This version of the form is not currently in use and is provided for reference only. Download this version of

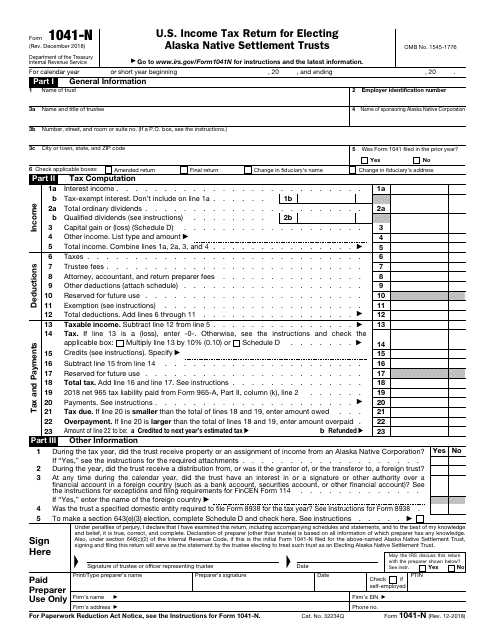

IRS Form 1041-N

for the current year.

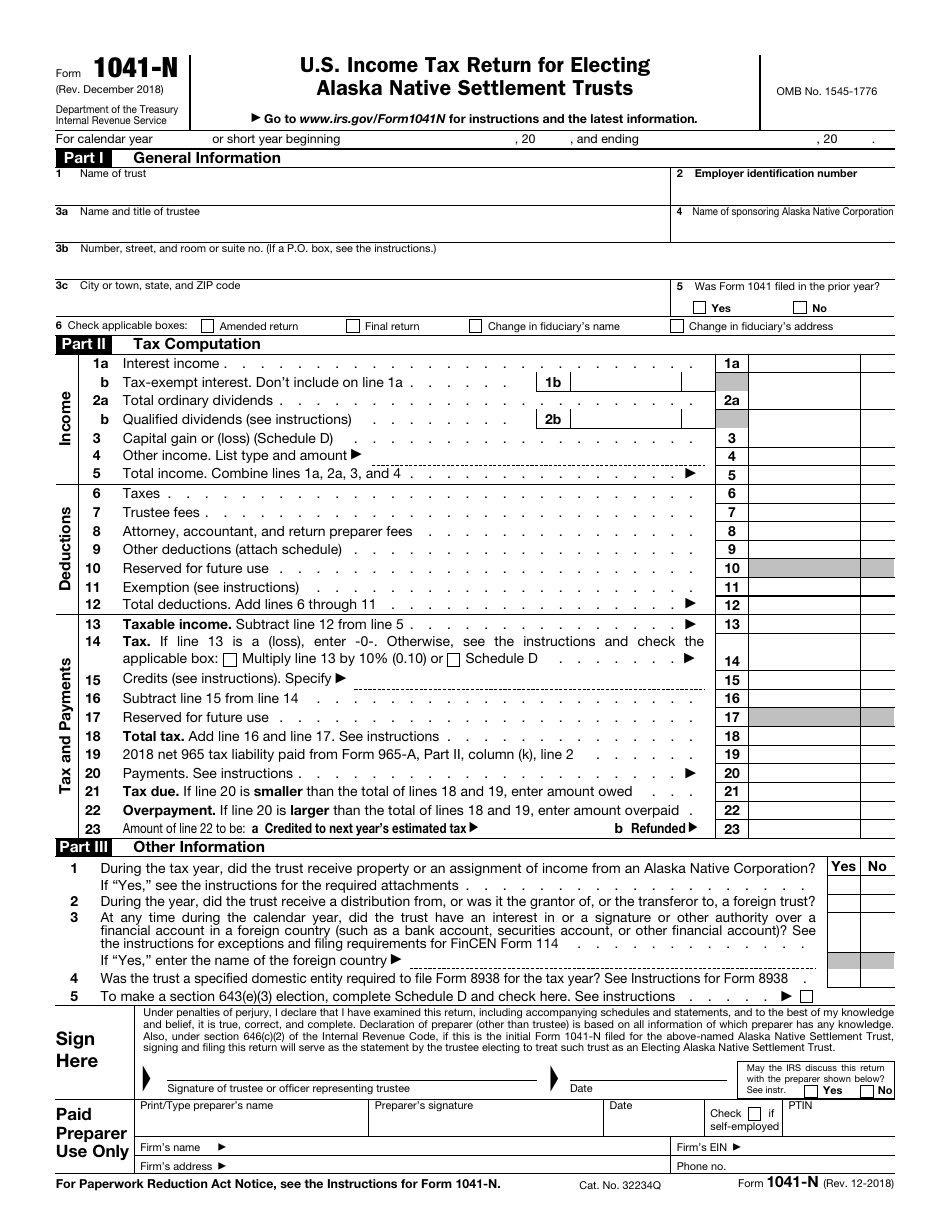

IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

What Is IRS Form 1041-N?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1041-N?

