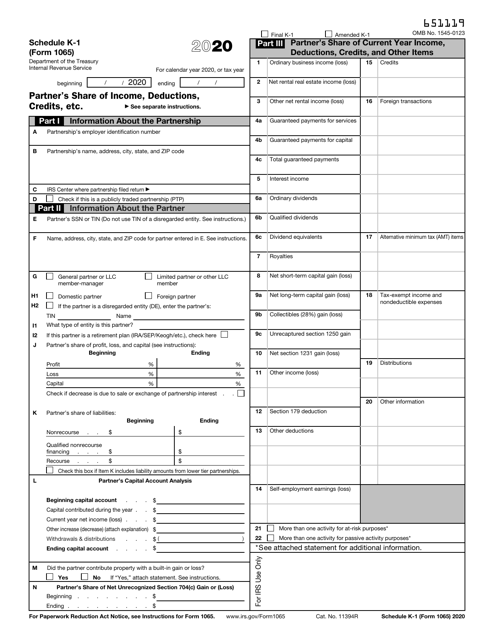

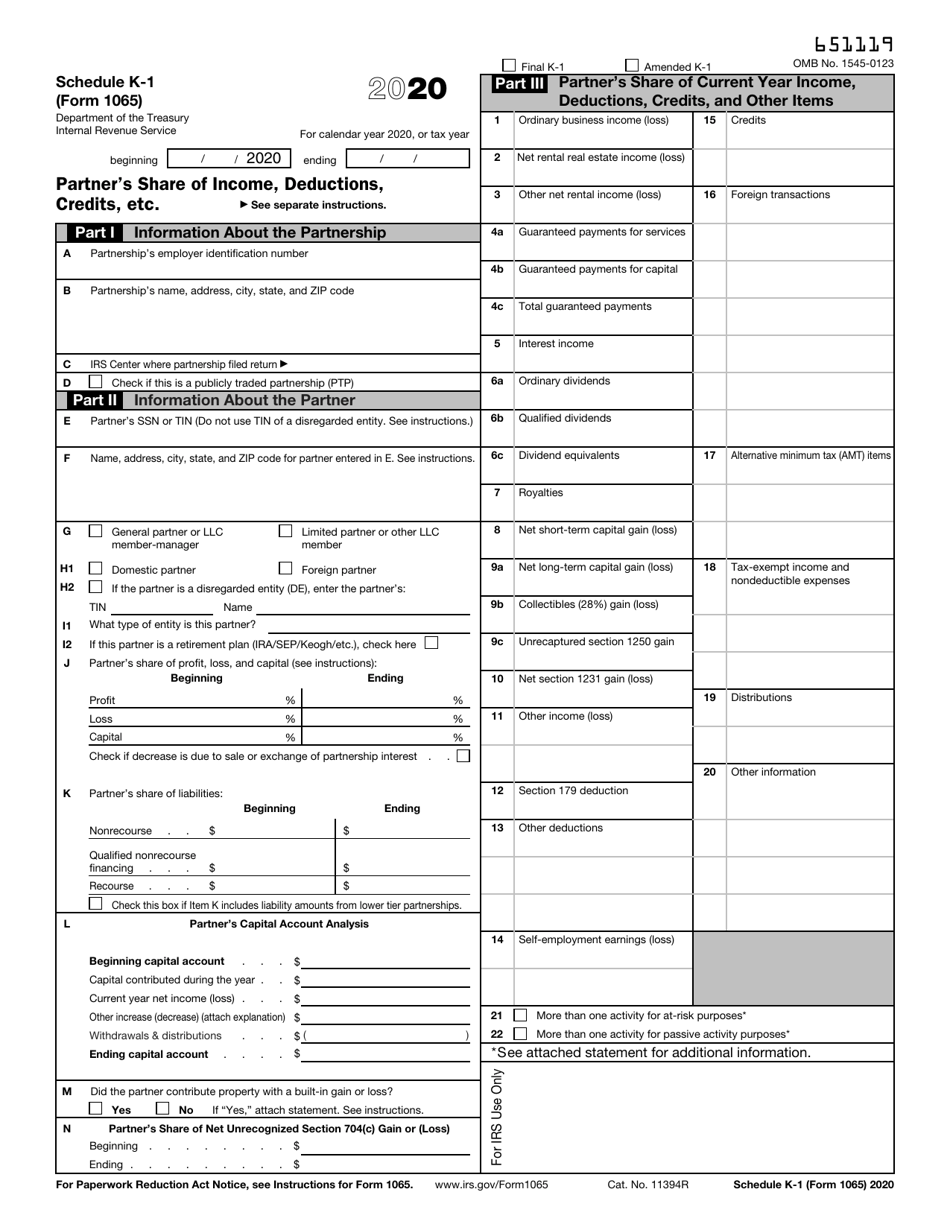

This version of the form is not currently in use and is provided for reference only. Download this version of

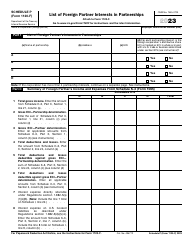

IRS Form 1065 Schedule K-1

for the current year.

IRS Form 1065 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc.

What Is IRS Form 1065 Schedule K-1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065 Schedule K-1?

A: IRS Form 1065 Schedule K-1 is a tax form used to report a partner's share of income, deductions, credits, and other tax items from a partnership.

Q: Who needs to fill out IRS Form 1065 Schedule K-1?

A: Partners in a partnership need to fill out IRS Form 1065 Schedule K-1.

Q: What information does IRS Form 1065 Schedule K-1 contain?

A: IRS Form 1065 Schedule K-1 contains information about a partner's share of partnership income, deductions, credits, etc.

Q: What is the purpose of IRS Form 1065 Schedule K-1?

A: The purpose of IRS Form 1065 Schedule K-1 is to report a partner's share of partnership income, deductions, credits, etc., to the IRS.

Q: When is IRS Form 1065 Schedule K-1 due?

A: IRS Form 1065 Schedule K-1 is due on the same day as IRS Form 1065, which is typically April 15th.

Q: Can I e-file IRS Form 1065 Schedule K-1?

A: Yes, you can e-file IRS Form 1065 Schedule K-1 if you are filing your partnership's tax return electronically.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule K-1 through the link below or browse more documents in our library of IRS Forms.