This version of the form is not currently in use and is provided for reference only. Download this version of

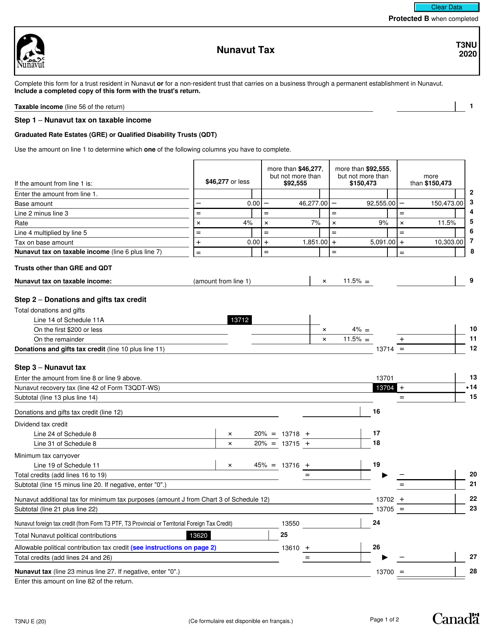

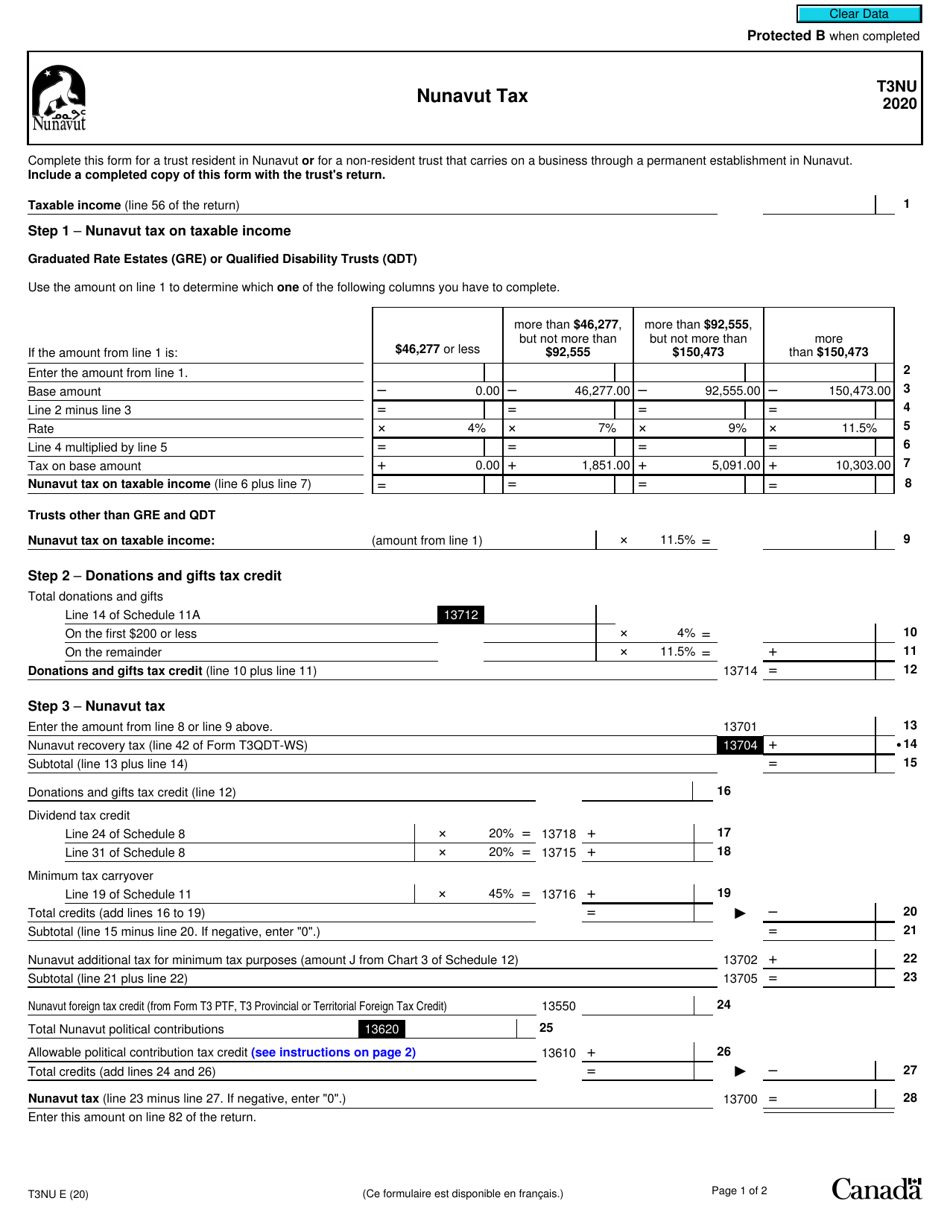

Form T3NU

for the current year.

