This version of the form is not currently in use and is provided for reference only. Download this version of

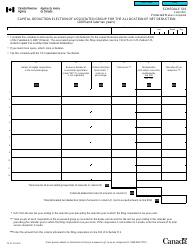

Form T3012A

for the current year.

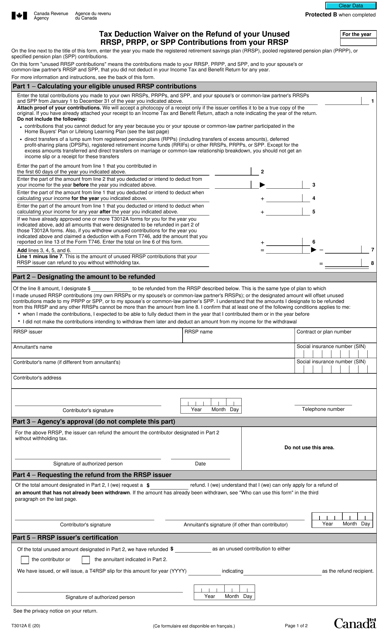

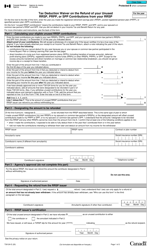

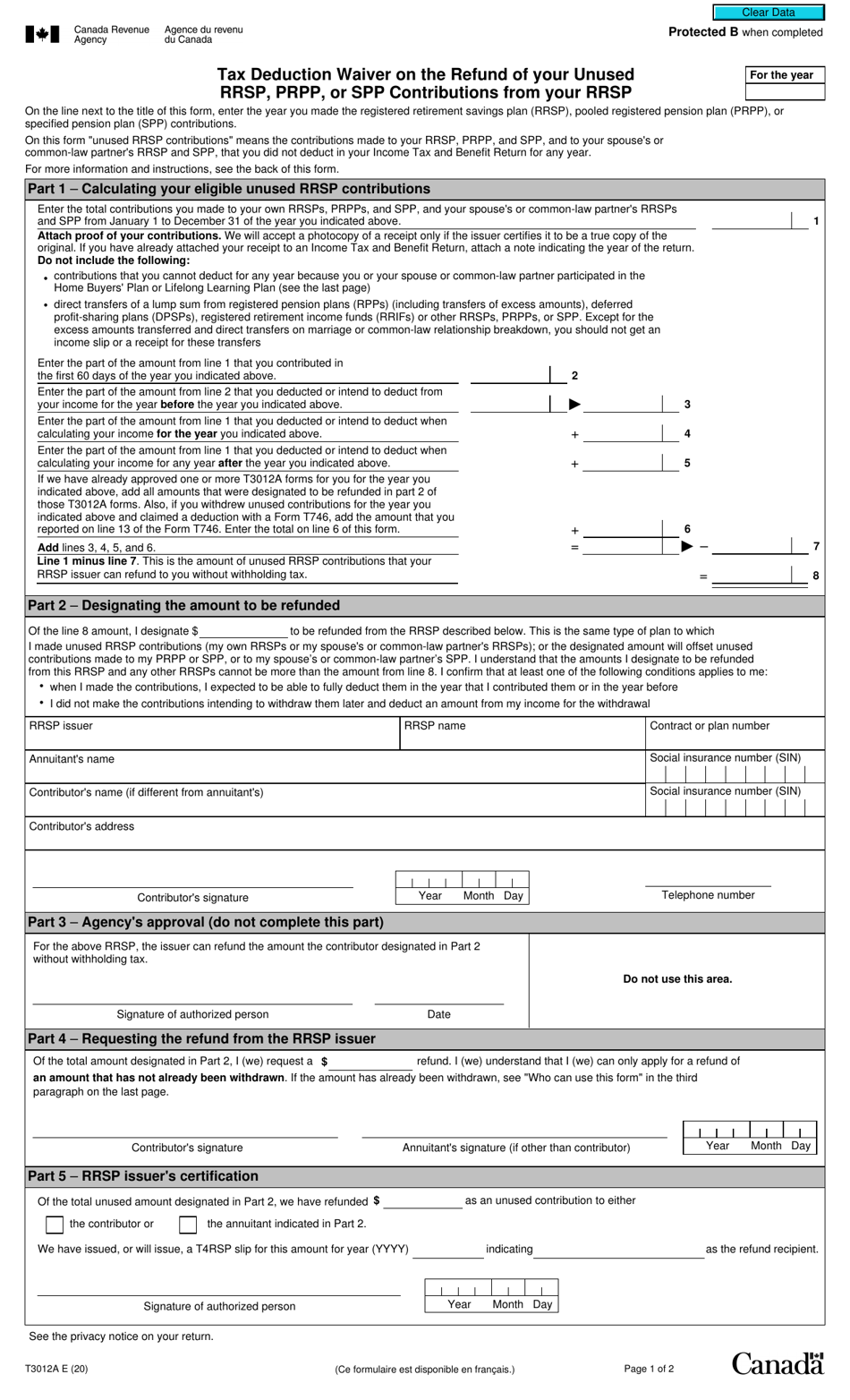

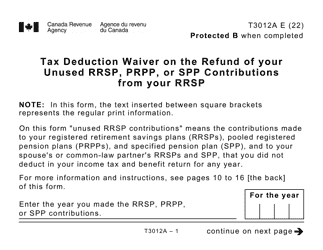

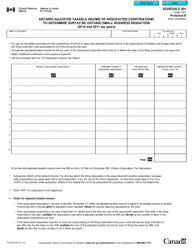

Form T3012A Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions From Your Rrsp - Canada

Form T3012A is used in Canada for requesting a tax deduction waiver on the refund of unused RRSP, PRPP, or SPP contributions from your RRSP. This waiver allows you to avoid paying taxes on the refunded amount.

