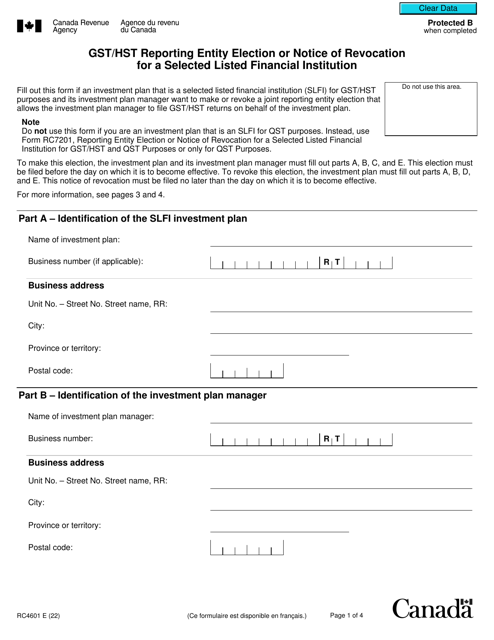

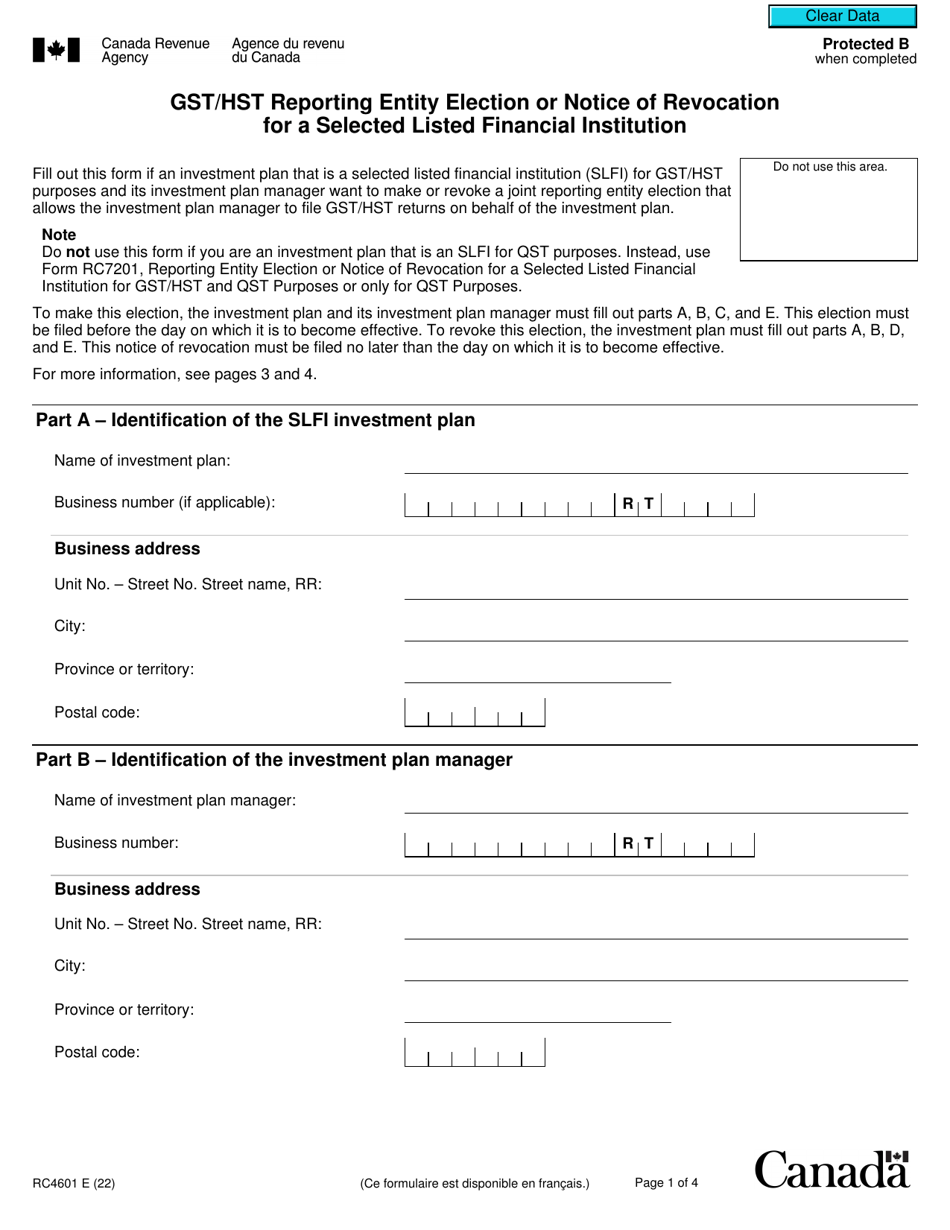

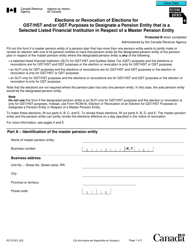

Form RC4601 Gst / Hst Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution - Canada

