This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC518

for the current year.

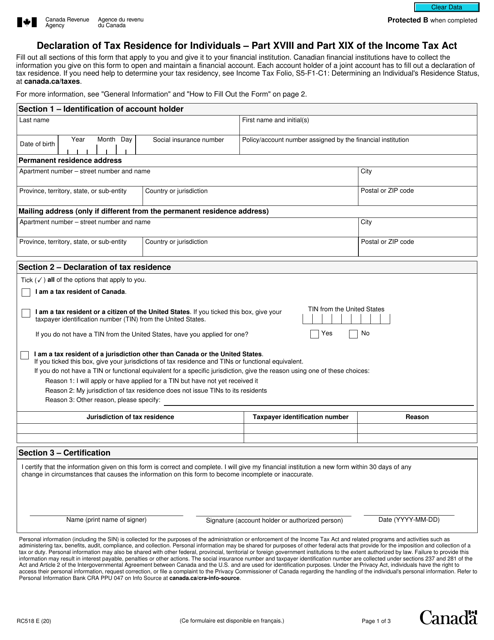

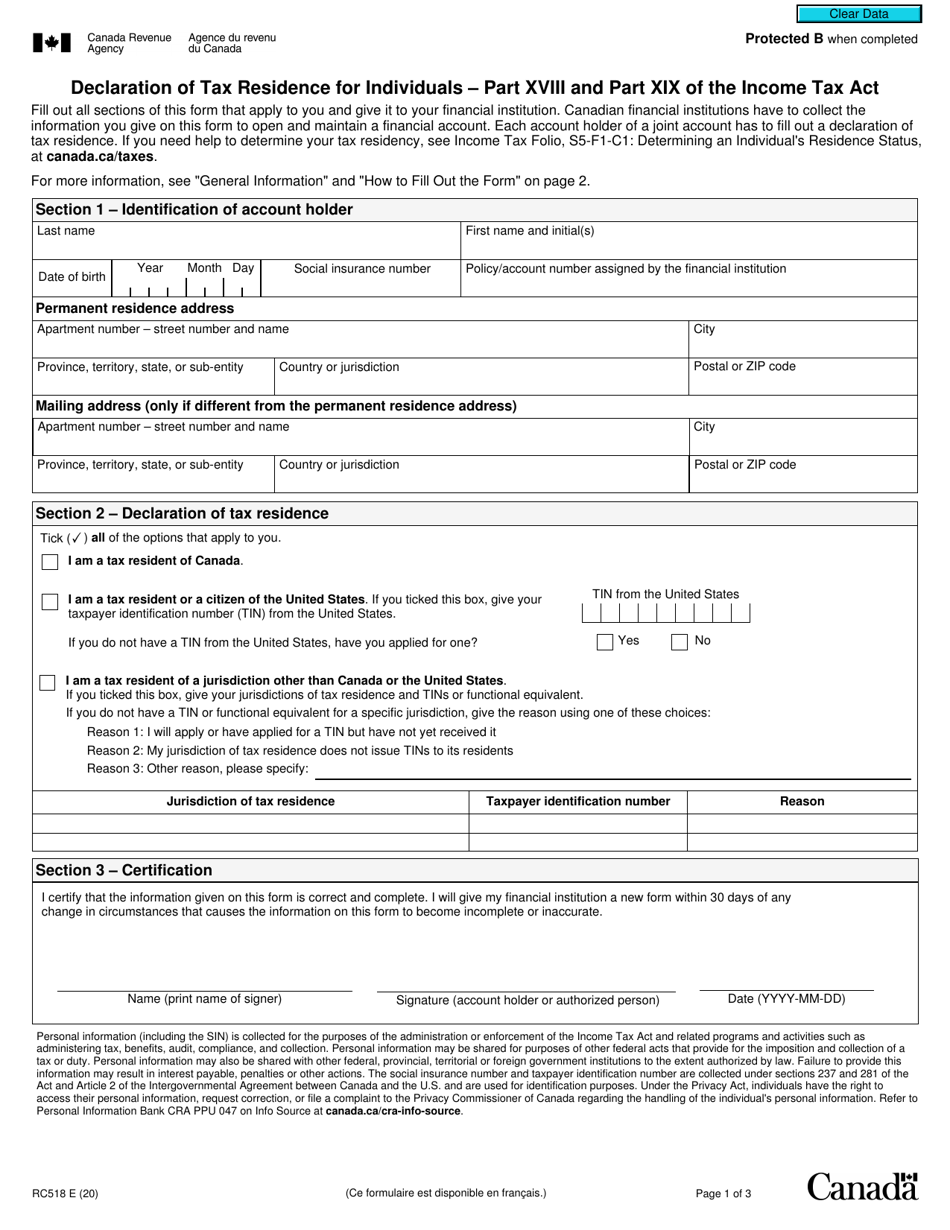

