This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2205

for the current year.

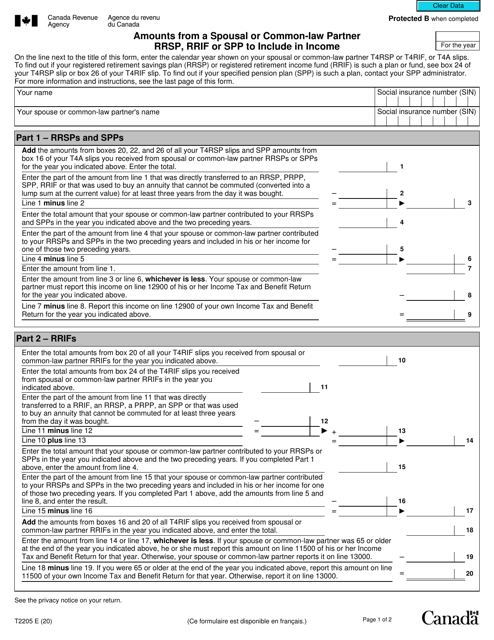

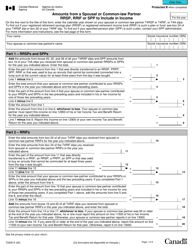

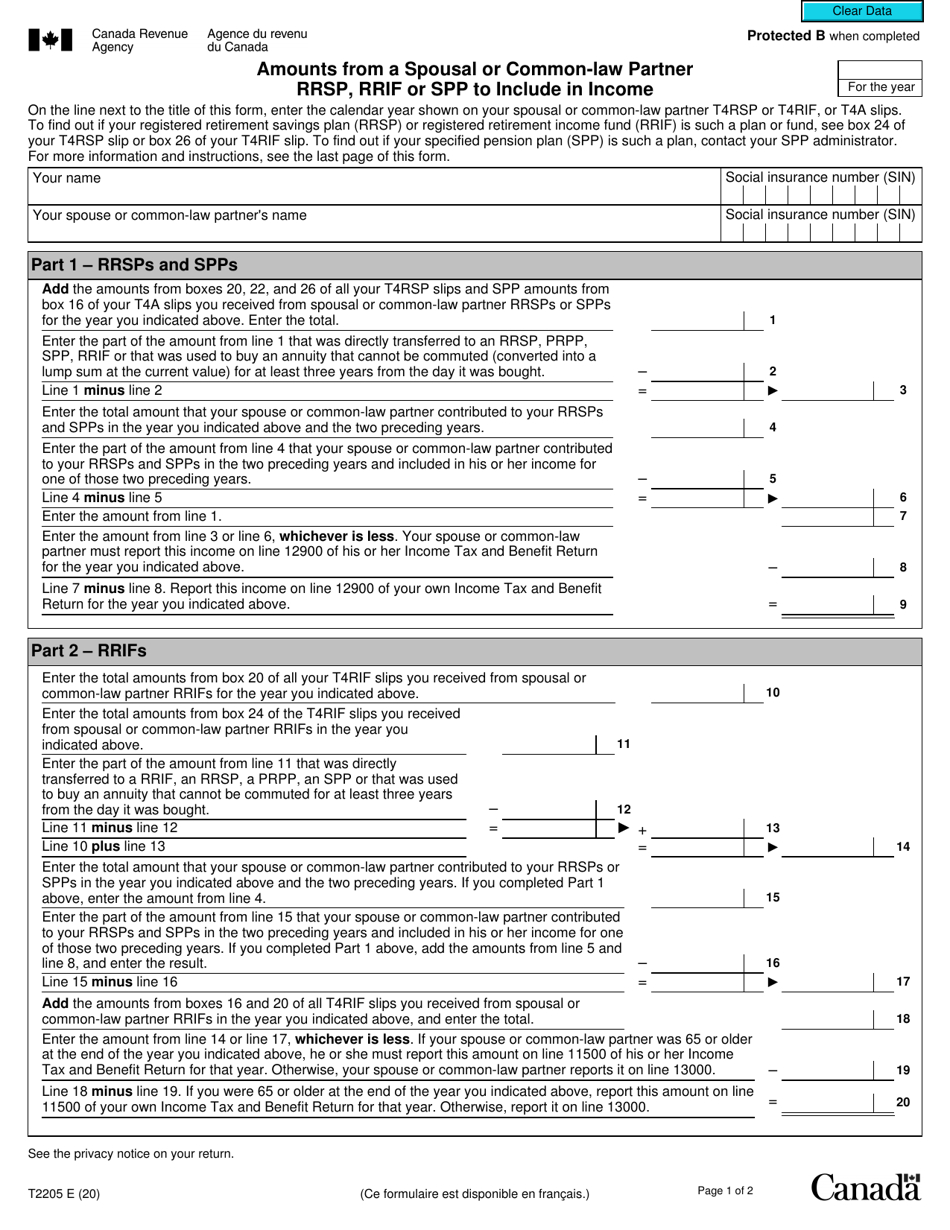

Form T2205 Amounts From a Spousal or Common-Law Partner Rrsp, Rrif or Spp to Include in Income - Canada

