This version of the form is not currently in use and is provided for reference only. Download this version of

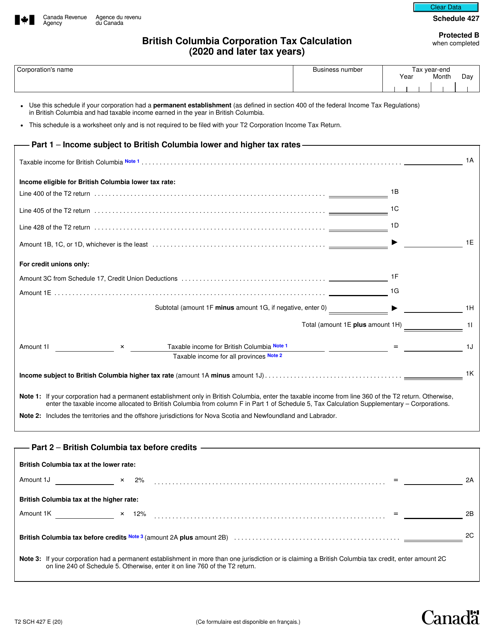

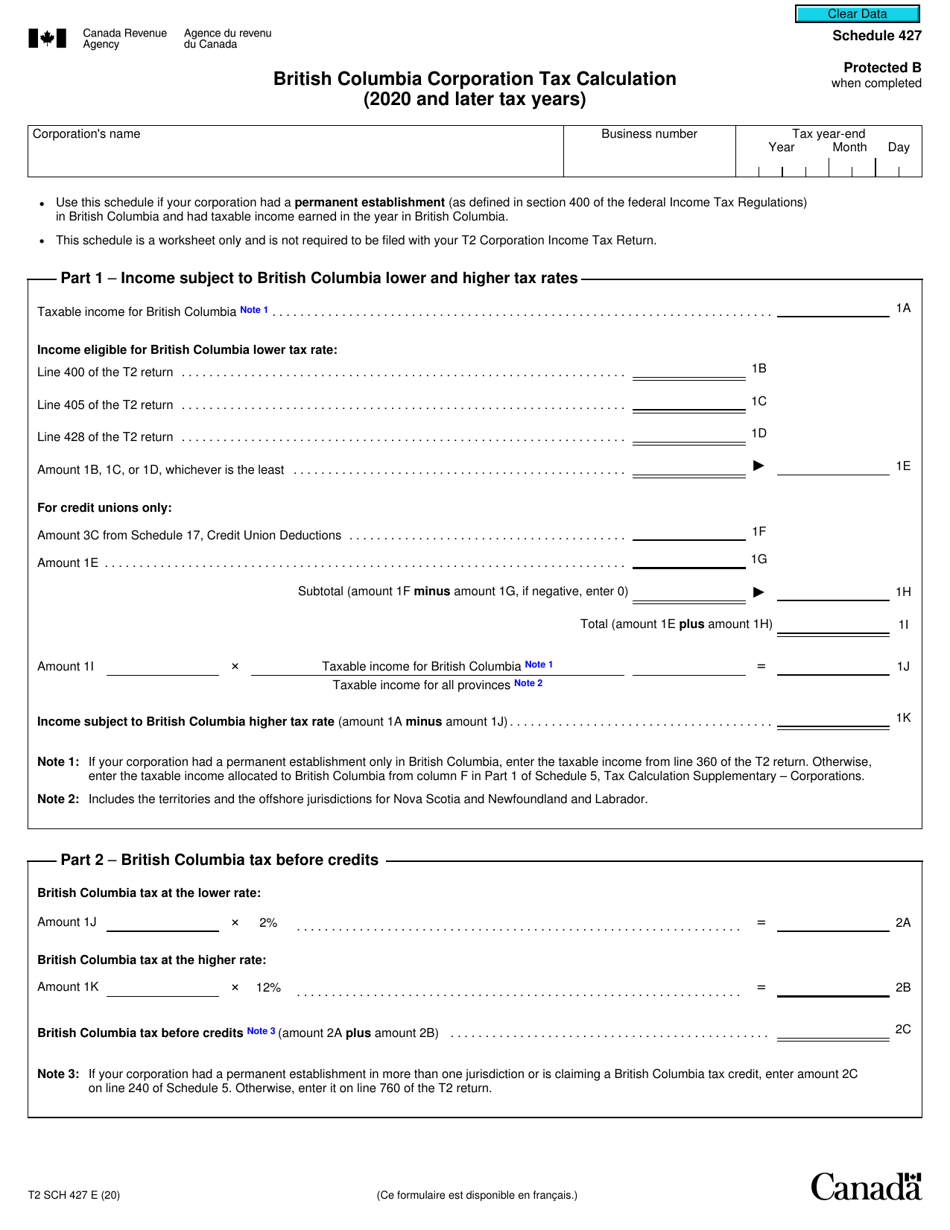

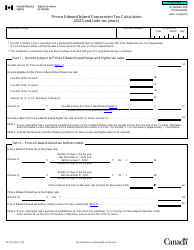

Form T2 Schedule 427

for the current year.

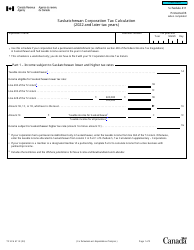

Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2020 and Later Tax Years) - Canada

Form T2 Schedule 427 is used by British Columbia corporations in Canada to calculate their provincial corporate tax liability for the tax years 2020 and later.

The British Columbia corporations would file the Form T2 Schedule 427 for their tax calculation.

FAQ

Q: What is a T2 Schedule 427?

A: T2 Schedule 427 is a tax form used by British Columbia corporations to calculate their corporation tax for the tax years 2020 and later.

Q: Who needs to use T2 Schedule 427?

A: British Columbia corporations need to use T2 Schedule 427 to calculate their corporation tax if it applies to their tax years.

Q: What is corporation tax?

A: Corporation tax is a tax imposed on the income of corporations.

Q: Is T2 Schedule 427 specific to British Columbia?

A: Yes, T2 Schedule 427 is specific to British Columbia corporations.

Q: What tax years does T2 Schedule 427 apply to?

A: T2 Schedule 427 applies to tax years starting in 2020 and later.

Q: Are there any specific requirements for using T2 Schedule 427?

A: Yes, you need to meet the criteria for filing corporation tax in British Columbia and have the necessary financial information to complete the form.