This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-102-043 Schedule OR-LTEZ

for the current year.

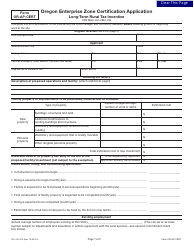

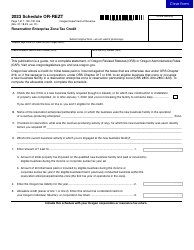

Instructions for Form 150-102-043 Schedule OR-LTEZ Long-Term Enterprise Zone Facilities Credit - Oregon

This document contains official instructions for Form 150-102-043 Schedule OR-LTEZ, Long-Term Enterprise Zone Facilities Credit - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-102-043 Schedule OR-LTEZ is available for download through this link.

FAQ

Q: What is Form 150-102-043?

A: Form 150-102-043 is the Schedule OR-LTEZ Long-Term Enterprise Zone Facilities Credit for Oregon.

Q: What is the purpose of this form?

A: The purpose of this form is to claim the Long-Term Enterprise Zone Facilities Credit in Oregon.

Q: Who is eligible to use this form?

A: Taxpayers who have a qualified facility located in an Oregon enterprise zone and have obtained certification for the Long-Term Enterprise Zone Facilities Credit are eligible to use this form.

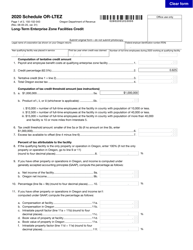

Q: What information is required on this form?

A: This form requires information about the taxpayer, the qualified facility, the amount of credit being claimed, and any carryforward amounts.

Q: Is there a deadline to file this form?

A: Yes, this form must be filed by the due date for the taxpayer's Oregon income tax return, including extensions.

Q: Are there any other documents that need to be attached to this form?

A: Yes, you must attach a copy of the certification letter issued by the Oregon Department of Revenue for the Long-Term Enterprise Zone Facilities Credit.

Q: What should I do if I have questions about this form?

A: If you have questions about this form, you can contact the Oregon Department of Revenue for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.