This version of the form is not currently in use and is provided for reference only. Download this version of

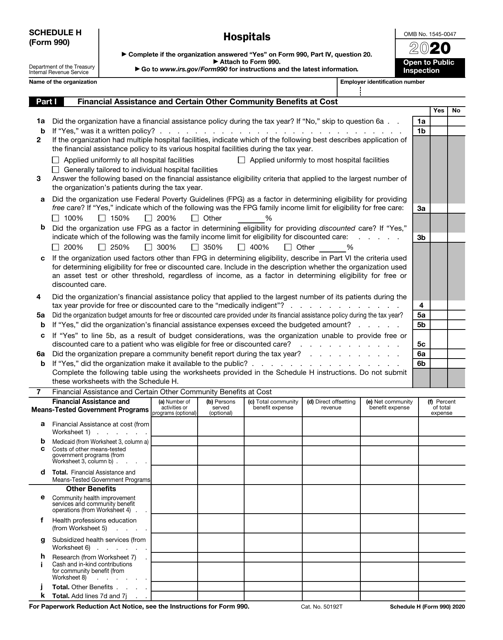

IRS Form 990 Schedule H

for the current year.

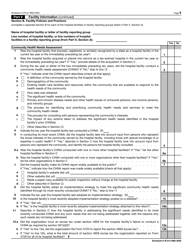

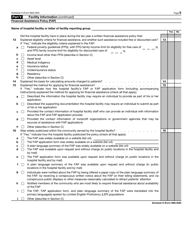

