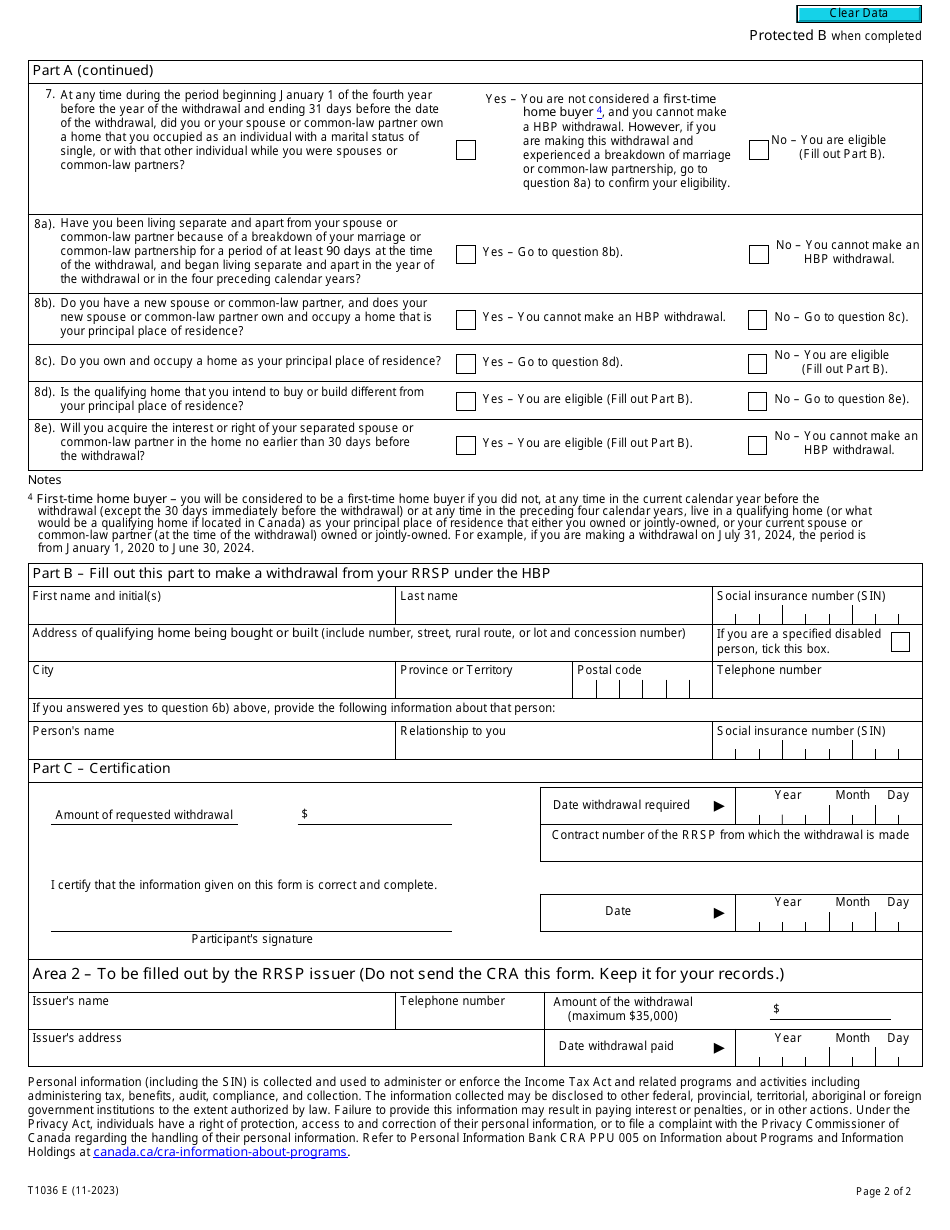

Form T1036 Home Buyers' Plan (Hbp) Request to Withdraw Funds From an Rrsp - Canada

