This version of the form is not currently in use and is provided for reference only. Download this version of

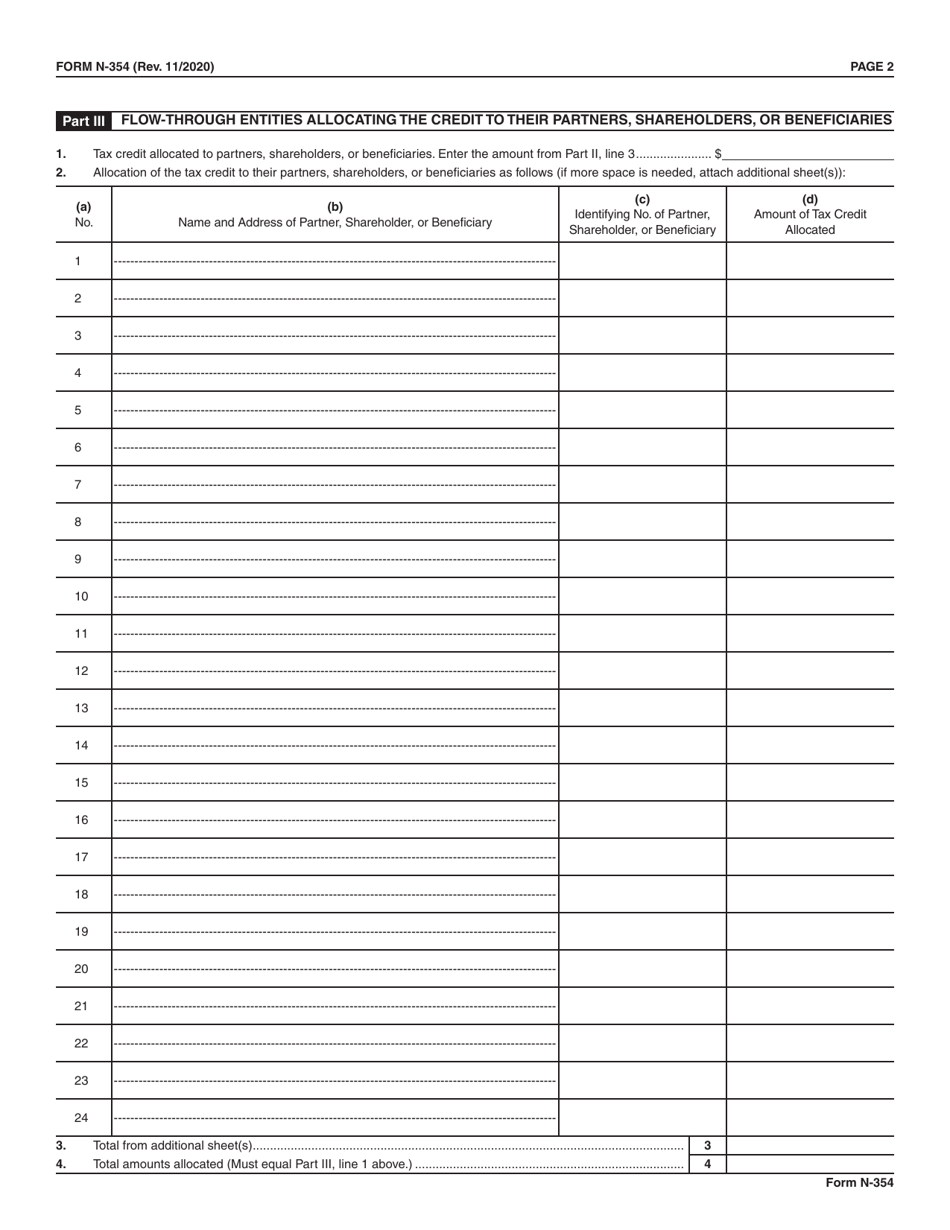

Form N-354

for the current year.