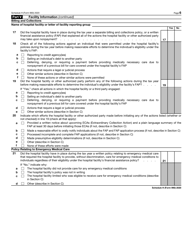

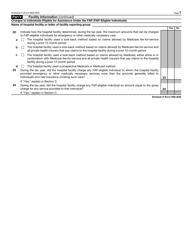

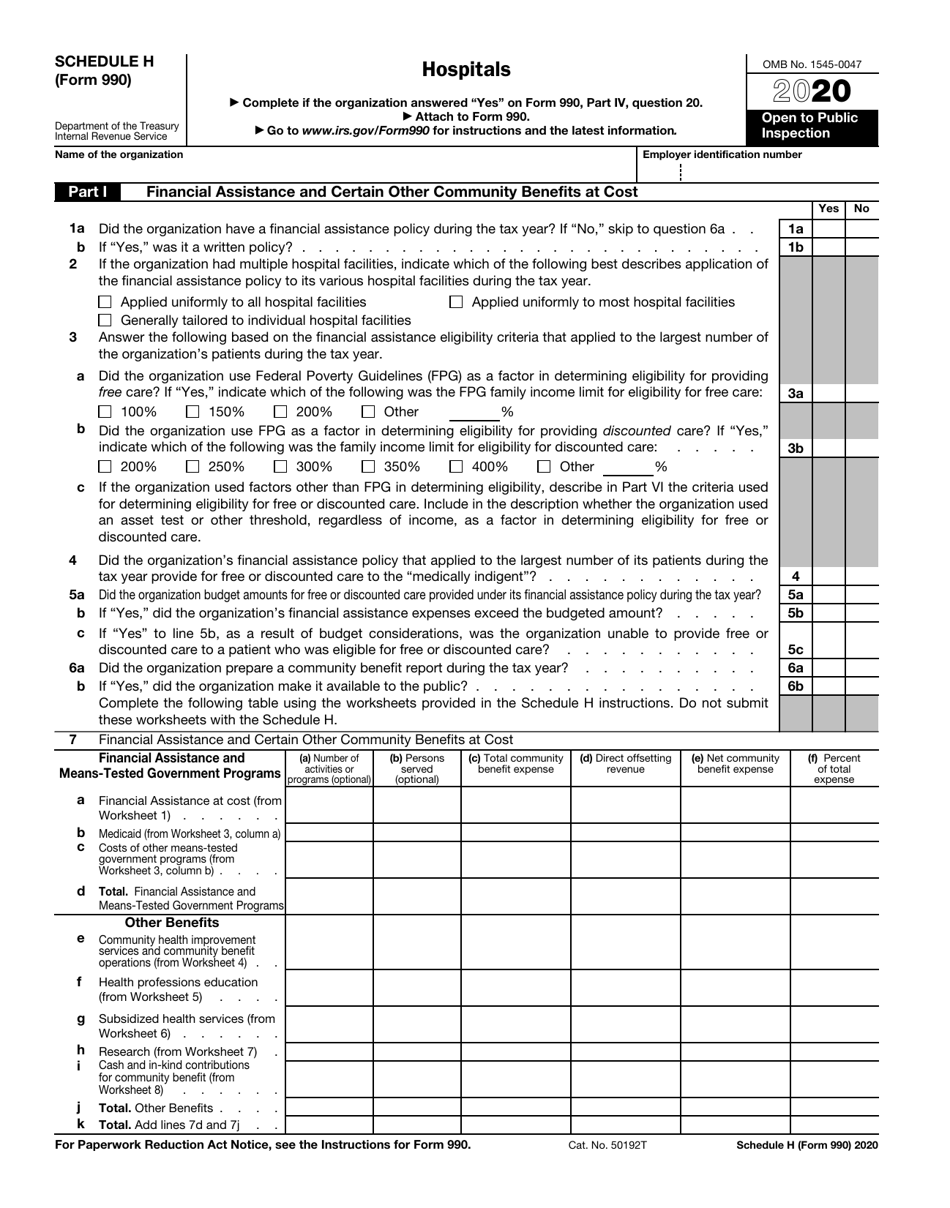

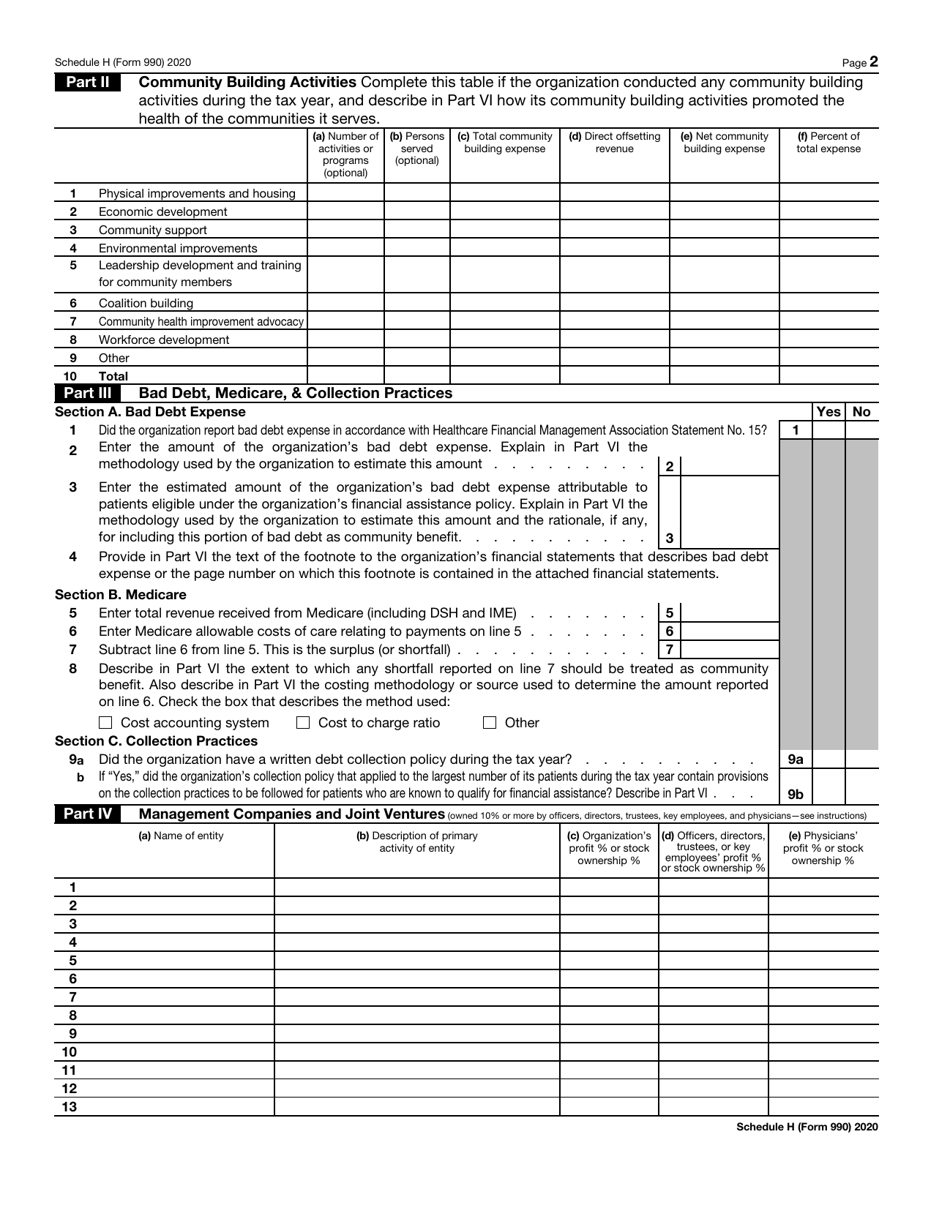

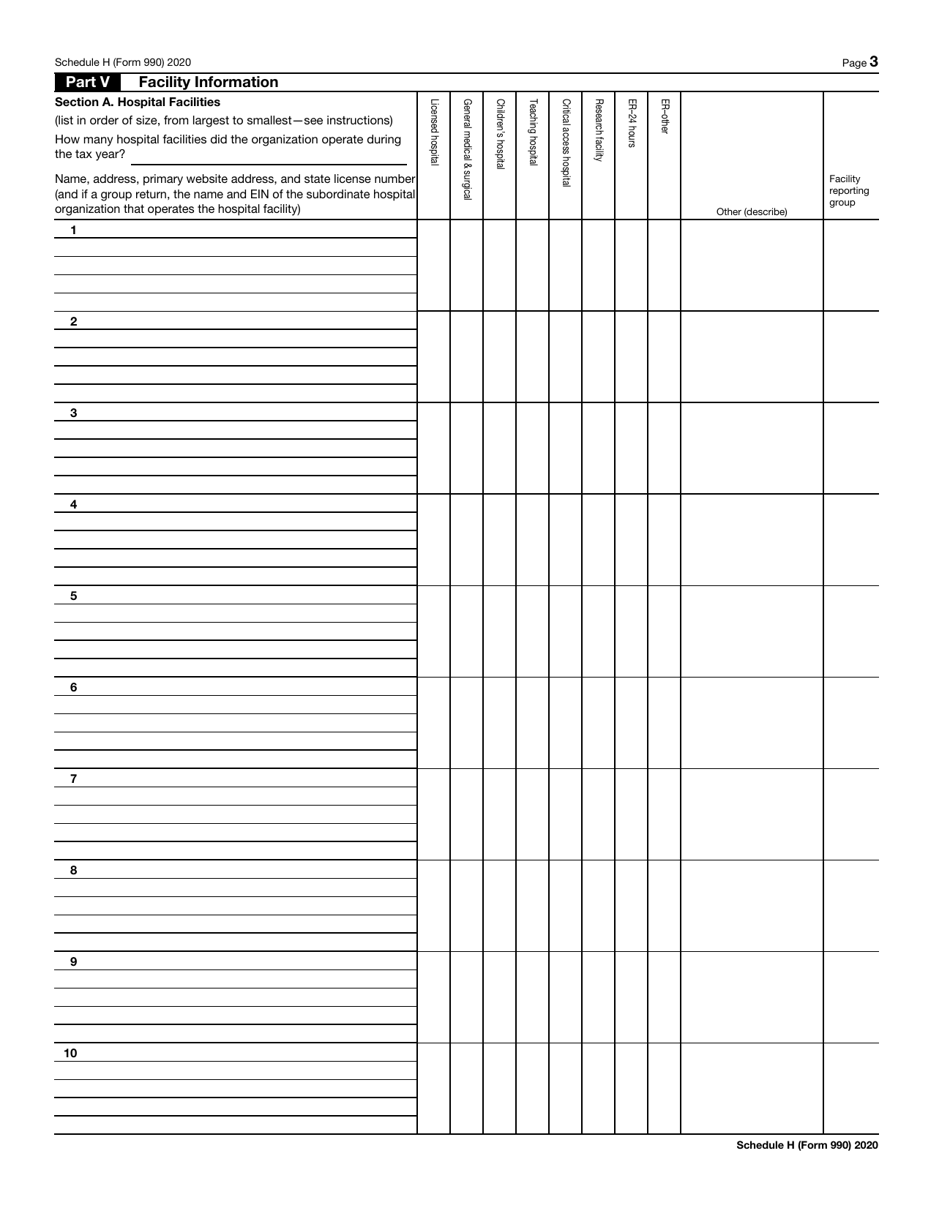

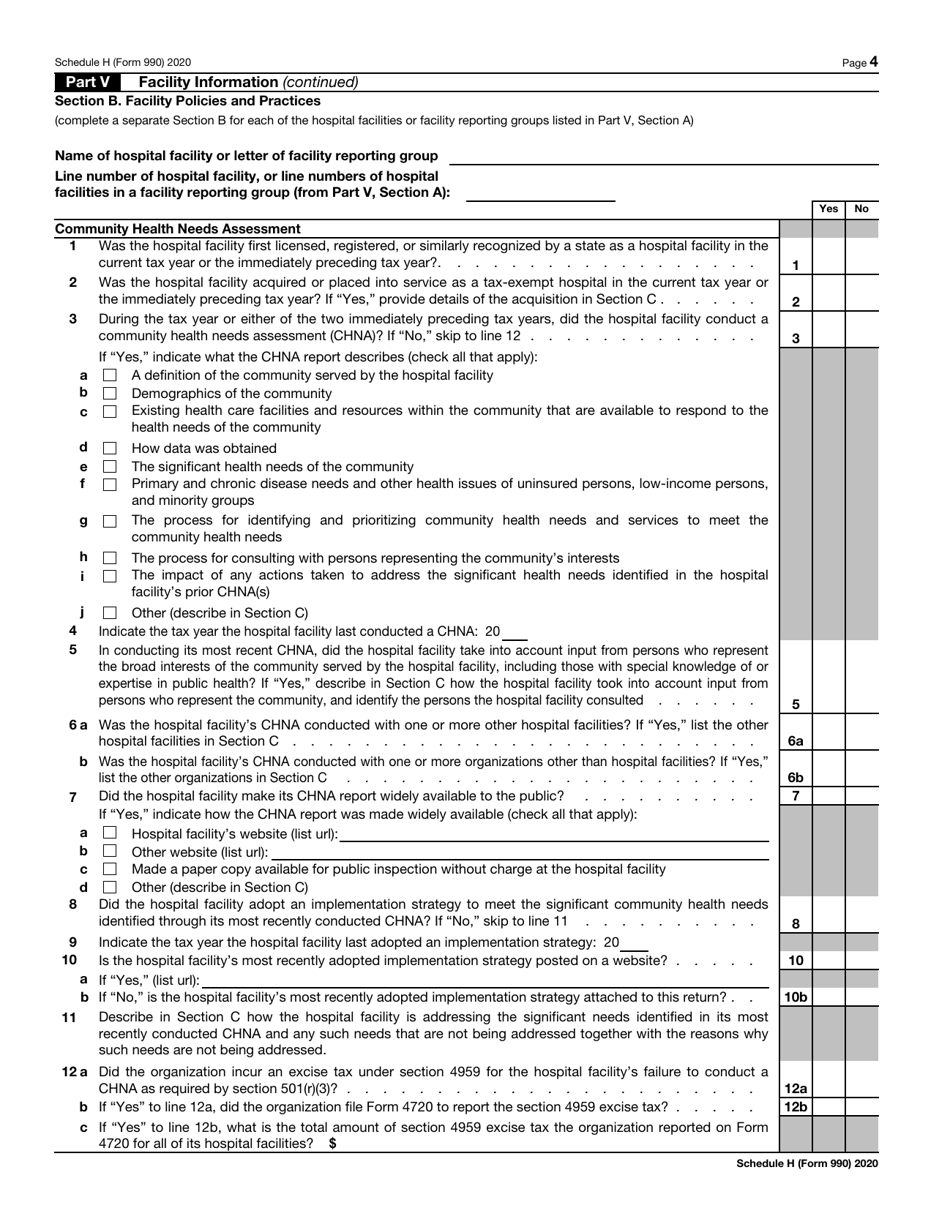

