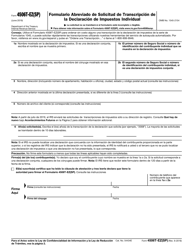

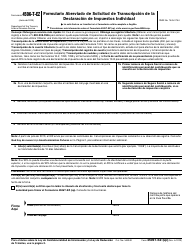

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 990-EZ

for the current year.

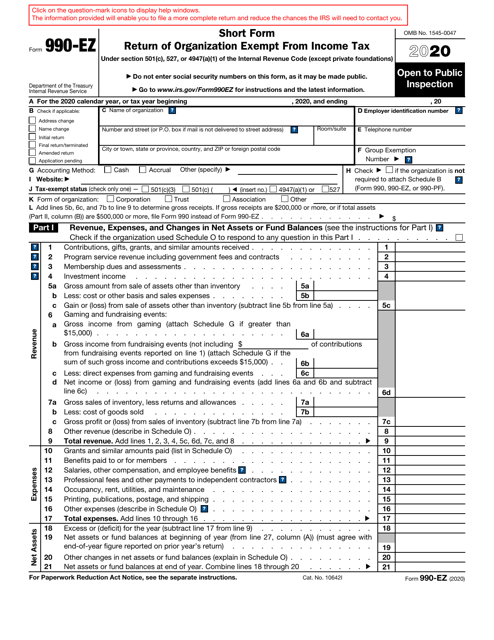

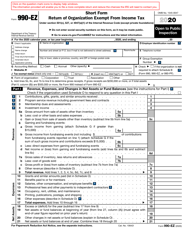

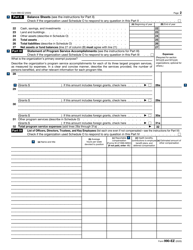

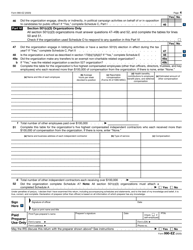

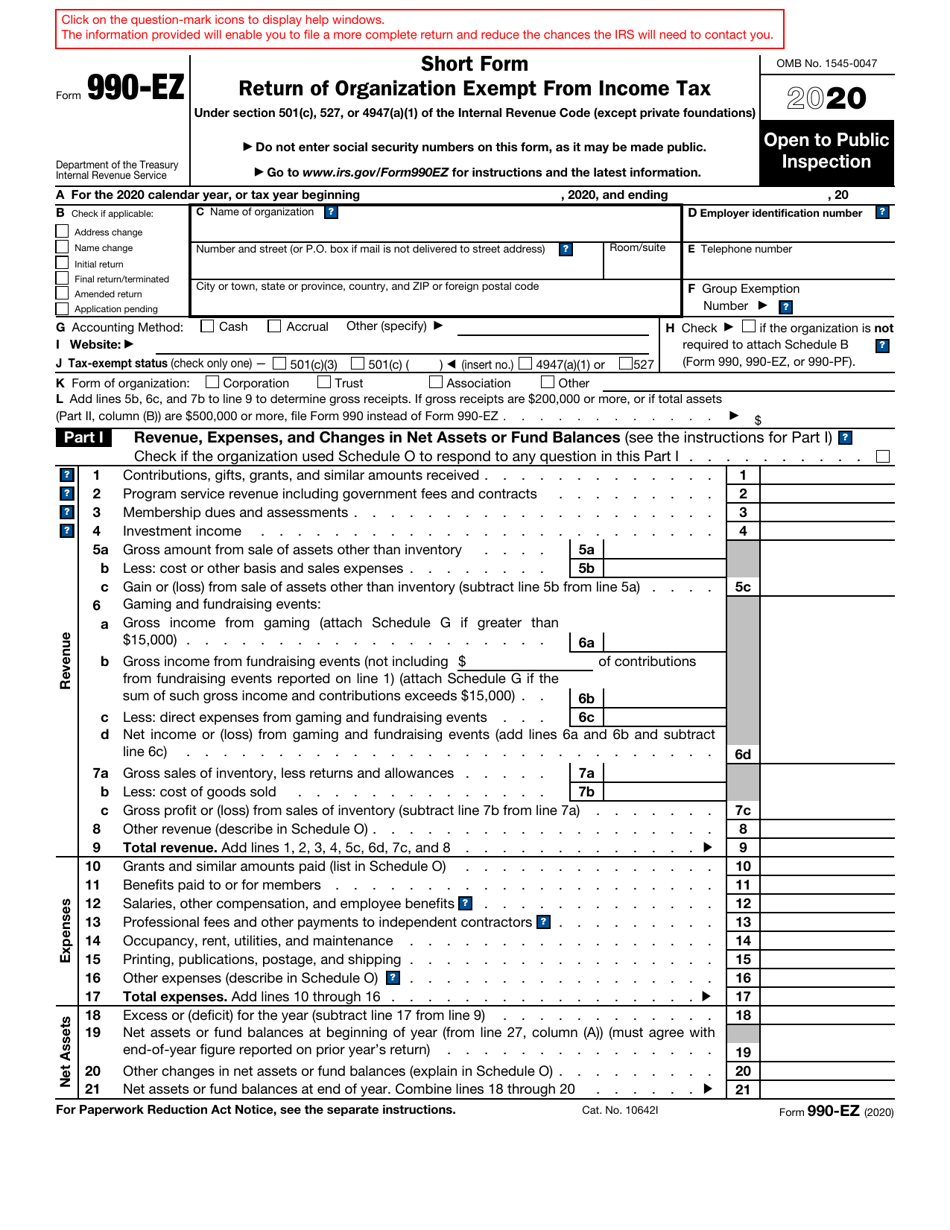

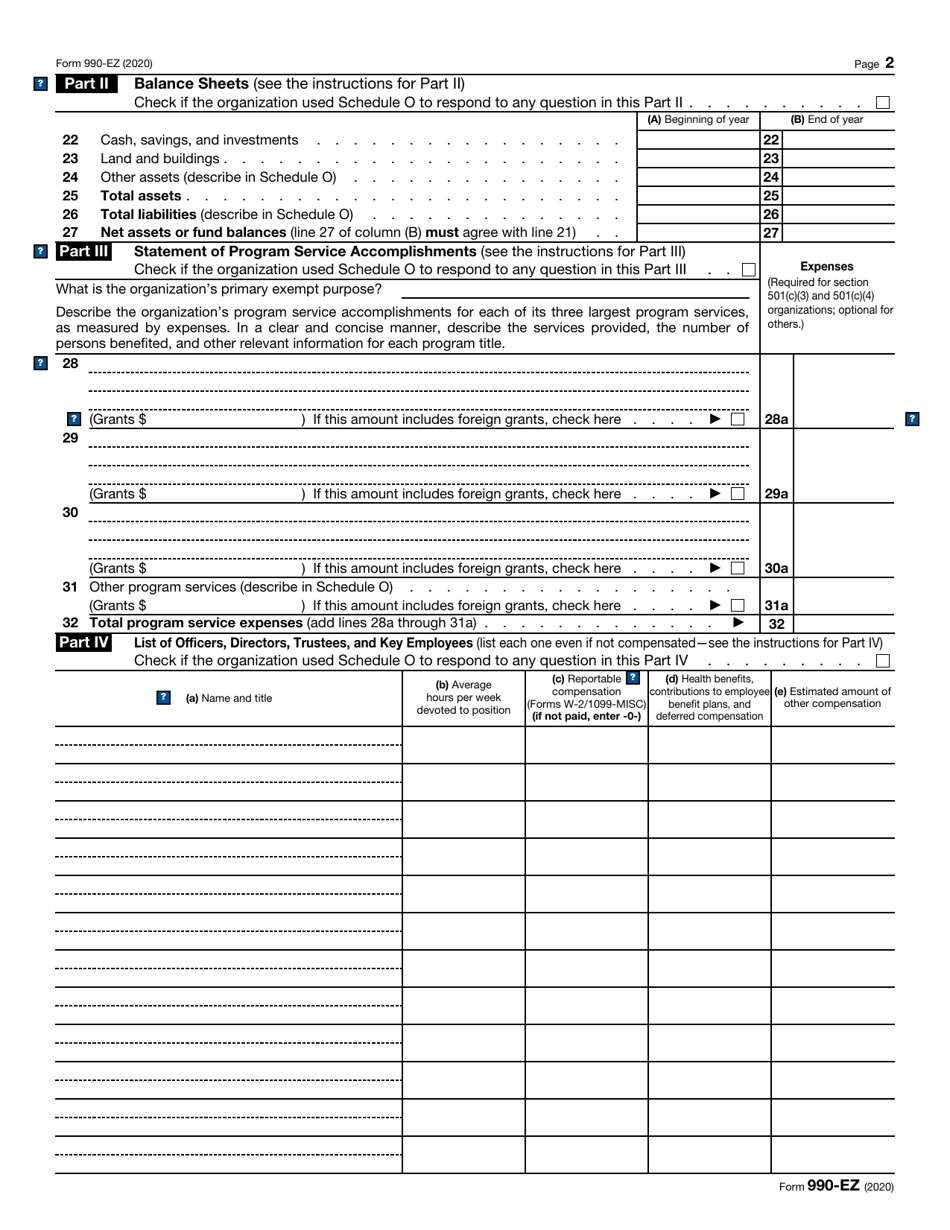

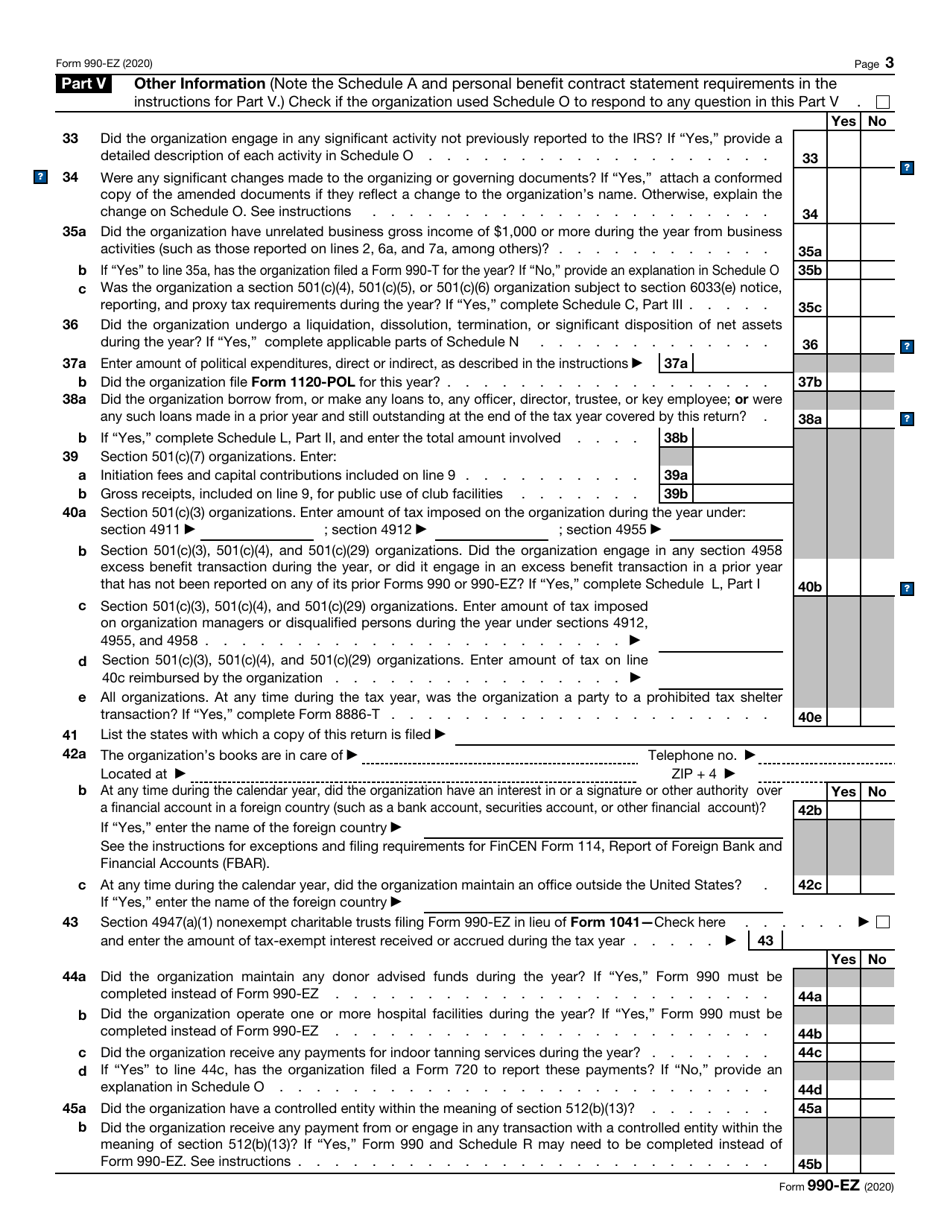

