This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule H

for the current year.

Instructions for IRS Form 990 Schedule H Hospitals

This document contains official instructions for IRS Form 990 Schedule H, Hospitals - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule H is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule H?

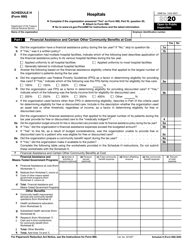

A: IRS Form 990 Schedule H is a form used by tax-exempt hospitals to report information about their activities, policies, and practices related to community health needs and financial assistance policies.

Q: Who needs to file IRS Form 990 Schedule H?

A: Tax-exempt hospitals, including those classified as non-profit or charitable organizations, generally need to file IRS Form 990 Schedule H if they meet certain requirements set by the IRS.

Q: What information is required to be reported on IRS Form 990 Schedule H?

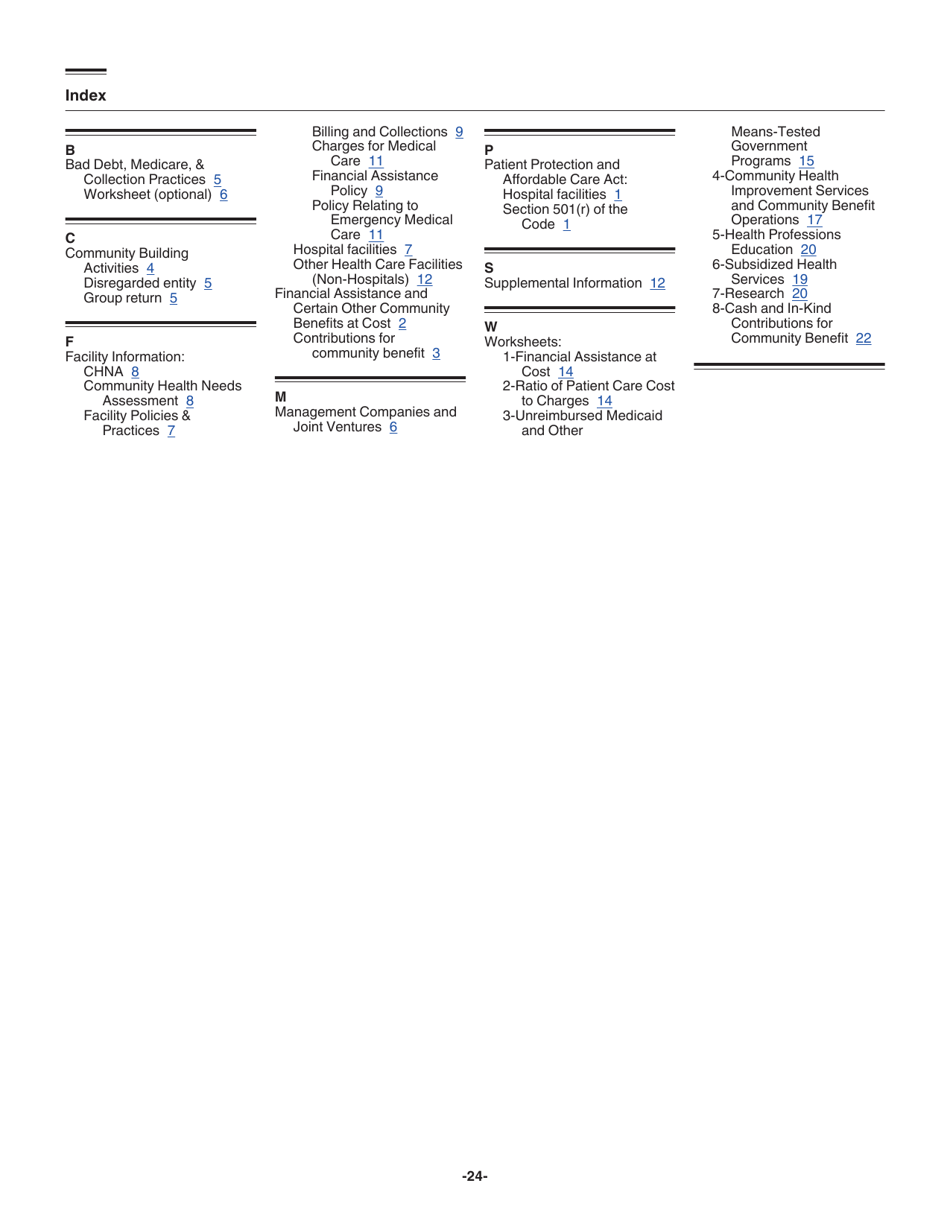

A: IRS Form 990 Schedule H requires tax-exempt hospitals to report information about their community health needs assessment, certain financial assistance policies, billing and collection practices, and other community benefits provided.

Q: When is the deadline to file IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is typically filed with the hospital's annual Form 990, which is due by the 15th day of the 5th month after the end of the hospital's fiscal year.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.