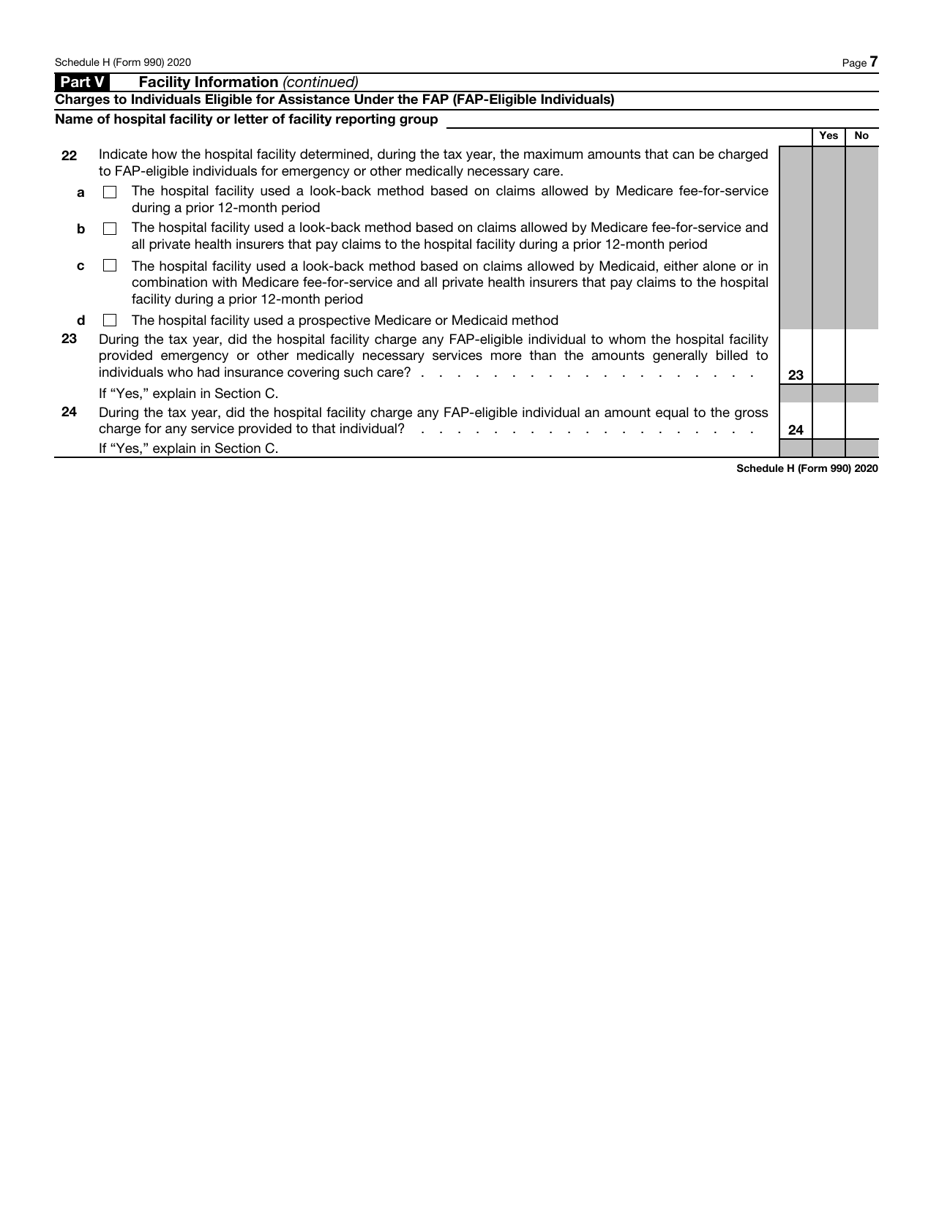

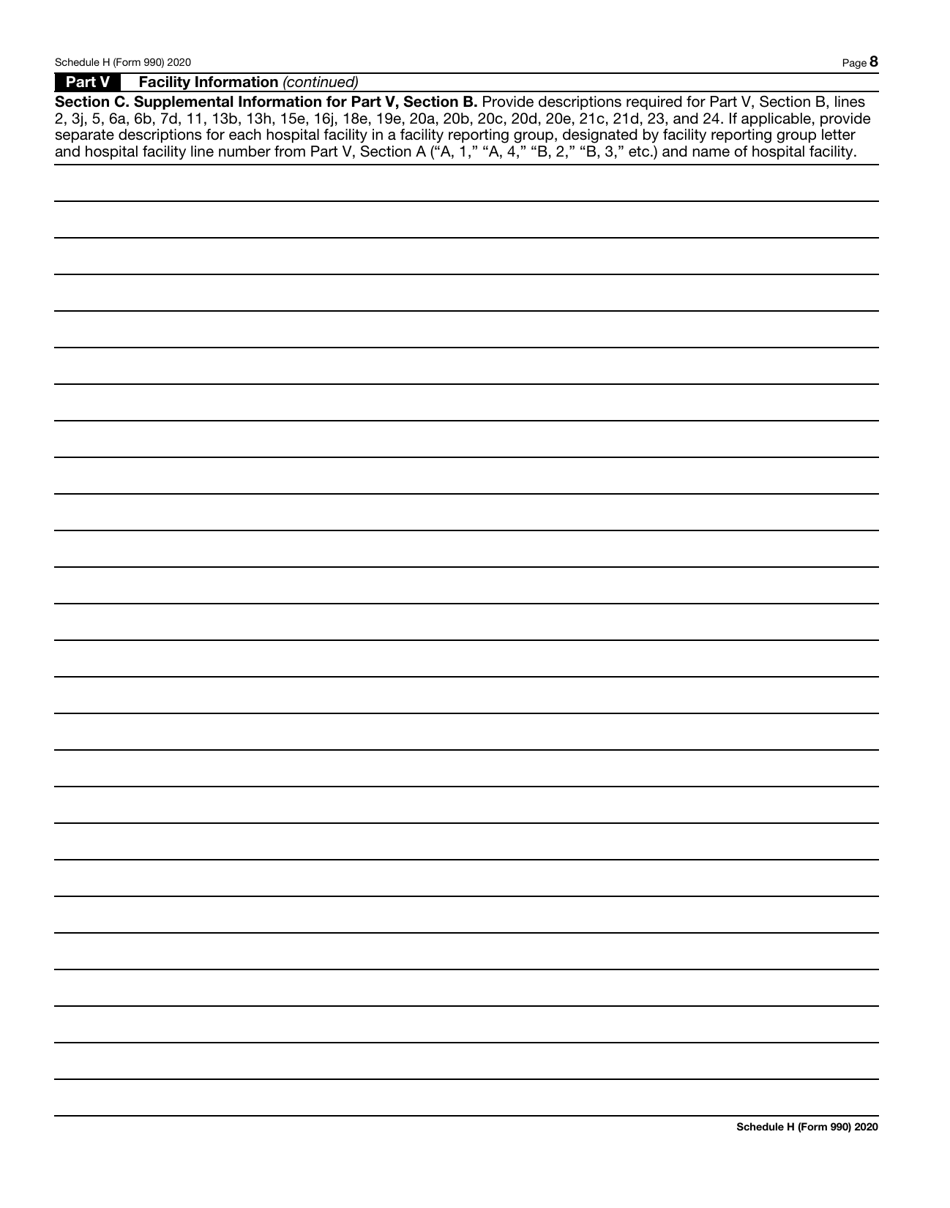

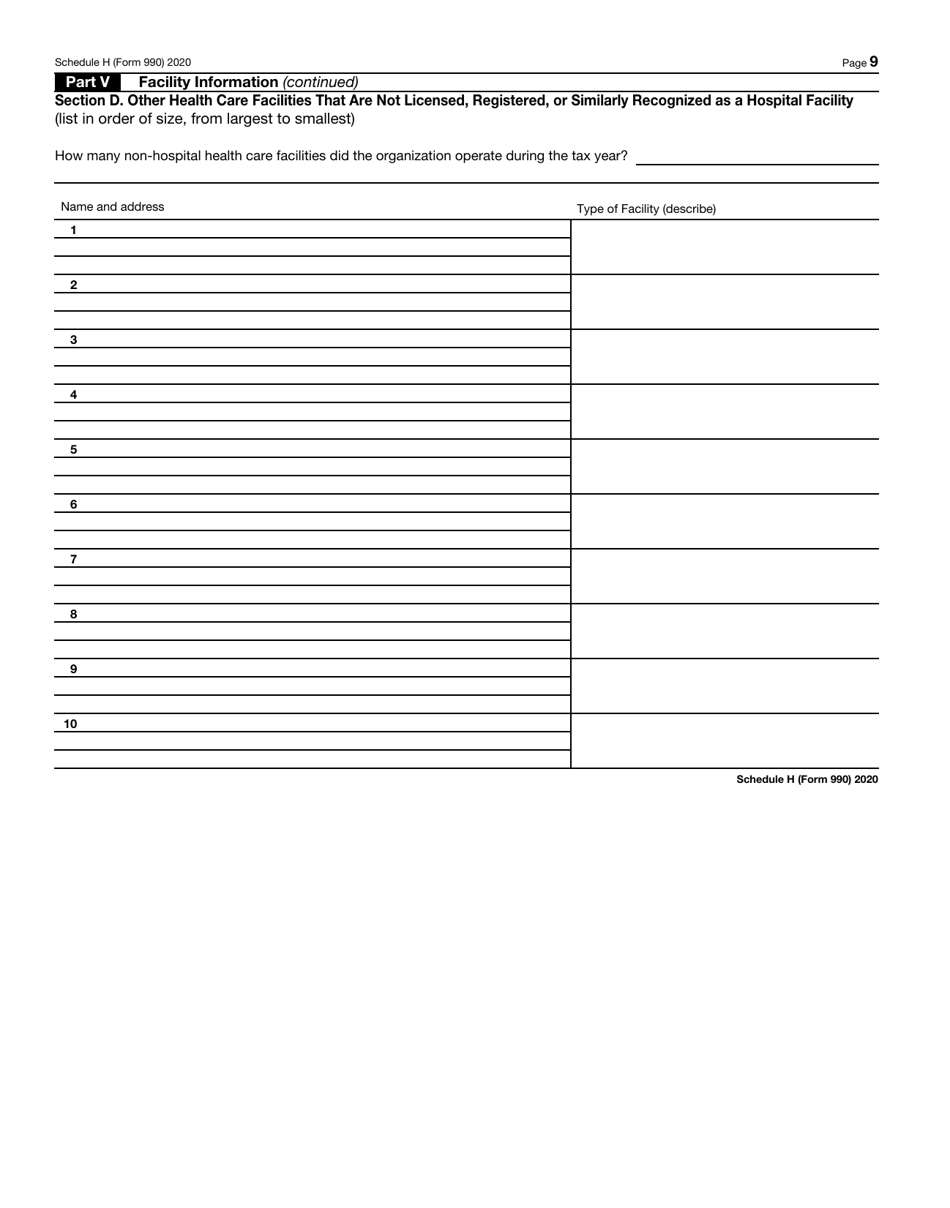

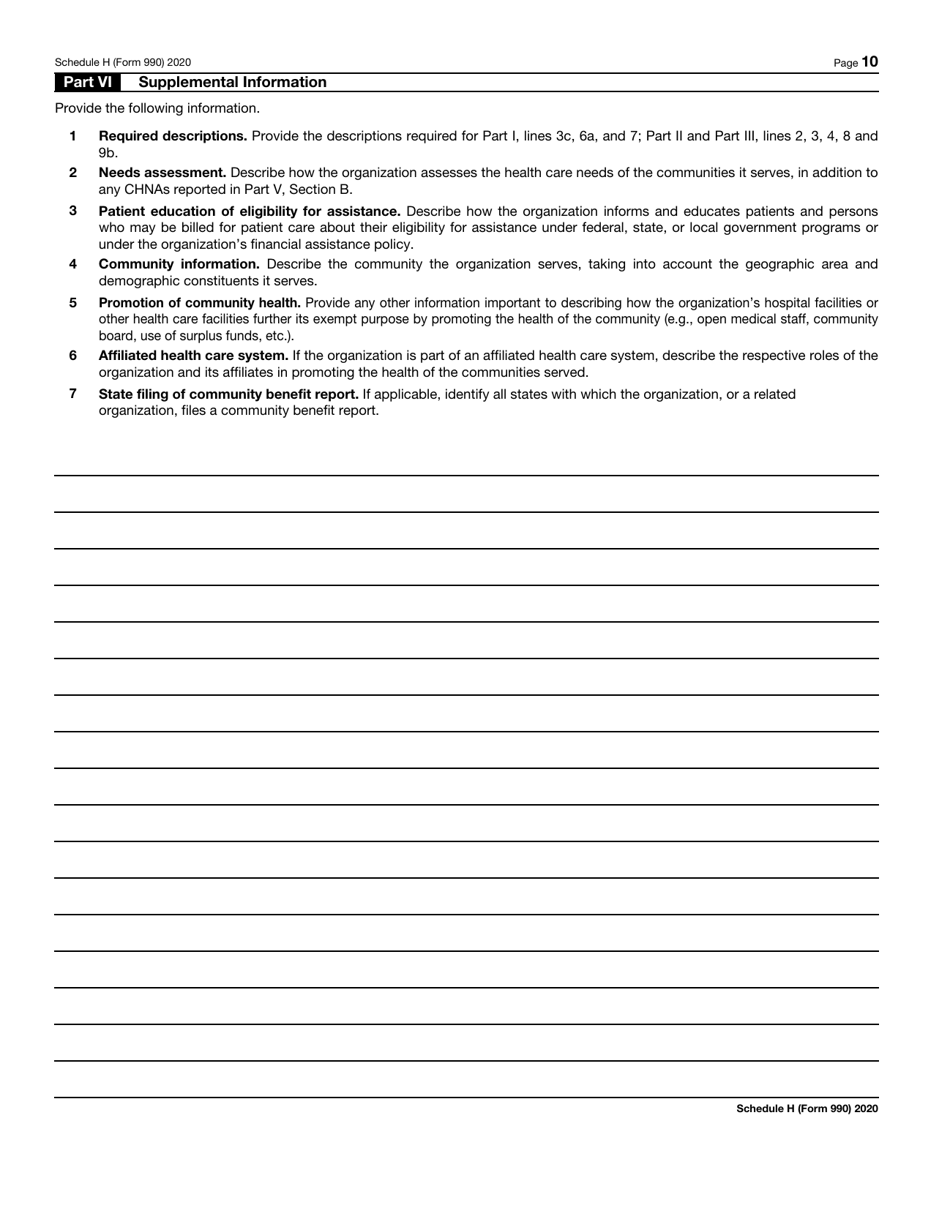

IRS Form 990 Schedule H Hospitals

What Is IRS Form 990 Schedule H?