This version of the form is not currently in use and is provided for reference only. Download this version of

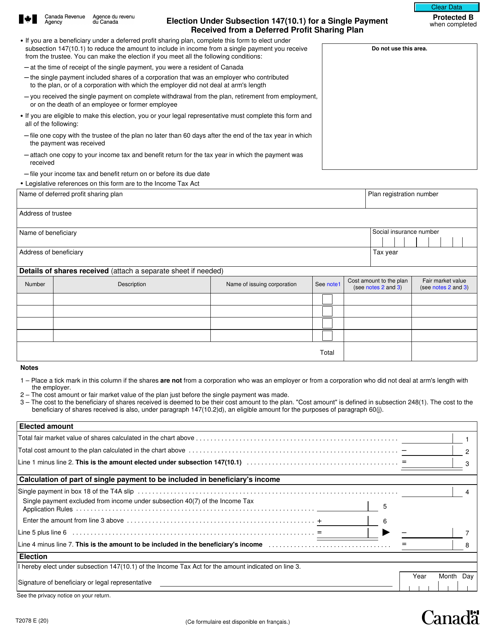

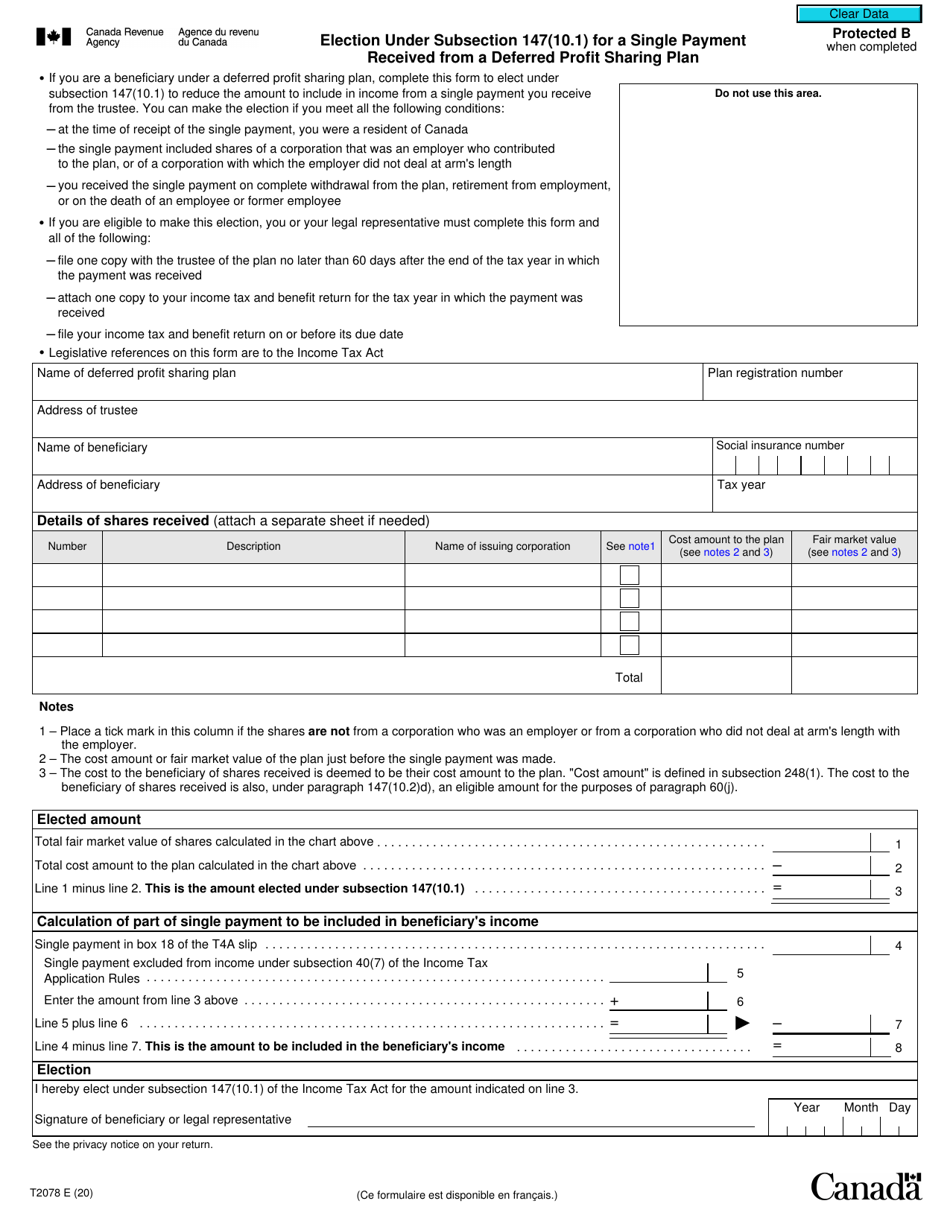

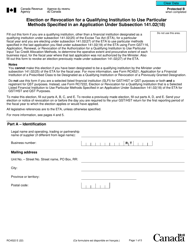

Form T2078

for the current year.

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan - Canada

Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan in Canada is used to make an election regarding the taxation of a single payment received from a deferred profit sharing plan.

The individual who receives a single payment from a deferred profit sharing plan in Canada would need to file the Form T2078 Election Under Subsection 147(10.1).

FAQ

Q: What is Form T2078?

A: Form T2078 is a tax form used in Canada.

Q: What is the purpose of Form T2078?

A: Form T2078 is used to make an election under subsection 147(10.1) of the Income Tax Act for a single payment received from a deferred profit sharing plan (DPSP).

Q: What does subsection 147(10.1) of the Income Tax Act refer to?

A: Subsection 147(10.1) of the Income Tax Act refers to the tax treatment of single payments received from a deferred profit sharing plan.

Q: What is a deferred profit sharing plan (DPSP)?

A: A deferred profit sharing plan (DPSP) is a type of retirement savings plan offered by employers in Canada.

Q: Why would someone need to use Form T2078?

A: Someone would need to use Form T2078 to make an election regarding the tax treatment of a single payment received from a DPSP.

Q: Can I use Form T2078 for multiple payments received from a DPSP?

A: No, Form T2078 is specifically for making an election regarding a single payment received from a DPSP.

Q: Is Form T2078 applicable only to residents of Canada?

A: Yes, Form T2078 is applicable to residents of Canada who have received a single payment from a DPSP.

Q: Is it mandatory to use Form T2078?

A: It is not mandatory to use Form T2078, but it may be necessary in order to make the desired election under subsection 147(10.1) of the Income Tax Act.