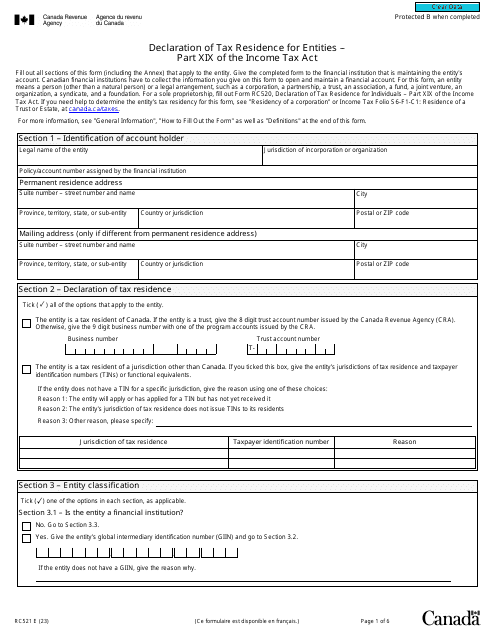

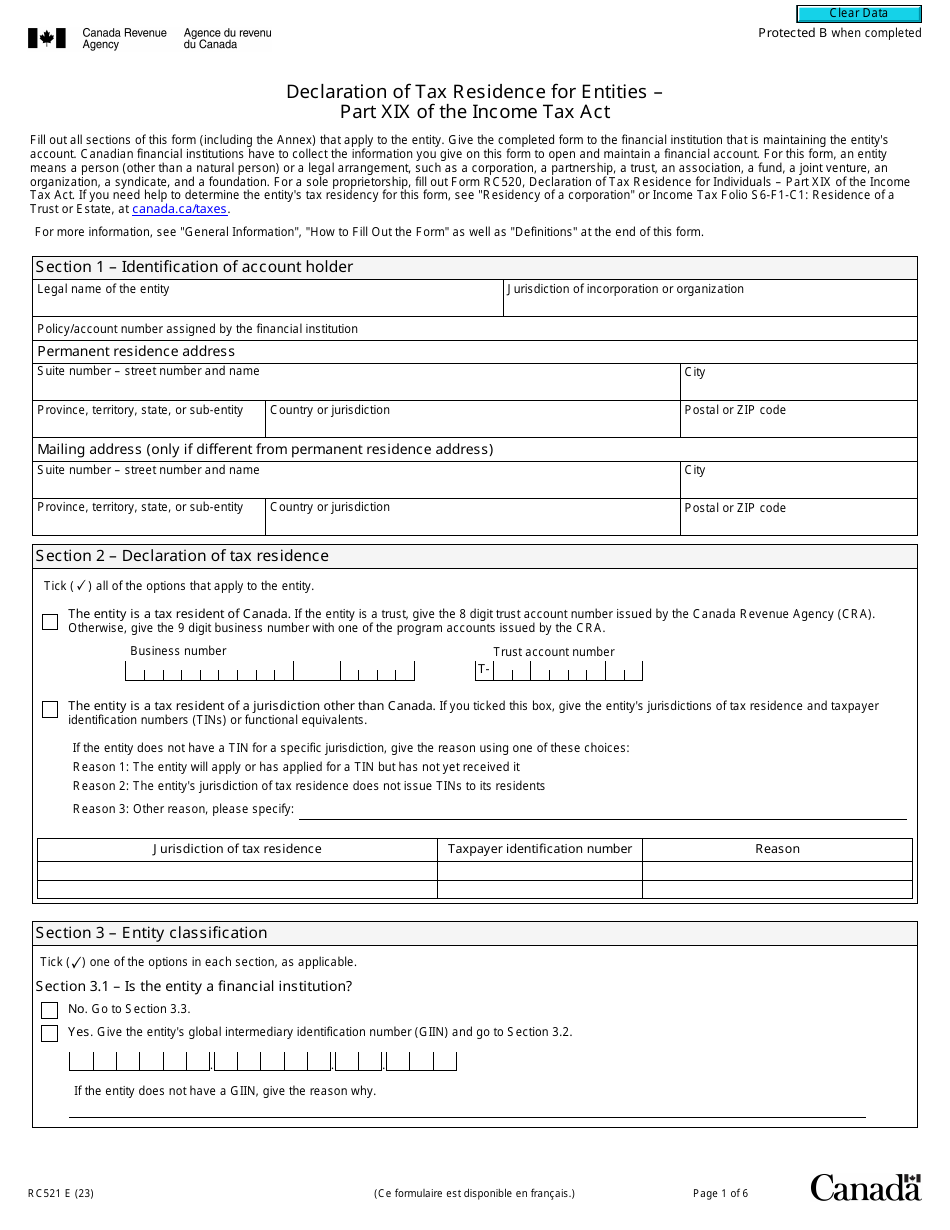

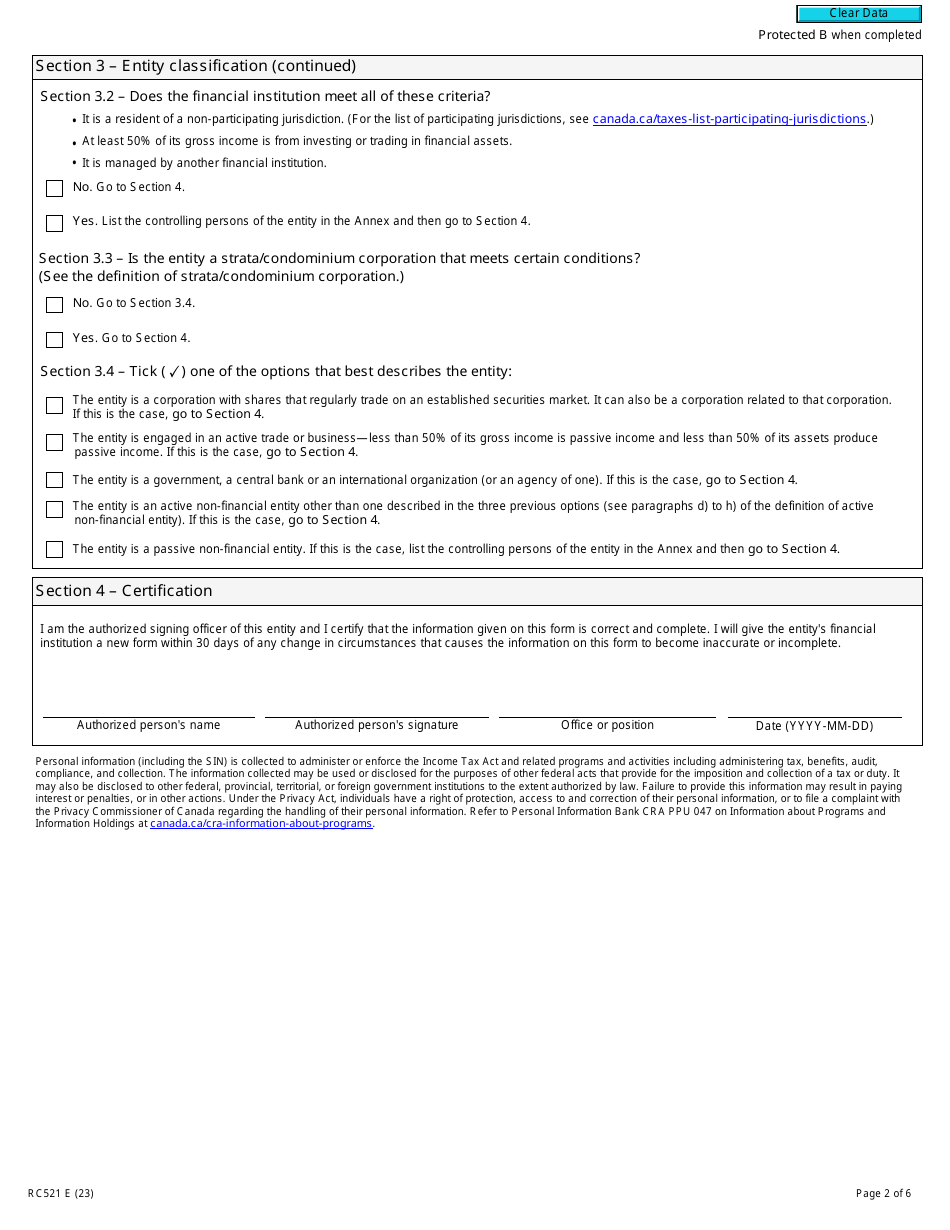

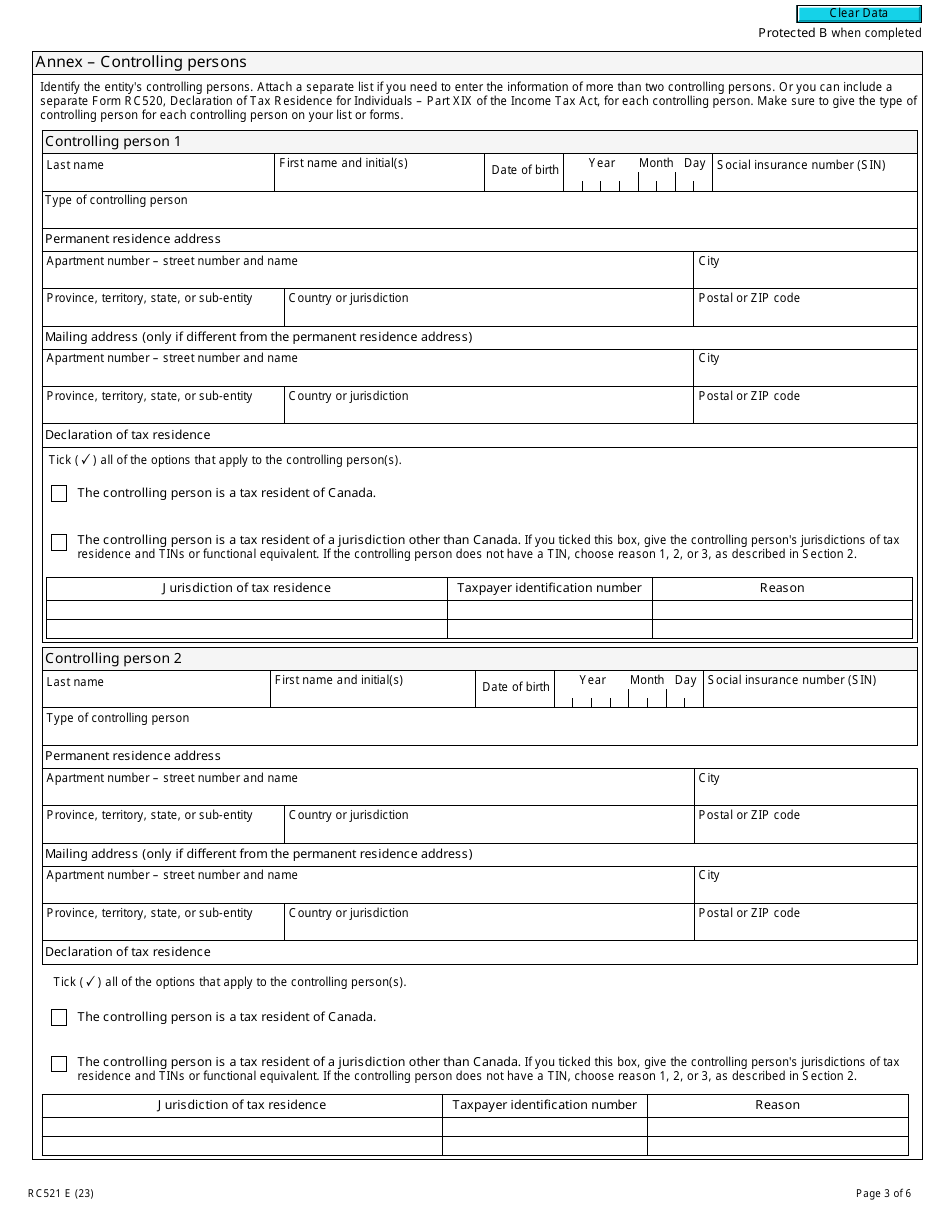

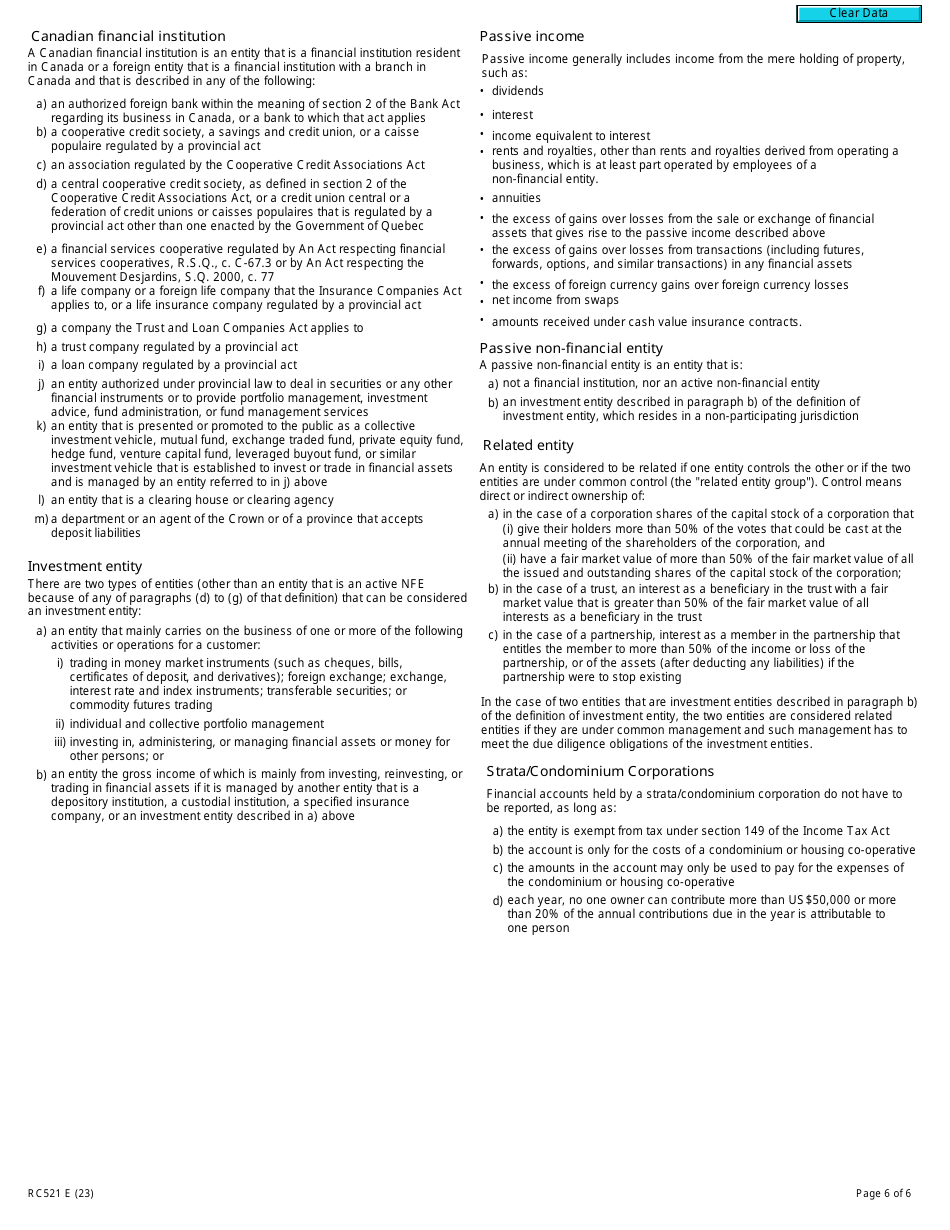

Form RC521 Declaration of Tax Residence for Entities - Part Xix of the Income Tax Act - Canada

Form RC521 Declaration of Tax Residence for Entities is used in Canada for entities to declare their tax residence status. It is required to determine if an entity qualifies for any tax benefits or exemptions provided by the Income Tax Act.

The Form RC521 Declaration of Tax Residence for Entities, Part XIX of the Income Tax Act in Canada, is filed by entities that want to declare their tax residence status.

Form RC521 Declaration of Tax Residence for Entities - Part Xix of the Income Tax Act - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC521?

A: Form RC521 is the Declaration of Tax Residence for Entities.

Q: What is Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act in Canada is the section that deals with international tax laws and regulations.

Q: Who needs to fill out Form RC521?

A: Entities that need to declare their tax residence in Canada should fill out Form RC521.

Q: What information is required on Form RC521?

A: Form RC521 requires information about the entity's name, address, tax identification number, and details about its tax residence.