This version of the form is not currently in use and is provided for reference only. Download this version of

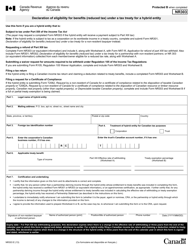

Form RC521

for the current year.

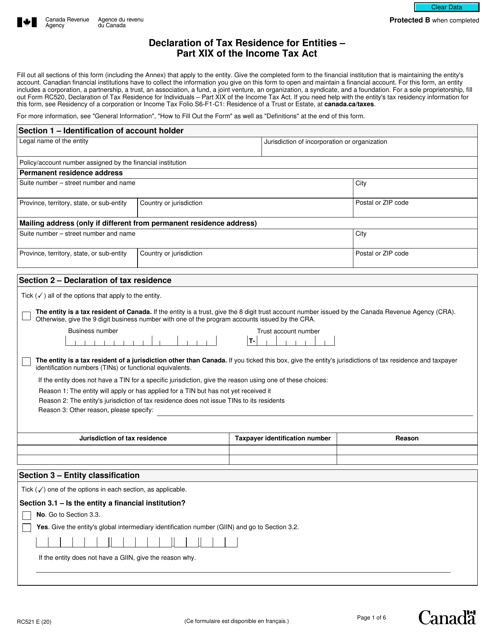

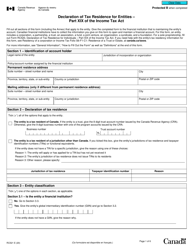

