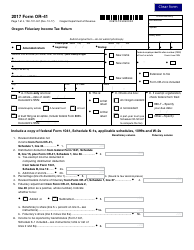

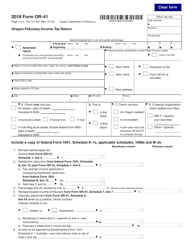

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form OR-41, 150-101-041

for the current year.

Instructions for Form OR-41, 150-101-041 Oregon Fiduciary Income Tax Return - Oregon

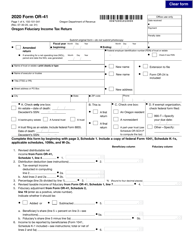

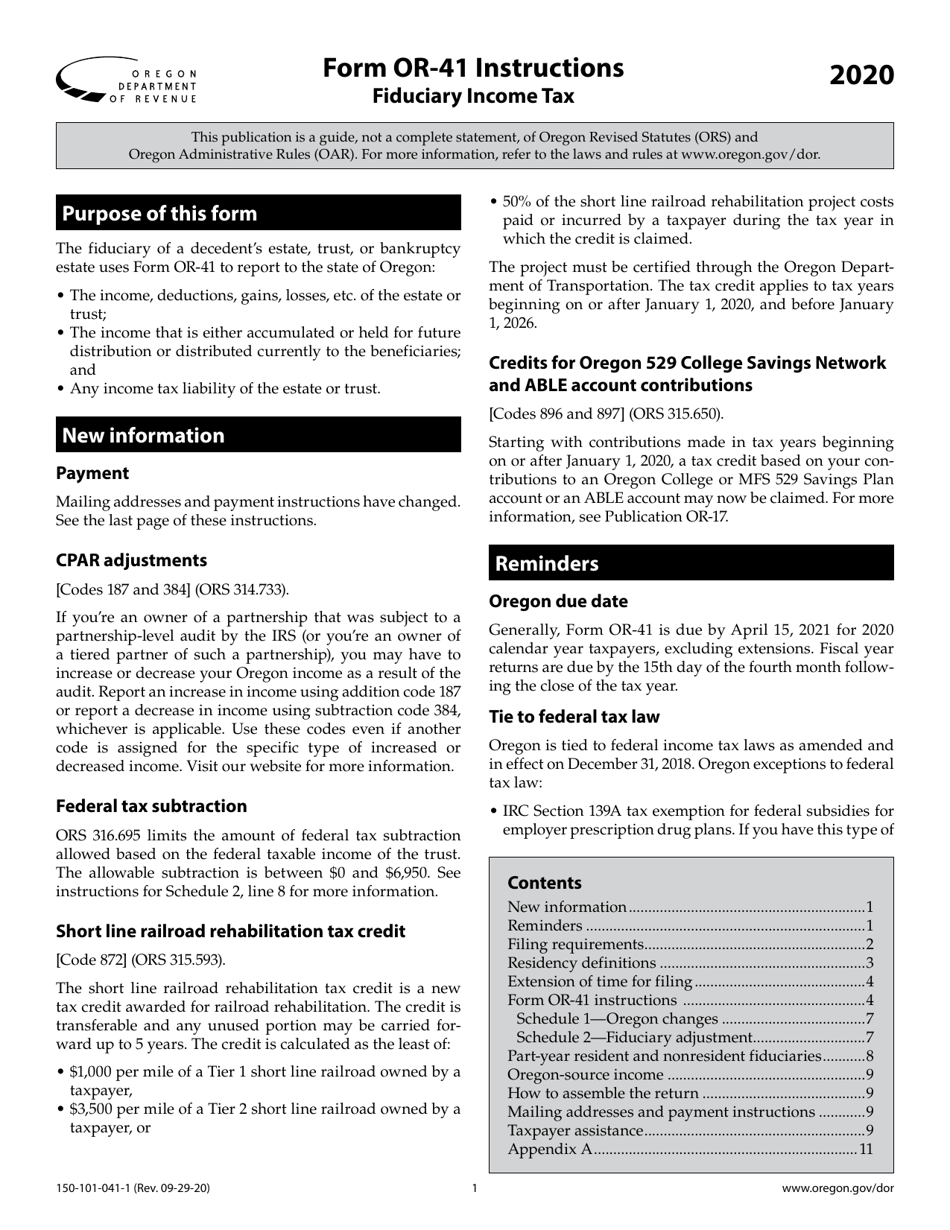

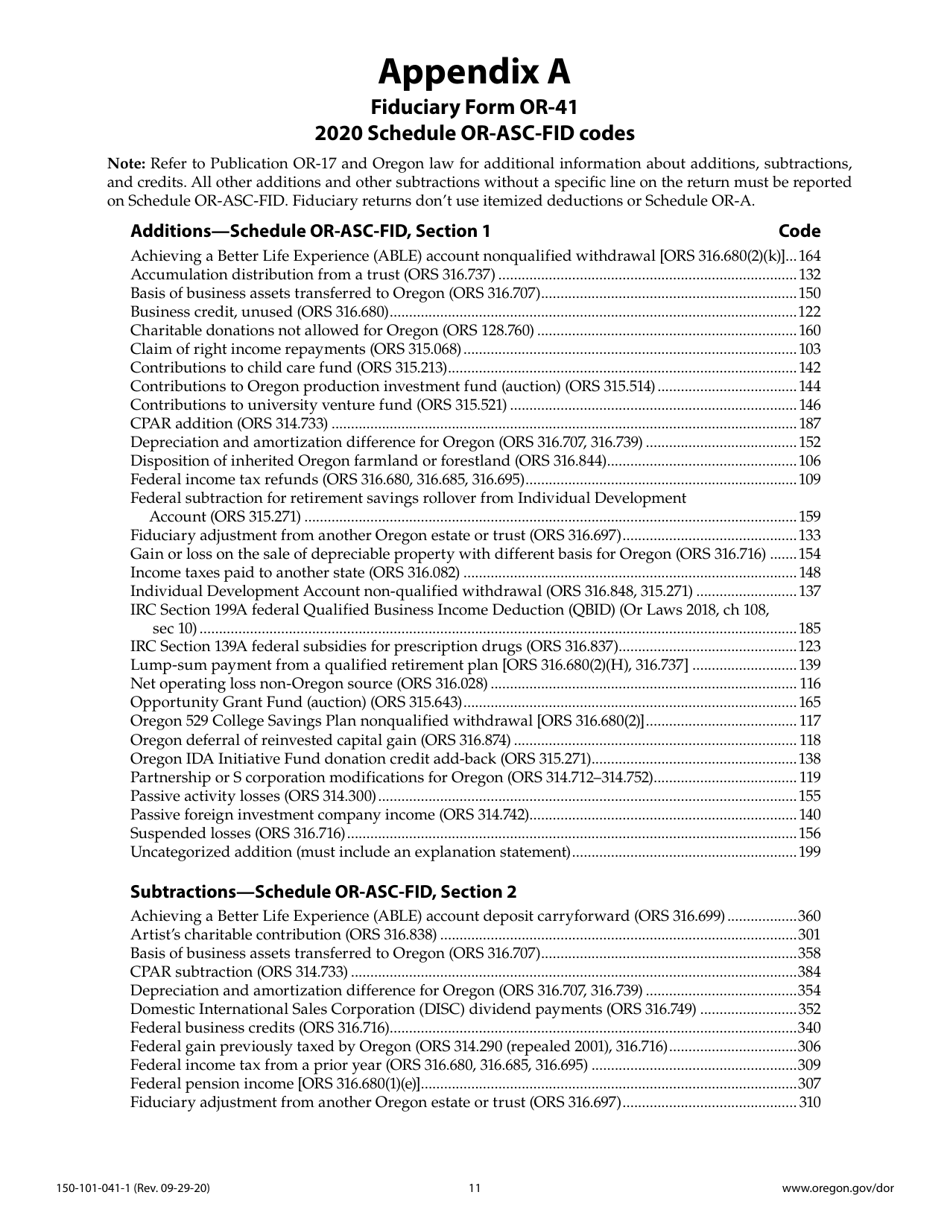

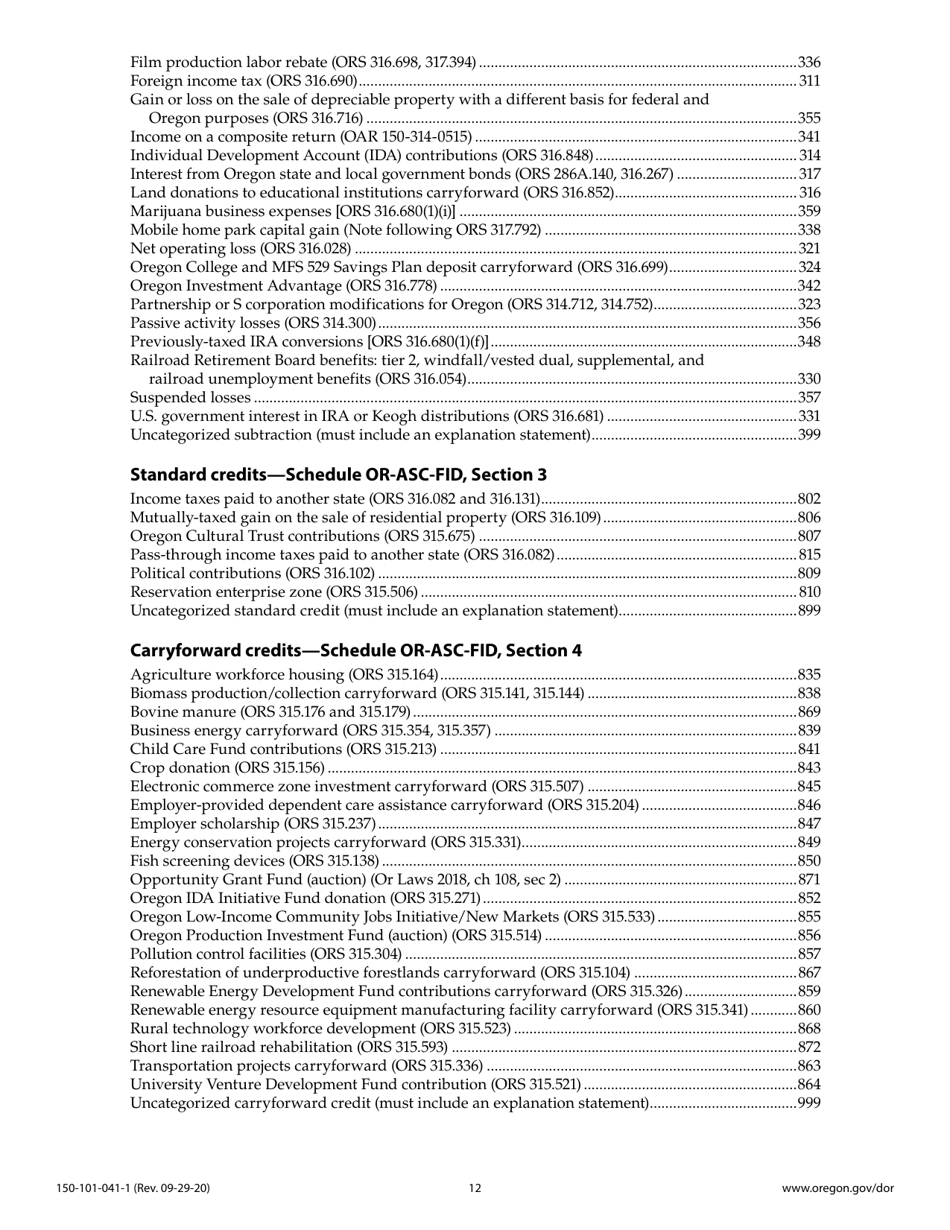

