This version of the form is not currently in use and is provided for reference only. Download this version of

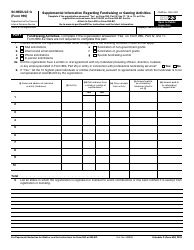

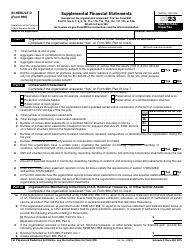

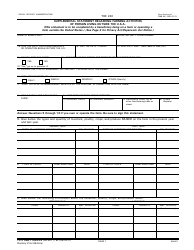

Instructions for IRS Form 990, 990-EZ Schedule G

for the current year.

Instructions for IRS Form 990, 990-EZ Schedule G

This document contains official instructions for IRS Form 990 Schedule G and IRS Form 990-EZ Schedule G . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 (990-EZ) Schedule G is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax return form used by tax-exempt organizations to provide information about their programs, finances, and governance.

Q: What is IRS Form 990-EZ?

A: IRS Form 990-EZ is a simplified version of Form 990, used by smaller tax-exempt organizations with less complicated financial situations.

Q: What is Schedule G?

A: Schedule G is a supplemental schedule that must be filed with Form 990 or Form 990-EZ. It is used to provide information about fundraising activities and certain gaming activities.

Q: Who needs to file Schedule G?

A: Tax-exempt organizations that engage in fundraising activities or certain gaming activities must file Schedule G along with Form 990 or Form 990-EZ.

Q: What information is required on Schedule G?

A: Schedule G requires information about fundraising and gaming activities, such as proceeds, expenses, and non-cash prizes.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.