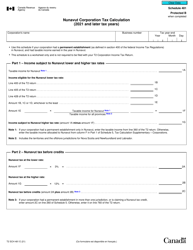

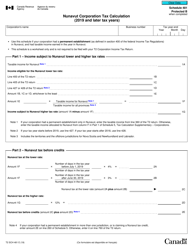

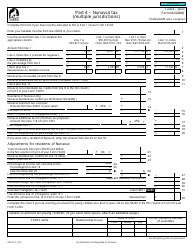

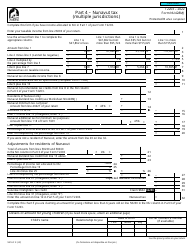

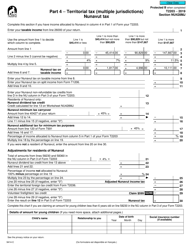

Form T3NU Nunavut Tax - Canada

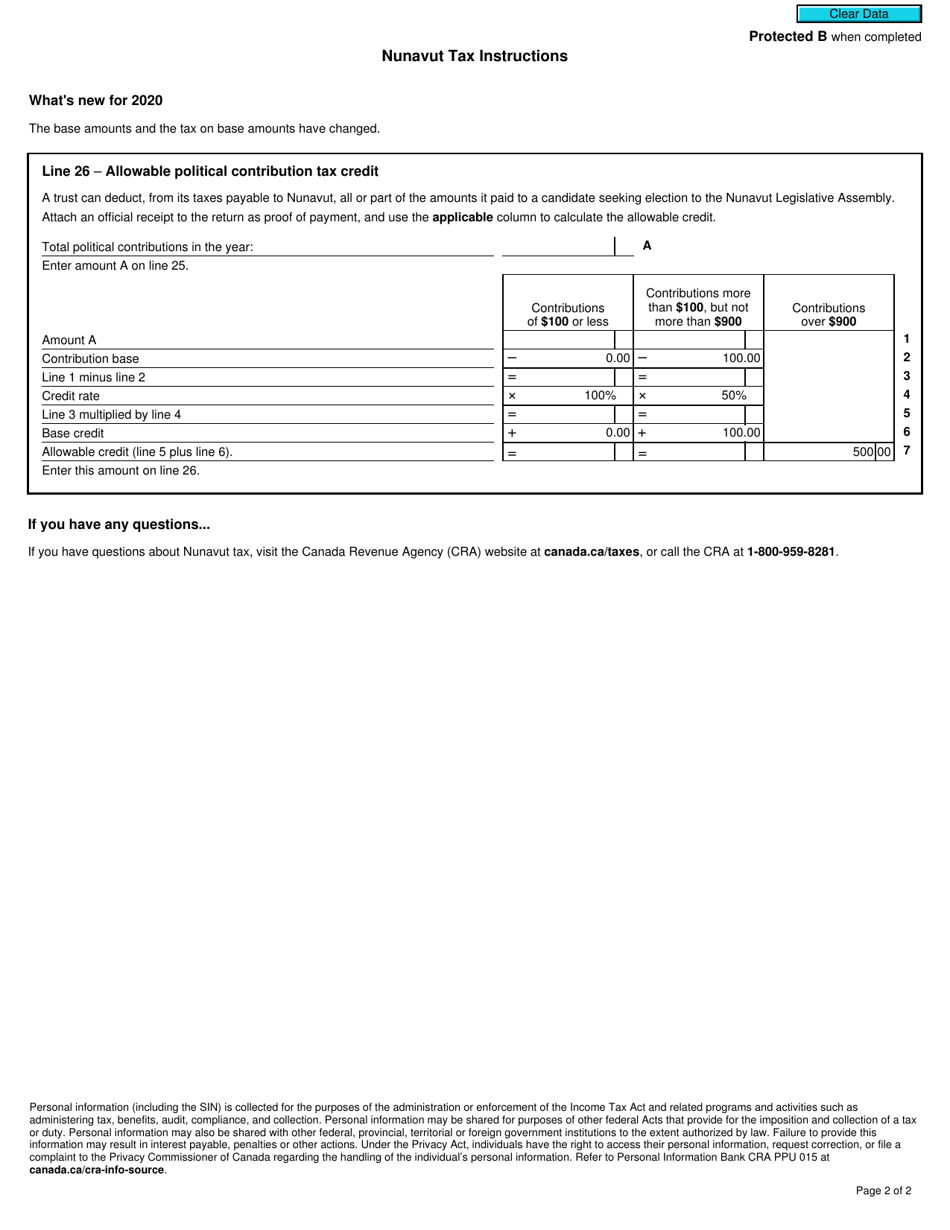

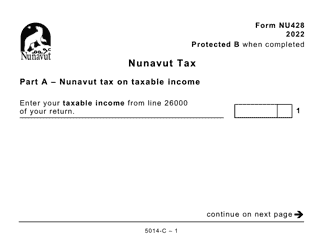

Form T3NU, also known as Nunavut Tax - Canada, is a tax form used by residents of Nunavut, a territory in Canada, to report their income and calculate their tax liability specific to this region. It is used to determine the amount of tax owed to the territorial government of Nunavut.

The Form T3NU Nunavut Tax in Canada is filed by residents or corporations in Nunavut who have taxable income and need to report it for tax purposes.

FAQ

Q: What is Form T3NU?

A: Form T3NU is a tax form used in Nunavut, Canada.

Q: Who needs to file Form T3NU?

A: Residents of Nunavut who have income to report are required to file Form T3NU.

Q: What kind of income is reported on Form T3NU?

A: Form T3NU is used to report income from sources such as employment, self-employment, investments, and rental property in Nunavut.

Q: When is Form T3NU due?

A: Form T3NU is generally due on or before April 30th of each year.

Q: Are there any penalties for late filing of Form T3NU?

A: Yes, there may be penalties for late filing of Form T3NU, so it's important to submit the form on time.

Q: Is there any assistance available for completing Form T3NU?

A: Yes, the Canada Revenue Agency provides resources and support to help individuals complete their tax forms, including Form T3NU.

Q: Do I need to include any supporting documents with Form T3NU?

A: It is important to keep all relevant supporting documents for your income and deductions for at least six years in case the Canada Revenue Agency requests them.

Q: What if I have questions or need assistance with Form T3NU?

A: If you have questions or need assistance with Form T3NU, you can contact the Canada Revenue Agency directly or consult with a tax professional.