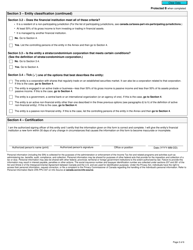

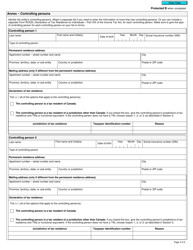

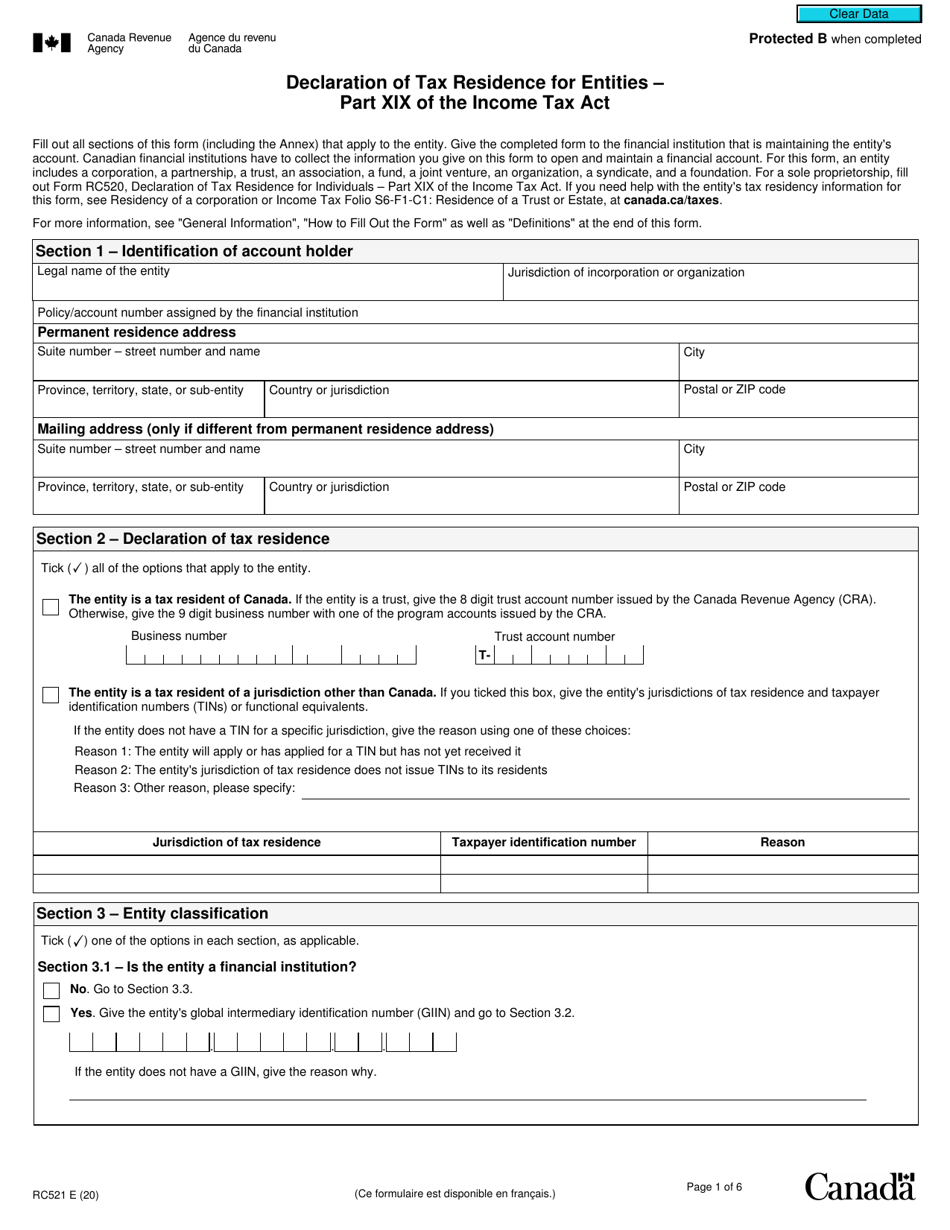

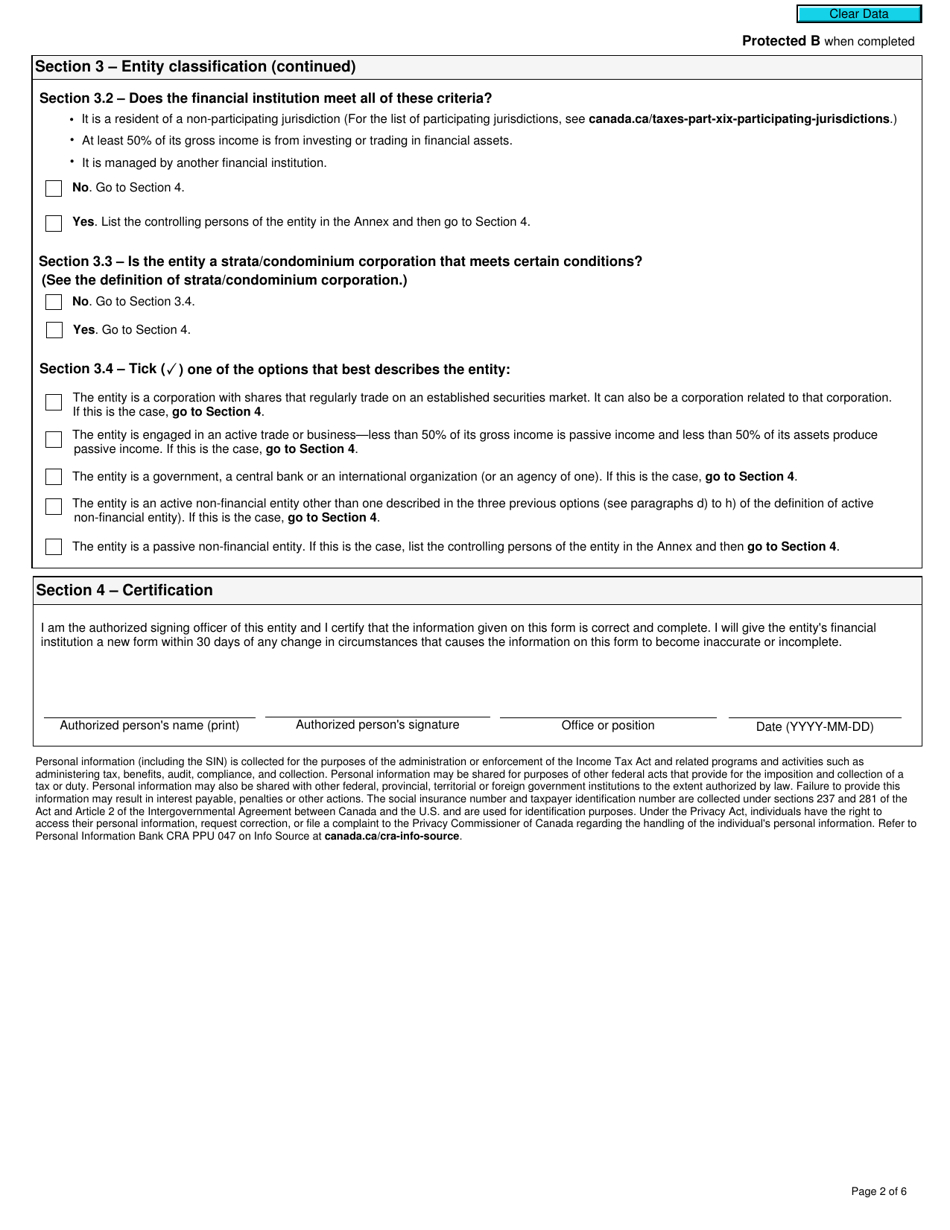

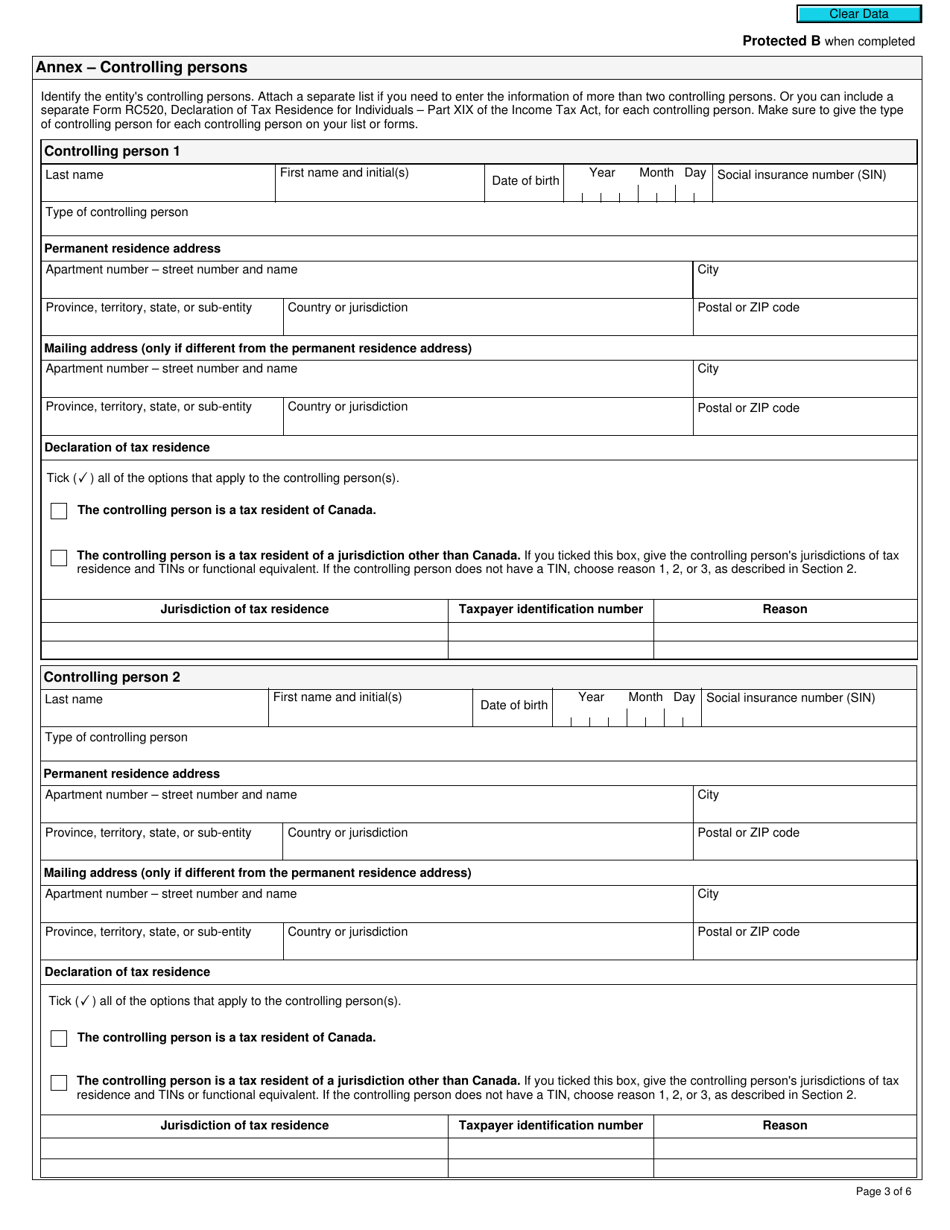

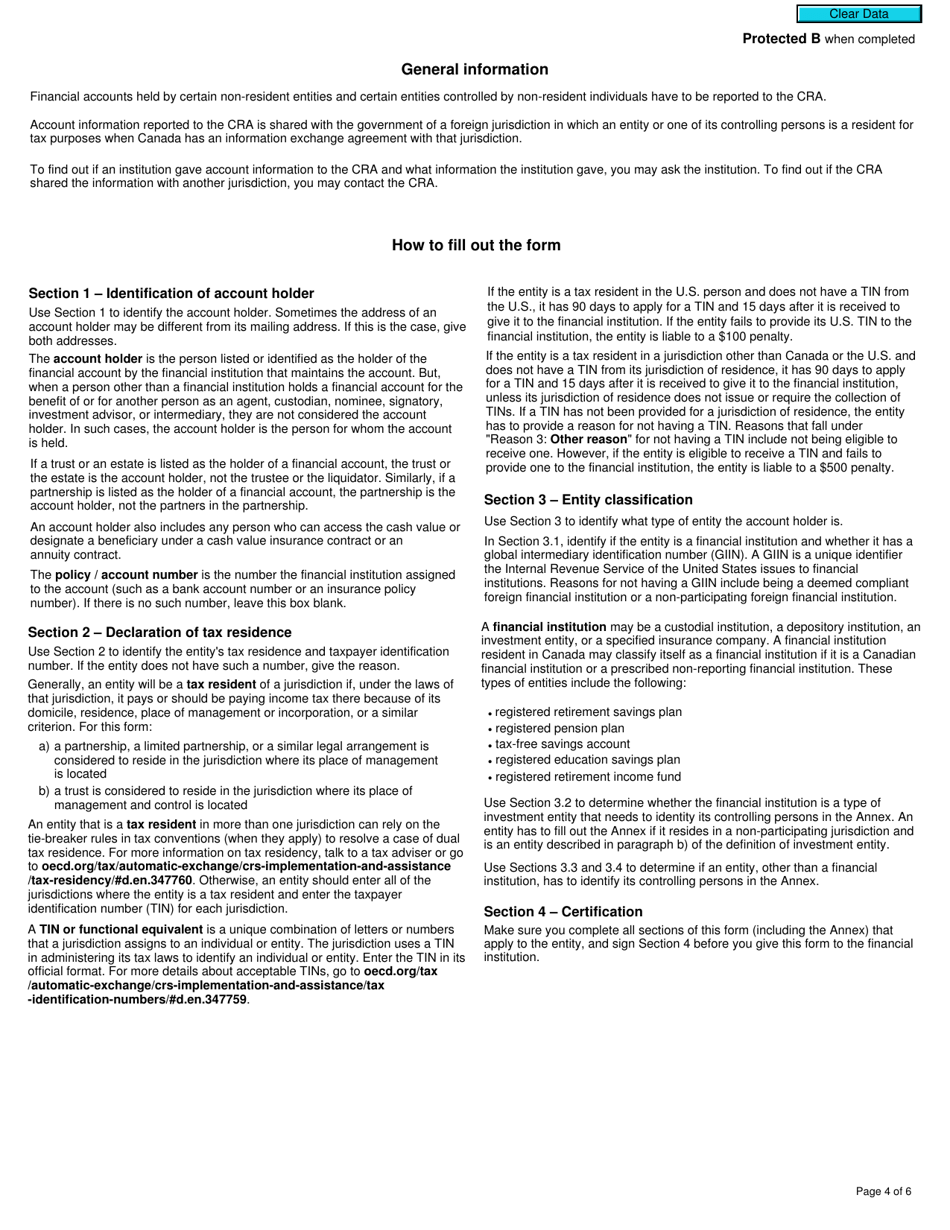

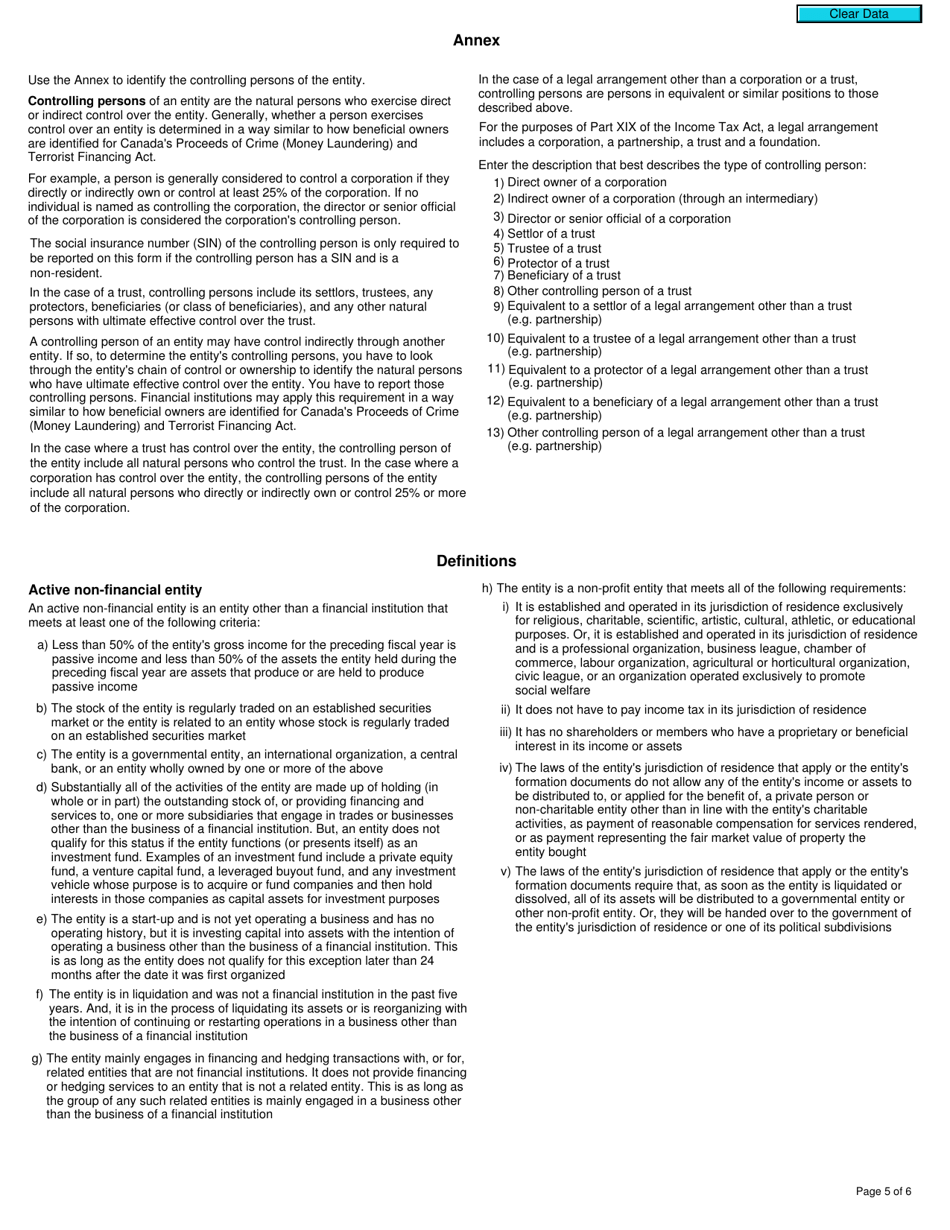

