This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC4601

for the current year.

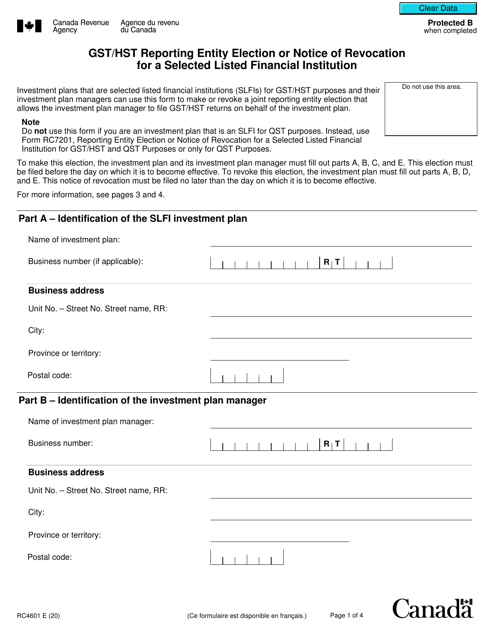

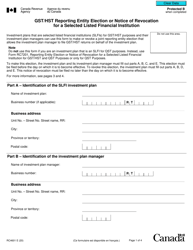

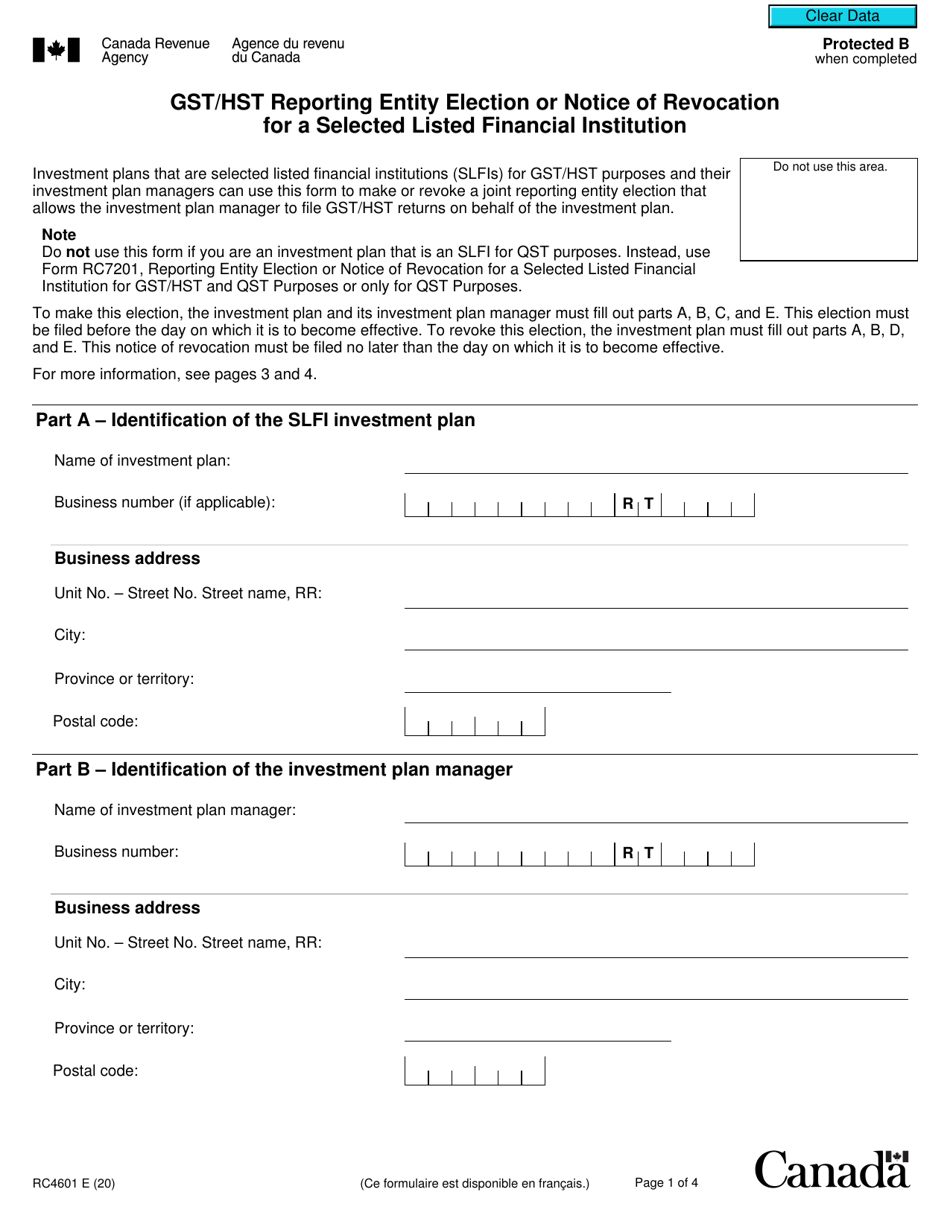

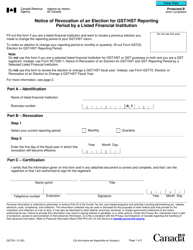

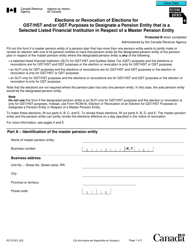

Form RC4601 Gst / Hst Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution - Canada

