This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-354

for the current year.

Instructions for Form N-354 Organic Foods Production Tax Credit - Hawaii

This document contains official instructions for Form N-354 , Organic Foods Production Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-354 is available for download through this link.

FAQ

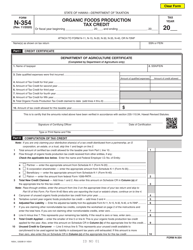

Q: What is Form N-354?

A: Form N-354 is a tax form used in Hawaii to claim the Organic FoodsProduction Tax Credit.

Q: What is the Organic Foods Production Tax Credit?

A: The Organic Foods Production Tax Credit is a credit available to farmers in Hawaii who produce organic food.

Q: Who can claim the Organic Foods Production Tax Credit?

A: Farmers in Hawaii who produce organic food can claim the Organic Foods Production Tax Credit.

Q: How do I qualify for the Organic Foods Production Tax Credit?

A: To qualify for the Organic Foods Production Tax Credit, you must meet the requirements specified by the Hawaii Department of Agriculture.

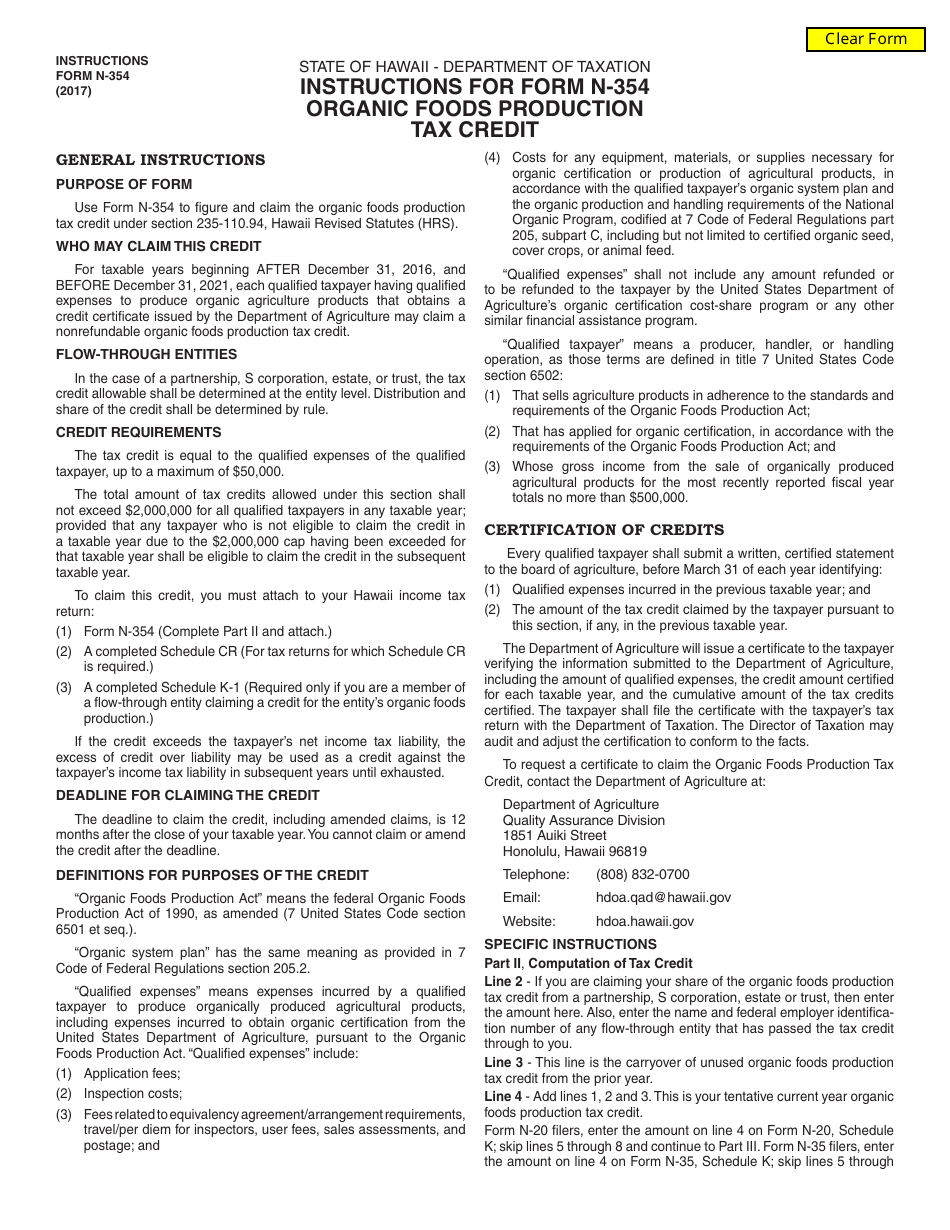

Q: When is the deadline to file Form N-354?