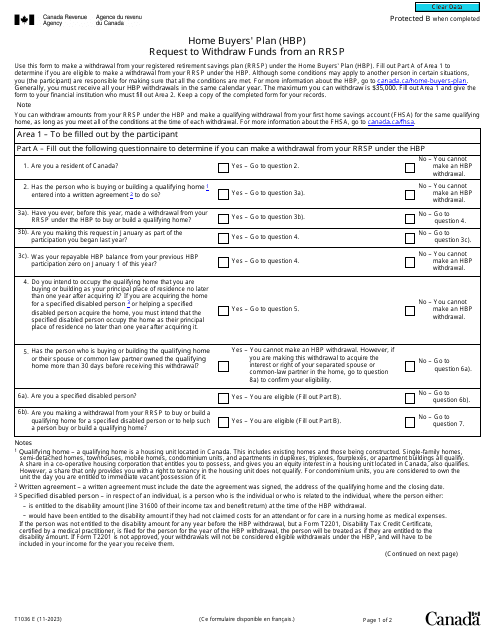

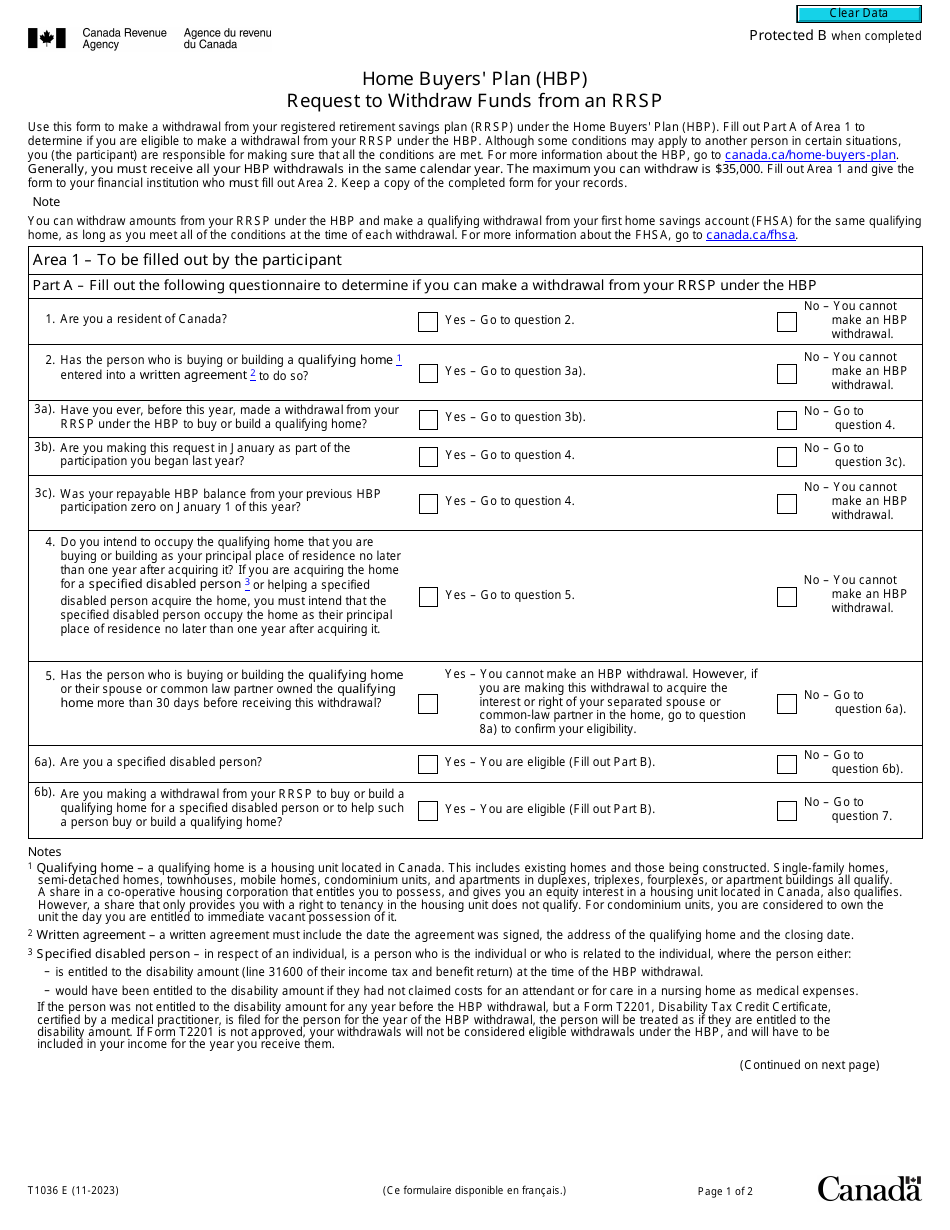

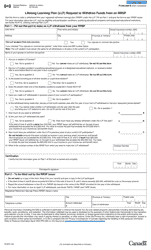

Form T1036 Home Buyers' Plan (Hbp) Request to Withdraw Funds From an RRSP is used in Canada for individuals who want to participate in the Home Buyers' Plan (HBP). The HBP allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to buy or build a qualifying home for themselves or a related person with a disability.

The individual who wishes to withdraw funds from their RRSP under the Home Buyers' Plan (HBP) must file the Form T1036 in Canada.

Form T1036 Home Buyers' Plan (Hbp) Request to Withdraw Funds From an Rrsp - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1036?

A: Form T1036 is a request form used in Canada to withdraw funds from an RRSP under the Home Buyers' Plan (HBP).

Q: What is the Home Buyers' Plan (HBP)?

A: The Home Buyers' Plan (HBP) is a program in Canada that allows first-time home buyers to withdraw money from their Registered Retirement Savings Plan (RRSP) to purchase or build a home.

Q: Who is eligible for the Home Buyers' Plan (HBP)?

A: To be eligible for the Home Buyers' Plan (HBP), you must be a first-time home buyer and have a written agreement to buy or build a qualifying home.

Q: What is an RRSP?

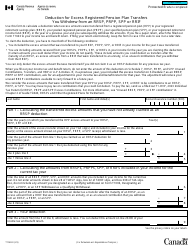

A: RRSP stands for Registered Retirement Savings Plan. It is a type of retirement savings account in Canada where individuals can contribute money and receive tax benefits.

