This version of the form is not currently in use and is provided for reference only. Download this version of

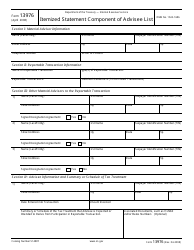

Instructions for IRS Form 1040 Schedule A

for the current year.

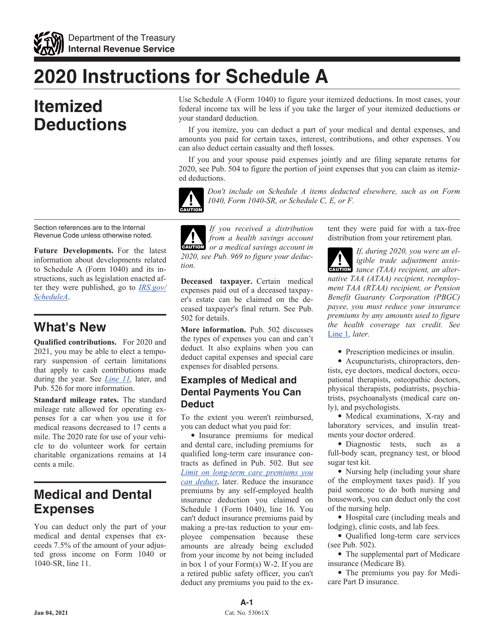

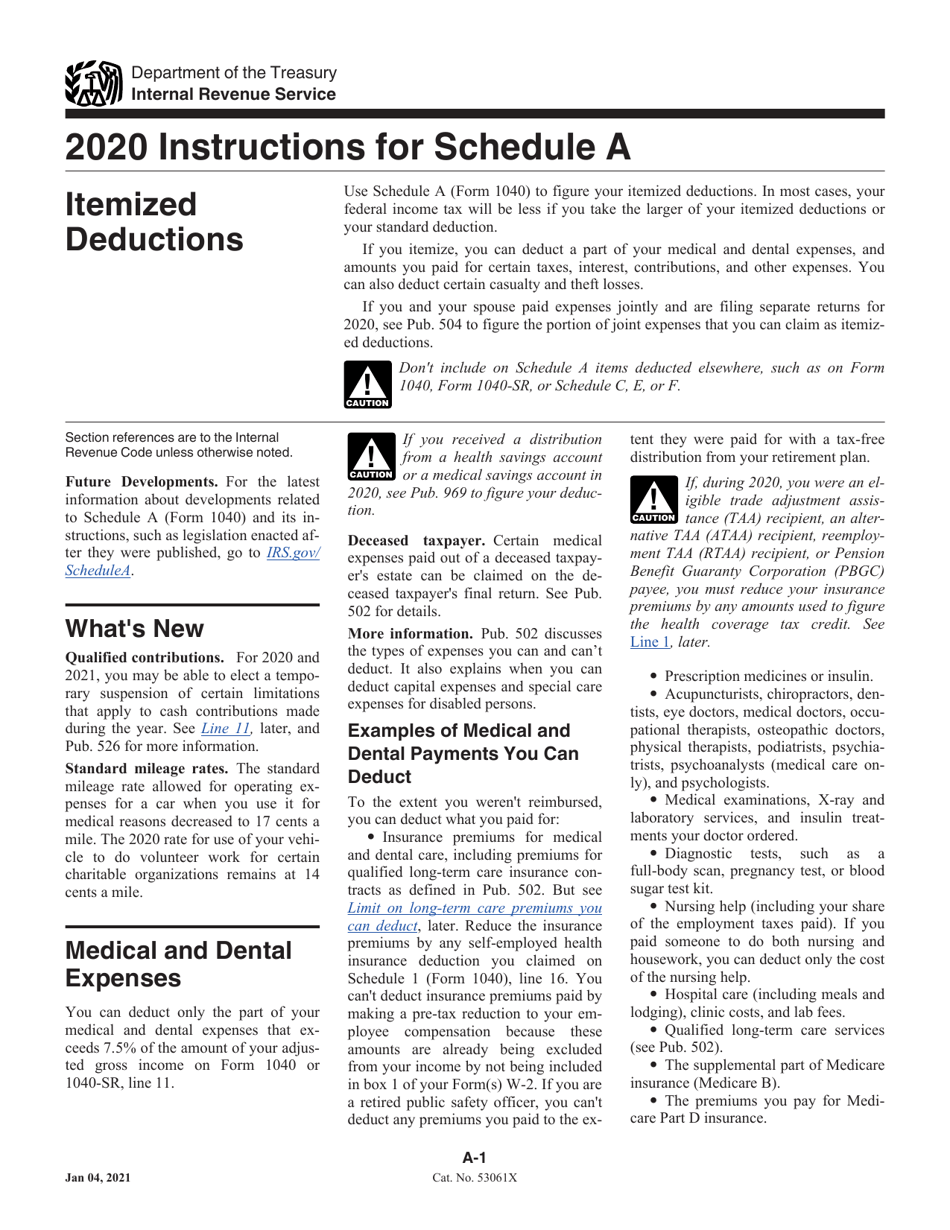

Instructions for IRS Form 1040 Schedule A Itemized Deductions

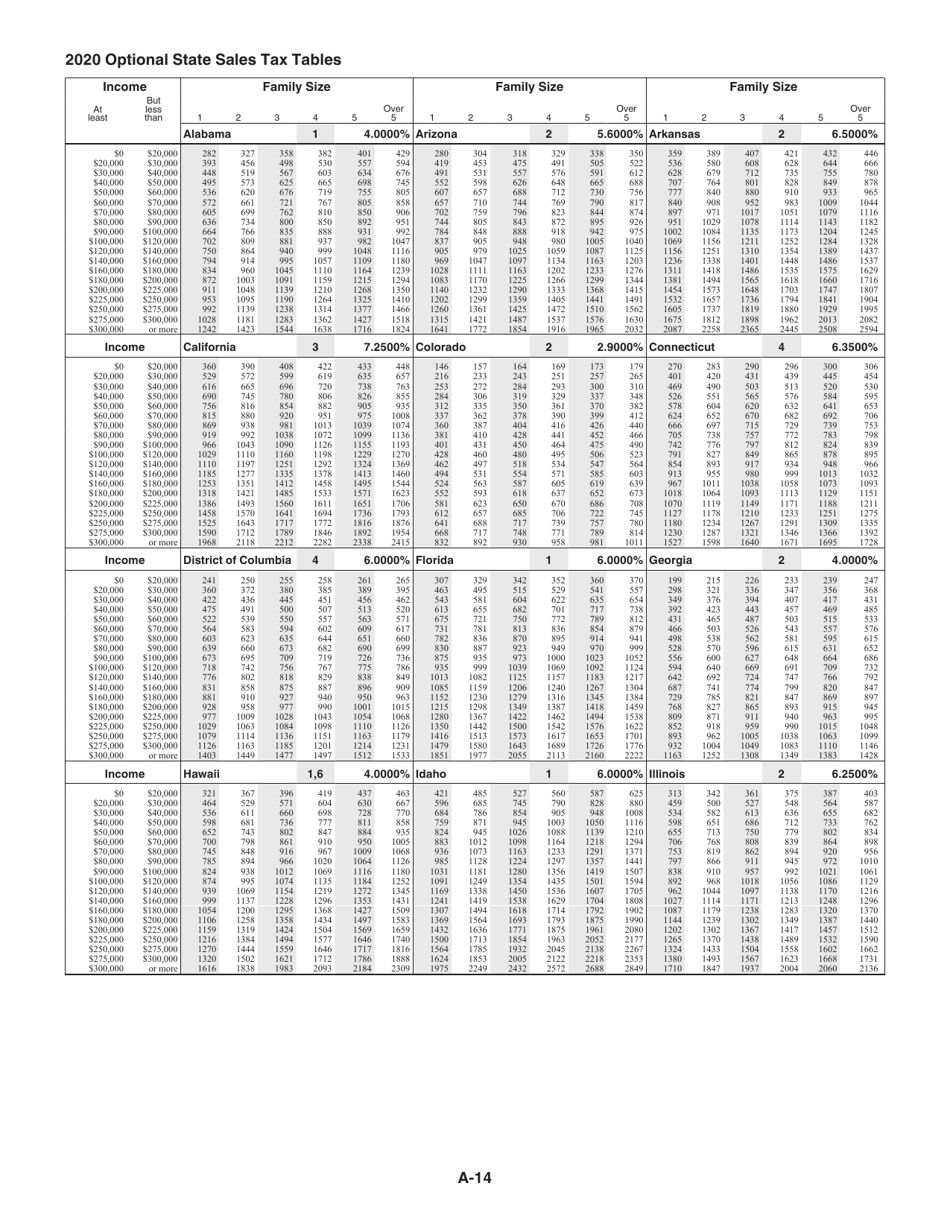

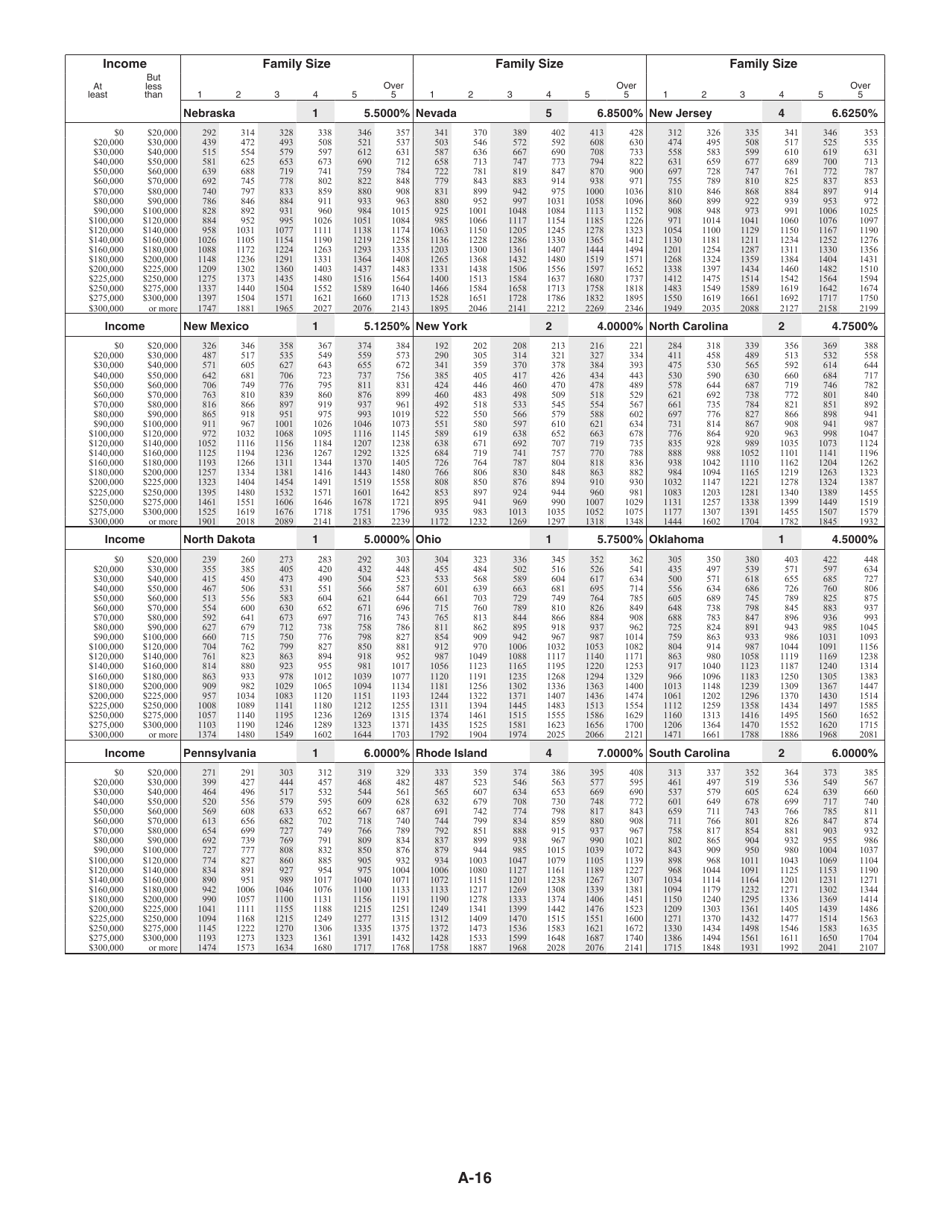

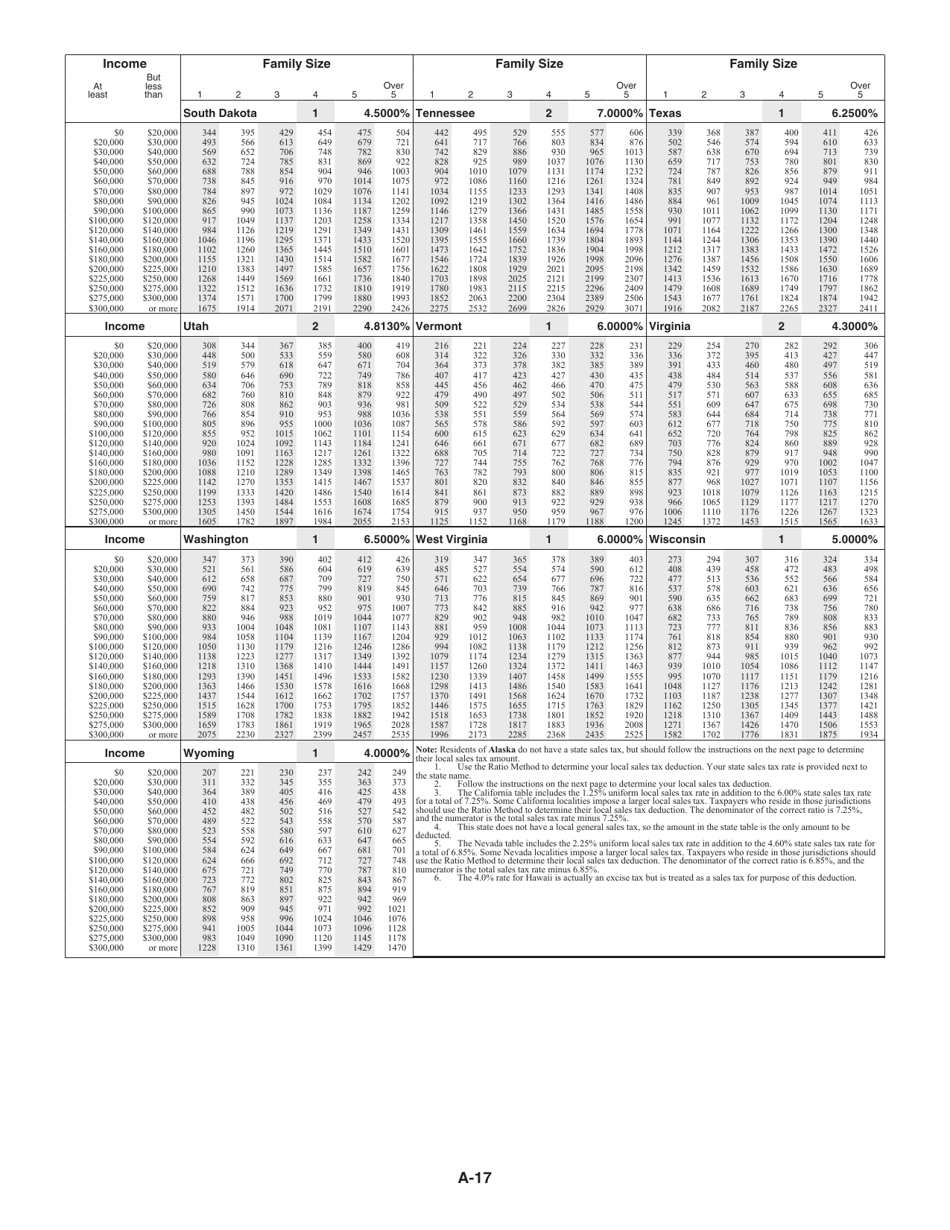

