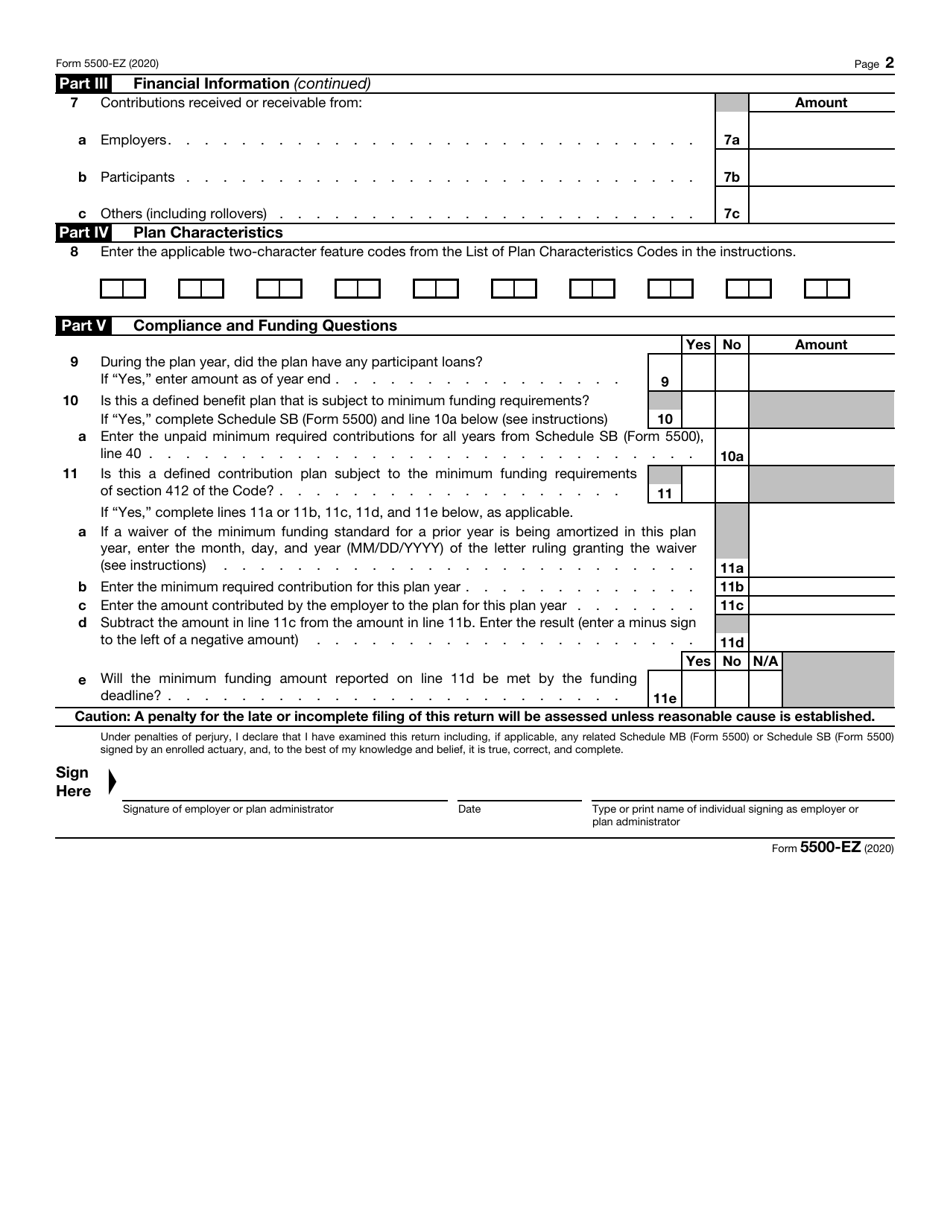

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 5500-EZ

for the current year.

