This version of the form is not currently in use and is provided for reference only. Download this version of

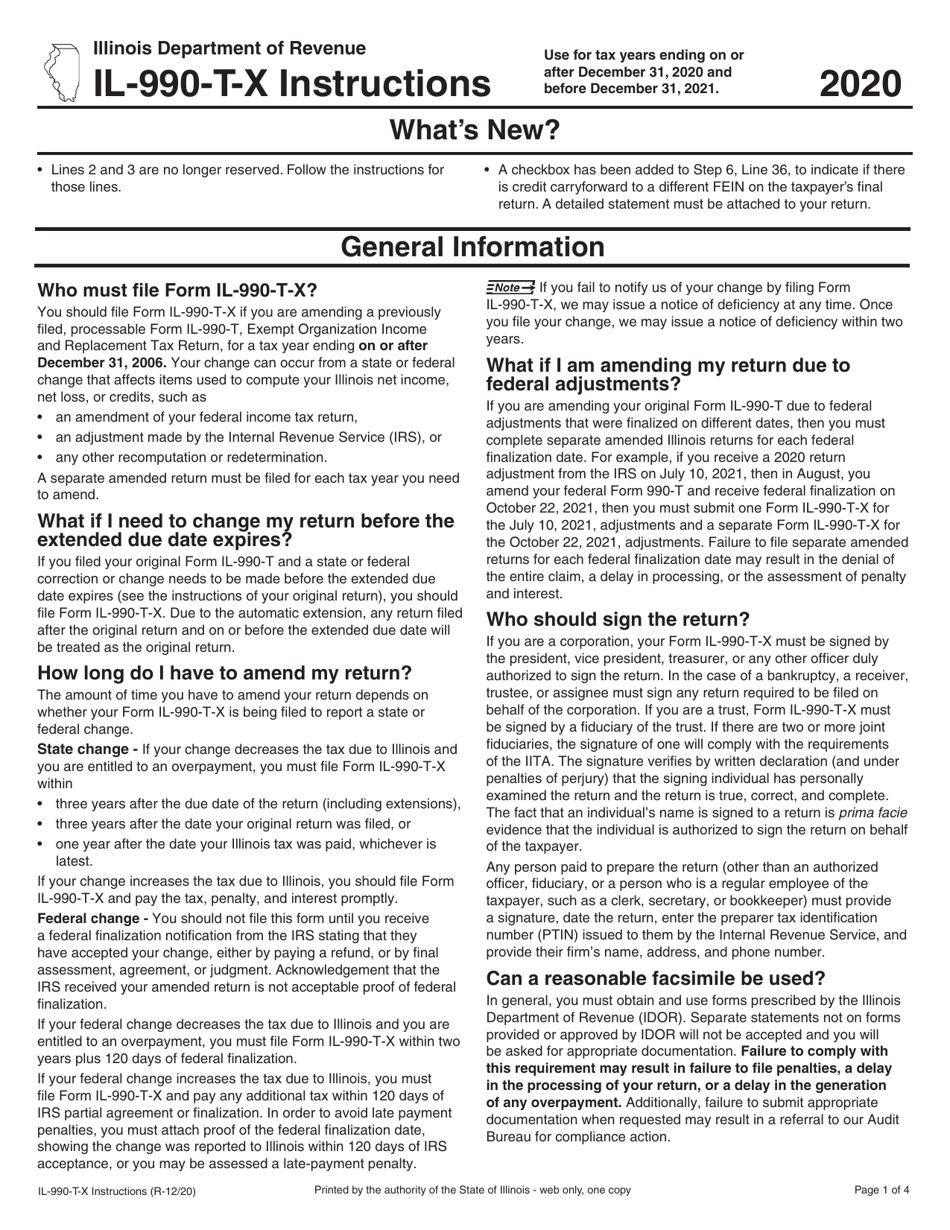

Instructions for Form IL-990-T-X

for the current year.

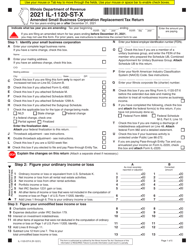

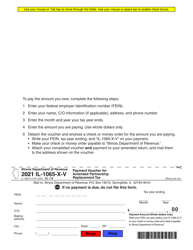

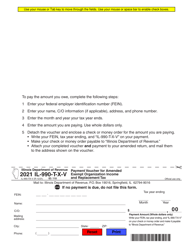

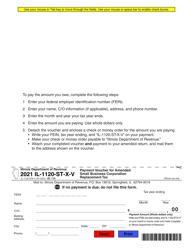

Instructions for Form IL-990-T-X Amended Exempt Organization Income and Replacement Tax Return - Illinois

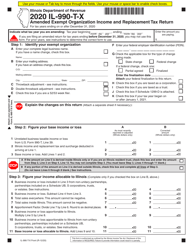

This document contains official instructions for Form IL-990-T-X , Amended Exempt Organization Income and Replacement Tax Return - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form IL-990-T-X is available for download through this link.

FAQ

Q: What is Form IL-990-T-X?

