This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule C

for the current year.

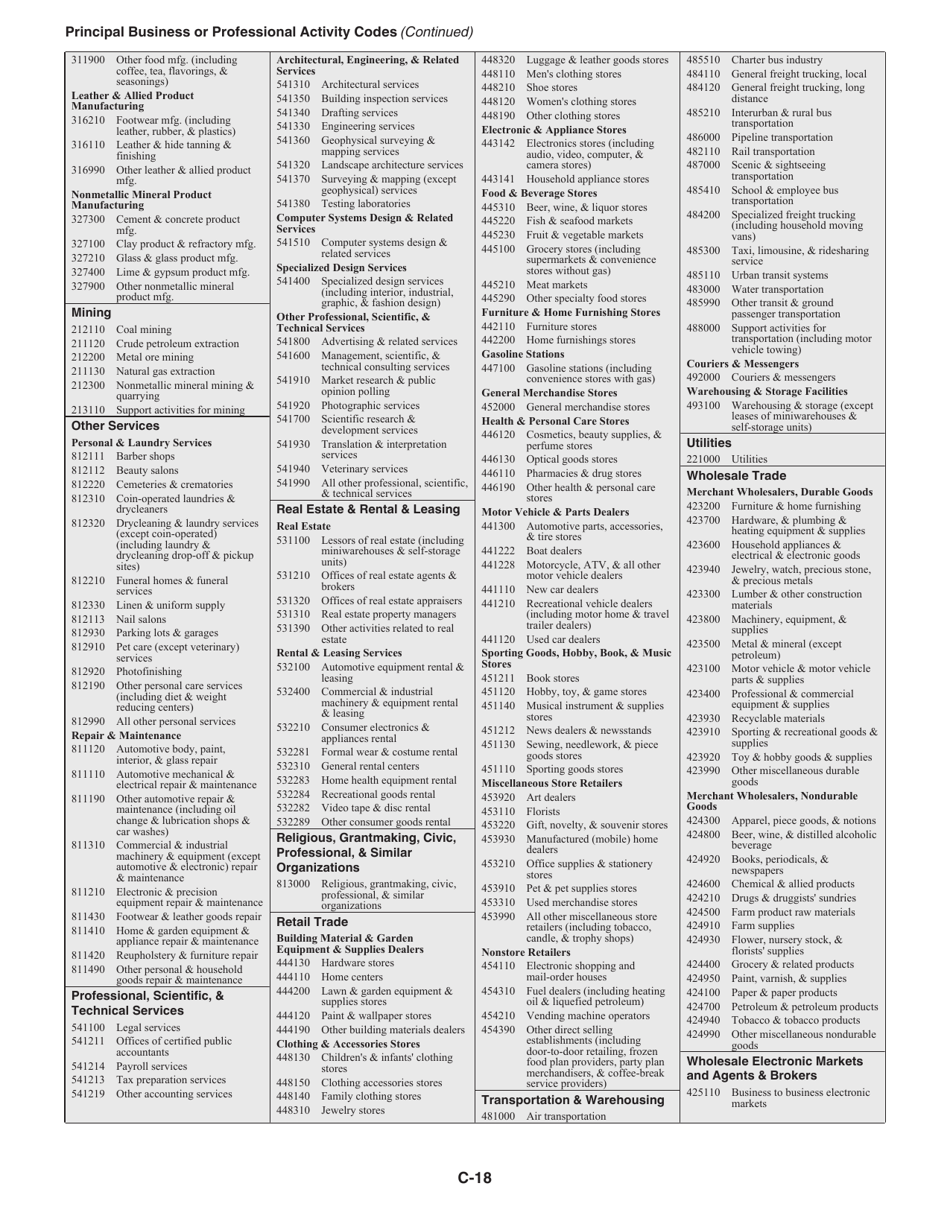

Instructions for IRS Form 1040 Schedule C Profit or Loss From Business

This document contains official instructions for IRS Form 1040 Schedule C, Profit or Loss From Business - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C is a tax form used to report profit or loss from a business.

Q: Who should use IRS Form 1040 Schedule C?

A: Individuals who have a business or self-employment income should use IRS Form 1040 Schedule C.

Q: What is the purpose of IRS Form 1040 Schedule C?

A: The purpose of IRS Form 1040 Schedule C is to calculate the net profit or loss from a business for tax purposes.

Q: What types of businesses can use IRS Form 1040 Schedule C?

A: Any type of business, including sole proprietorships, single-member LLCs, and certain partnerships, can use IRS Form 1040 Schedule C.

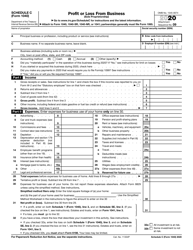

Q: What information is required on IRS Form 1040 Schedule C?

A: You will need to provide your business income, deductible expenses, and other relevant information on IRS Form 1040 Schedule C.

Q: When is the deadline to file IRS Form 1040 Schedule C?

A: The deadline to file IRS Form 1040 Schedule C is usually April 15th, unless an extension has been requested.

Q: Can I use IRS Form 1040 Schedule C if I have a regular job as well?

A: Yes, you can use IRS Form 1040 Schedule C to report business income even if you have a regular job.

Q: Can I deduct my business expenses on IRS Form 1040 Schedule C?

A: Yes, you can deduct qualifying business expenses on IRS Form 1040 Schedule C to reduce your taxable income.

Q: Do I need to keep records of my business income and expenses?

A: Yes, it is important to keep records of your business income and expenses to support the information reported on IRS Form 1040 Schedule C.

Q: Can I e-file IRS Form 1040 Schedule C?

A: Yes, you can e-file IRS Form 1040 Schedule C along with your individual tax return using IRS-approved tax software or through a tax professional.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.