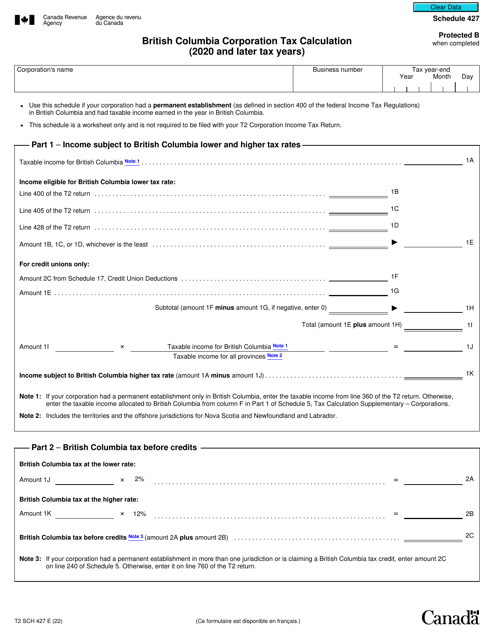

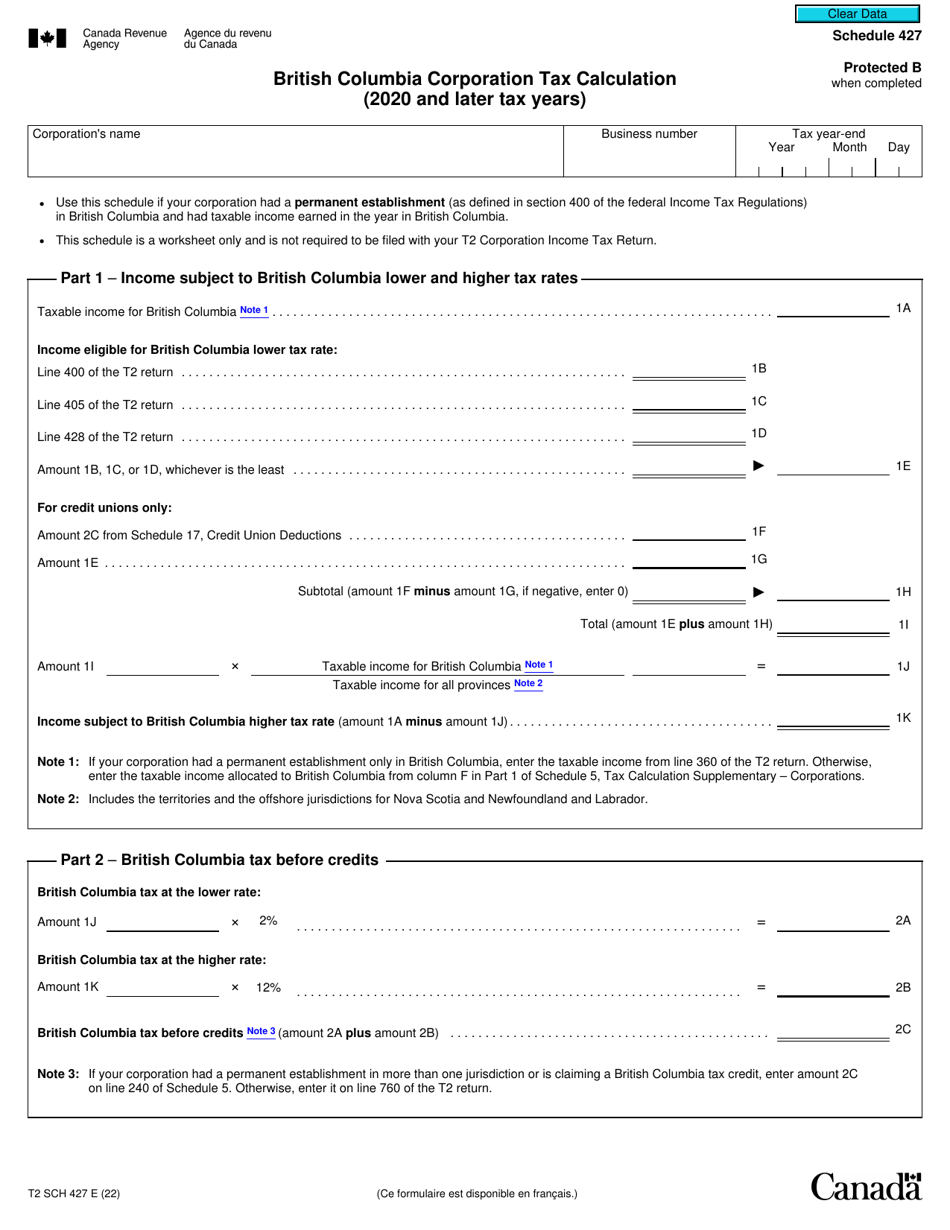

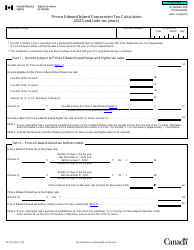

Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2020 and Later Tax Years) - Canada

Form T2 Schedule 427 is used by British Columbia corporations in Canada for calculating their provincial tax liability for the tax years 2020 and later. It helps businesses determine the amount of tax they owe to the province of British Columbia.

The Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2020 and Later Tax Years) in Canada is filed by corporations that are subject to British Columbia corporate tax.

Form T2 Schedule 427 British Columbia Corporation Tax Calculation (2020 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 427?

A: Form T2 Schedule 427 is a tax calculation form specific to British Columbia corporations in Canada.

Q: What is the purpose of Form T2 Schedule 427?

A: The purpose of Form T2 Schedule 427 is to calculate the British Columbia corporation tax for tax years 2020 and later.

Q: Who needs to fill out Form T2 Schedule 427?

A: British Columbia corporations that are required to file a T2 Corporation Income Tax Return need to fill out Form T2 Schedule 427.

Q: What information is required on Form T2 Schedule 427?

A: Form T2 Schedule 427 requires information such as the corporation's income, deductions, and credits specific to British Columbia.

Q: Is Form T2 Schedule 427 only for tax year 2020?

A: No, Form T2 Schedule 427 is for tax years 2020 and later.

Q: Are there any deadlines for filing Form T2 Schedule 427?

A: The deadline for filing Form T2 Schedule 427 is the same as the deadline for filing the T2 Corporation Income Tax Return, which is six months after the end of the corporation's tax year.

Q: Are there any penalties for not filing Form T2 Schedule 427?

A: Yes, there may be penalties for not filing Form T2 Schedule 427. It is important to meet all filing requirements to avoid penalties.