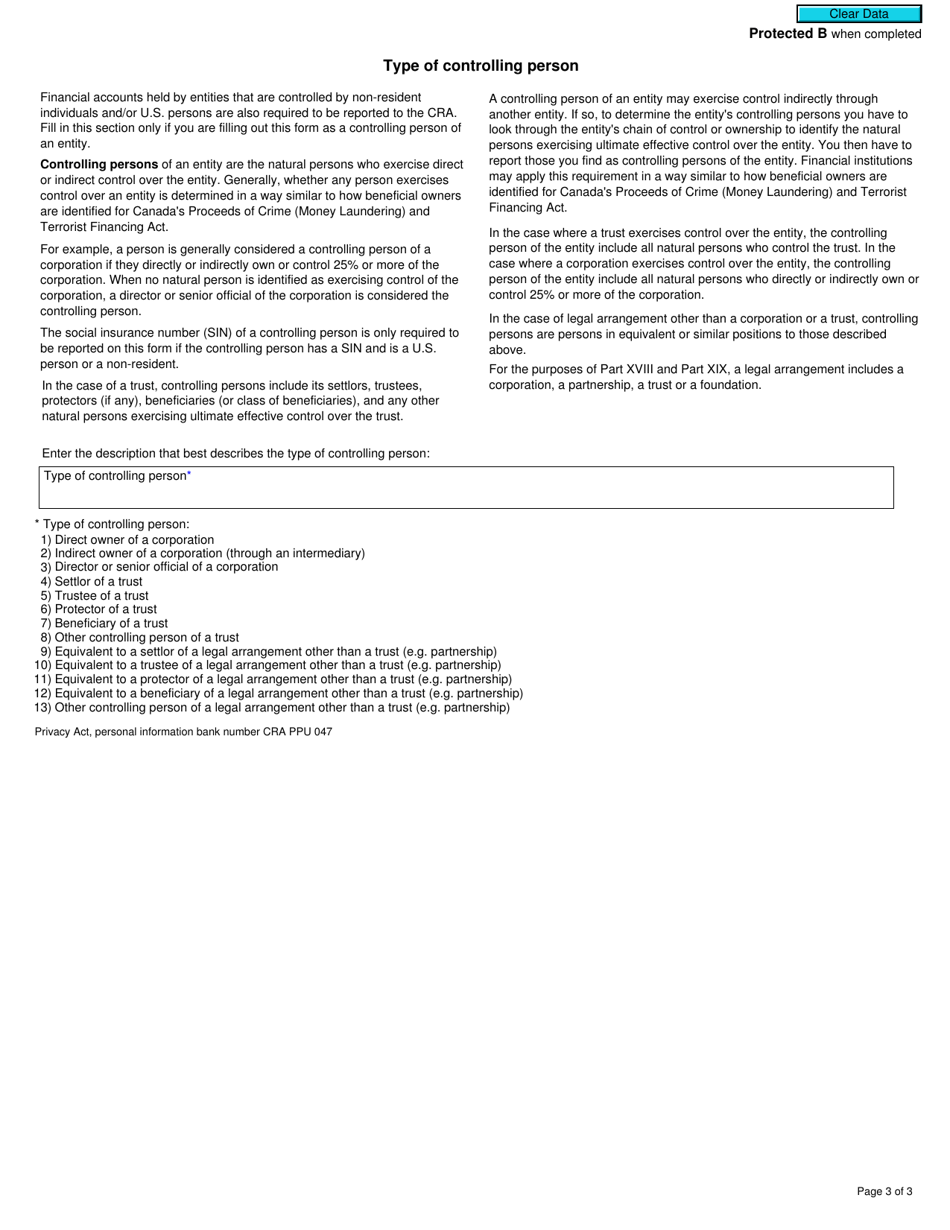

Form RC518 Declaration of Tax Residence for Individuals - Part Xviii and Part Xix of the Income Tax Act - Canada

