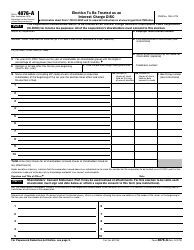

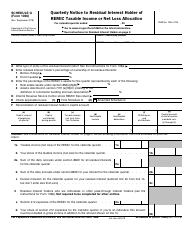

This version of the form is not currently in use and is provided for reference only. Download this version of

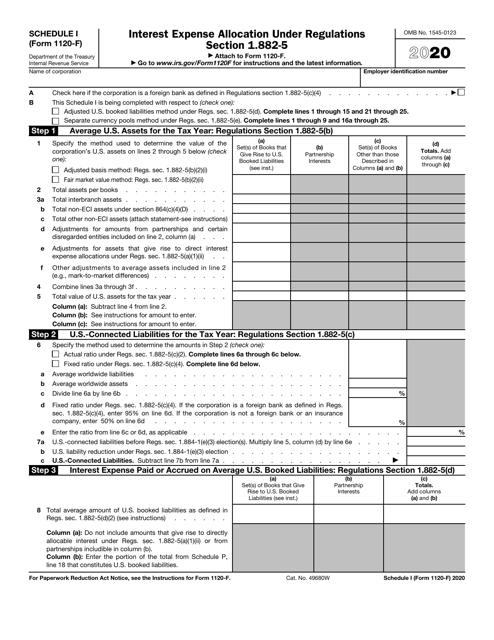

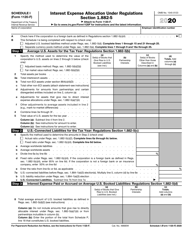

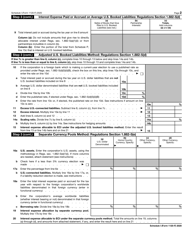

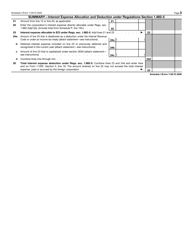

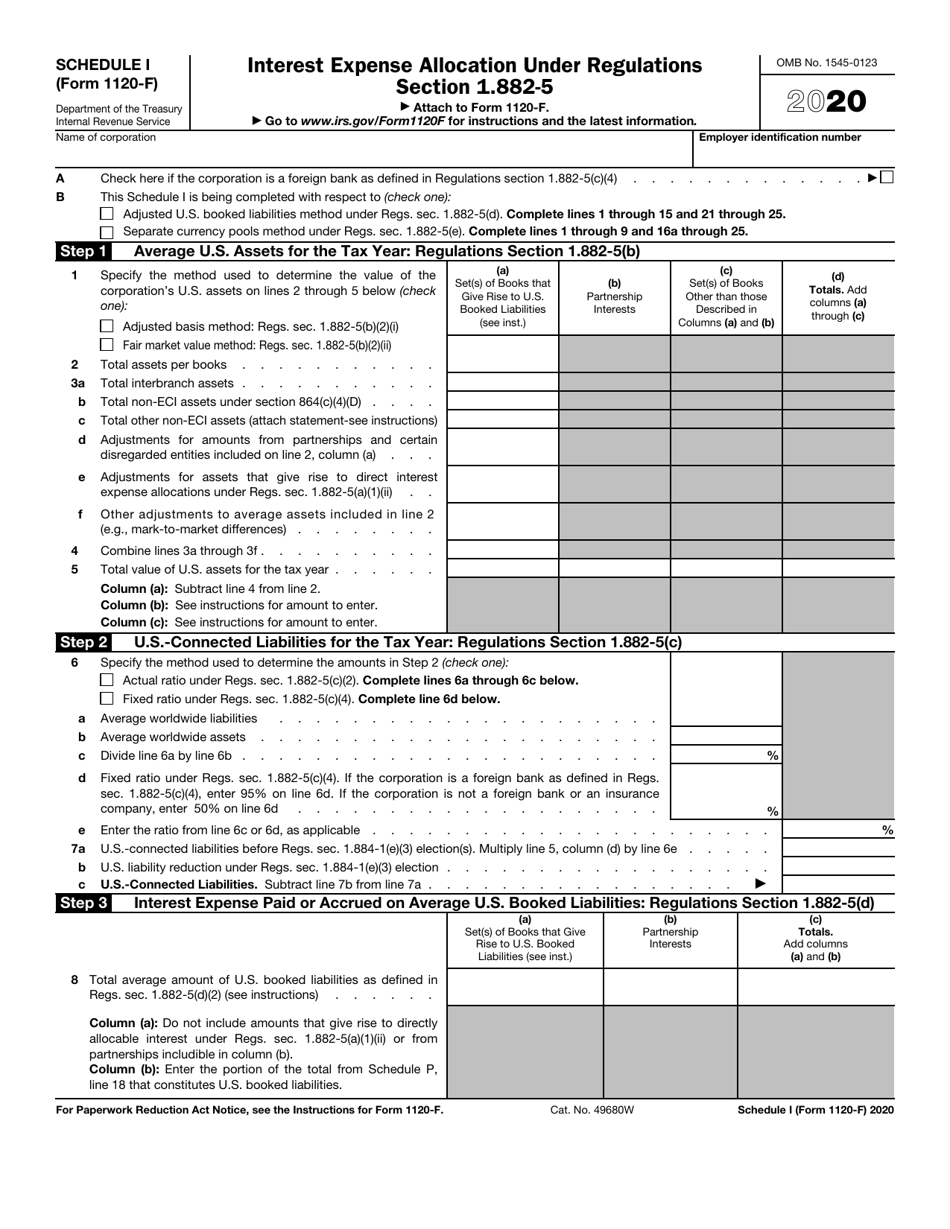

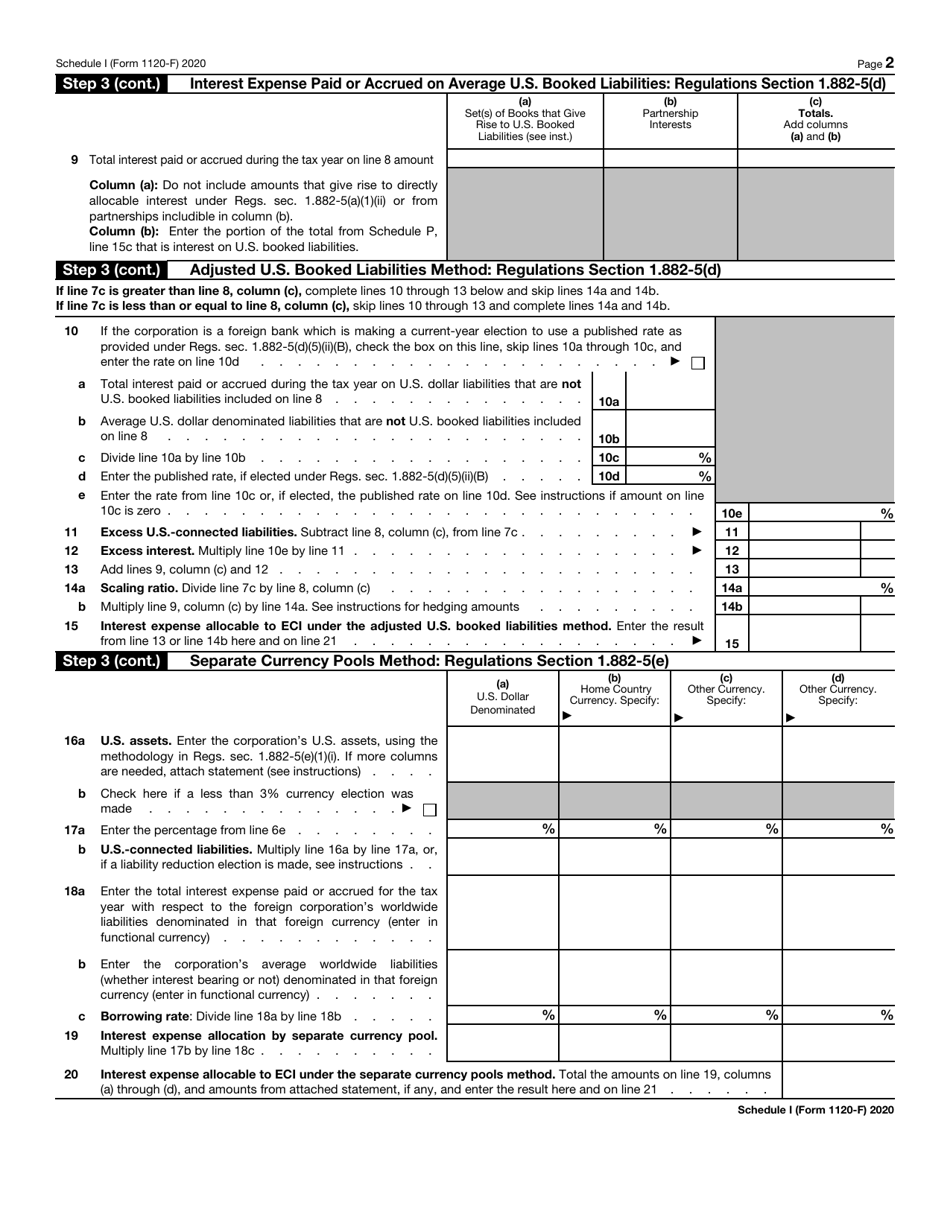

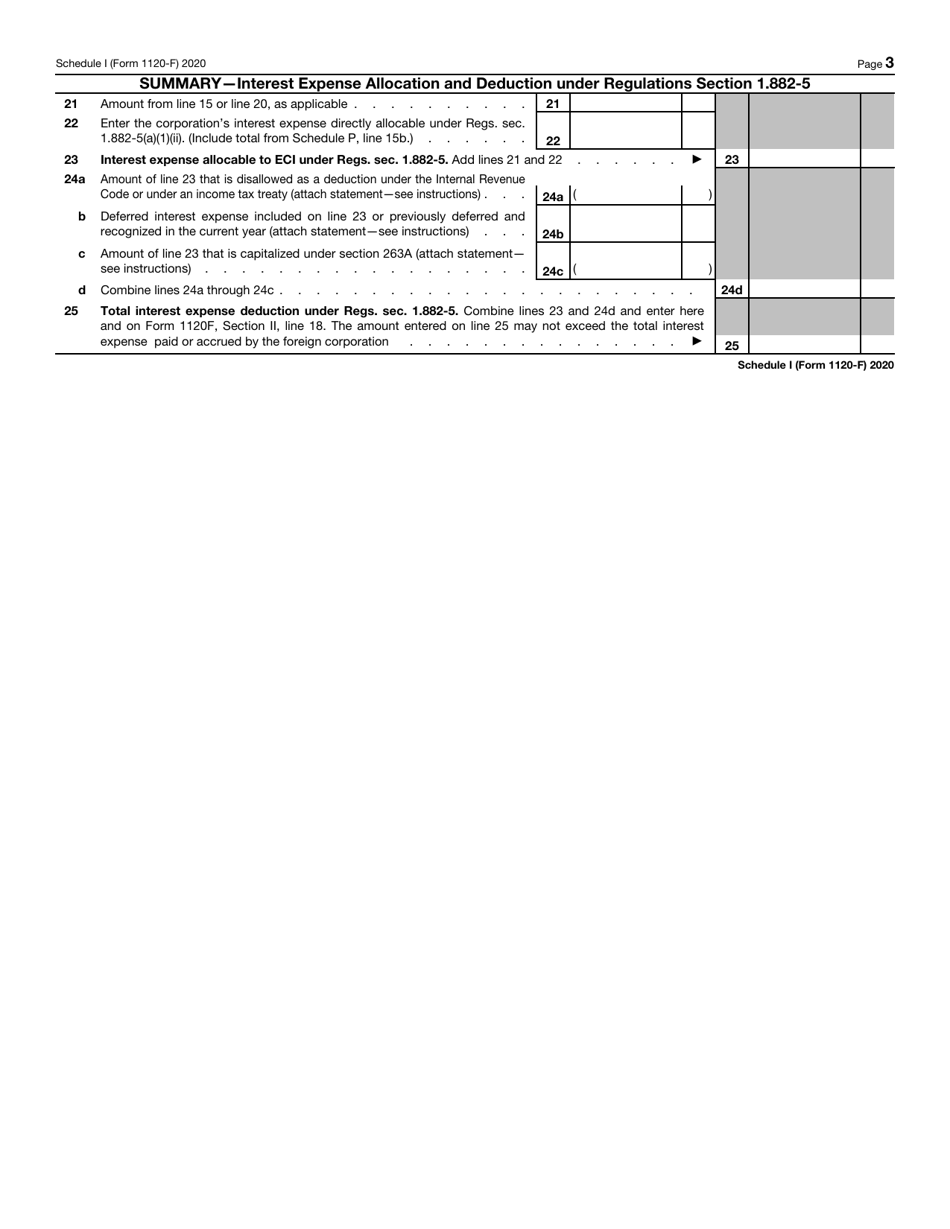

IRS Form 1120-F Schedule I

for the current year.

IRS Form 1120-F Schedule I Interest Expense Allocation Under Regulations Section 1.882-5

What Is IRS Form 1120-F Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F Schedule I?

A: IRS Form 1120-F Schedule I is a form used to report the allocation of interest expenses for foreign corporations.

Q: What does Schedule I of Form 1120-F relate to?