A: IRS Form 1041-N is the U.S. Income Tax Return specifically for Electing Alaska Native Settlement Trusts.

Q: Who should file IRS Form 1041-N?

A: Electing Alaska Native Settlement Trusts should file IRS Form 1041-N.

Q: What is the purpose of filing IRS Form 1041-N?

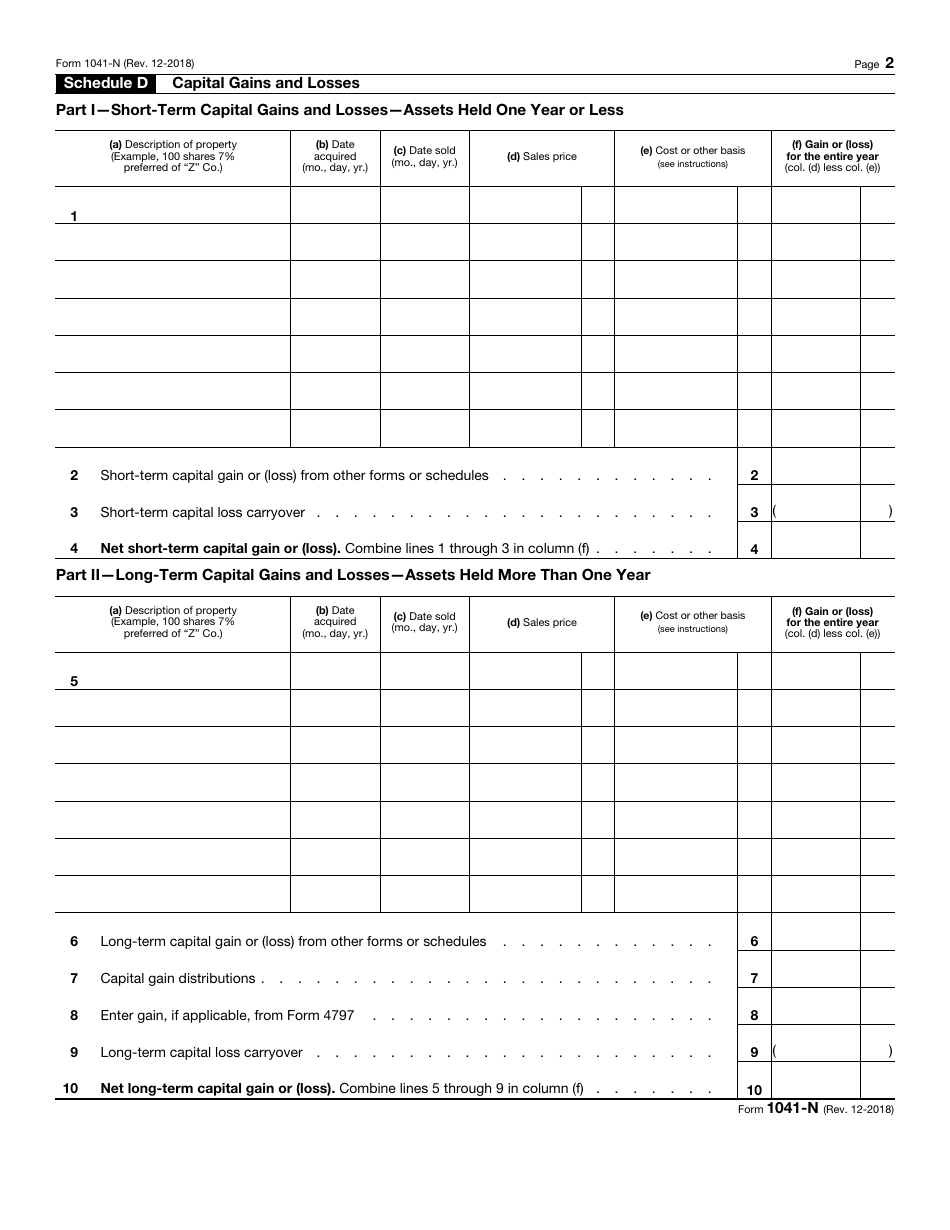

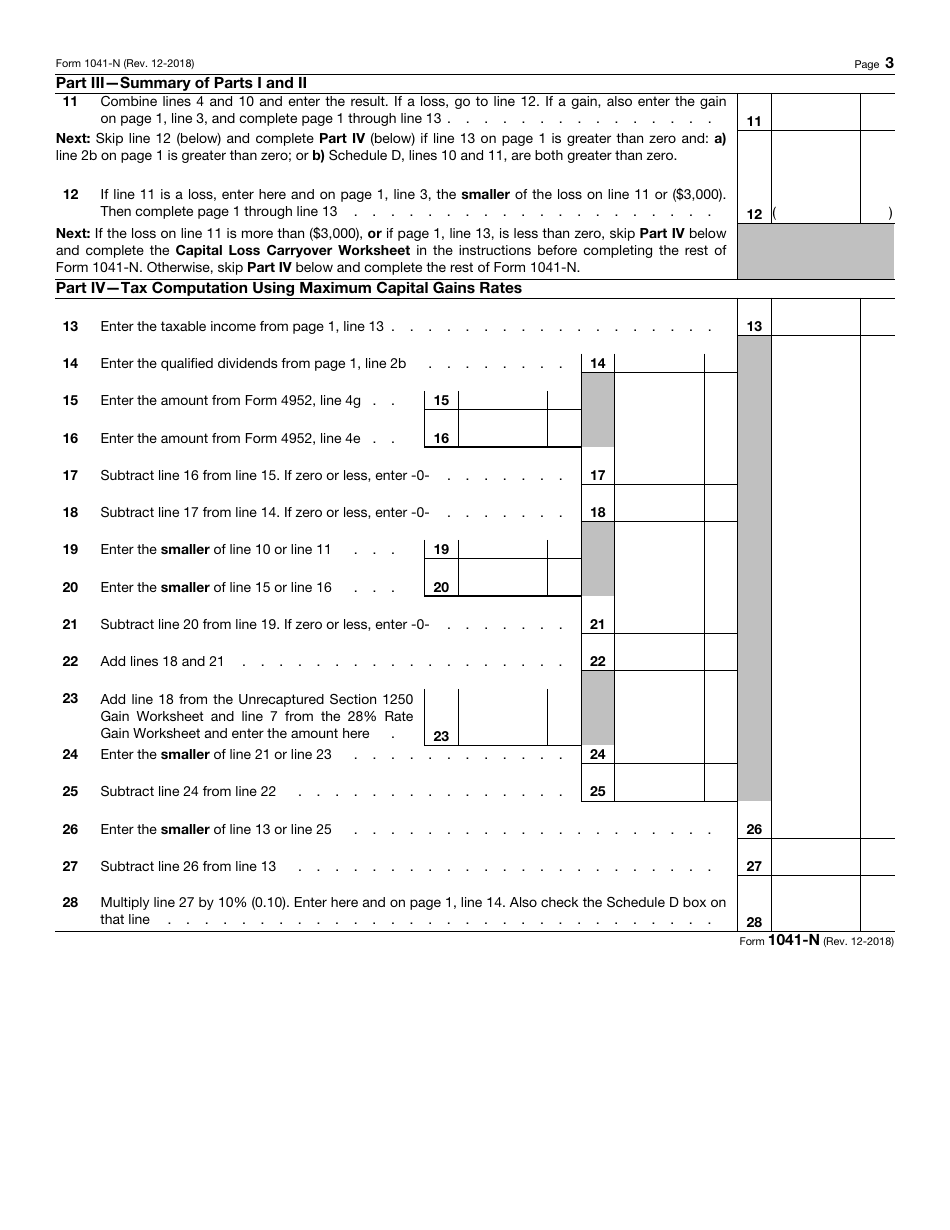

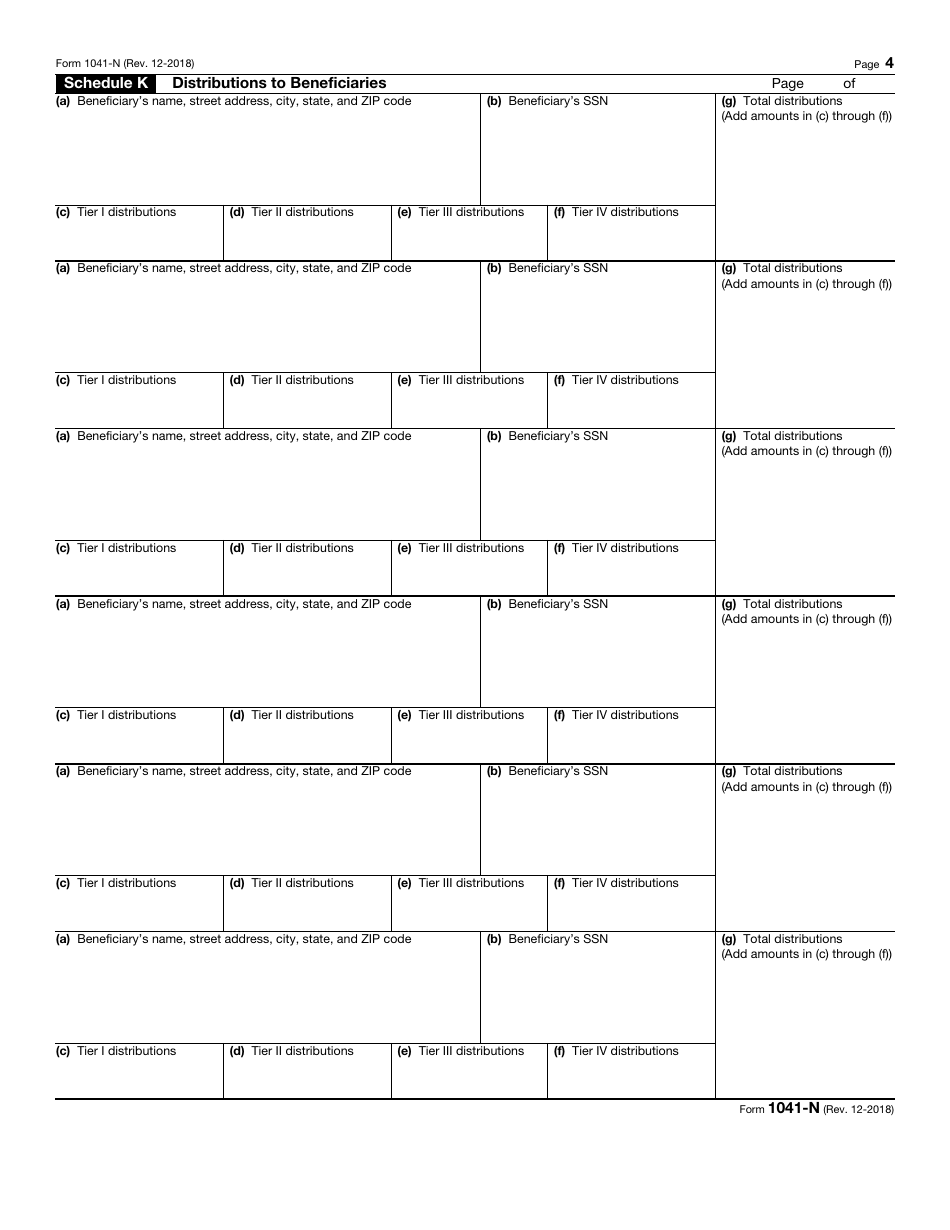

A: The purpose of filing IRS Form 1041-N is to report income, deductions, gains, losses, and credits for Electing Alaska Native Settlement Trusts.

Q: When is the deadline to file IRS Form 1041-N?

A: The deadline to file IRS Form 1041-N is usually on or before the 15th day of the 4th month after the end of the trust's tax year.

Q: Are there any penalties for not filing IRS Form 1041-N?

A: Yes, there may be penalties for not filing IRS Form 1041-N or for filing it late. It's important to meet the deadline.

Q: Do I need to attach any documents with IRS Form 1041-N?

A: Yes, you may need to attach certain documents such as schedules, forms, or statements, depending on the specific circumstances of the trust.

Q: Can I e-file IRS Form 1041-N?

A: No, you cannot e-file IRS Form 1041-N. It must be filed by mail.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1041-N through the link below or browse more documents in our library of IRS Forms.