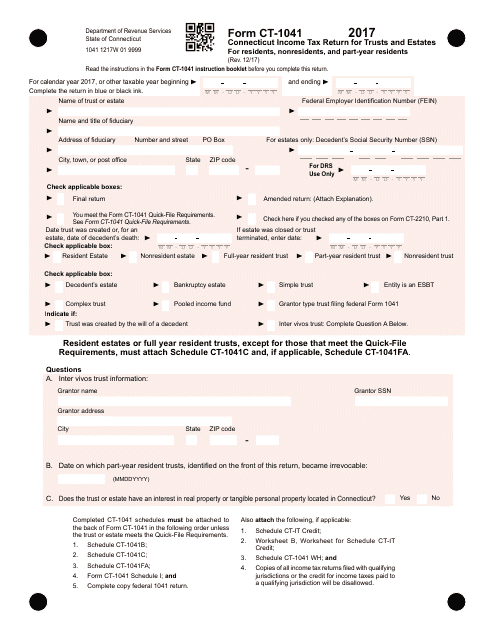

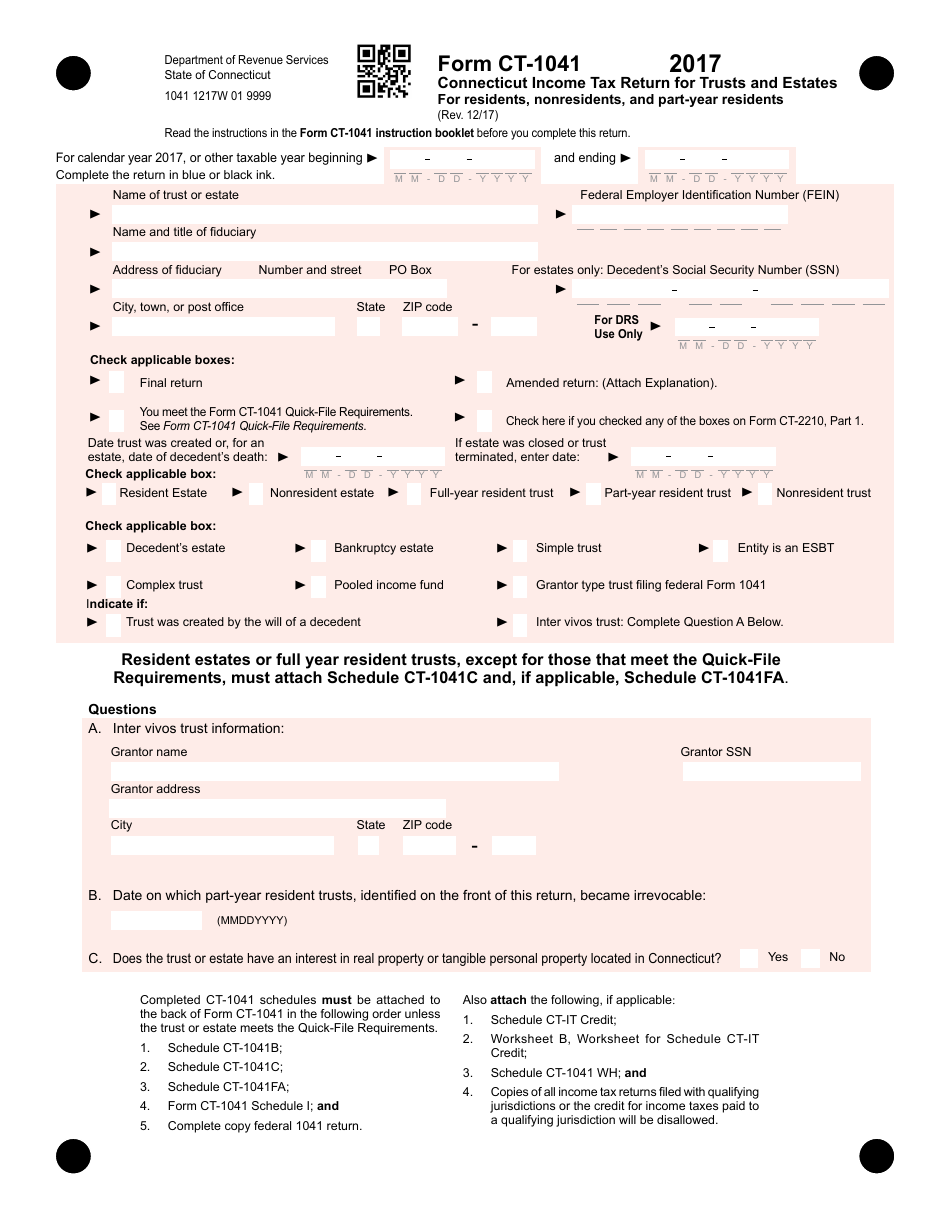

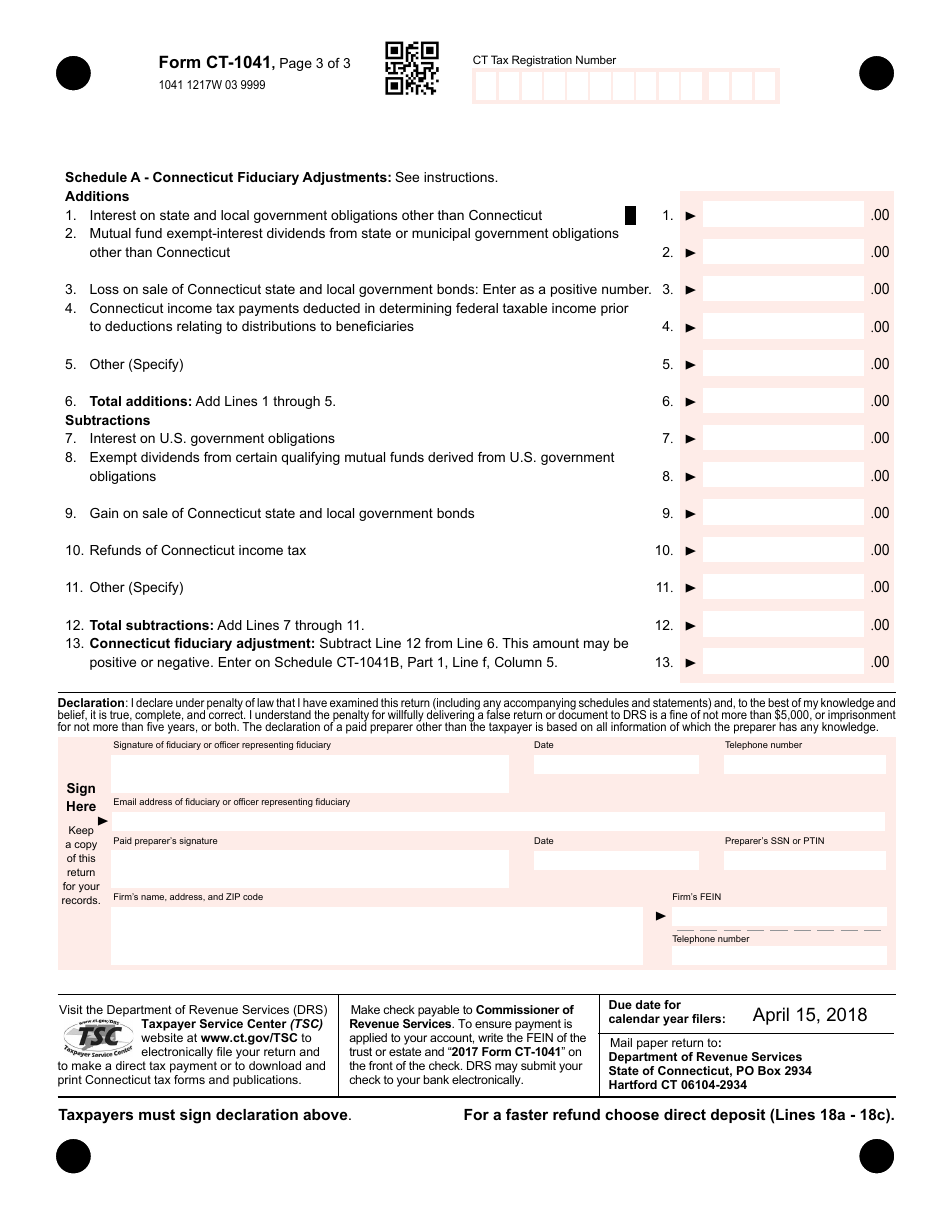

Form CT-1041 Connecticut Income Tax Return for Trusts and Estates for Residents, Nonresidents, and Part-Year Residents - Connecticut

What Is Form CT-1041?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form CT-1041?

A: Trusts and estates for residents, nonresidents, and part-year residents of Connecticut.

Q: What is the purpose of Form CT-1041?