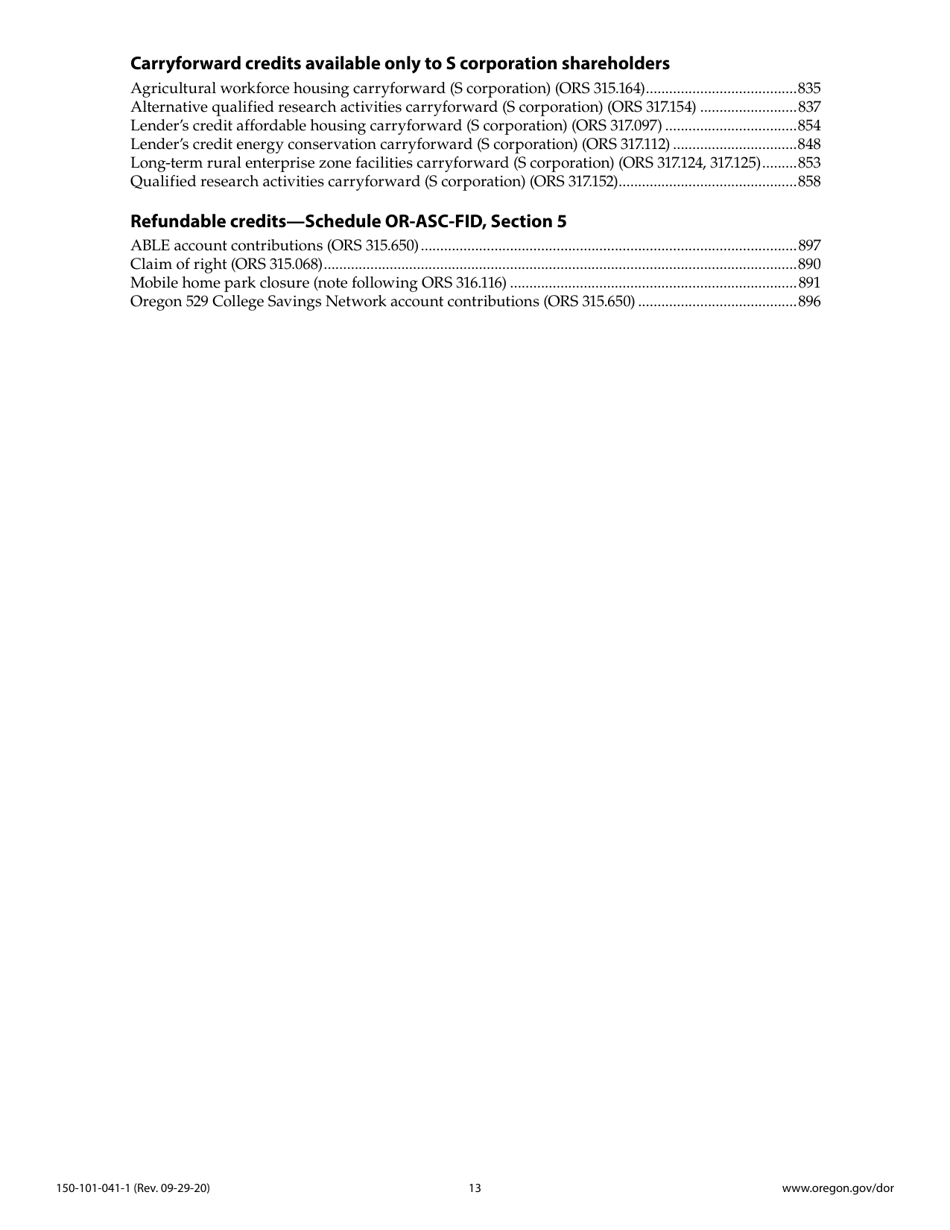

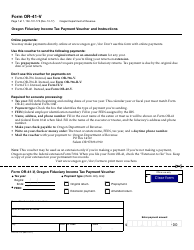

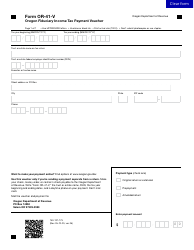

This document contains official instructions for Form OR-41 , and Form 150-101-041 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-41 (150-101-041) is available for download through this link.

FAQ

Q: What is Form OR-41?

A: Form OR-41 is the Oregon Fiduciary Income Tax Return.

Q: Who needs to file Form OR-41?

A: Any fiduciary (such as an executor, administrator, or trustee) who is responsible for filing the Oregon income tax return for a trust or estate needs to file Form OR-41.

Q: When is Form OR-41 due?

A: Form OR-41 is due on the 15th day of the 4th month following the close of the tax year, which is usually April 15th for calendar year filers.

Q: What information do I need to complete Form OR-41?

A: You will need information about the trust or estate's income, deductions, and credits, as well as the names and Social Security numbers of the beneficiaries.

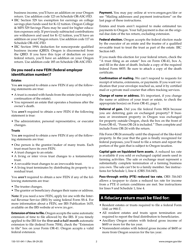

Q: Are there any special instructions for completing Form OR-41?

A: Yes, the instructions for Form OR-41 provide detailed guidance on how to complete each section of the form. Make sure to read and follow the instructions carefully.

Instruction Details:

- This 13-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.