This version of the form is not currently in use and is provided for reference only. Download this version of

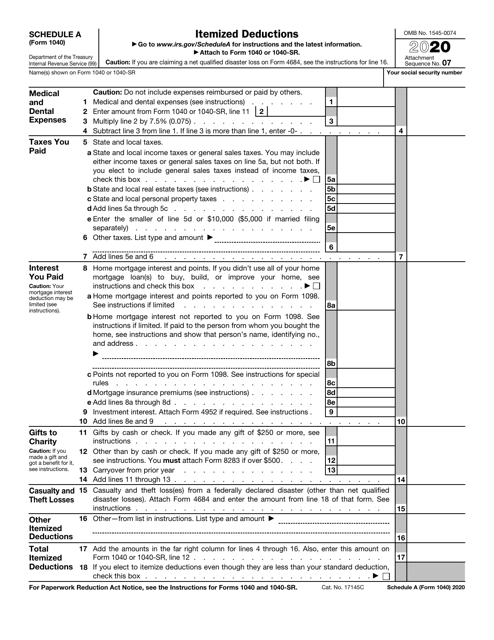

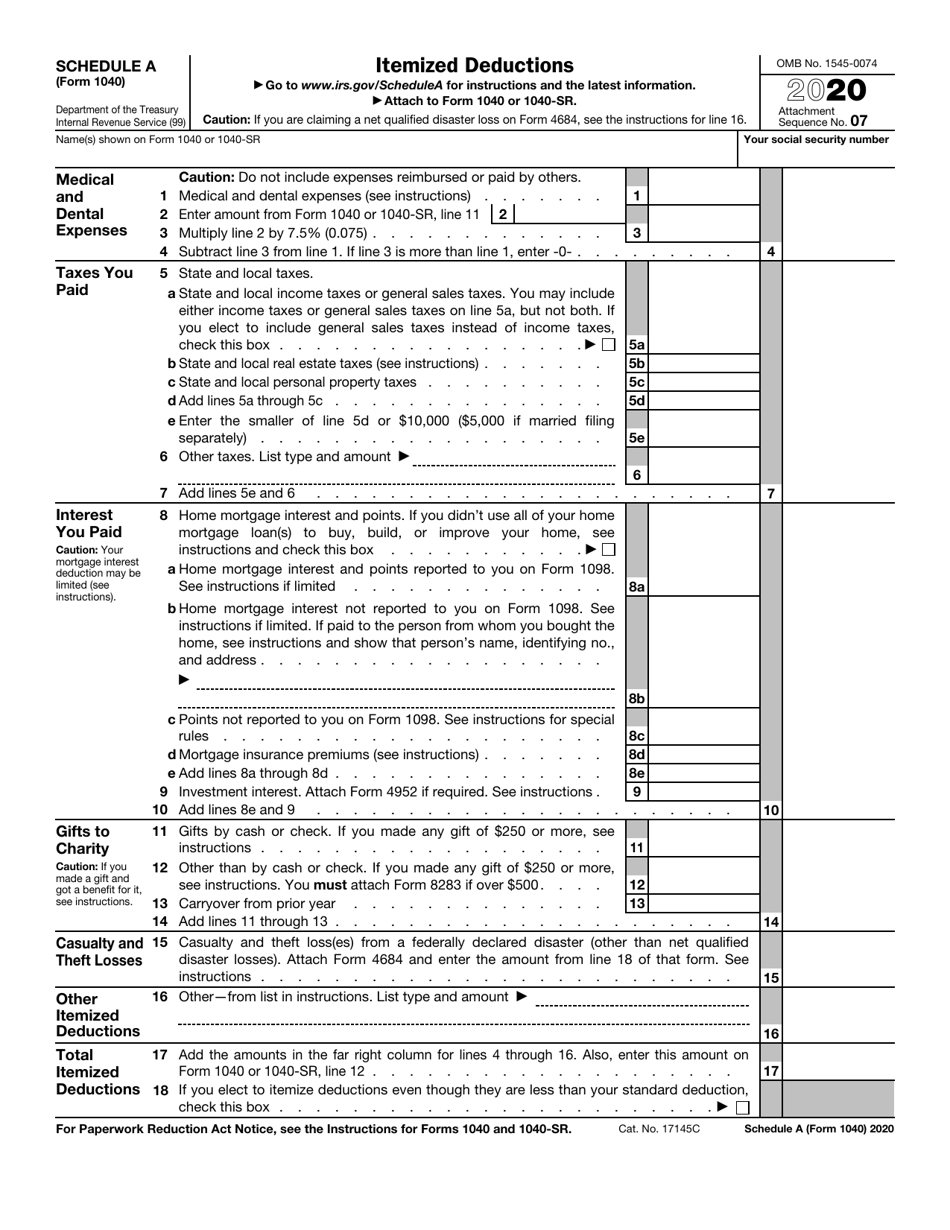

IRS Form 1040 Schedule A

for the current year.

IRS Form 1040 Schedule A Itemized Deductions

What Is IRS Form 1040 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a tax form used to itemize deductions on your federal income tax return.

Q: What are itemized deductions?

A: Itemized deductions are expenses that can be subtracted from your taxable income, potentially reducing the amount of taxes you owe.

Q: What can be included in itemized deductions?

A: Common examples of expenses that can be included in itemized deductions are medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and certain miscellaneous deductions.

Q: Do I have to itemize deductions?

A: No, you can choose to take the standard deduction instead of itemizing deductions if it results in a higher tax benefit for you.

Q: How do I fill out IRS Form 1040 Schedule A?

A: You will need to gather documentation for your itemized deductions and enter the amounts in the appropriate sections of the form. It's recommended to consult with a tax professional for assistance.

Q: When is the deadline to file IRS Form 1040 Schedule A?

A: The deadline to file IRS Form 1040 Schedule A is typically the same as the deadline to file your federal income tax return, which is usually April 15th.

Q: Can I e-file IRS Form 1040 Schedule A?

A: Yes, you can e-file IRS Form 1040 Schedule A if you are filing your federal income tax return electronically.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule A through the link below or browse more documents in our library of IRS Forms.