This version of the form is not currently in use and is provided for reference only. Download this version of

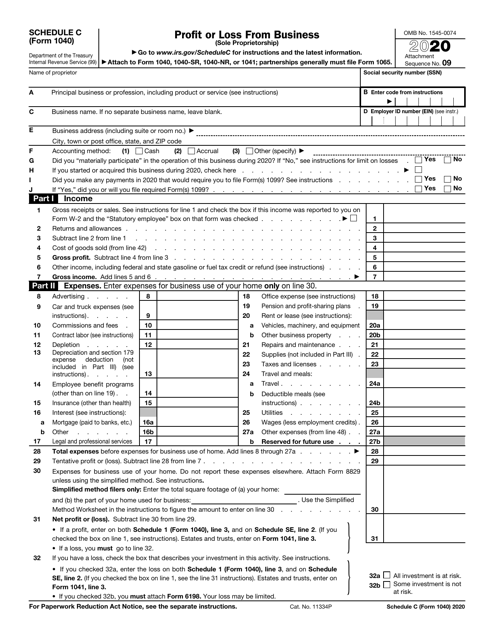

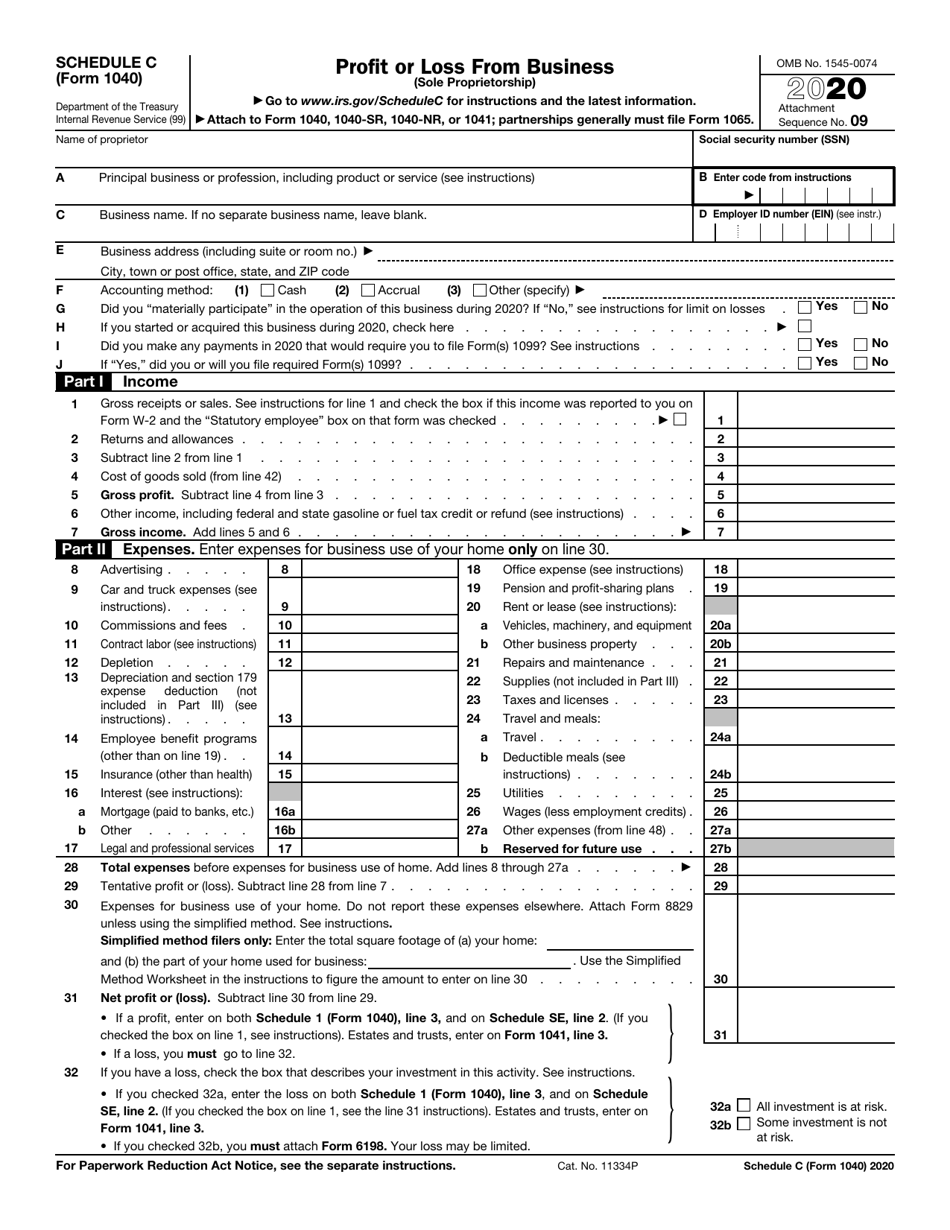

IRS Form 1040 Schedule C

for the current year.

