This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-196

for the current year.

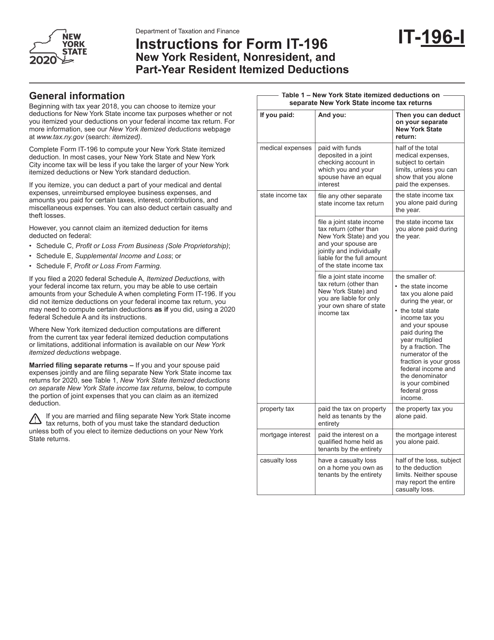

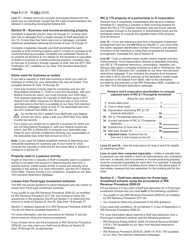

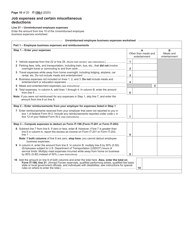

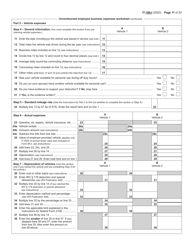

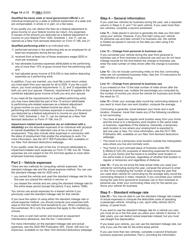

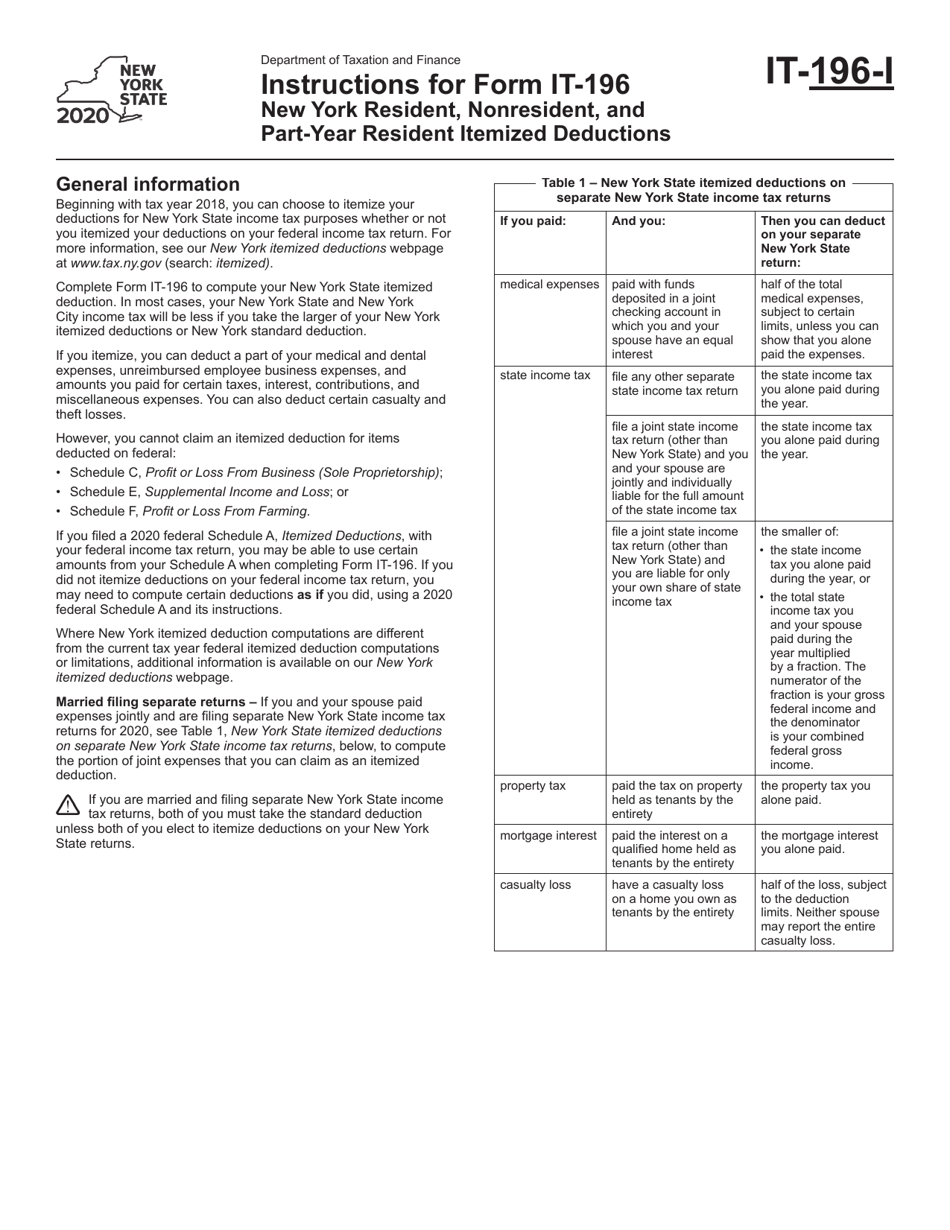

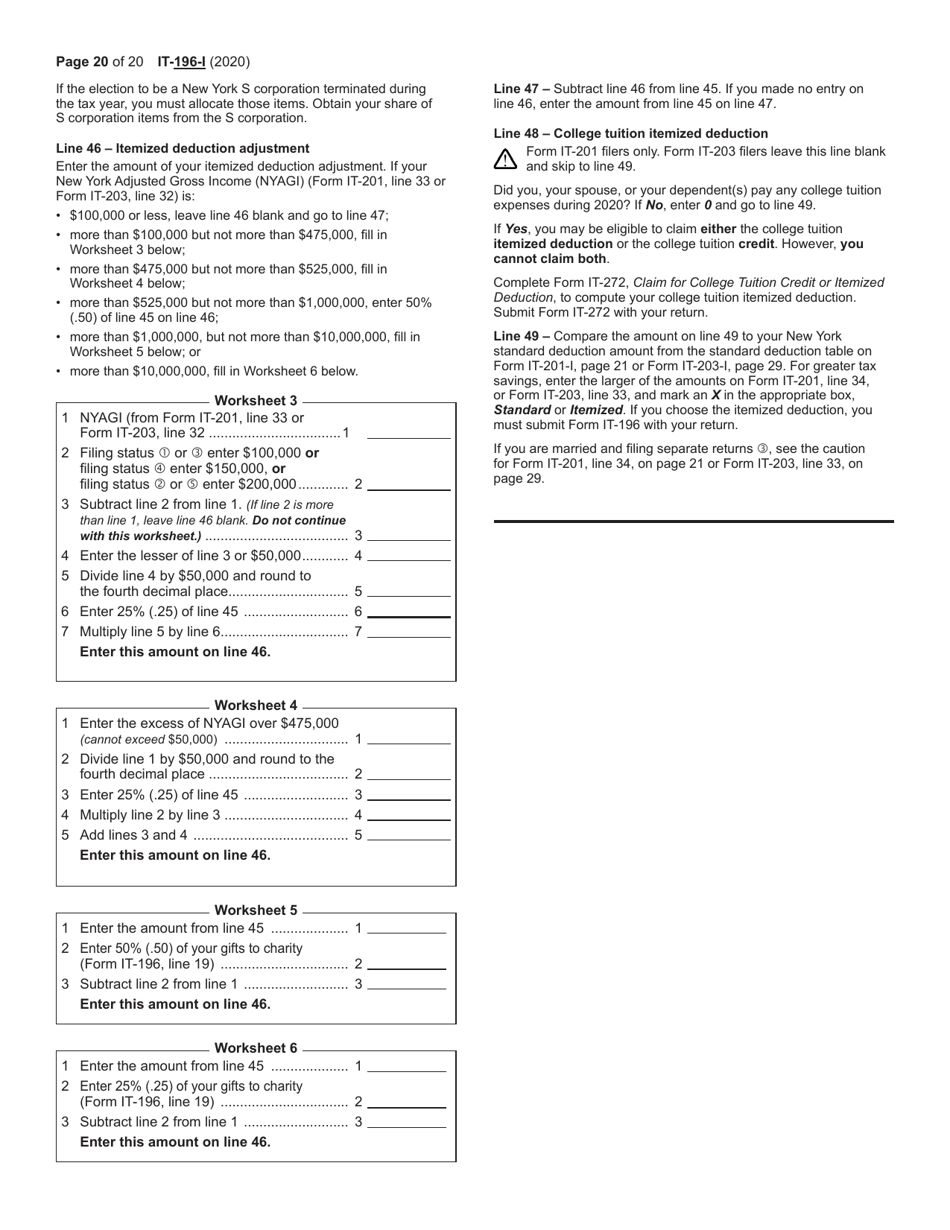

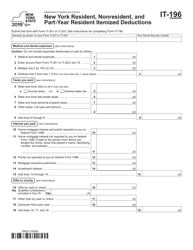

Instructions for Form IT-196 New York Resident, Nonresident, and Part-Year Resident Itemized Deductions - New York

This document contains official instructions for Form IT-196 , New York Resident, Nonresident, and Part-Year Resident Itemized Deductions - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form IT-196?

A: Form IT-196 is a New York State tax form used by residents, nonresidents, and part-year residents to itemize deductions.

Q: Who can use Form IT-196?

A: Form IT-196 can be used by New York State residents, nonresidents, and part-year residents who want to itemize their deductions on their state tax return.

Q: What are itemized deductions?

A: Itemized deductions are specific expenses that you can subtract from your taxable income to reduce your overall tax liability.