A: Schedule I of Form 1120-F relates to the allocation of interest expense under Regulations Section 1.882-5.

Q: What is the purpose of the interest expense allocation?

A: The purpose of the interest expense allocation is to determine the portion of interest expenses that can be deducted by a foreign corporation for U.S. income tax purposes.

Q: What is Regulations Section 1.882-5?

A: Regulations Section 1.882-5 is a set of regulations that provide guidance on the allocation of interest expenses for foreign corporations.

Q: Who needs to file IRS Form 1120-F Schedule I?

A: Foreign corporations that have interest expenses and are subject to U.S. income tax need to file IRS Form 1120-F Schedule I.

Q: Are there any specific requirements for completing Schedule I?

A: Yes, there are specific requirements for completing Schedule I. It is important to review the instructions and follow them carefully to ensure accurate reporting.

Q: Is Schedule I of Form 1120-F required to be filed electronically?

A: Yes, Schedule I of Form 1120-F is required to be filed electronically if the foreign corporation meets certain filing criteria.

Q: What happens if I fail to file Schedule I or file it incorrectly?

A: Failure to file Schedule I or filing it incorrectly may result in penalties and potential adjustment of the foreign corporation's tax liability.

Q: Can I consult a tax professional for help with completing Schedule I?

A: Yes, it is recommended to consult a tax professional for assistance with completing Schedule I to ensure accurate reporting and compliance with tax laws.

Form Details:

- A 3-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule I through the link below or browse more documents in our library of IRS Forms.