Q: What is the purpose of Form T1036?

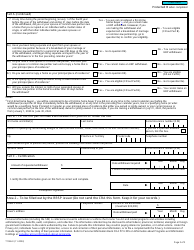

A: Form T1036 is used to request a withdrawal of funds from an RRSP under the Home Buyers' Plan (HBP). It provides the necessary information to the Canada Revenue Agency (CRA) to assess eligibility and process the withdrawal.

Q: What information is required on Form T1036?

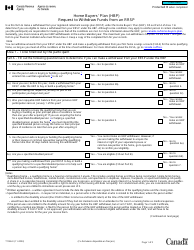

A: Form T1036 requires information such as your personal details, RRSP account information, details of the home purchase or construction, and the amount you wish to withdraw.

Q: Are there any conditions or restrictions for using the Home Buyers' Plan (HBP)?

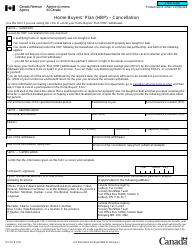

A: Yes, there are conditions and restrictions for using the Home Buyers' Plan (HBP). Some of these include repayment requirements, deadlines for using the funds, and limitations on the maximum withdrawal amount.

Q: What are the repayment requirements for the Home Buyers' Plan (HBP)?

A: The Home Buyers' Plan (HBP) requires you to repay the withdrawn amount back into your RRSP within a specified time period. Failure to repay the required amount may result in tax consequences.

Q: Can I use Form T1036 for any other purposes?

A: No, Form T1036 is specifically used for requesting a withdrawal of funds from an RRSP under the Home Buyers' Plan (HBP). It cannot be used for any other purposes.