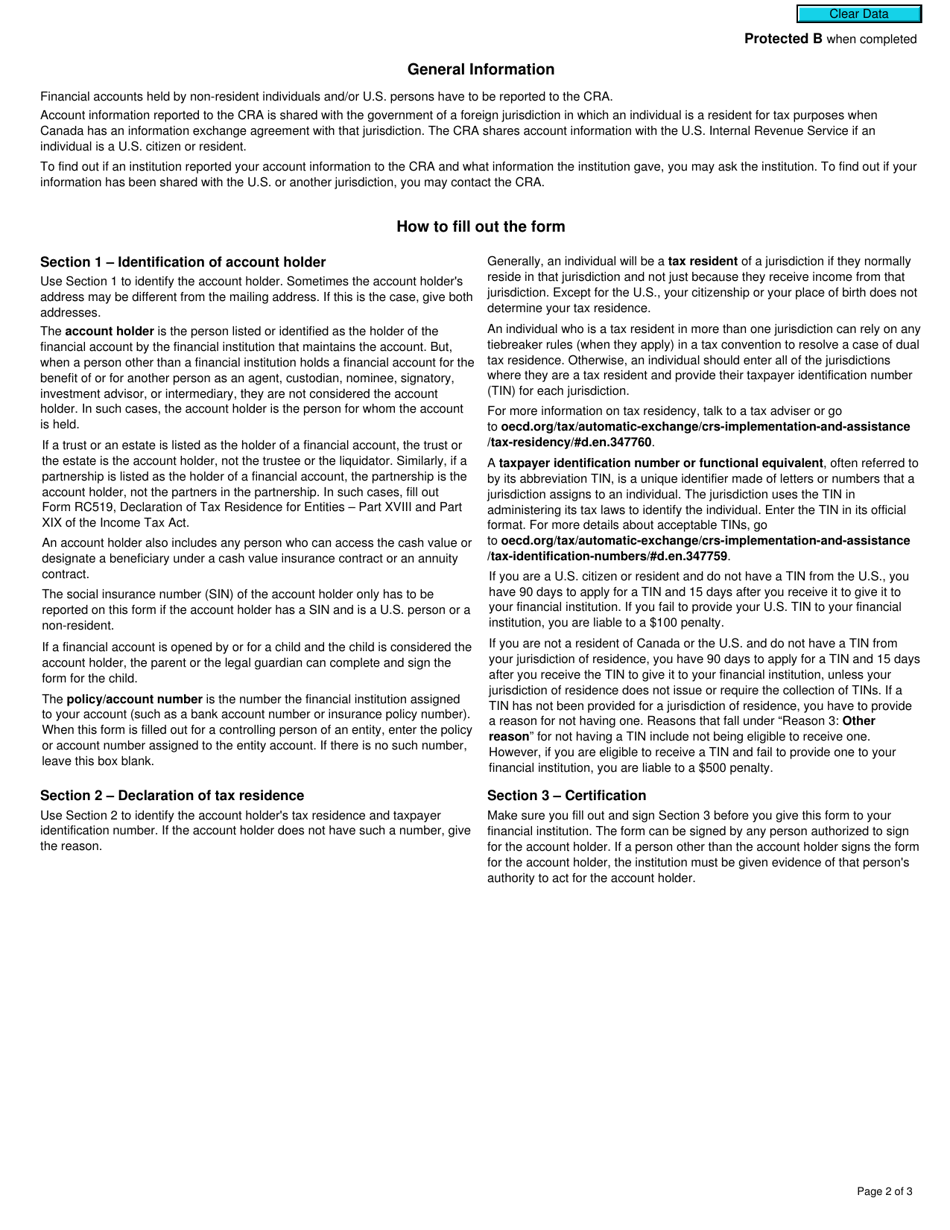

The Form RC518 Declaration of Tax Residence for Individuals - Part XVIII and Part XIX of the Income Tax Act - Canada is used to determine an individual's tax residency status in Canada. It helps individuals declare their status as a resident or non-resident for tax purposes.

The Form RC518 Declaration of Tax Residence for Individuals is filed by individuals themselves who are residents of Canada.

FAQ

Q: What is Form RC518?

A: Form RC518 is the Declaration of Tax Residence for Individuals in Canada.

Q: When do I need to use Form RC518?

A: You need to use Form RC518 if you want to declare your tax residence status in Canada.

Q: What are Part XVIII and Part XIX of the Income Tax Act?

A: Part XVIII and Part XIX of the Income Tax Act are sections that pertain to the taxation of non-resident individuals in Canada.

Q: What information do I need to provide on Form RC518?

A: You need to provide your personal details, such as name, address, and social insurance number, as well as information about your tax residence status.

Q: Is Form RC518 only for Canadian residents?

A: No, Form RC518 is also used by non-residents to declare their tax residence status in Canada.

Q: What happens if I don't submit Form RC518?

A: If you don't submit Form RC518, the Canada Revenue Agency may not recognize your tax residence status and may treat you as a non-resident for tax purposes.

Q: Can I make changes to Form RC518 after submitting it?

A: Yes, you can make changes to Form RC518 by submitting a new form with the updated information.

Q: Is there a deadline for submitting Form RC518?

A: There is no specific deadline for submitting Form RC518, but it is recommended to submit it as soon as possible to avoid any issues with your tax residence status.