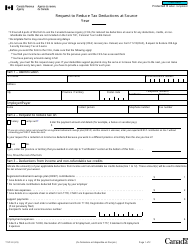

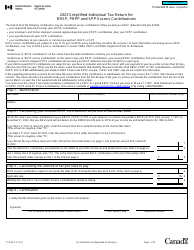

Form T3012A Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions From Your Rrsp, Prpp or Spp - Canada

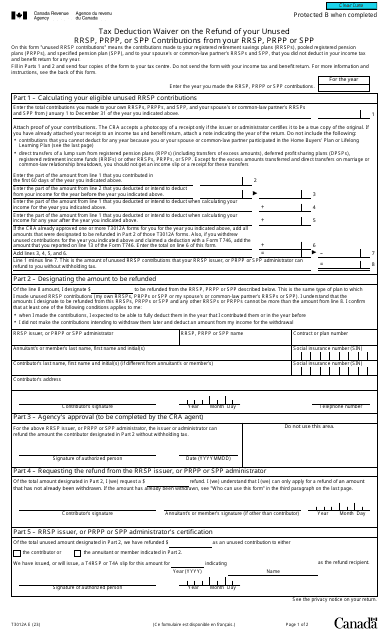

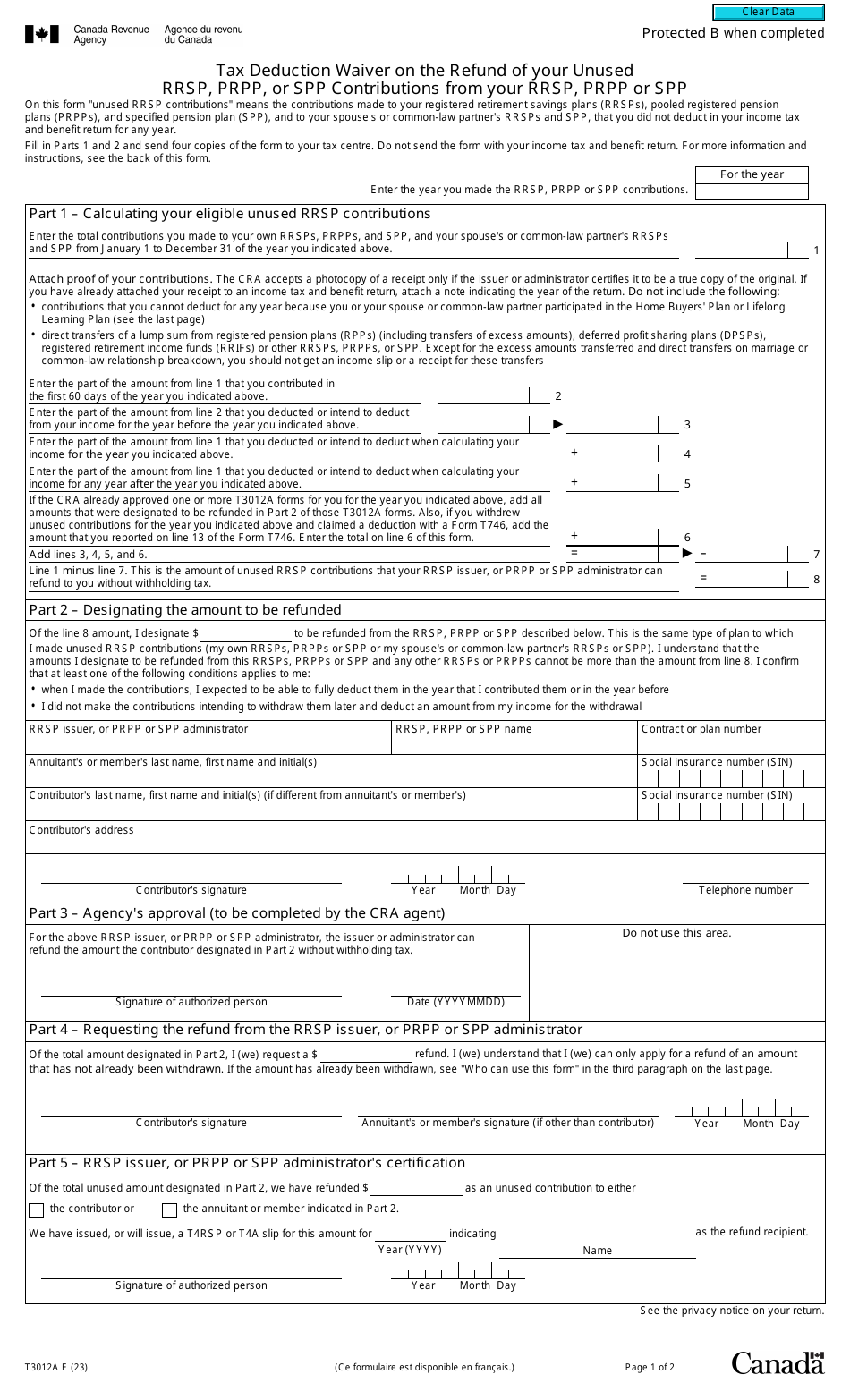

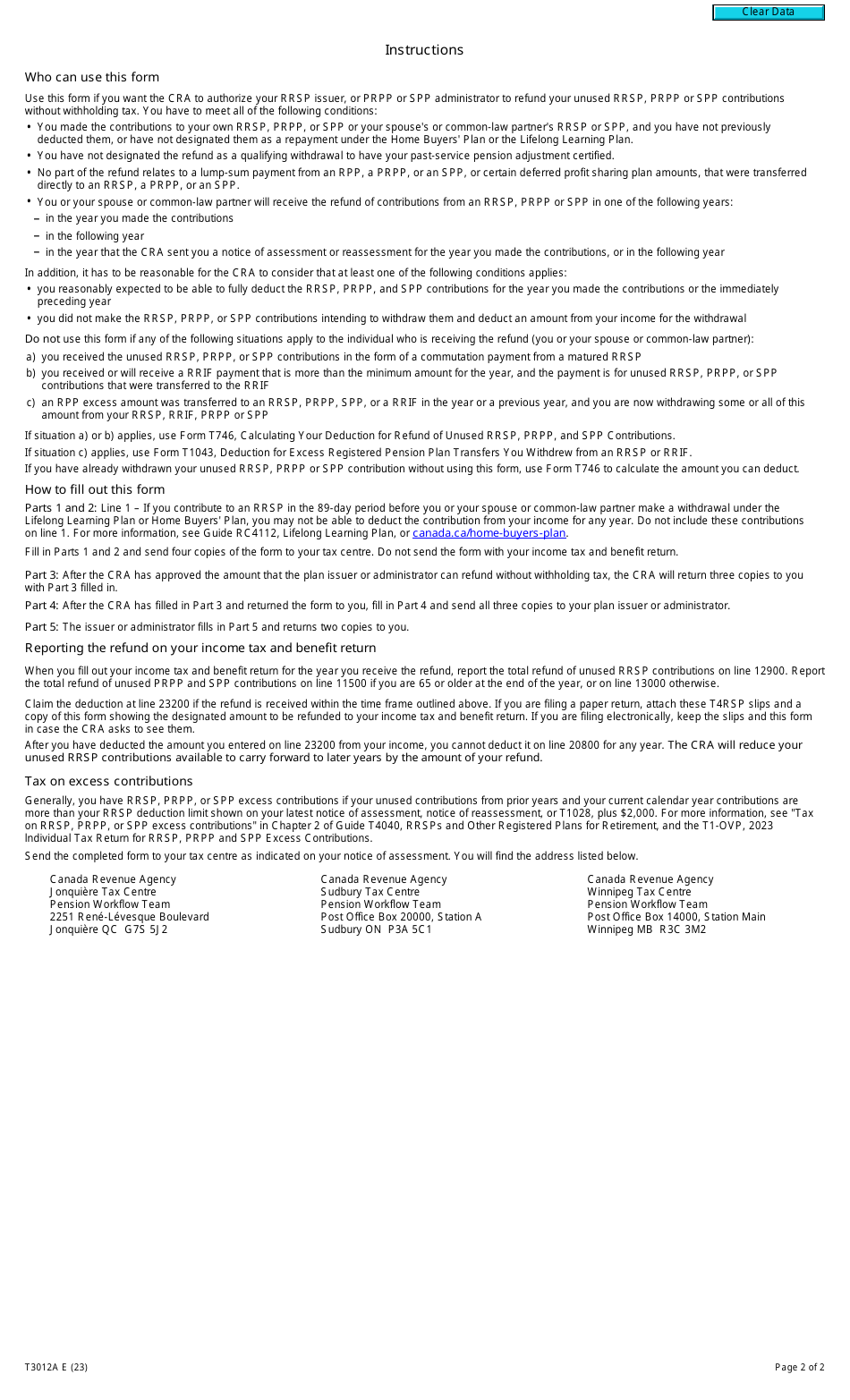

The Form T3012A is used by Canada Revenue Agency (CRA) to waive the tax deduction on the refund of your unused RRSP, PRPP, or SPP contributions. This form is required when you withdraw contributions from your Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) and want to waive the tax withholding at source. The form allows you to avoid immediate tax withholding on these withdrawals.

The form T3012A for tax deduction waiver on the refund of unused RRSP, PRPP, or SPP contributions from your RRSP in Canada is filed by the taxpayer themselves.

Form T3012A Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions From Your Rrsp - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T3012A?

A: Form T3012A is a tax deduction waiver for the refund of your unused RRSP, PRPP or SPP contributions in Canada.

Q: What does RRSP stand for?

A: RRSP stands for Registered Retirement Savings Plan.

Q: What does PRPP stand for?

A: PRPP stands for Pooled Registered Pension Plan.

Q: What does SPP stand for?

A: SPP stands for Specified Pension Plan.

Q: Who can use Form T3012A?

A: Form T3012A can be used by Canadian residents who want to claim a tax deduction on the refund of their unused RRSP, PRPP, or SPP contributions.

Q: What is the purpose of Form T3012A?

A: The purpose of Form T3012A is to waive the tax deduction on the refund of your unused RRSP, PRPP, or SPP contributions.

Q: How do I fill out Form T3012A?

A: You can fill out Form T3012A by providing your personal information, details about your RRSP, PRPP, or SPP contributions, and indicating whether or not you want to claim a tax deduction on the refund.

Q: When is the deadline to file Form T3012A?

A: The deadline to file Form T3012A is typically within one year from the end of the year in which you received the refund of your unused RRSP, PRPP, or SPP contributions.