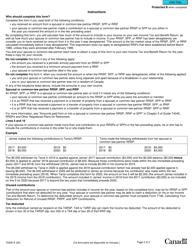

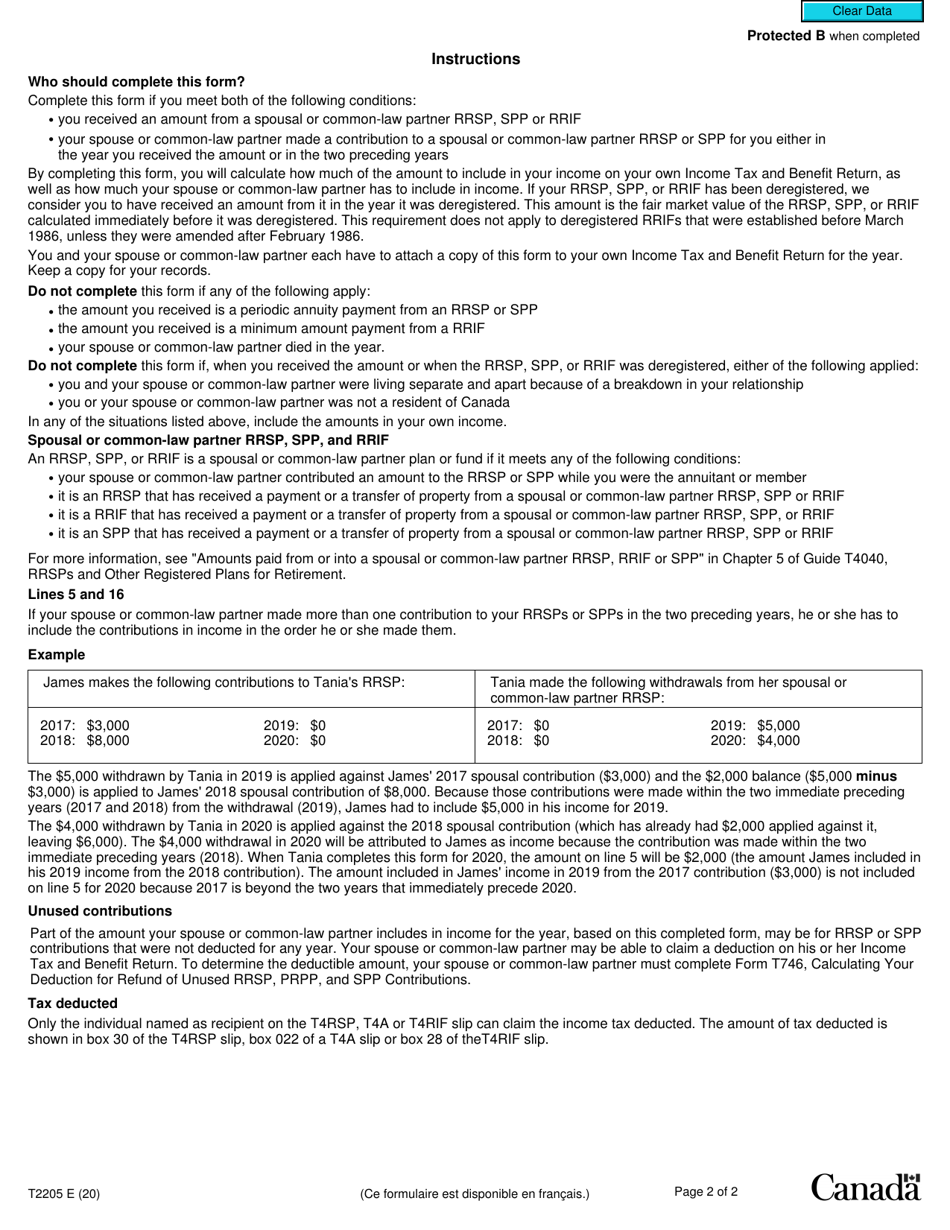

Form T2205 - Amounts from a Spousal or Common-Law Partner RRSP, RRIF or SPP to Include in Income is used in Canada for reporting amounts withdrawn from your spouse's or common-law partner's Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), or Specified Pension Plan (SPP) that you include in your income. This form is part of your Canadian tax return and is used to calculate your taxable income.

The taxpayer who received the amounts from the spousal or common-law partner's RRSP, RRIF, or SPP should file the Form T2205 in Canada.

FAQ

Q: What is Form T2205?

A: Form T2205 is a tax form used in Canada.

Q: What does Form T2205 calculate?

A: Form T2205 calculates the amounts from a spousal or common-law partner RRSP, RRIF, or SPP to include in income.

Q: Who needs to complete Form T2205?

A: Form T2205 needs to be completed by individuals in Canada who have spousal or common-law partner RRSP, RRIF, or SPP income.

Q: What is RRSP?

A: RRSP stands for Registered Retirement Savings Plan, which is a retirement savings account in Canada.

Q: What is RRIF?

A: RRIF stands for Registered Retirement Income Fund, which is a retirement income account in Canada.

Q: What is SPP?

A: SPP stands for Specified Pension Plan, which is a type of pension plan in Canada.

Q: Why do I need to include amounts from a spousal or common-law partner RRSP, RRIF, or SPP in income?

A: The amounts from a spousal or common-law partner RRSP, RRIF, or SPP are considered taxable income in Canada.