A: The deadline to file Form N-354 is the same as the deadline for filing your Hawaii income tax return, typically April 20th.

Q: What supporting documents do I need to submit with Form N-354?

A: You may need to submit documents such as organic certification documents or proof of organic food sales.

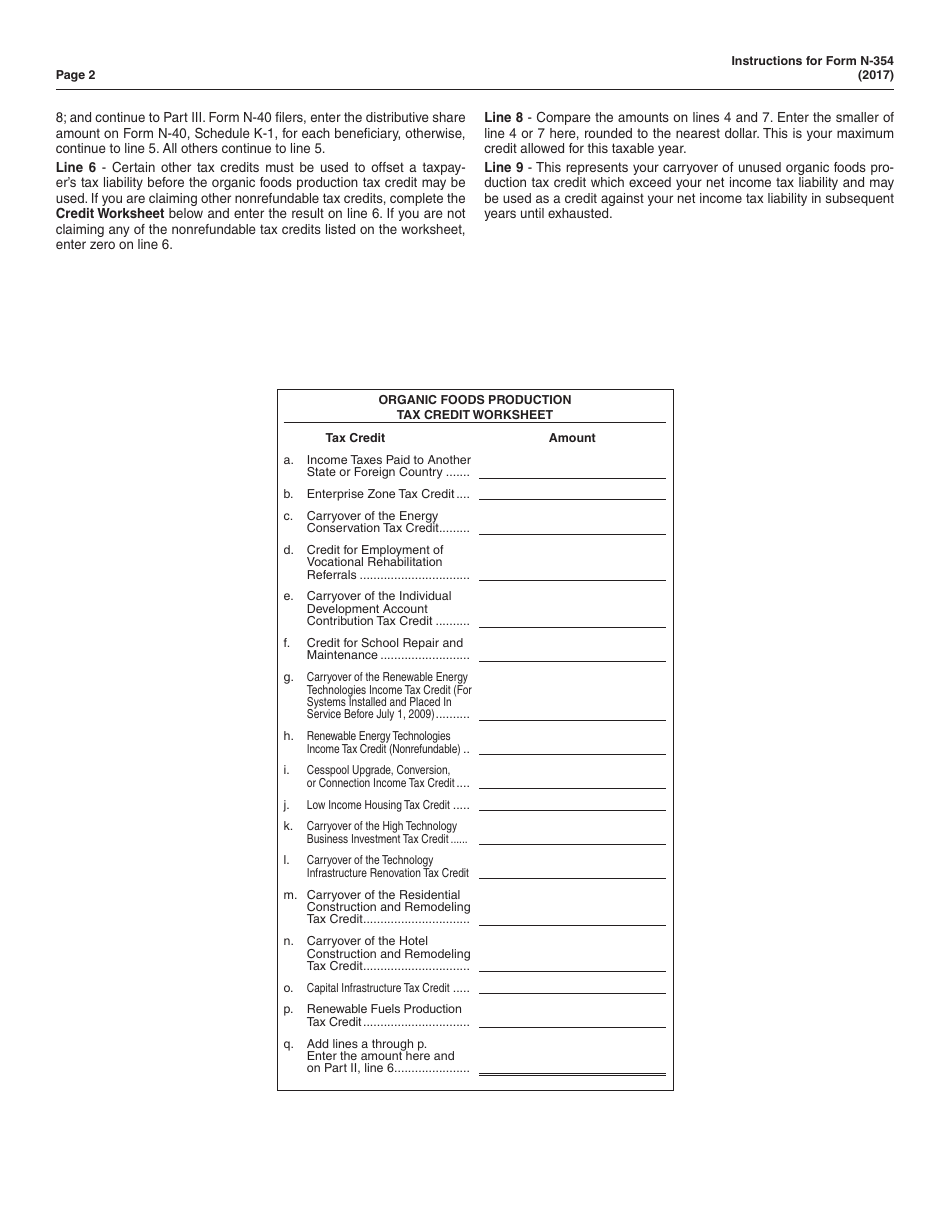

Q: How do I calculate the amount of the credit?

A: The credit amount is calculated based on the net income derived from the sale of organic food products.

Q: Can I carry forward any unused credit?

A: Yes, any unused credit can be carried forward for up to five years.

Q: What if I made a mistake on my Form N-354?

A: If you made a mistake on your Form N-354, you can file an amended return to correct the error.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.