This version of the form is not currently in use and is provided for reference only. Download this version of

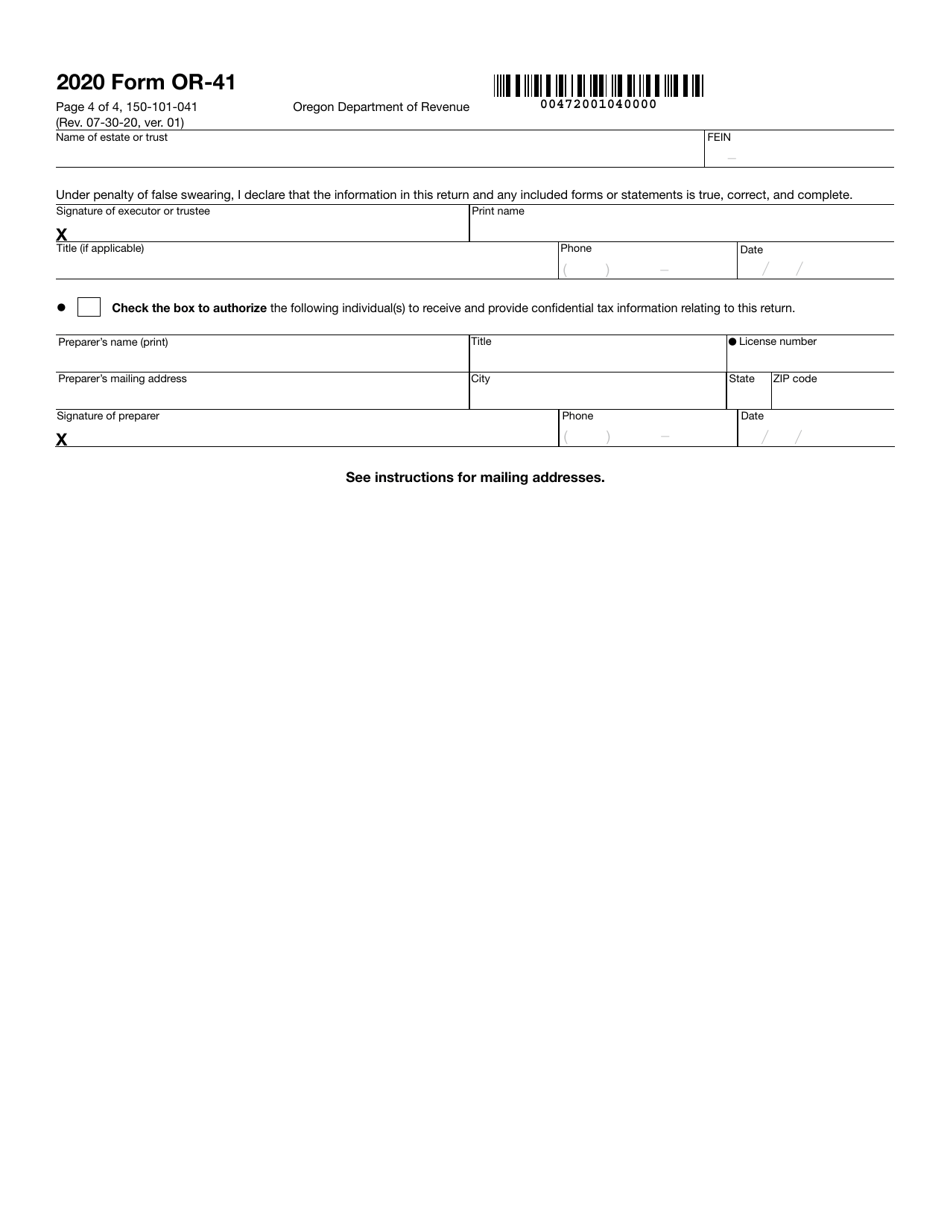

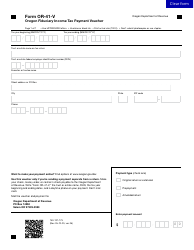

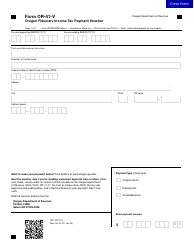

Form OR-41 (150-101-041)

for the current year.