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H is a form required for hospitals to report information about their community benefit activities and other health care-related activities.

Q: Who needs to file IRS Form 990 Schedule H?

A: Non-profit hospitals that are required to file IRS Form 990 must also complete and file Schedule H if they meet certain criteria.

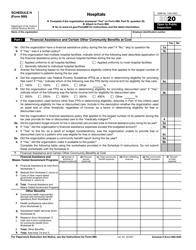

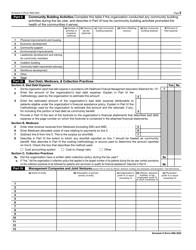

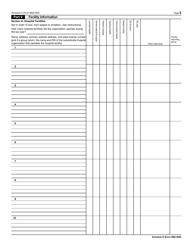

Q: What information is required on IRS Form 990 Schedule H?

A: IRS Form 990 Schedule H requires hospitals to provide information about their community benefit expenses, charity care, and other activities related to their tax-exempt status.

Q: When is the deadline to file IRS Form 990 Schedule H?

A: The deadline to file IRS Form 990 and any accompanying schedules, including Schedule H, is the 15th day of the 5th month after the end of the fiscal year.

Q: Are there any penalties for not filing IRS Form 990 Schedule H?

A: Yes, non-profit hospitals that fail to file IRS Form 990 and any required schedules, including Schedule H, may face penalties and/or loss of their tax-exempt status.

Form Details:

- A 10-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule H through the link below or browse more documents in our library of IRS Forms.