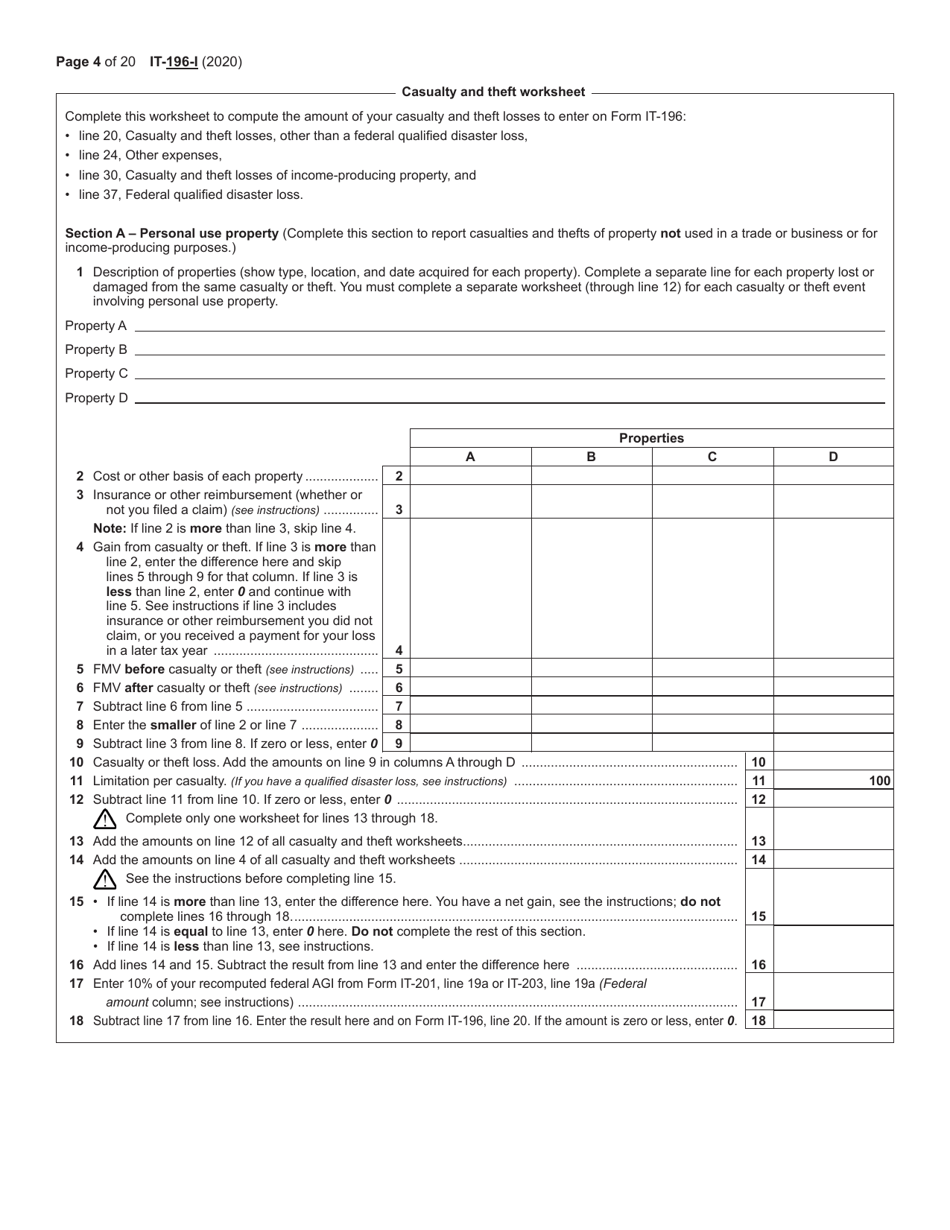

Q: What expenses can be itemized on Form IT-196?

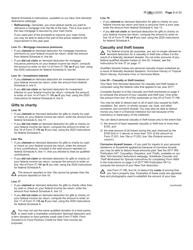

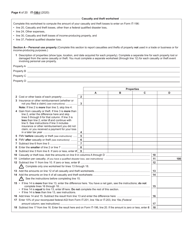

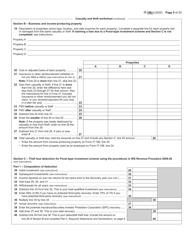

A: Expenses that can be itemized on Form IT-196 include medical and dental expenses, state and local taxes paid, mortgage interest, charitable contributions, and more.

Q: Can I take the standard deduction instead of itemizing?

A: Yes, you can choose to take the standard deduction instead of itemizing if it results in a larger deduction for you.

Q: What documentation do I need to support my itemized deductions?

A: You should keep records of your expenses and have supporting documentation, such as receipts, invoices, and statements, to substantiate your itemized deductions.

Q: Is there a deadline to file Form IT-196?

A: Form IT-196 must be filed by the due date of your New York State tax return, which is usually April 15th.

Q: Can I e-file Form IT-196?

A: Yes, you can e-file Form IT-196 using approved tax software or through a tax professional.

Q: What if I made a mistake on Form IT-196?

A: If you made a mistake on Form IT-196, you can file an amended return using Form IT-201-X within three years from the original due date of the return.

Instruction Details:

- This 24-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.