This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2200S

for the current year.

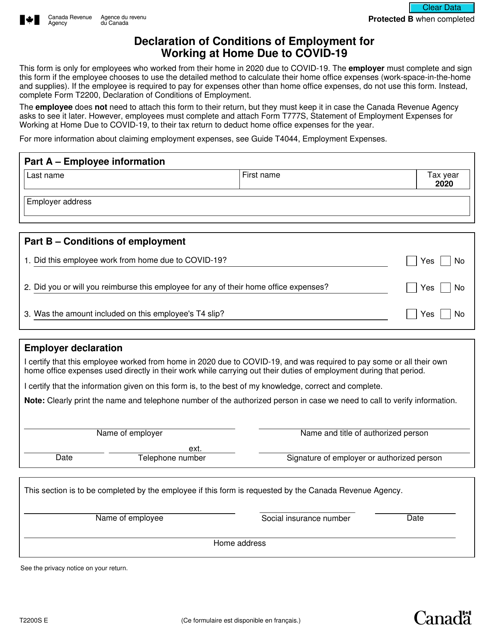

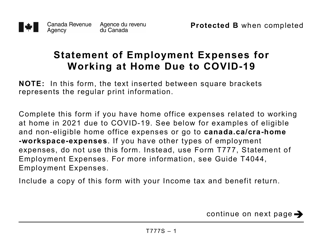

Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 - Canada

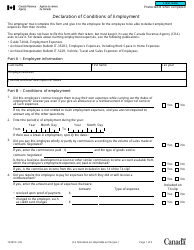

Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 is a form used in Canada to declare the conditions of employment for individuals who have been working from home due to the Covid-19 pandemic. This form is used to claim certain employment expenses and is required to be completed by employees in certain situations. The form provides information about the workspace and expenses that are eligible for deduction.

The employee files the Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 in Canada.

FAQ

Q: What is Form T2200S?

A: Form T2200S is a declaration of conditions of employment for working at home due to Covid-19 in Canada.

Q: Who can use Form T2200S?

A: Employees who worked from home in 2020 due to Covid-19 and need to claim home office expenses for tax purposes in Canada can use Form T2200S.

Q: What is the purpose of Form T2200S?

A: The purpose of Form T2200S is to allow employees to claim home office expenses on their tax return in Canada.

Q: What expenses can be claimed using Form T2200S?

A: Expenses related to working from home, such as utilities, internet access fees, and office supplies, can be claimed using Form T2200S.

Q: Is Form T2200S specific to Covid-19?

A: Yes, Form T2200S is specific to the Covid-19 pandemic and the eligibility to claim home office expenses during this period.

Q: Are there any eligibility criteria to use Form T2200S?

A: Yes, employees must meet certain criteria, such as being required to work from home and not being reimbursed by their employer for home office expenses, to use Form T2200S.

Q: When should Form T2200S be filled out?

A: Form T2200S should be filled out for the tax year in which you worked from home due to Covid-19.

Q: Do I need to submit Form T2200S with my tax return?

A: No, you do not need to submit Form T2200S with your tax return, but you should keep it for your records in case the CRA requests it.

Q: Can I claim all my home office expenses using Form T2200S?

A: No, only certain eligible expenses can be claimed using Form T2200S. It is advised to consult the CRA guidelines or a tax professional for more information.