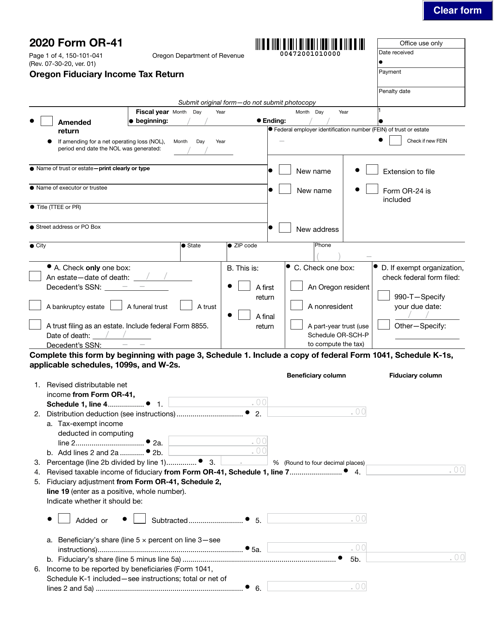

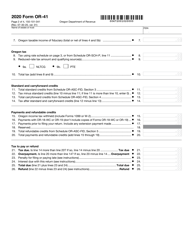

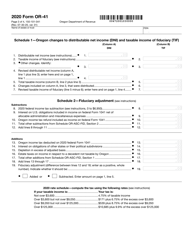

Form OR-41 (150-101-041) Oregon Fiduciary Income Tax Return - Oregon

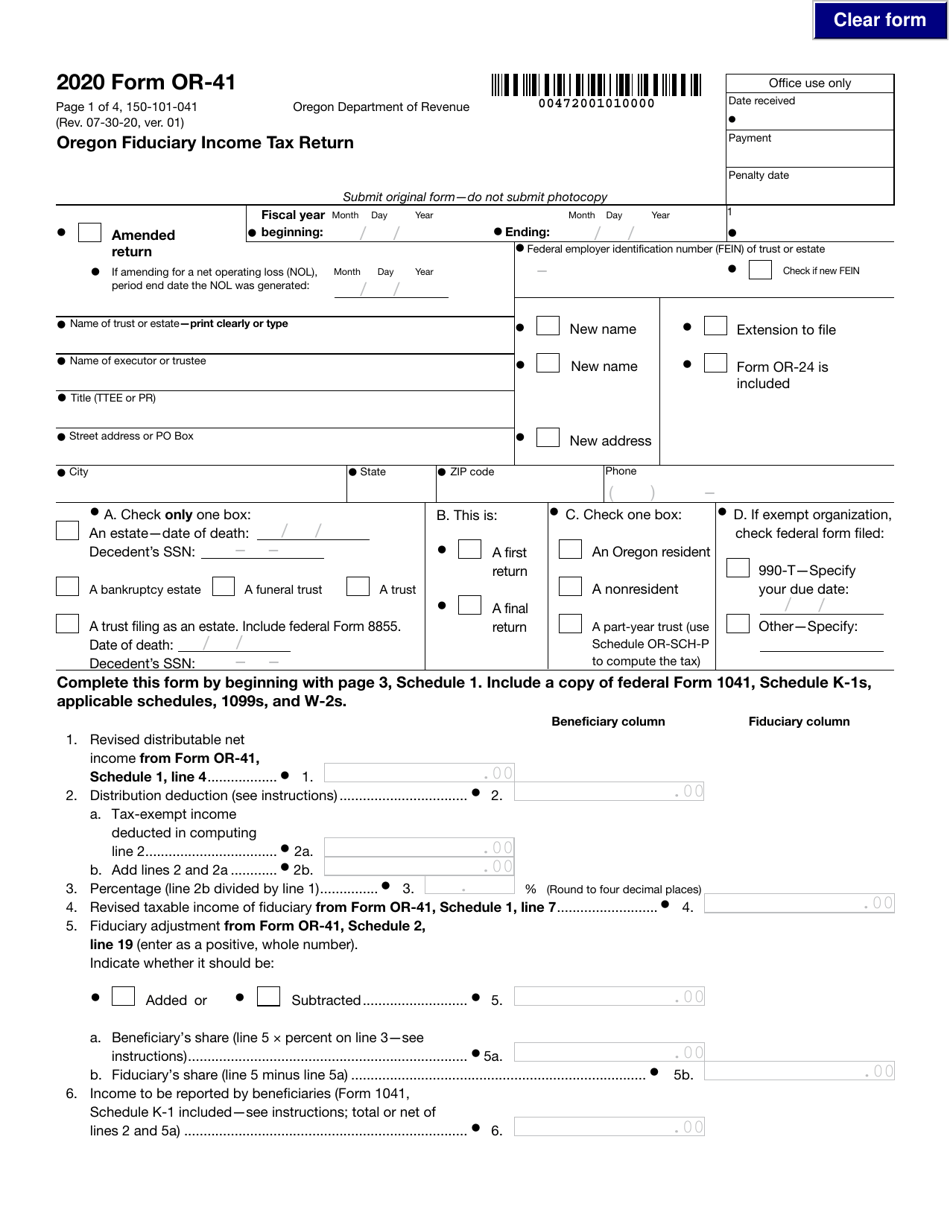

What Is Form OR-41 (150-101-041)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-41?