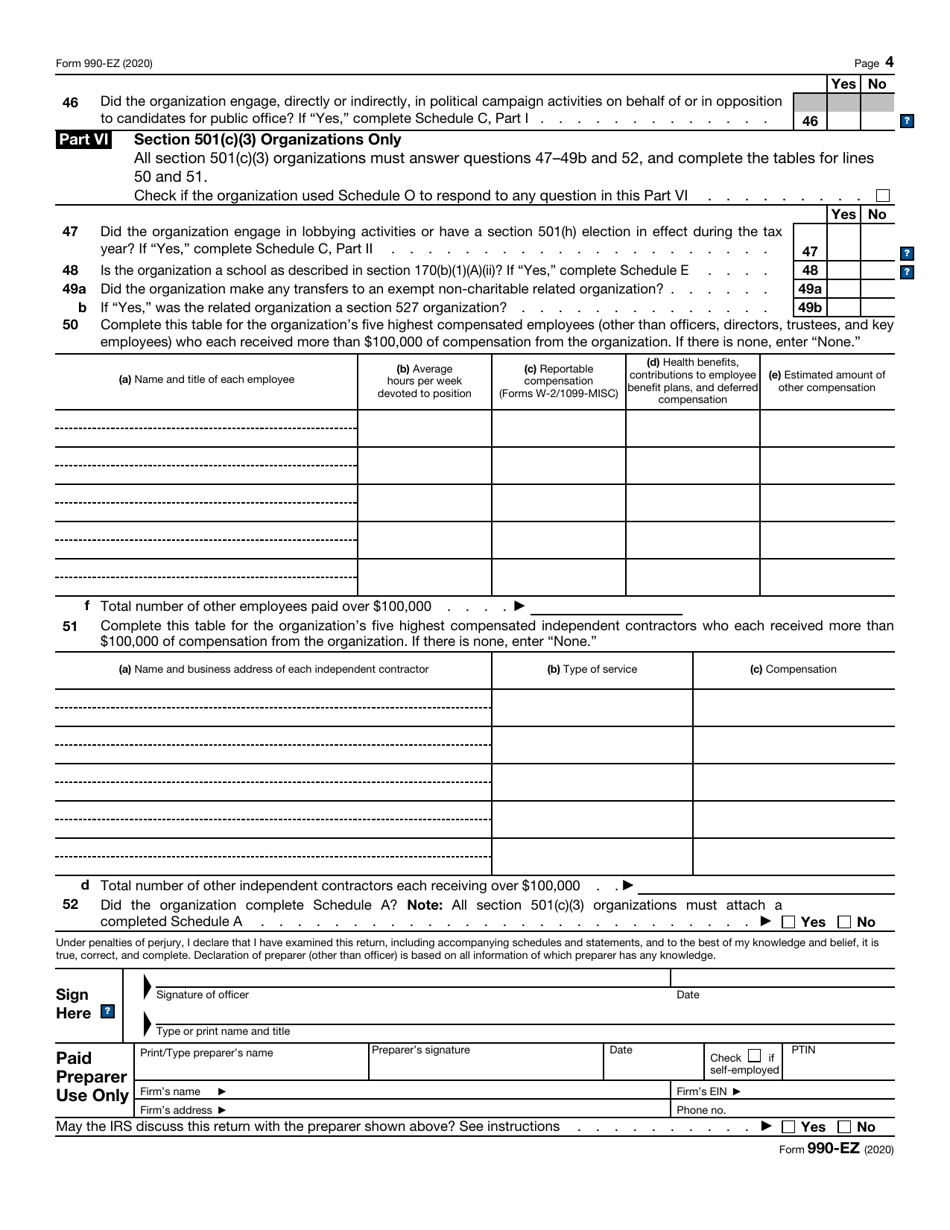

IRS Form 990-EZ Short Form Return of Organization Exempt From Income Tax

What Is IRS Form 990-EZ?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a tax return form for organizations that are exempt from income tax.

Q: Who is eligible to use IRS Form 990-EZ?

A: Certain tax-exempt organizations with gross receipts less than $200,000 and total assets less than $500,000 can use Form 990-EZ instead of the longer Form 990.

Q: What is the purpose of filing IRS Form 990-EZ?

A: The purpose of filing Form 990-EZ is to provide the IRS with information about the organization's finances and activities to maintain its tax-exempt status.

Q: What information is required on IRS Form 990-EZ?

A: Form 990-EZ requires information about the organization's income, expenses, assets, liabilities, and its mission and activities.

Q: When is the deadline for filing IRS Form 990-EZ?

A: The deadline for filing Form 990-EZ is usually the 15th day of the 5th month after the organization's tax year ends.

Q: Are there any penalties for not filing IRS Form 990-EZ?

A: Yes, there can be penalties for not filing Form 990-EZ or for filing it late. It is important to comply with the filing requirements to maintain the organization's tax-exempt status.

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-EZ through the link below or browse more documents in our library of IRS Forms.