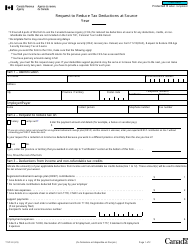

The individual taxpayer files the Form T3012A Tax Deduction Waiver on the refund of their unused RRSP, PRPP, or SPP contributions from their RRSP in Canada.

FAQ

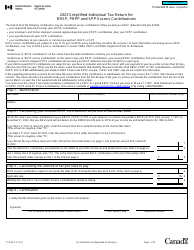

Q: What is Form T3012A?

A: Form T3012A is a tax form in Canada.

Q: What does the form T3012A allow you to do?

A: The form T3012A allows you to waive the tax deduction on the refund of your unused RRSP, PRPP, or SPP contributions.

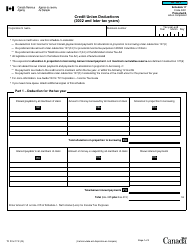

Q: What is RRSP?

A: RRSP stands for Registered Retirement Savings Plan, which is a type of retirement savings account in Canada.

Q: What is PRPP?

A: PRPP stands for Pooled Registered Pension Plan, which is another type of retirement savings plan in Canada.

Q: What is SPP?

A: SPP stands for Specified Pension Plan, which is yet another type of pension plan in Canada.

Q: Why would someone use Form T3012A?

A: Someone might use Form T3012A to waive the tax deduction on the refund of their unused RRSP, PRPP, or SPP contributions, potentially reducing their tax liability.

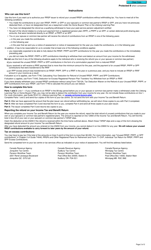

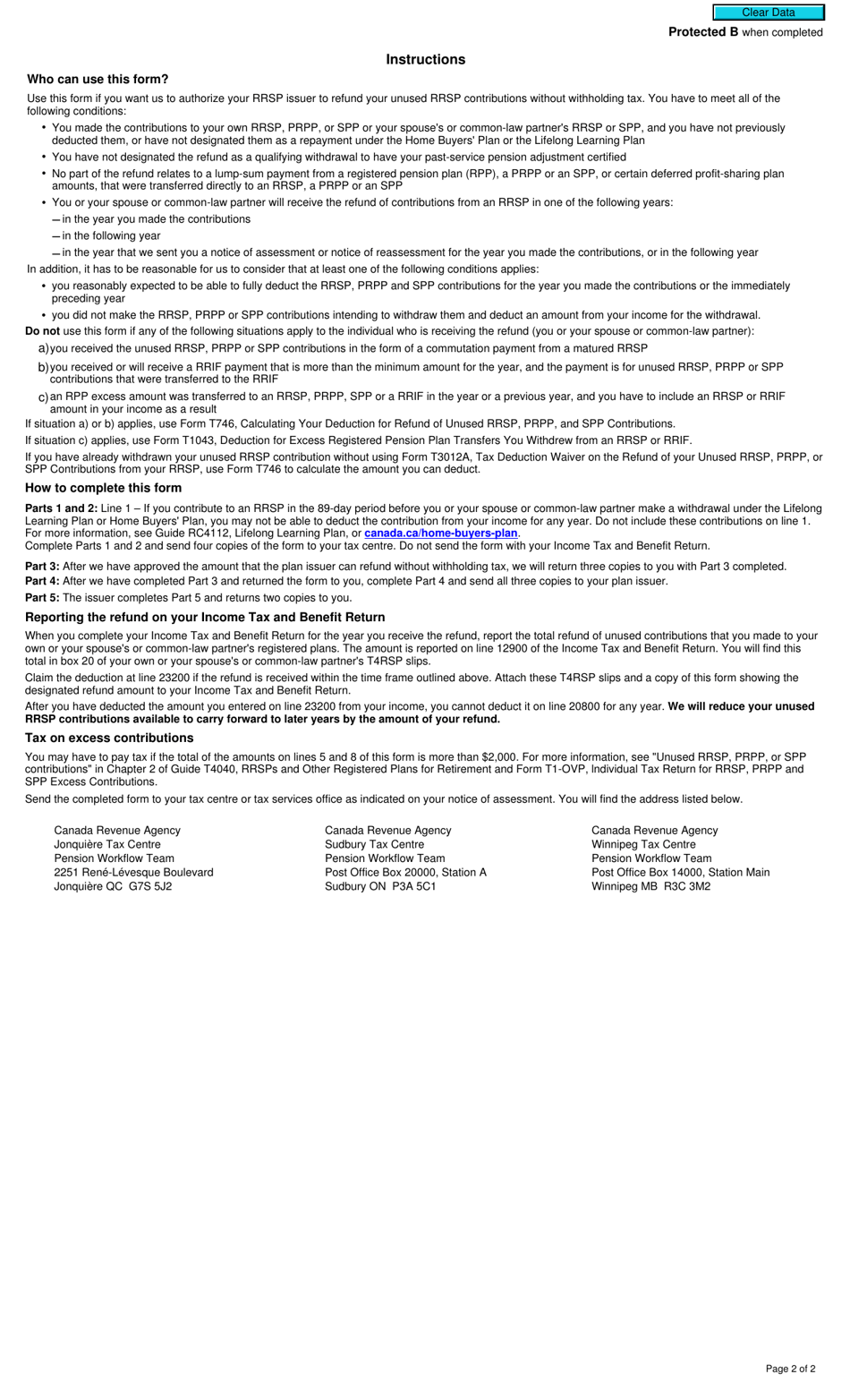

Q: How do I fill out Form T3012A?

A: To fill out Form T3012A, you should consult the instructions provided with the form or seek assistance from a tax professional.