A: Form OR-41 is the Oregon Fiduciary Income Tax Return.

Q: Who needs to file Form OR-41?

A: Individuals or entities acting as a fiduciary in Oregon need to file Form OR-41.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that holds legal or financial responsibility for another person or entity.

Q: What is the purpose of Form OR-41?

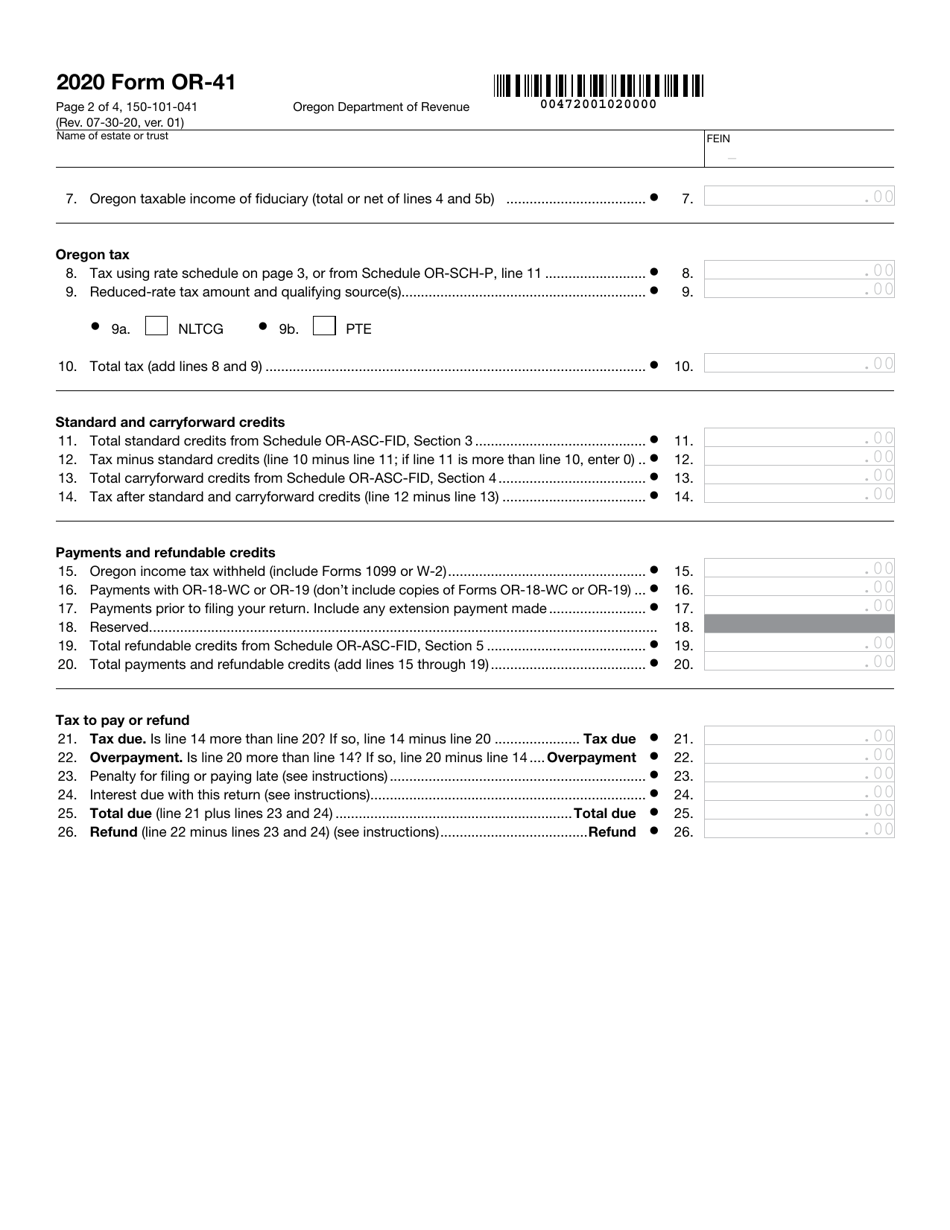

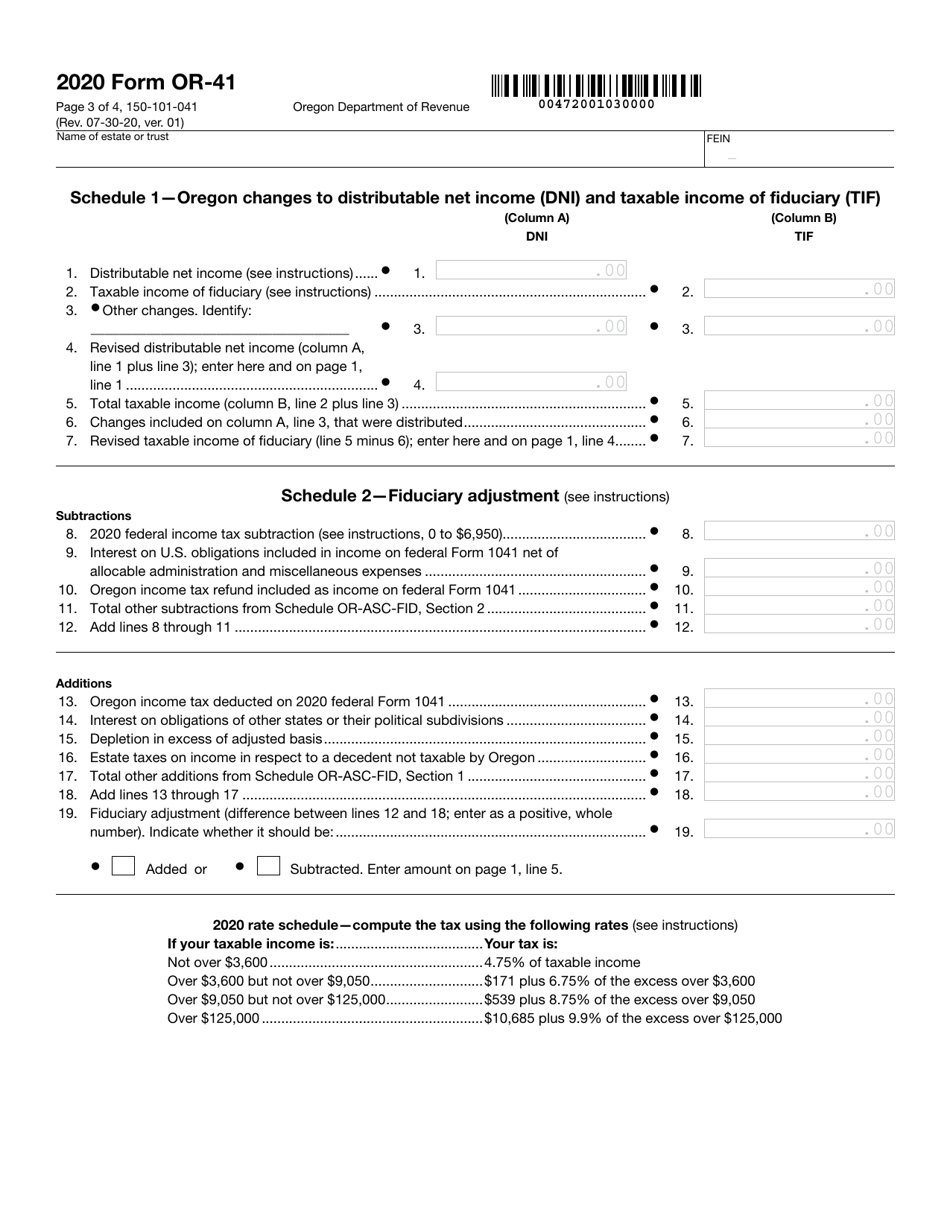

A: Form OR-41 is used to report and calculate the income tax owed by fiduciaries in Oregon.

Q: When is Form OR-41 due?

A: Form OR-41 is due on or before the 15th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file Form OR-41 on time to avoid penalties and interest.

Q: Is there a separate Form OR-41 for individuals and entities?

A: No, there is only one Form OR-41 for both individuals and entities acting as fiduciaries.

Q: Can Form OR-41 be filed electronically?

A: Yes, Form OR-41 can be filed electronically using the Oregon e-file system.

Q: What supporting documents are required with Form OR-41?

A: Supporting documents may include federal income tax returns, schedules, and any other documents relevant to the fiduciary's income and deductions.

Form Details:

- Released on July 30, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-41 (150-101-041) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.