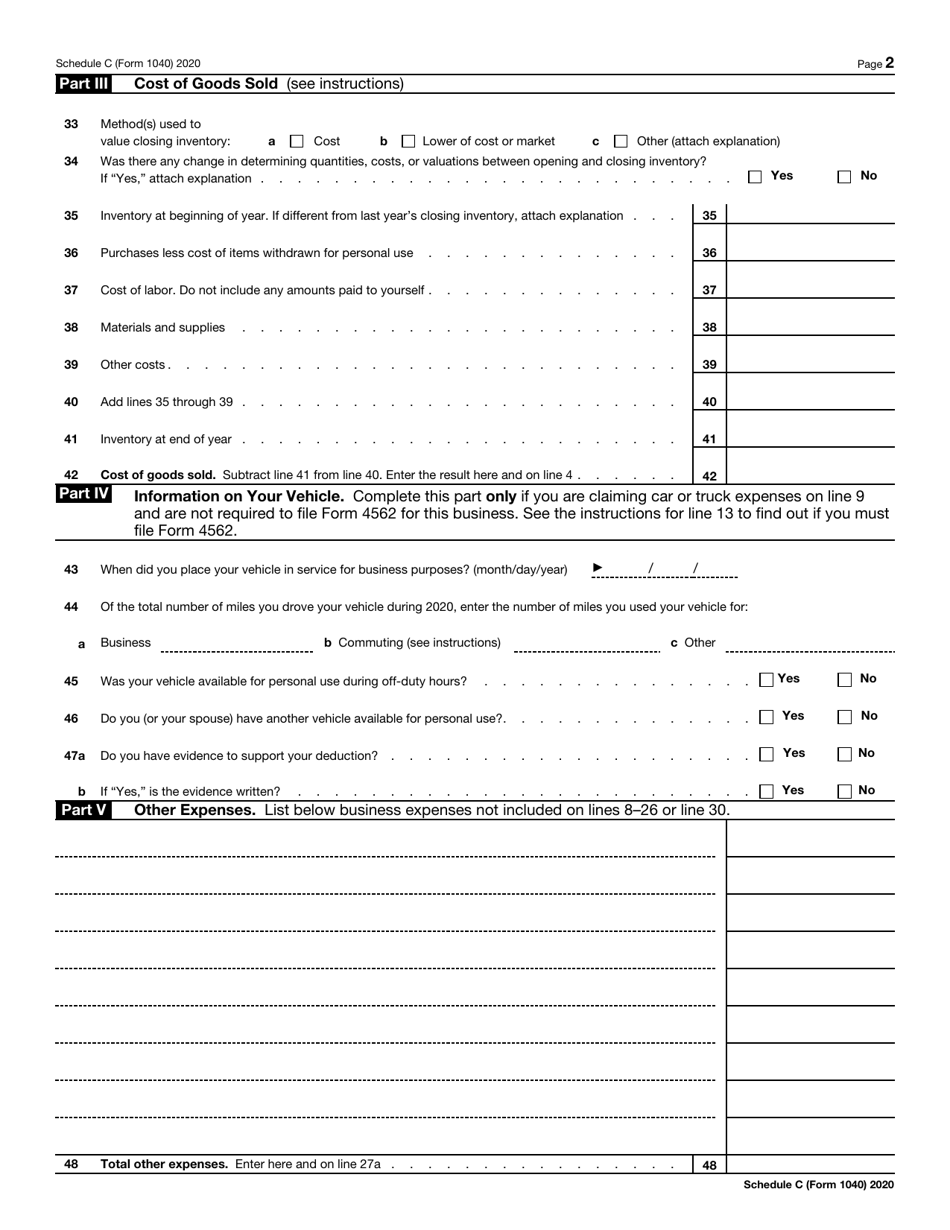

IRS Form 1040 Schedule C Profit or Loss From Business (Sole Proprietorship)

What Is IRS Form 1040 Schedule C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C is a tax form used to report profit or loss from a sole proprietorship business.

Q: Who needs to file IRS Form 1040 Schedule C?

A: Sole proprietors who operate a business must file IRS Form 1040 Schedule C to report their business income and expenses.

Q: What information is required to fill out IRS Form 1040 Schedule C?

A: To fill out IRS Form 1040 Schedule C, you'll need to provide information about your business income, expenses, and deductions.

Q: Is IRS Form 1040 Schedule C for individuals or corporations?

A: IRS Form 1040 Schedule C is for individuals who operate a sole proprietorship business. Corporations have different tax forms.

Q: When is the deadline to file IRS Form 1040 Schedule C?

A: The deadline to file IRS Form 1040 Schedule C is typically April 15th, unless an extension has been requested.

Q: What happens if I don't file IRS Form 1040 Schedule C?

A: If you are required to file IRS Form 1040 Schedule C and fail to do so, you could face penalties and fines from the IRS.

Q: Can I deduct business expenses on IRS Form 1040 Schedule C?

A: Yes, you can deduct legitimate business expenses on IRS Form 1040 Schedule C to reduce your taxable income.

Q: Is it necessary to include receipts with IRS Form 1040 Schedule C?

A: It is not necessary to include receipts with IRS Form 1040 Schedule C, but you should keep them for your records in case of an audit.

Q: Can I electronically file IRS Form 1040 Schedule C?

A: Yes, you can electronically file IRS Form 1040 Schedule C using IRS-approved tax software or through a tax professional.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule C through the link below or browse more documents in our library of IRS Forms.