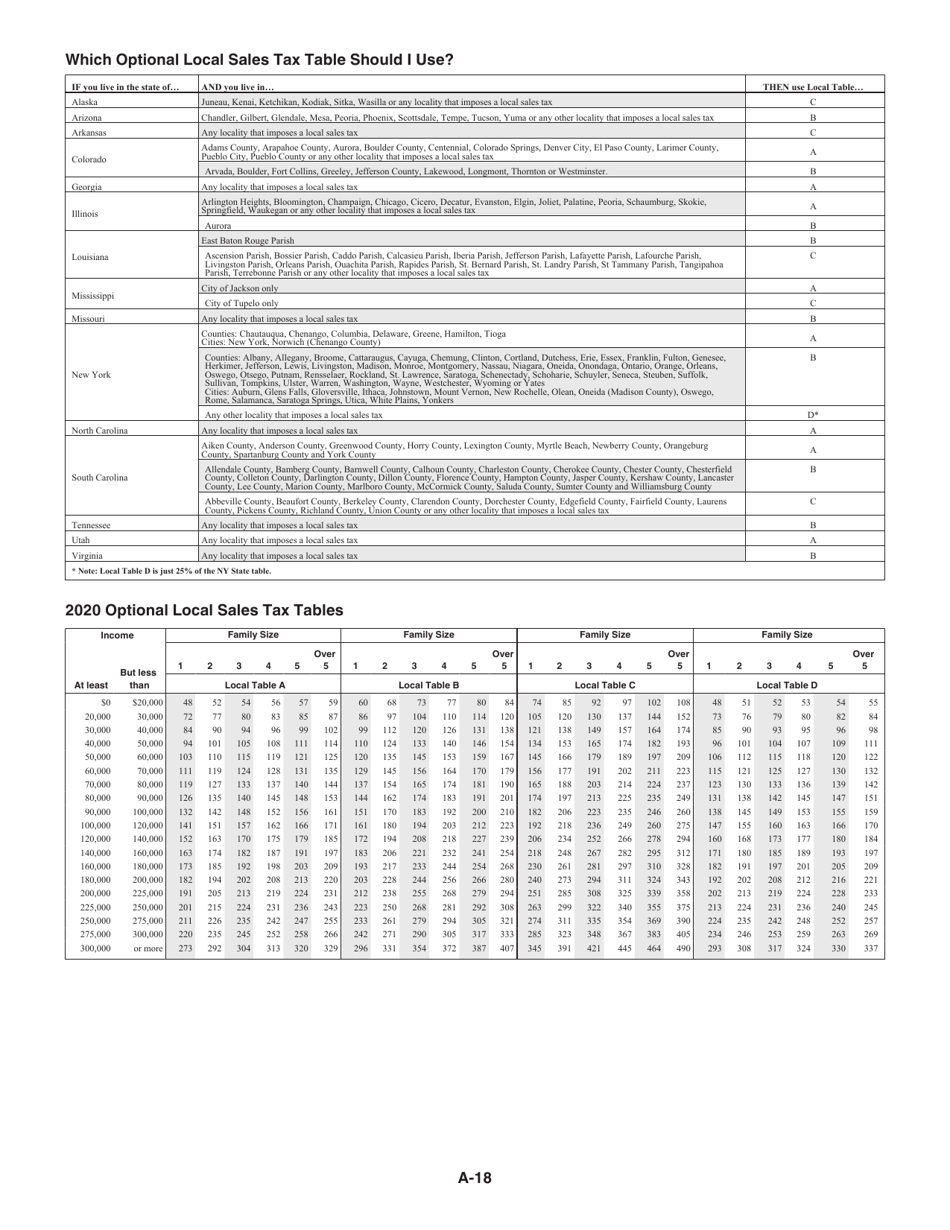

This document contains official instructions for IRS Form 1040 Schedule A, Itemized Deductions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a tax form used by individuals to itemize their deductions.

Q: What are itemized deductions?

A: Itemized deductions are eligible expenses that can be subtracted from your taxable income, reducing your overall tax liability.

Q: Which expenses can be itemized?

