This version of the form is not currently in use and is provided for reference only. Download this version of

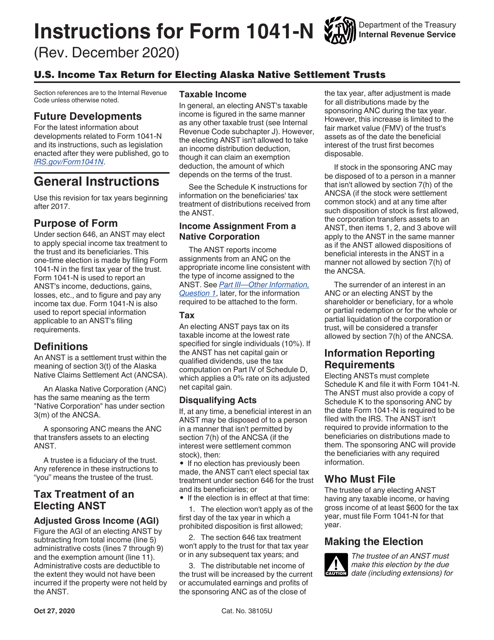

Instructions for IRS Form 1041-N

for the current year.

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

This document contains official instructions for IRS Form 1041-N , U.S. Income Tax Return for Electing Alaska Native Settlement Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041-N is available for download through this link.

FAQ

Q: What is IRS Form 1041-N?

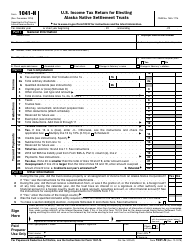

A: IRS Form 1041-N is the U.S. Income Tax Return for Electing Alaska Native Settlement Trusts.

Q: Who needs to file IRS Form 1041-N?

A: Electing Alaska Native Settlement Trusts need to file IRS Form 1041-N.

Q: What is an Electing Alaska Native Settlement Trust?

A: An Electing Alaska Native Settlement Trust is a trust established under the Alaska Native Claims Settlement Act.

Q: What income should be reported on IRS Form 1041-N?

A: All taxable income earned by the Electing Alaska Native Settlement Trust should be reported on IRS Form 1041-N.

Q: Are there any exemptions or deductions available on IRS Form 1041-N?

A: Yes, certain exemptions and deductions may be available to Electing Alaska Native Settlement Trusts.

Q: When is the deadline to file IRS Form 1041-N?

A: The deadline to file IRS Form 1041-N is generally on or before the 15th day of the 4th month after the end of the trust's tax year.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.