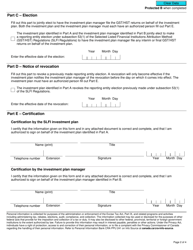

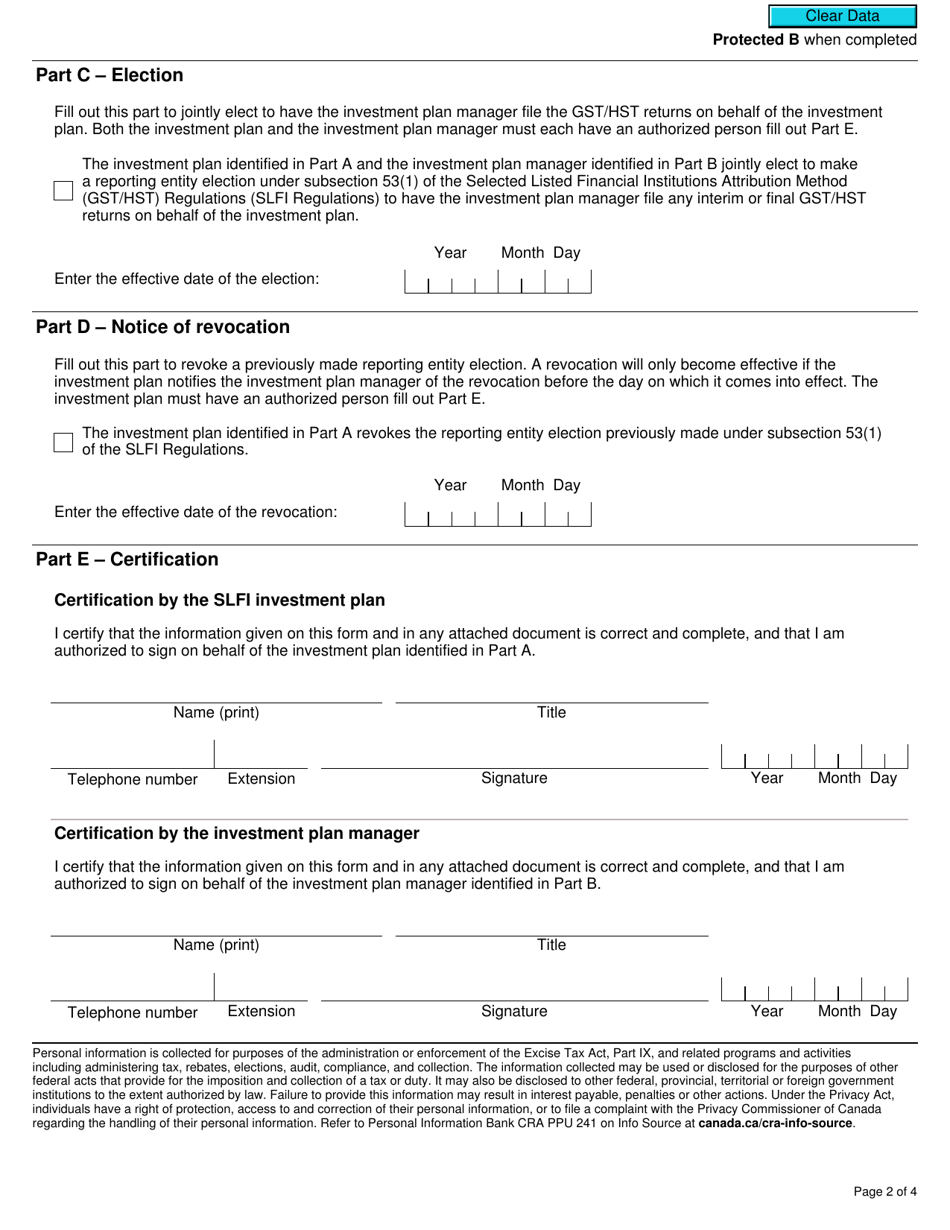

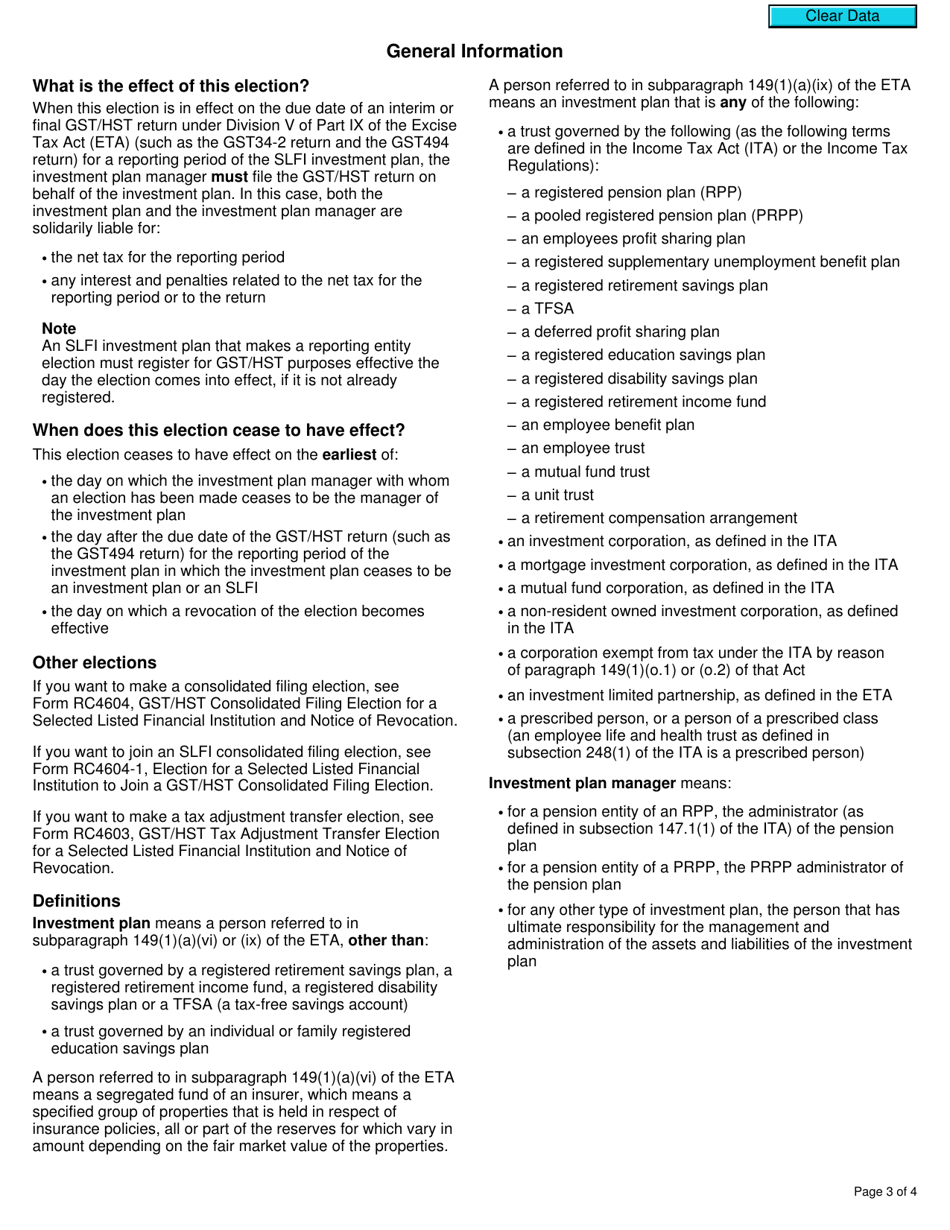

Form RC4601 is the GST/HST Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution in Canada. This form is used by financial institutions to elect or revoke their status as a GST/HST reporting entity. By completing this form, the financial institution notifies the Canada Revenue Agency (CRA) about their intention to report and remit GST/HST directly, or to have a designated entity report and remit on their behalf. The form helps the CRA to identify the appropriate reporting and remitting responsibilities of the financial institution under the Goods and Services Tax/Harmonized Sales Tax (GST/HST) system in Canada.

The Form RC4601 GST/HST Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution in Canada is filed by the financial institution itself.

FAQ

Q: What is Form RC4601?

A: Form RC4601 is the GST/HST Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution in Canada.

Q: Who should use Form RC4601?

A: Form RC4601 should be used by selected listed financial institutions in Canada to elect to be a GST/HST reporting entity or revoke their election.

Q: What is a selected listed financial institution?

A: A selected listed financial institution is a financial institution that is listed in Schedule VI to the Excise Tax Act and is required to make certain GST/HST filings.

Q: What is the purpose of the GST/HST Reporting Entity Election?

A: The purpose of the GST/HST Reporting Entity Election is to allow selected listed financial institutions to elect to be a GST/HST reporting entity and assume the responsibility of reporting and remitting the GST/HST on designated financial services.

Q: Can a selected listed financial institution revoke their election?

A: Yes, a selected listed financial institution can revoke their election by submitting the Form RC4601 to the Canada Revenue Agency.

Q: What are the filing requirements for a selected listed financial institution?

A: A selected listed financial institution is required to file a GST/HST return, along with any applicable schedules and forms, on a quarterly basis.