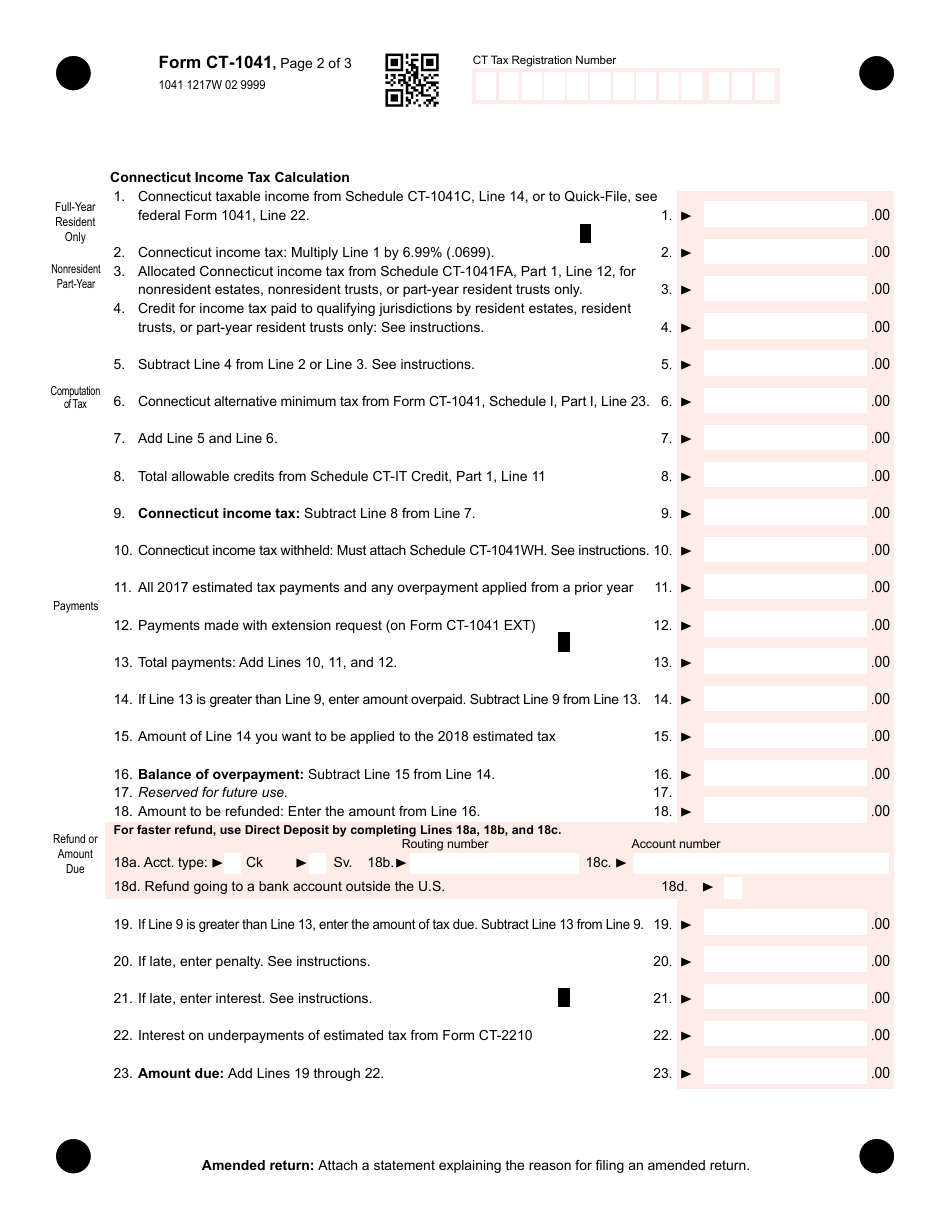

A: To report and pay income tax for trusts and estates in Connecticut.

Q: What types of income should be reported on Form CT-1041?

A: All income earned by the trust or estate, including dividends, interest, capital gains, and rental income.

Q: Are there any deductions or credits available on Form CT-1041?

A: Yes, there are various deductions and credits available for trusts and estates, such as the federal income tax deduction and the Connecticut property tax credit.

Q: When is Form CT-1041 due?

A: Form CT-1041 is due on or before the 15th day of the fourth month following the close of the taxable year.

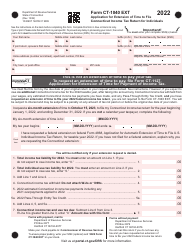

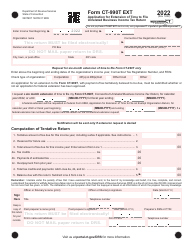

Q: Are extensions available for filing Form CT-1041?

A: Yes, extensions are available. To request an extension, taxpayers must file Form CT-1041 EXT.

Q: Is electronic filing available for Form CT-1041?

A: Yes, taxpayers can choose to file Form CT-1041 electronically through the Connecticut Taxpayer Service Center.

Q: What should be included with Form CT-1041?

A: Taxpayers should include all necessary schedules, forms, and documentation to support their income, deductions, and credits reported on Form CT-1041.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1041 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.