This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-F Schedule I

for the current year.

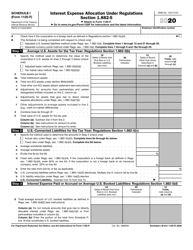

Instructions for IRS Form 1120-F Schedule I Interest Expense Allocation Under Regulations Section 1.882-5

This document contains official instructions for IRS Form 1120-F Schedule I, Interest Expense Allocation Under Regulations Section 1.882-5 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-F Schedule I is available for download through this link.

FAQ

Q: What is the purpose of IRS Form 1120-F Schedule I?

A: The purpose of IRS Form 1120-F Schedule I is to allocate and report interest expense under regulations section 1.882-5.

Q: Who needs to file IRS Form 1120-F Schedule I?

A: Foreign corporations engaged in a U.S. trade or business need to file IRS Form 1120-F Schedule I.

Q: What is the significance of regulations section 1.882-5?

A: Regulations section 1.882-5 provides guidelines on how to allocate and determine the amount of interest expense related to a foreign corporation's U.S. trade or business.

Q: What information is required on IRS Form 1120-F Schedule I?

A: IRS Form 1120-F Schedule I requires information about the foreign corporation, its interest expense, and the allocation of such expenses.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.