This version of the form is not currently in use and is provided for reference only. Download this version of

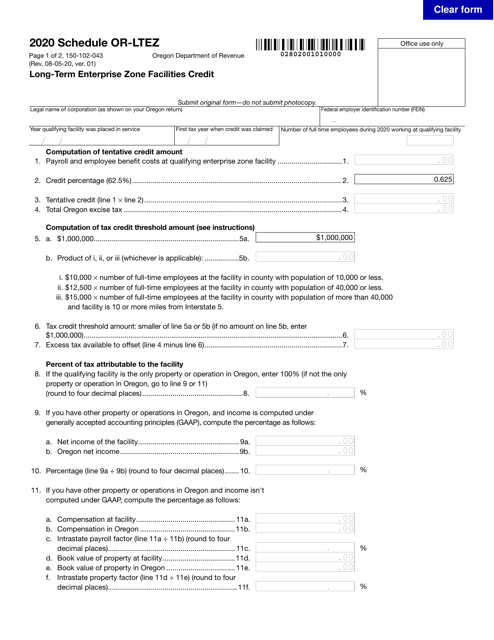

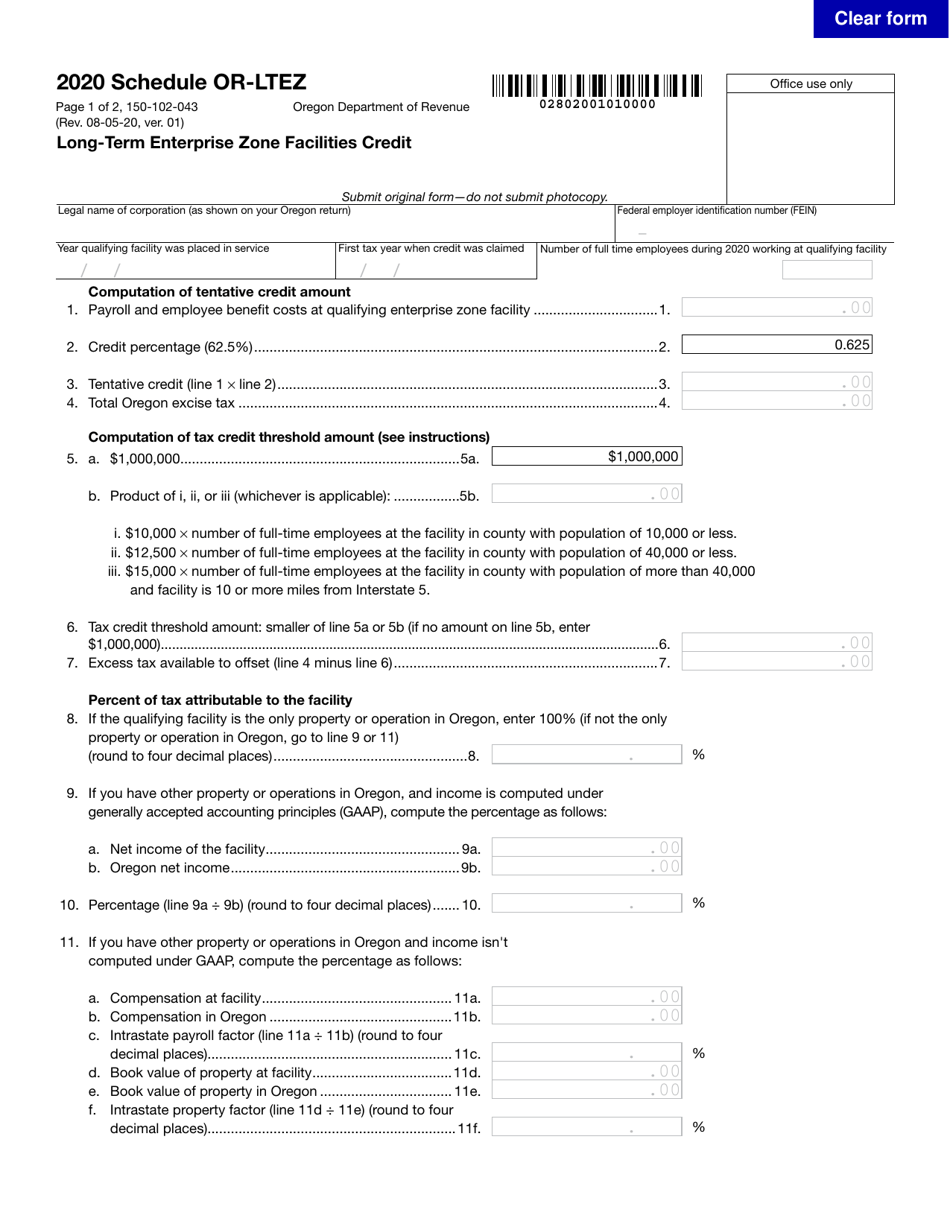

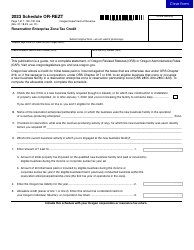

Form 150-102-043 Schedule OR-LTEZ

for the current year.

Form 150-102-043 Schedule OR-LTEZ Long-Term Enterprise Zone Facilities Credit - Oregon

What Is Form 150-102-043 Schedule OR-LTEZ?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-043?

A: Form 150-102-043 is a schedule used to claim the Long-Term Enterprise Zone Facilities Credit in Oregon.

Q: What is the Long-Term Enterprise Zone Facilities Credit?

A: The Long-Term Enterprise Zone Facilities Credit is a tax incentive program in Oregon that provides credits to qualifying businesses located in designated enterprise zones.

Q: Who is eligible to claim the Long-Term Enterprise Zone Facilities Credit?

A: Businesses that meet certain criteria and are located in designated enterprise zones in Oregon are eligible to claim the credit.

Q: How do I fill out Form 150-102-043?

A: You need to provide information about your business, the enterprise zone, and the qualifying facility in order to complete the form.

Form Details:

- Released on August 5, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-043 Schedule OR-LTEZ by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.