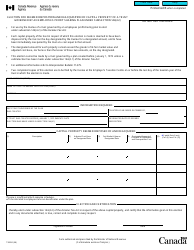

Form T3 Schedule 1

for the current year.

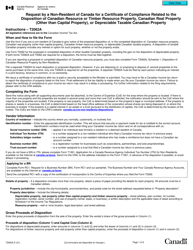

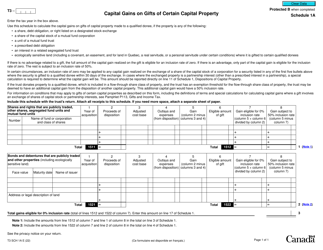

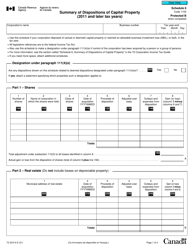

Form T3 Schedule 1 Dispositions of Capital Property - Canada

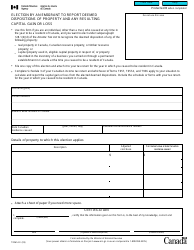

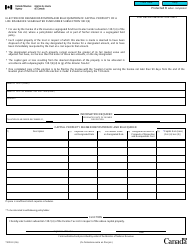

Form T3 Schedule 1 Dispositions of Capital Property in Canada is used to report the disposition of capital property by a trust or certain estates. It is used to calculate any capital gains or losses that may arise from the sale or transfer of such property.

The taxpayer who disposes of capital property in Canada is responsible for filing the Form T3 Schedule 1.

FAQ

Q: What is Form T3 Schedule 1?

A: Form T3 Schedule 1 is a document used in Canada to report the dispositions of capital property.

Q: What is considered capital property?

A: Capital property includes things like real estate, stocks, and bonds.

Q: Why do I need to file Form T3 Schedule 1?

A: You need to file Form T3 Schedule 1 to report any capital property that you have sold or disposed of during the tax year.

Q: Do I need to file Form T3 Schedule 1 if I haven't sold any capital property?

A: No, you only need to file Form T3 Schedule 1 if you have sold or disposed of capital property.

Q: When is the deadline to file Form T3 Schedule 1?

A: The deadline to file Form T3 Schedule 1 is the same as the deadline for filing your tax return, which is generally April 30th.

Q: Are there any penalties for not filing Form T3 Schedule 1?

A: Yes, there may be penalties for not filing Form T3 Schedule 1, so it's important to make sure you complete and submit it if required.

Q: Can I file Form T3 Schedule 1 electronically?

A: Yes, you can file Form T3 Schedule 1 electronically using the CRA's NetFile or EFILE services.

Q: Who needs to file Form T3 Schedule 1?

A: Anyone who has sold or disposed of capital property during the tax year needs to file Form T3 Schedule 1.

Q: Do I need to include supporting documents with Form T3 Schedule 1?

A: Yes, you should keep supporting documents, such as receipts and statements, in case the CRA requests them for verification purposes.