This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1036

for the current year.

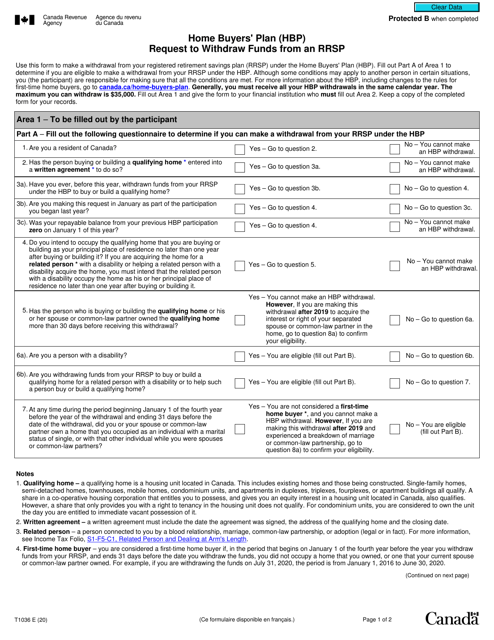

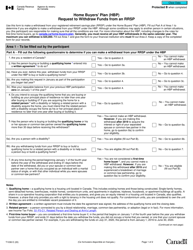

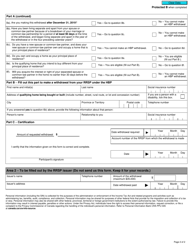

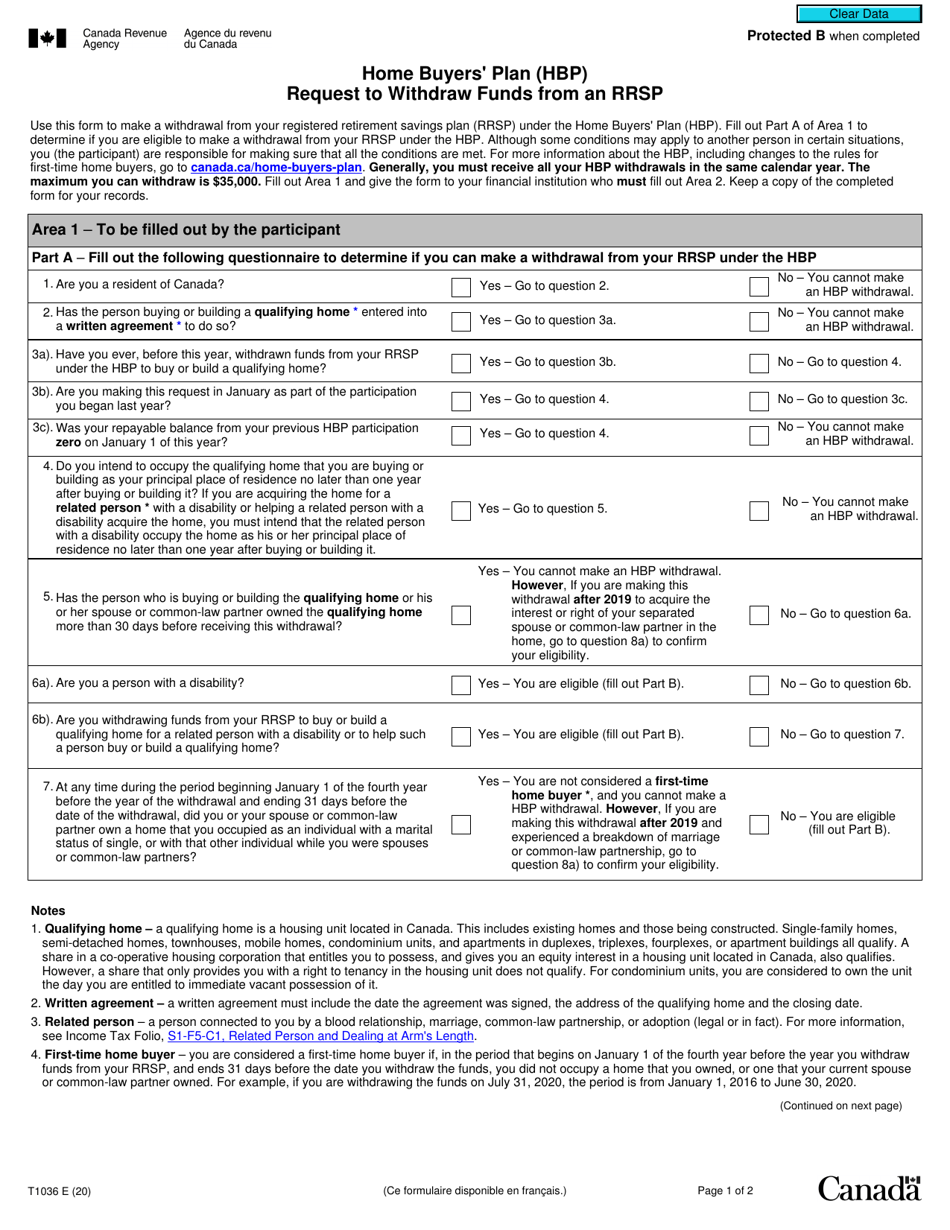

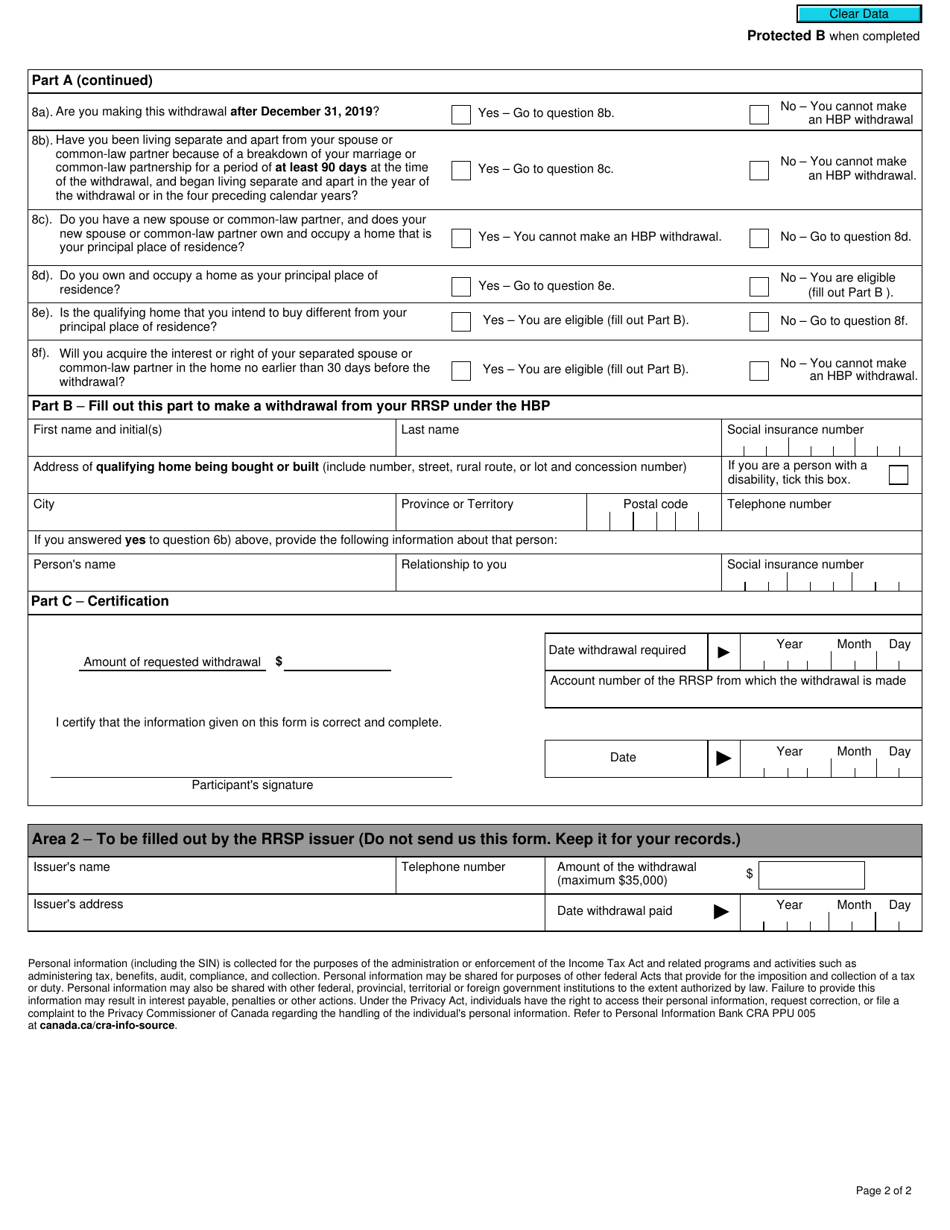

Form T1036 Home Buyers' Plan (Hbp) Request to Withdraw Funds From an Rrsp - Canada

Form T1036 is used in Canada for individuals who want to participate in the Home Buyers' Plan (HBP). The HBP allows first-time home buyers to withdraw funds from their Registered Retirement Savings Plan (RRSP) to purchase or build a qualifying home. Therefore, Form T1036 is the request form needed to withdraw funds from an RRSP under the HBP.

The individual who wants to withdraw funds from their Registered Retirement Savings Plan (RRSP) under the Home Buyers' Plan (HBP) in Canada is required to file the Form T1036 Home Buyers' Plan (HBP) Request.

FAQ

Q: What is Form T1036?

A: Form T1036 is a document used in Canada for the Home Buyers' Plan (HBP) to request the withdrawal of funds from an RRSP.

Q: What is the Home Buyers' Plan (HBP)?

A: The Home Buyers' Plan (HBP) is a program in Canada that allows first-time homebuyers to withdraw funds from their RRSP to purchase a home.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a type of retirement savings account in Canada.

Q: Who can use the Home Buyers' Plan?

A: First-time homebuyers in Canada who meet certain criteria can use the Home Buyers' Plan.

Q: What are the criteria for using the Home Buyers' Plan?

A: To use the Home Buyers' Plan, you must be a first-time homebuyer, have a written agreement to buy or build a qualifying home, and intend to live in the home within one year of its purchase or construction.

Q: How much can I withdraw from my RRSP under the Home Buyers' Plan?

A: You can withdraw up to $35,000 from your RRSP under the Home Buyers' Plan.

Q: Do I have to repay the withdrawn amount?

A: Yes, you have to repay the withdrawn amount to your RRSP over a 15-year period.

Q: What happens if I don't repay the withdrawn amount?

A: If you don't repay the withdrawn amount according to the HBP rules, it will be considered as income and taxed accordingly.

Q: How do I request to withdraw funds using Form T1036?

A: You can request to withdraw funds using Form T1036 by filling out the form and submitting it to your financial institution that holds your RRSP.