This version of the form is not currently in use and is provided for reference only. Download this version of

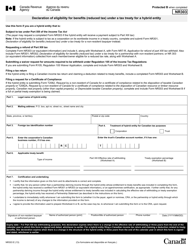

Form RC520

for the current year.

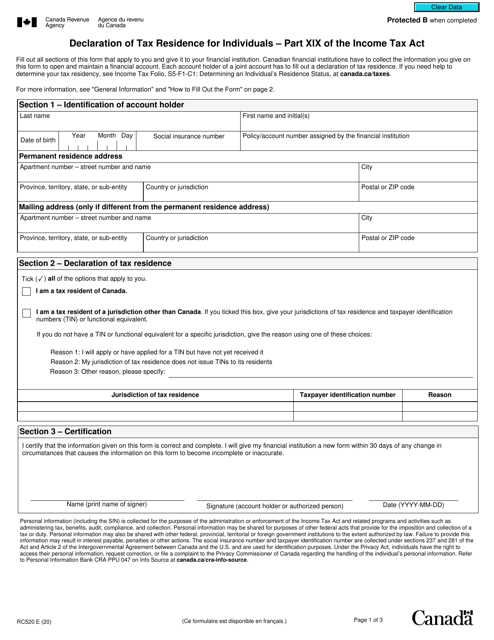

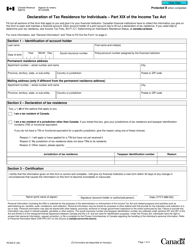

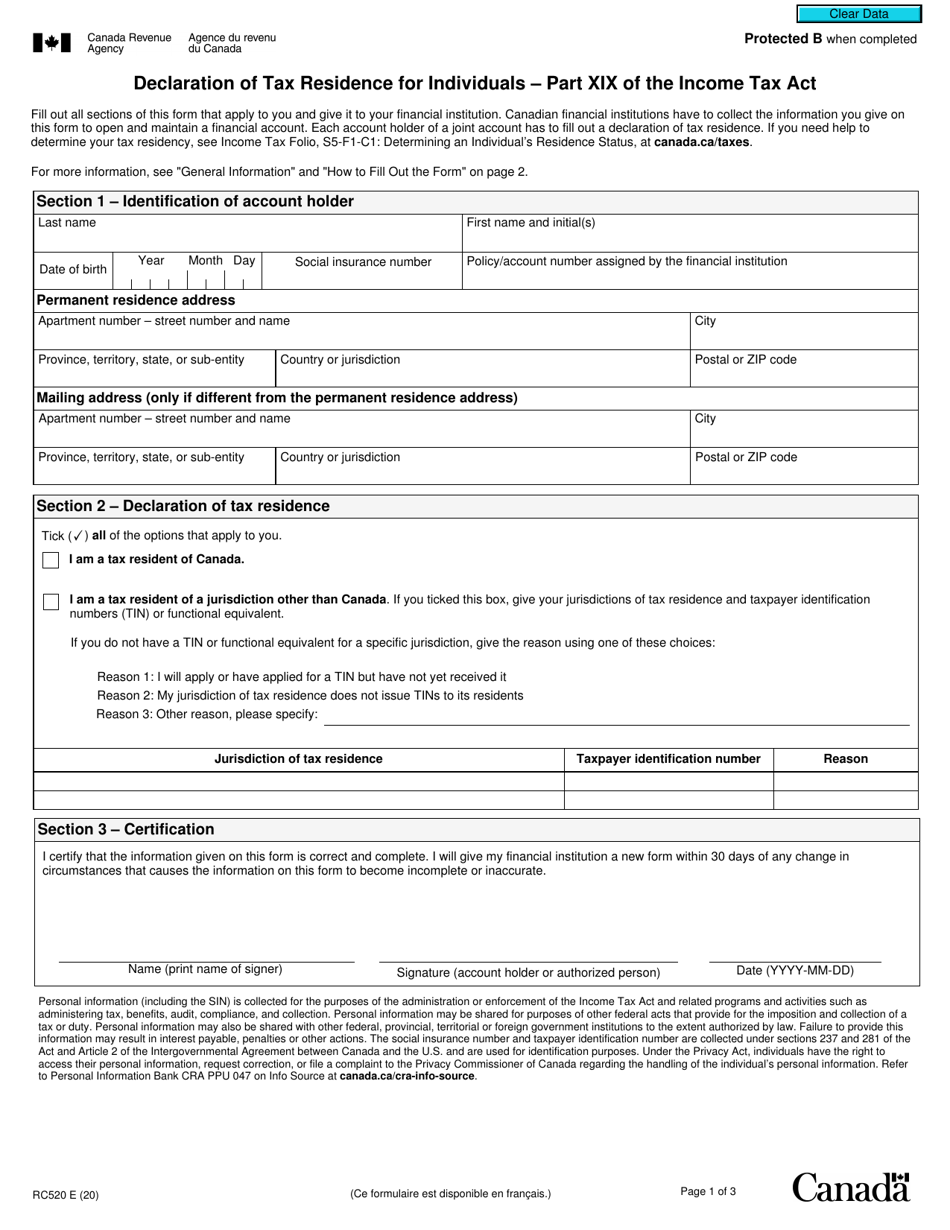

Form RC520 Declaration of Tax Residence for Individuals - Part Xix of the Income Tax Act - Canada

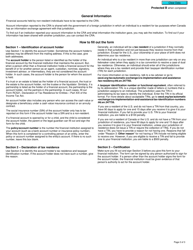

Form RC520 Declaration of Tax Residence for Individuals is used in Canada for individuals to declare their tax residency status. It is specifically used to determine if an individual is a resident of Canada for income tax purposes and to claim the benefits of tax treaties between Canada and other countries.

The Form RC520 Declaration of Tax Residence for Individuals in Canada is filed by individuals who are claiming to be residents of Canada for tax purposes.

FAQ

Q: What is Form RC520?

A: Form RC520 is the Declaration of Tax Residence for Individuals.

Q: What is Part XIX of the Income Tax Act?

A: Part XIX of the Income Tax Act pertains to the taxation of non-residents of Canada.

Q: Who should use Form RC520?

A: Form RC520 should be used by individuals who are declaring their tax residence status in Canada.

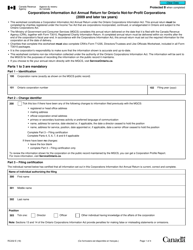

Q: What information is required in Form RC520?

A: Form RC520 requires information about the individual's identification, residence, and tax status.

Q: Are there any deadlines for submitting Form RC520?

A: Yes, the deadline for submitting Form RC520 depends on your personal circumstances. It is recommended to check with the CRA for specific deadlines.

Q: What happens after submitting Form RC520?

A: After submitting Form RC520, the CRA will determine your tax residency status based on the information provided.

Q: Do I need to submit Form RC520 every year?

A: No, Form RC520 generally needs to be submitted only once, unless your tax residency status changes.

Q: Can I make changes to Form RC520 after submitting it?

A: Yes, you can make changes or submit a new form if your tax residency status changes or if there are errors in the original form.

Q: Is Form RC520 applicable for U.S. residents?

A: No, Form RC520 is specifically for individuals declaring their tax residence status in Canada. U.S. residents should consult the applicable tax authorities.