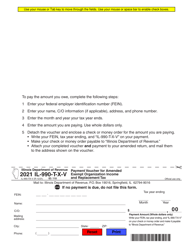

This version of the form is not currently in use and is provided for reference only. Download this version of

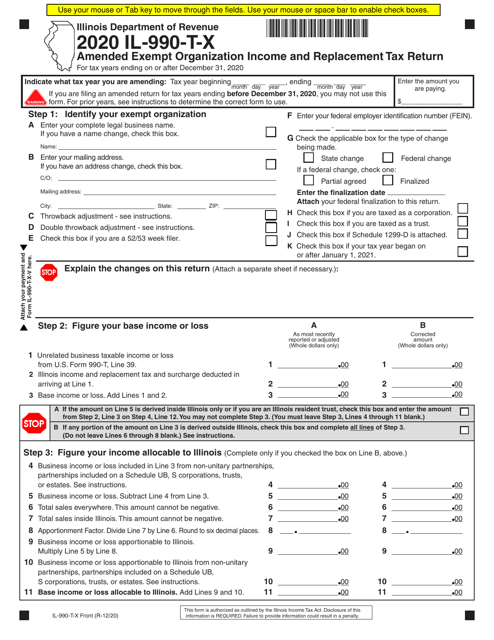

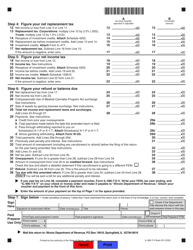

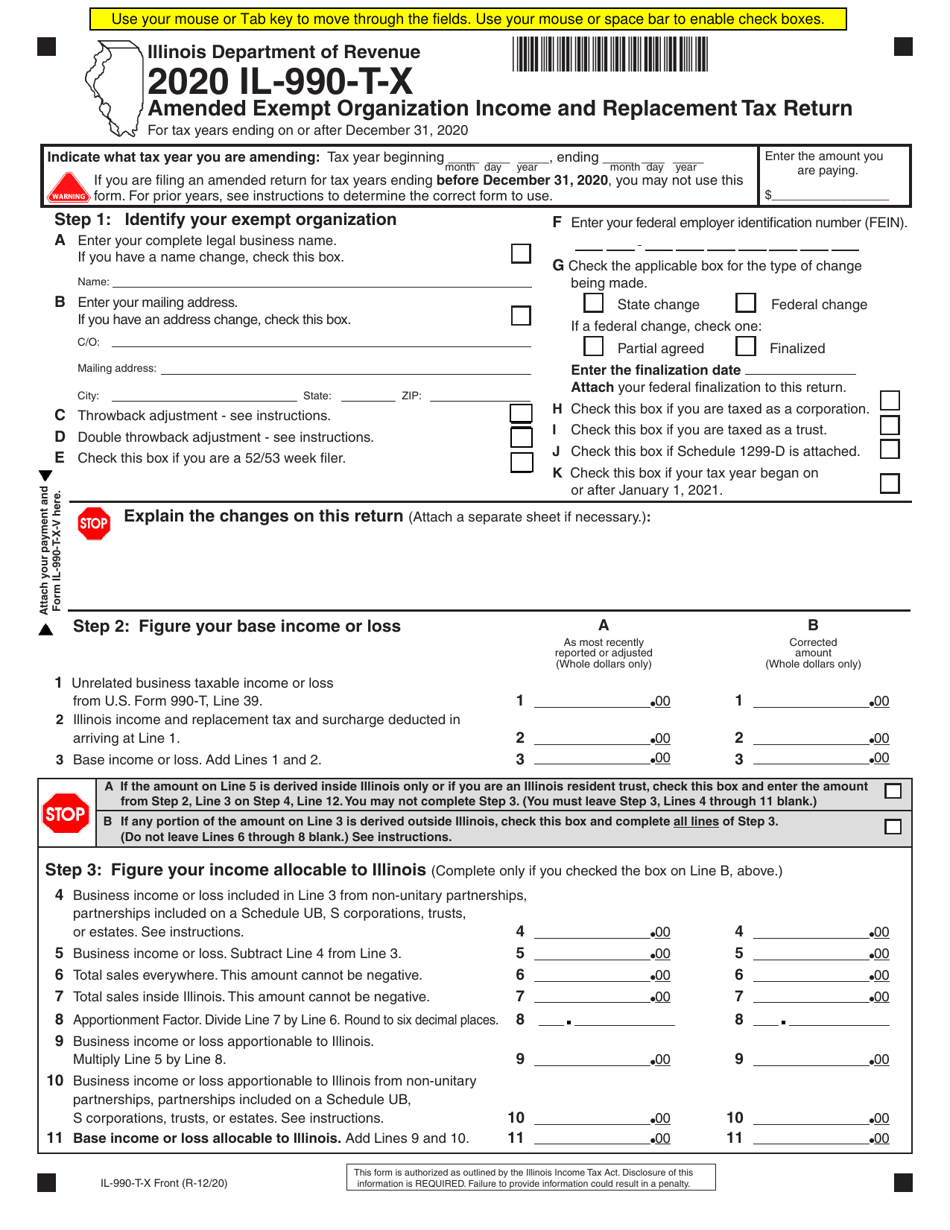

Form IL-990-T-X

for the current year.

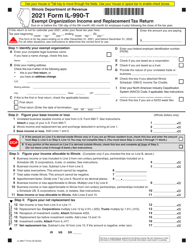

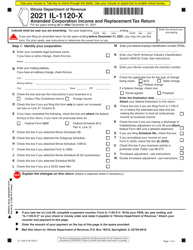

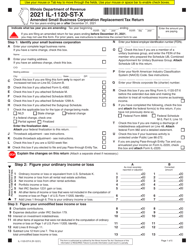

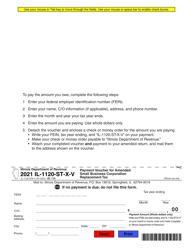

Form IL-990-T-X Amended Exempt Organization Income and Replacement Tax Return - Illinois

What Is Form IL-990-T-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-990-T-X?

A: Form IL-990-T-X is the Amended Exempt Organization Income and Replacement Tax Return specific to Illinois.

Q: Who needs to file Form IL-990-T-X?

A: Exempt organizations in Illinois that need to amend their income and replacement tax return.

Q: What is the purpose of Form IL-990-T-X?

A: The purpose of Form IL-990-T-X is to report changes or corrections to the previously filed IL-990-T.

Q: When should Form IL-990-T-X be filed?

A: Form IL-990-T-X should be filed when there are changes or corrections to be made to a previously filed IL-990-T.

Q: Is there a filing fee for Form IL-990-T-X?

A: No, there is no filing fee for Form IL-990-T-X.

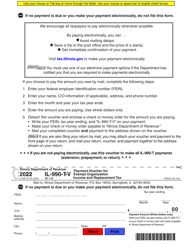

Q: Can Form IL-990-T-X be filed electronically?

A: No, Form IL-990-T-X cannot be filed electronically. It must be filed by mail.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.