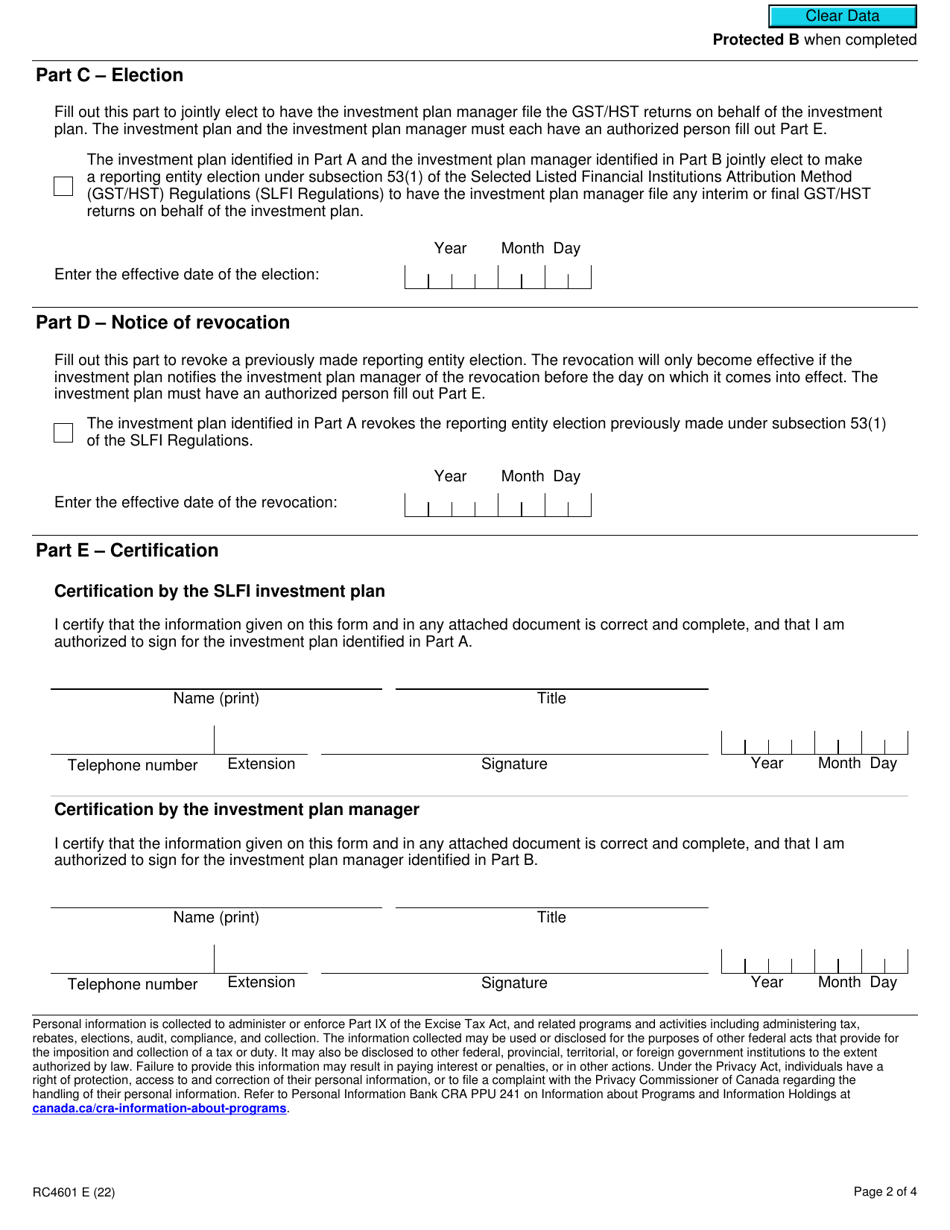

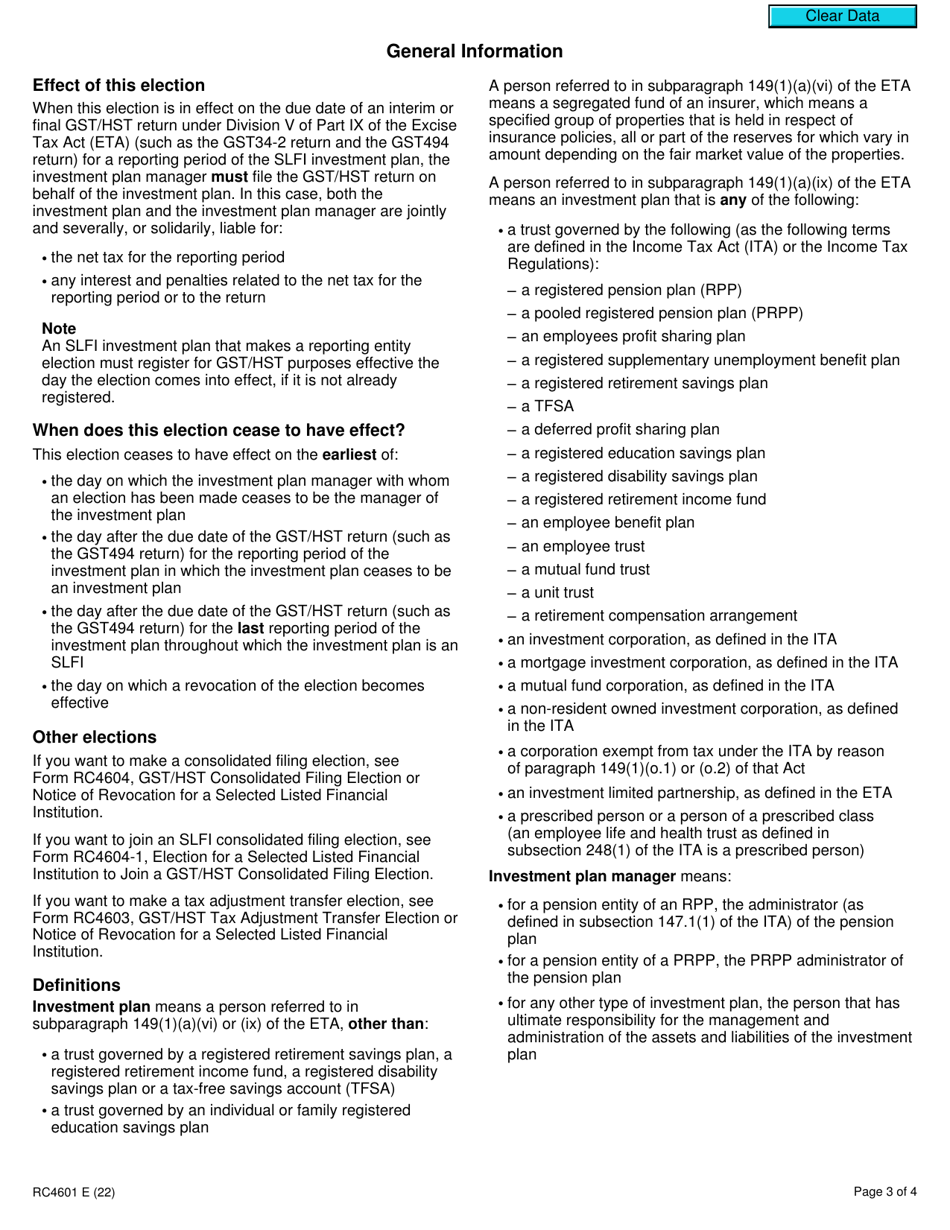

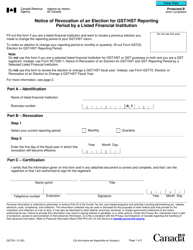

Form RC4601 GST/HST Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution in Canada is used to indicate whether a financial institution wants to become a GST/HST reporting entity or to revoke its status as a reporting entity. By completing this form, financial institutions notify the Canada Revenue Agency (CRA) about their election or revocation for reporting GST/HST. This helps the CRA to properly administer and assess the appropriate GST/HST taxes for these financial institutions.

The Form RC4601 GST/HST Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution in Canada is typically filed by the financial institution itself.

Form RC4601 Gst/Hst Reporting Entity Election or Notice of Revocation for a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC4601?

A: Form RC4601 is a document used in Canada for the election or revocation of a selected listed financial institution as a GST/HST reporting entity.

Q: What is a selected listed financial institution?

A: A selected listed financial institution refers to certain financial institutions registered under the Excise Tax Act, which are required to file GST/HST returns.

Q: Why would a financial institution elect to be a GST/HST reporting entity?

A: By electing to be a GST/HST reporting entity, a financial institution can claim input tax credits and recover the GST/HST paid on expenses.

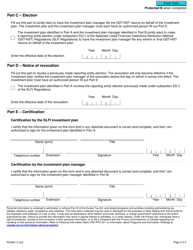

Q: How do I complete form RC4601?

