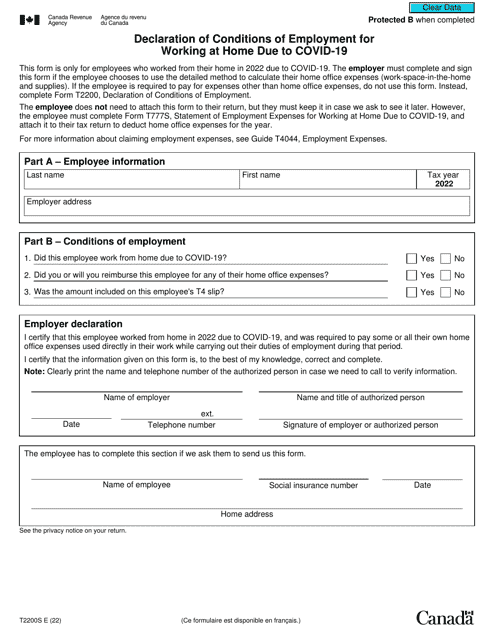

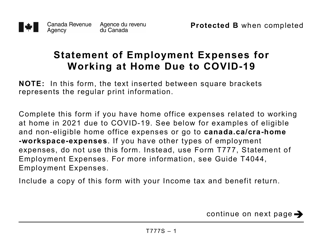

Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 - Canada

Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 in Canada is used by employees to declare their eligibility for claiming home office expenses as a result of working from home during the Covid-19 pandemic.

The employee files the Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 in Canada.

Form T2200S Declaration of Conditions of Employment for Working at Home Due to Covid-19 - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2200S?

A: Form T2200S is a declaration of conditions of employment for working at home due to Covid-19 in Canada.

Q: Who needs to fill out Form T2200S?

A: Employees who worked from home due to Covid-19 and want to claim certain deductions on their income tax return in Canada.

Q: What information does Form T2200S require?

A: Form T2200S requires information about the employee's employment status, duties performed at home, and the amount of time spent working from home.

Q: How can I obtain Form T2200S?

A: You should ask your employer to provide you with a completed and signed Form T2200S.

Q: Can I claim expenses if I don't have Form T2200S?

A: No, you need Form T2200S to support your claim for home office expenses.

Q: What expenses can be claimed with Form T2200S?

A: Expenses related to working from home, such as office supplies, workspace-in-the-home expenses, and certain electronic devices, may be claimed with Form T2200S.

Q: Do I need to submit Form T2200S with my tax return?

A: No, you don't need to submit Form T2200S with your tax return, but you should keep it for your records in case the Canada Revenue Agency requests it.