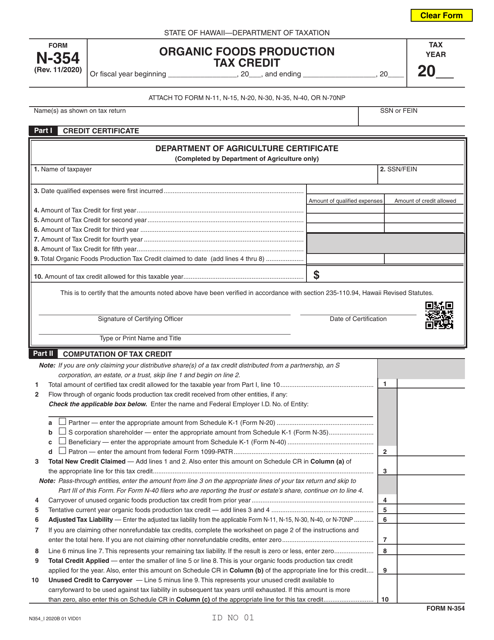

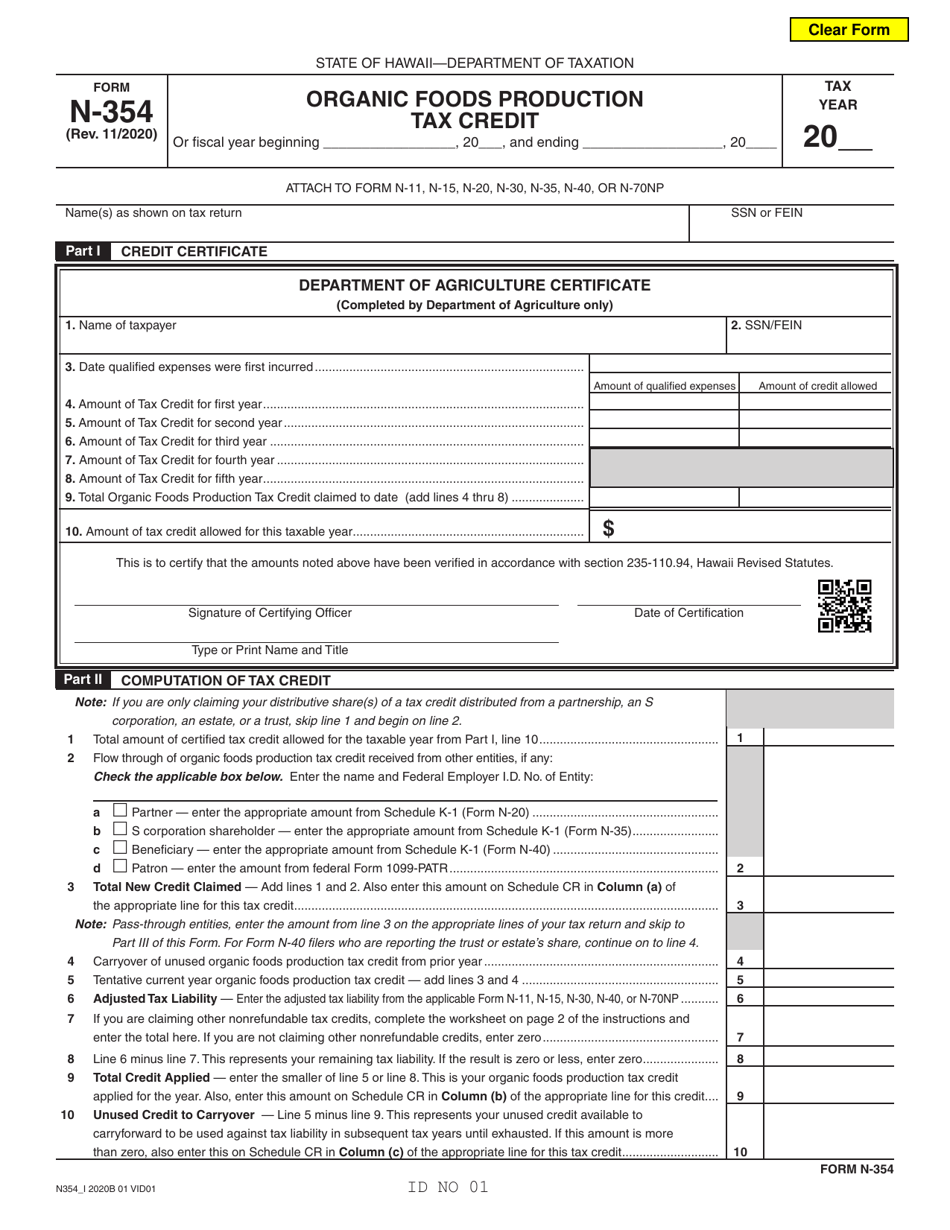

Form N-354 Organic Foods Production Tax Credit - Hawaii

What Is Form N-354?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-354?

A: Form N-354 is the Organic FoodsProduction Tax Credit form for Hawaii.

Q: What is the Organic Foods Production Tax Credit?

A: The Organic Foods Production Tax Credit is a tax credit available for organic food producers in Hawaii.

Q: Who is eligible for the Organic Foods Production Tax Credit?

A: Organic food producers in Hawaii who are certified by the Hawaii Department of Agriculture are eligible for the tax credit.

Q: What is the purpose of Form N-354?

A: Form N-354 is used to claim the Organic Foods Production Tax Credit.

Q: What information is required on Form N-354?

A: Form N-354 requires information about the organic food production activities, gross sales, and expenses of the taxpayer.

Q: When is Form N-354 due?

A: Form N-354 is due on or before the 20th day of the 4th month following the close of the tax year.

Q: How much is the Organic Foods Production Tax Credit?

A: The tax credit amount is determined based on the eligible expenses and the taxpayer's gross sales of organic food.

Q: Can the Organic Foods Production Tax Credit be carried forward or back?

A: Yes, the tax credit can be carried forward for up to 7 years or carried back for up to 3 years.

Q: Are there any limitations or restrictions for claiming the Organic Foods Production Tax Credit?

A: Yes, there are certain limitations and restrictions, such as a cap on the total amount of tax credits that can be claimed in a single year.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-354 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.