A: To complete form RC4601, you need to provide your financial institution's information, including its name, business number, and type of financial institution. You also need to indicate whether you are electing or revoking the election, and provide the effective date of the election or revocation.

Q: Are there any deadlines for filing form RC4601?

A: There are no specific deadlines for filing form RC4601, but it is recommended to submit the form as soon as possible after the decision to elect or revoke the election has been made.

Q: Do I need to submit any supporting documents with form RC4601?

A: Generally, no supporting documents are required to be submitted with form RC4601. However, the CRA may request additional information or documentation to support the election or revocation.

Q: What are the consequences of electing or revoking the election as a GST/HST reporting entity?

A: Electing or revoking the election as a GST/HST reporting entity may have various tax implications, including the eligibility to claim input tax credits, the need to charge and remit GST/HST on taxable supplies, and compliance with reporting requirements.

Q: Can I make changes to my election or revocation after submitting form RC4601?

A: Yes, you can make changes to your election or revocation by submitting a new version of form RC4601 to the CRA. It is important to notify the CRA of any changes as soon as possible.

Q: Is it mandatory for a financial institution to elect to be a GST/HST reporting entity?

A: No, it is not mandatory for a financial institution to elect to be a GST/HST reporting entity. However, it may be beneficial for the institution to do so in order to claim input tax credits and recover GST/HST paid on expenses.