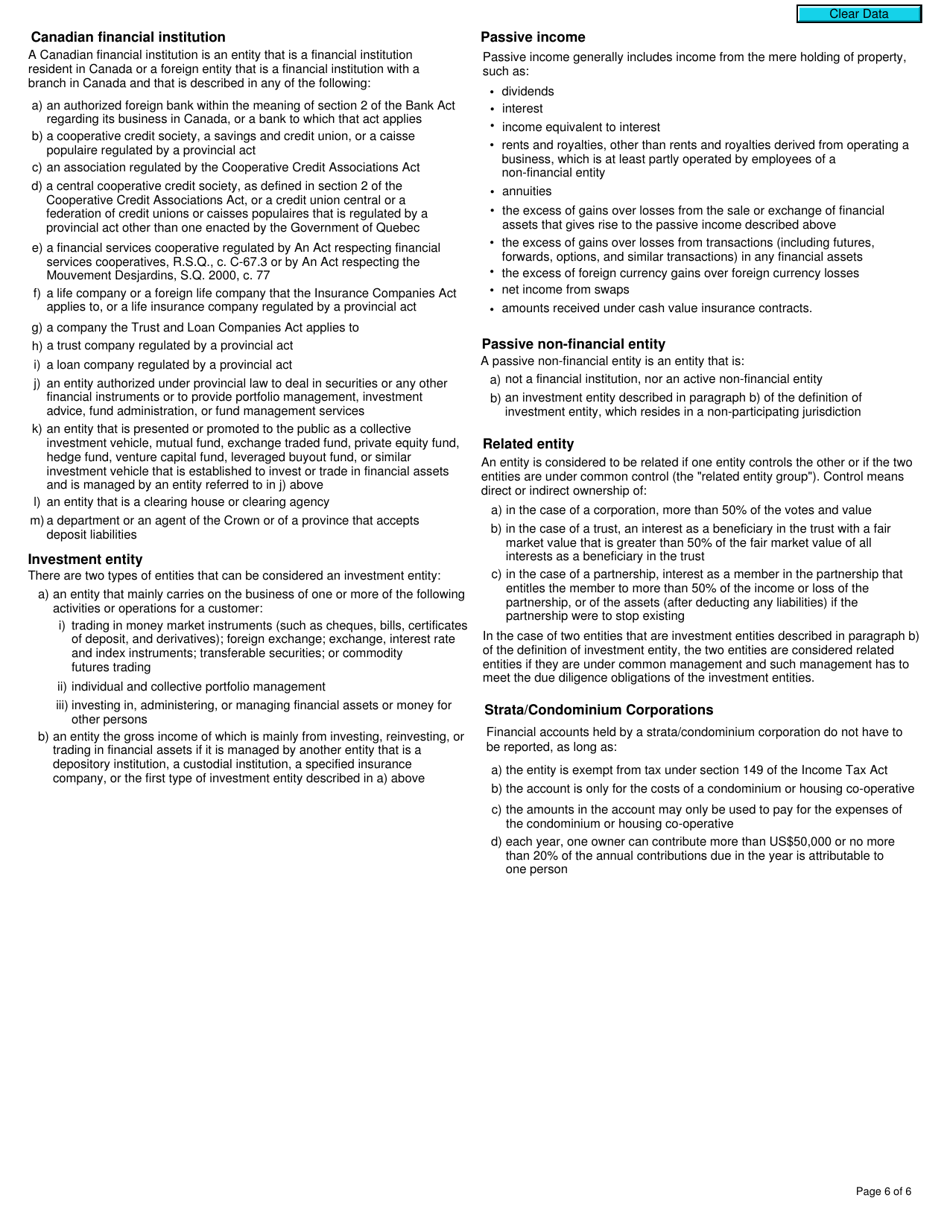

Form RC521 Declaration of Tax Residence for Entities - Part Xix of the Income Tax Act - Canada

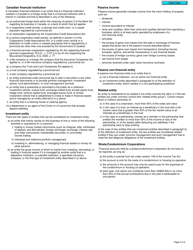

Form RC521 Declaration of Tax Residence for Entities is used by entities to declare their tax residence status in Canada. It is a part of the Income Tax Act and is used for tax-related purposes. It helps the Canadian tax authorities determine the entity's eligibility for tax benefits and to prevent double taxation.

The Form RC521 Declaration of Tax Residence for Entities is filed by entities that need to declare their tax residence status in Canada.

FAQ

Q: What is Form RC521?

A: Form RC521 is a document used in Canada for declaring tax residence for entities.

Q: Who needs to fill out Form RC521?

A: Entities that need to declare their tax residence in Canada need to fill out Form RC521.

Q: What is Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act in Canada contains provisions related to non-resident taxation.

Q: What information is required in Form RC521?

A: Form RC521 asks for information such as the entity's name, address, and tax identification number.