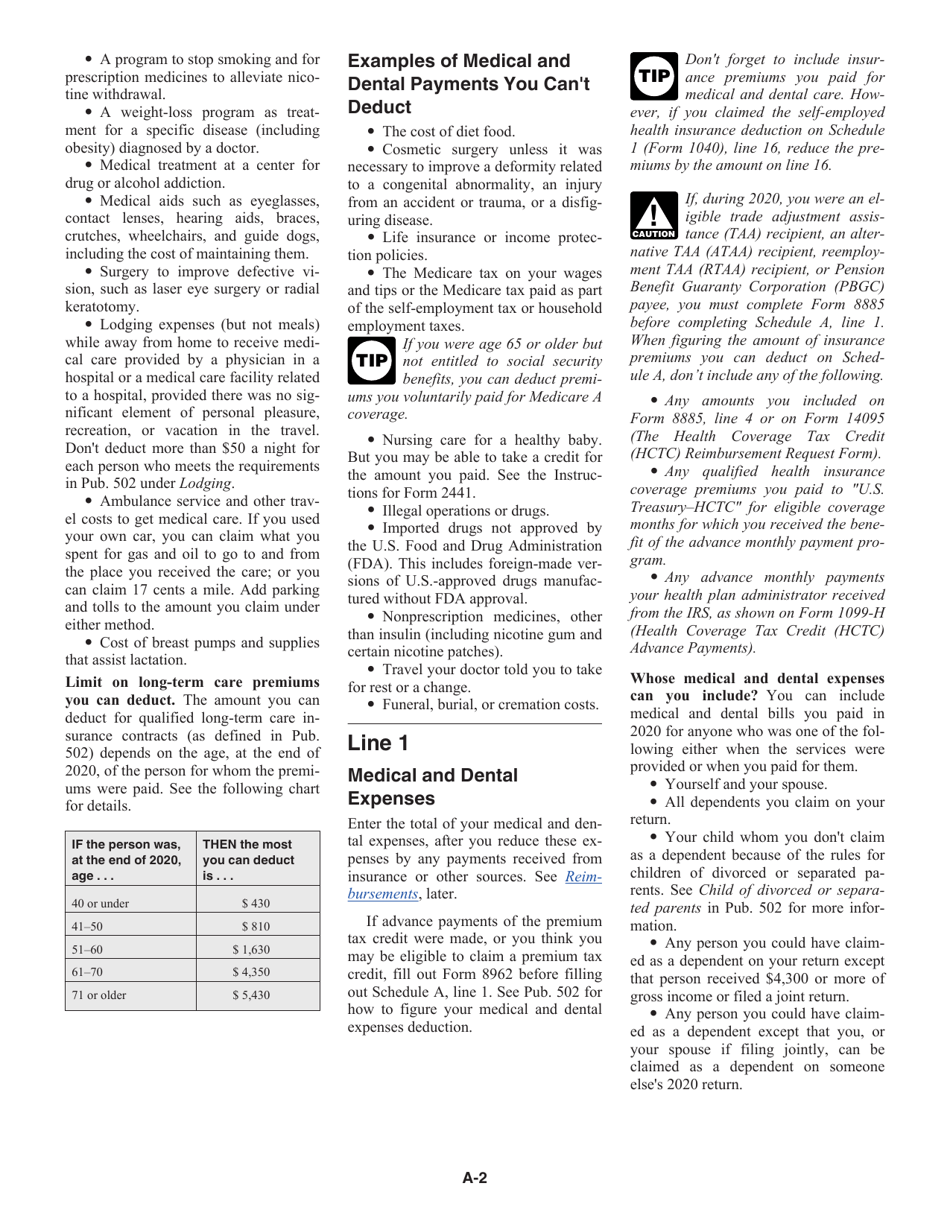

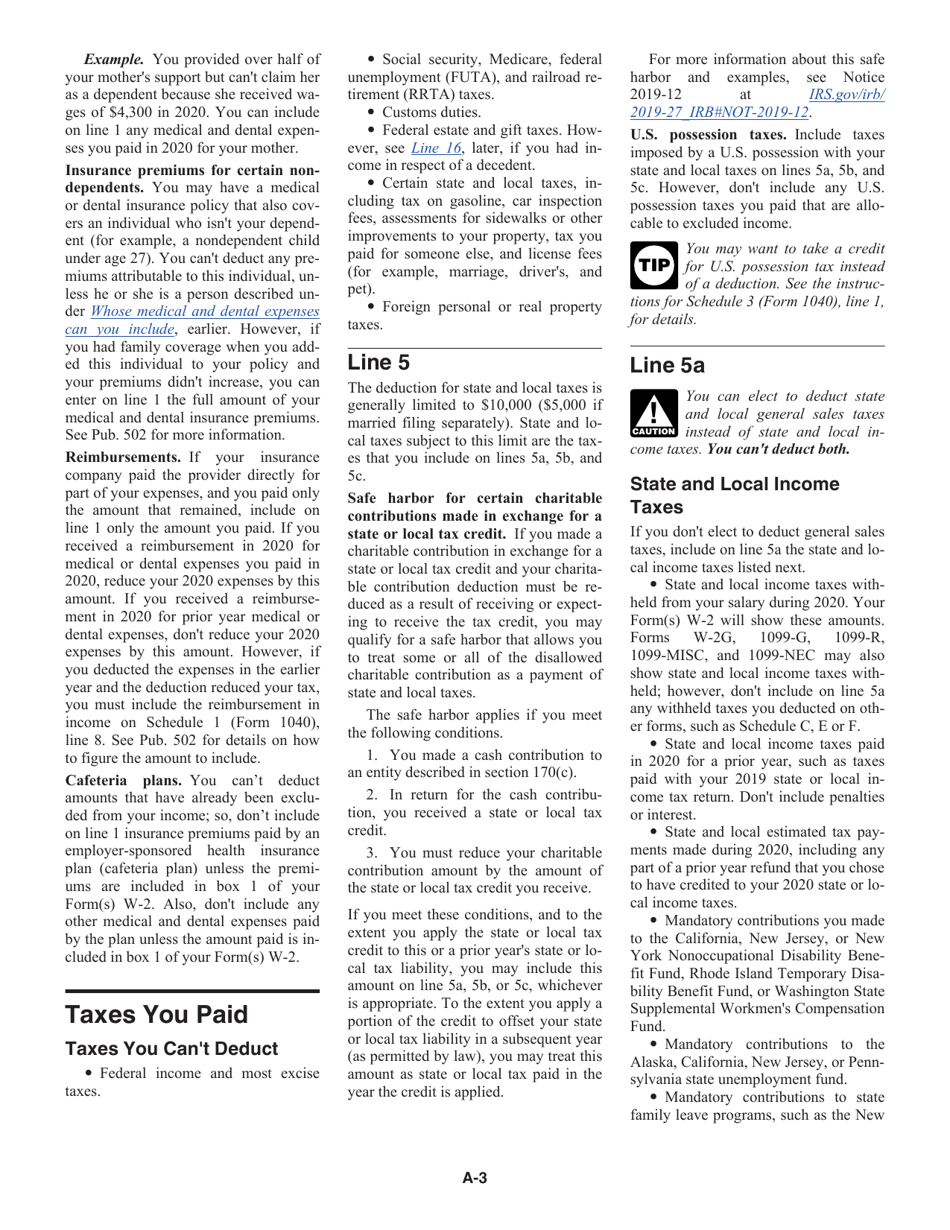

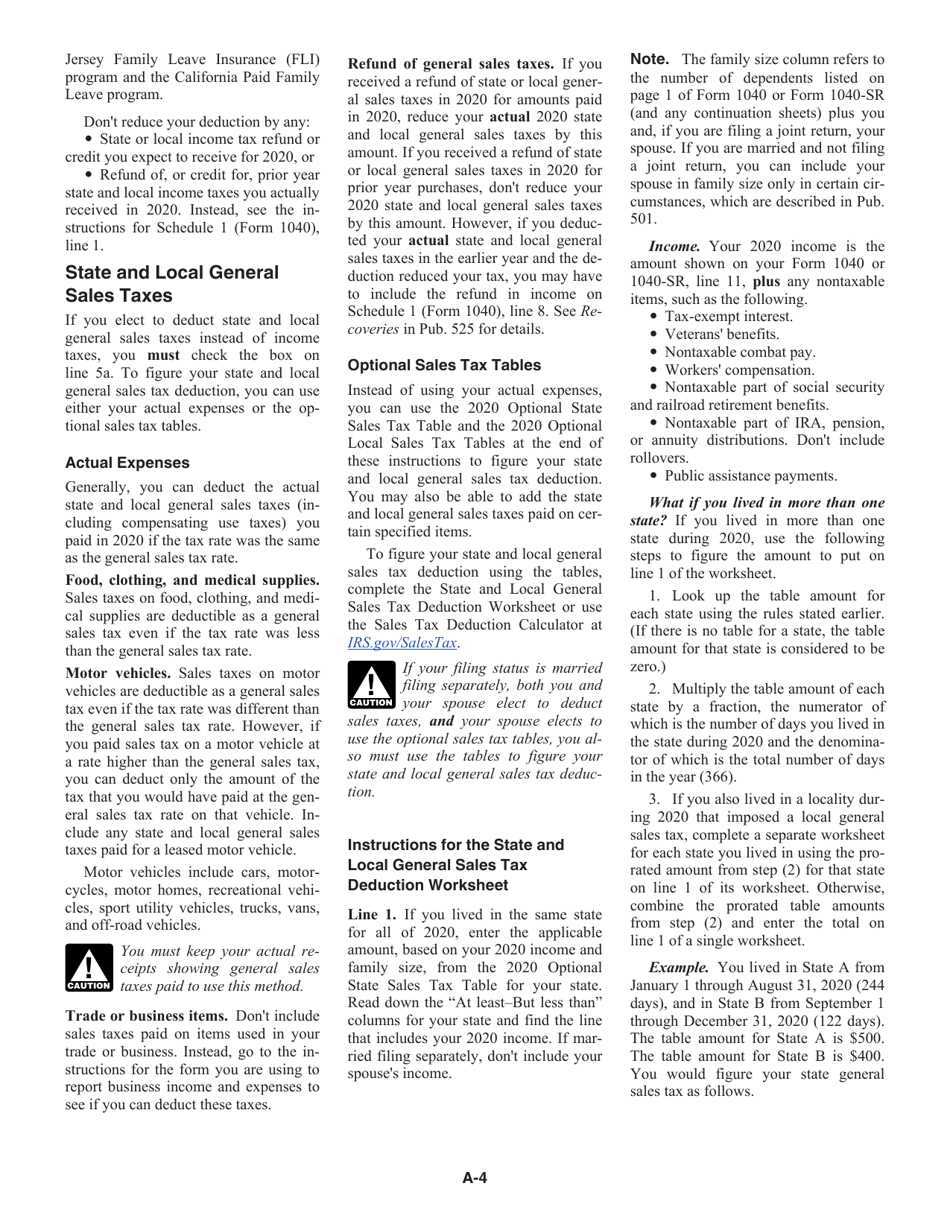

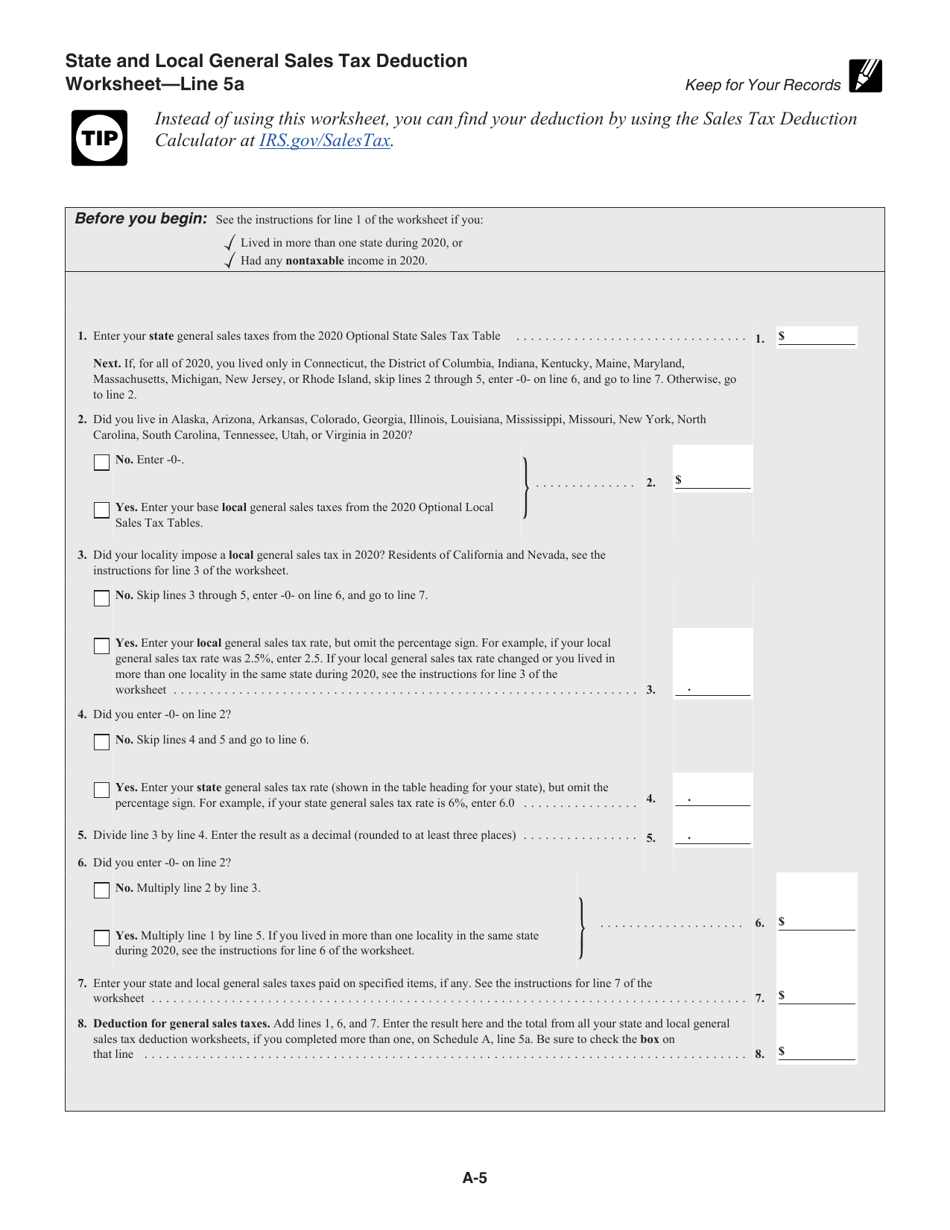

A: Expenses that can be itemized include medical expenses, mortgage interest, state and local taxes, charitable contributions, and certain miscellaneous deductions.

Q: Do I have to itemize deductions?

A: No, you can choose to take the standard deduction instead of itemizing. The standard deduction is a set amount determined by the IRS.

Q: How do I know if I should itemize deductions?

A: You should compare your eligible itemized deductions to the standard deduction. If your itemized deductions exceed the standard deduction, it may be beneficial to itemize.

Q: Are there any limitations on itemized deductions?

A: Yes, there are limitations on certain itemized deductions. For example, there is a limit on the deduction for state and local taxes, and a cap on the deduction for mortgage interest.

Q: Can I deduct medical expenses on Schedule A?

A: Yes, you can deduct qualified medical expenses on Schedule A. However, there is a threshold that must be met before you can claim this deduction.

Q: Can I deduct charitable contributions on Schedule A?

A: Yes, you can deduct qualified charitable contributions on Schedule A. However, there are certain rules and limitations that apply.

Q: Is completing Schedule A complicated?

A: The complexity of completing Schedule A may vary depending on your individual circumstances. It is recommended to consult a tax professional or use tax software for assistance.

Instruction Details:

- This 18-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.