A: Form IL-990-T-X is the Amended Exempt Organization Income and Replacement Tax Return specific to Illinois.

Q: Who should file Form IL-990-T-X?

A: Exempt organizations in Illinois who need to amend their income and replacement tax return should file Form IL-990-T-X.

Q: What is the purpose of Form IL-990-T-X?

A: The purpose of Form IL-990-T-X is to report any changes or corrections to a previously filed exempt organization income and replacement tax return.

Q: When is Form IL-990-T-X due?

A: Form IL-990-T-X is due by the original due date of the exempt organization income and replacement tax return, which is the 15th day of the 5th month following the end of the organization's fiscal year.

Q: Are there any penalties for filing Form IL-990-T-X late?

A: Yes, there may be penalties for filing Form IL-990-T-X late. It is important to file the amended return as soon as possible to avoid any potential penalties or interest.

Q: Can I e-file Form IL-990-T-X?

A: No, Form IL-990-T-X must be filed by mail. There is currently no e-filing option for this form.

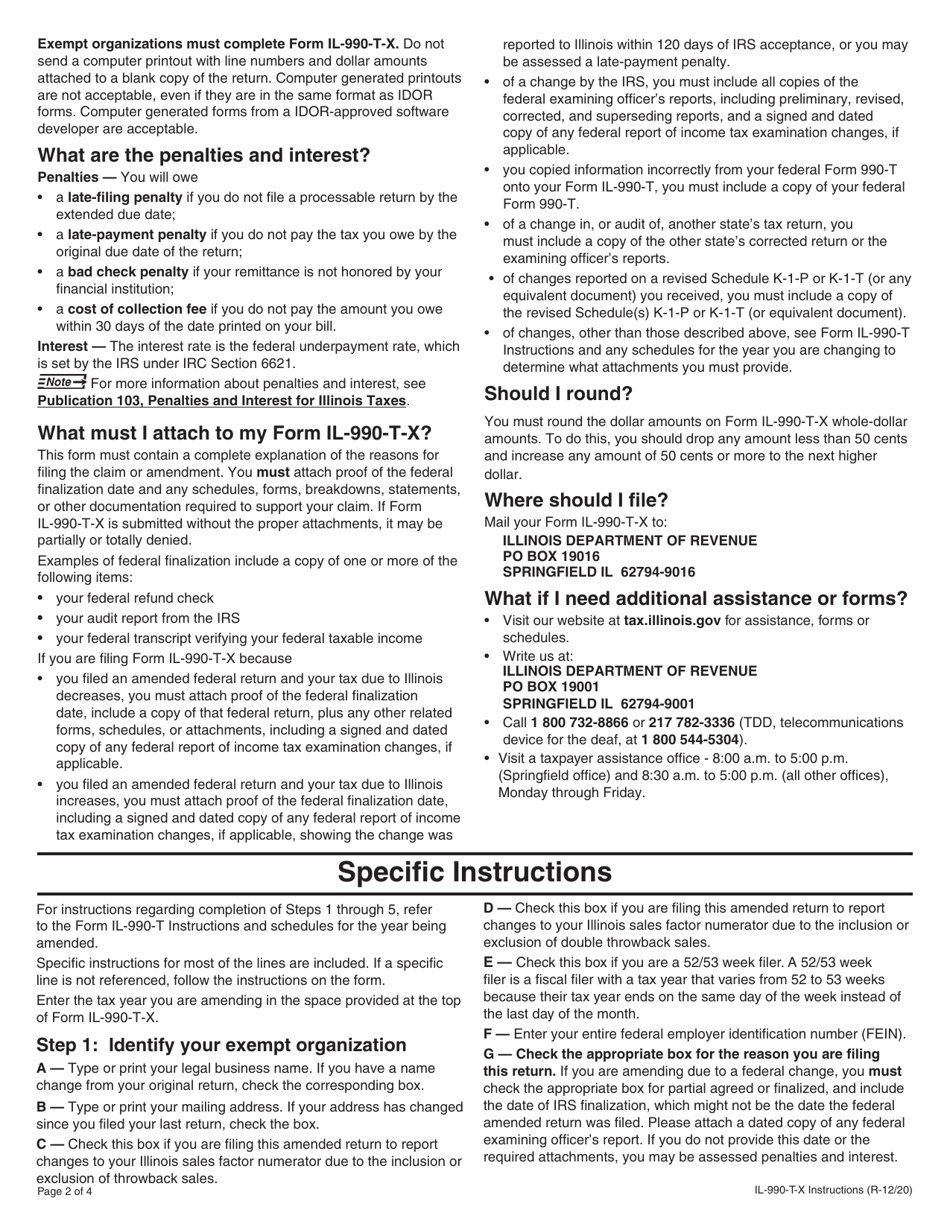

Q: Do I need to include any attachments with Form IL-990-T-X?

A: Yes, depending on the changes being made, you may need to include supporting documentation or schedules with Form IL-990-T-X. It is important to review the instructions for the form to determine which attachments are required.

Q: Can I file Form IL-990-T-X electronically?

A: No, Form IL-990-T-X cannot be filed electronically. It must be filed by mail.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.