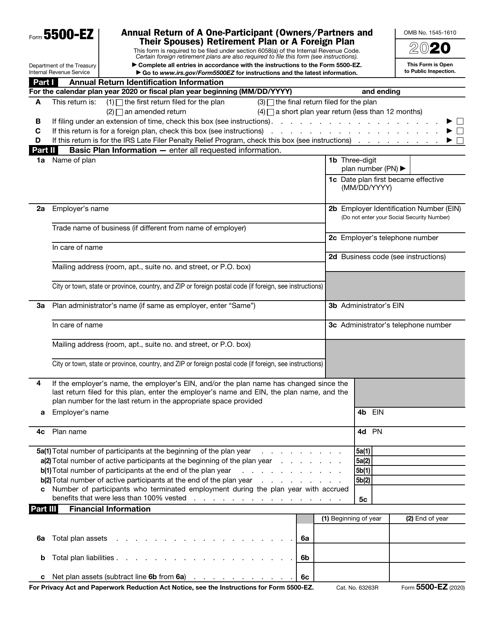

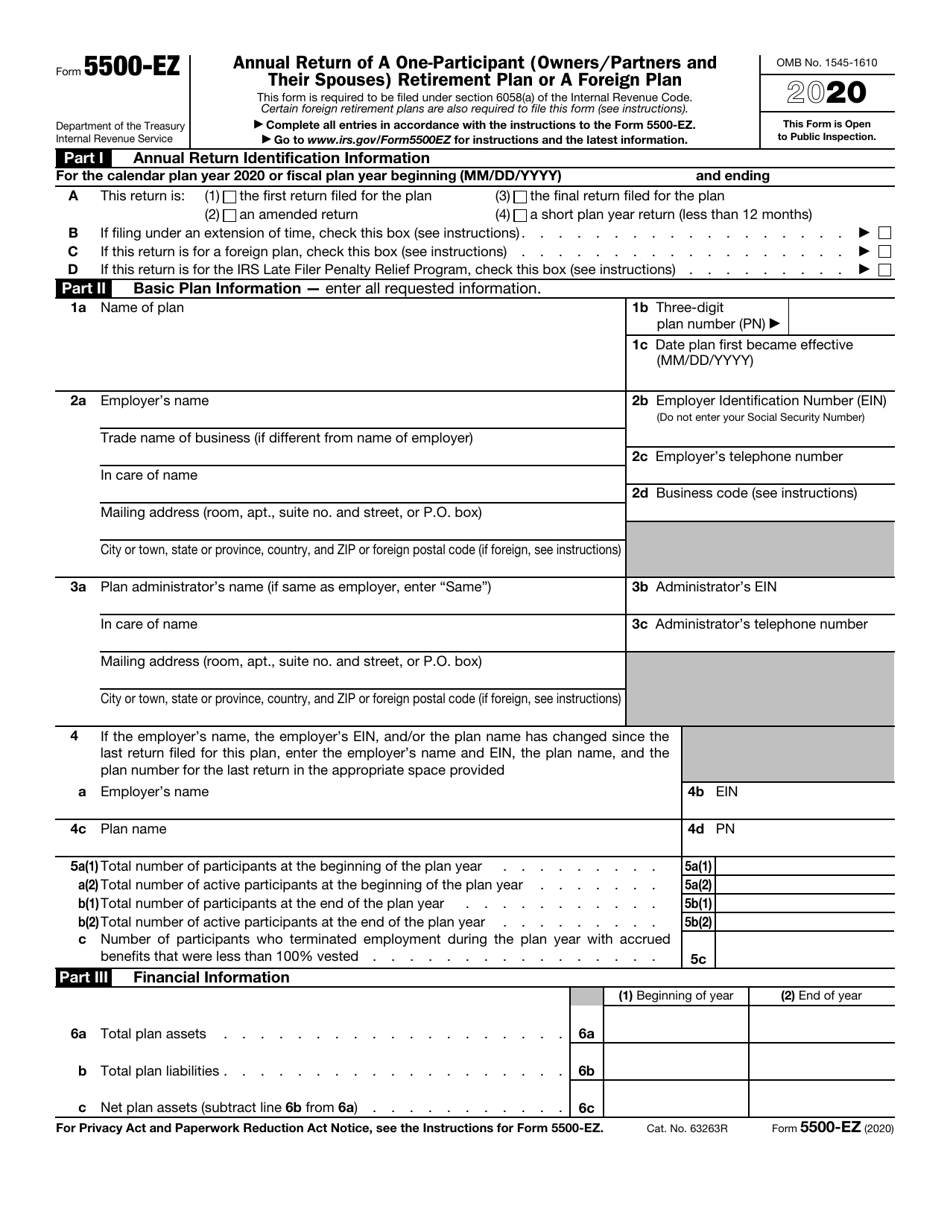

IRS Form 5500-EZ Annual Return of a One-Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

What Is IRS Form 5500-EZ?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 5500-EZ?

A: Form 5500-EZ is an annual return for one-participant retirement plans or foreign plans.

Q: Who needs to file Form 5500-EZ?

A: Owners, partners, or their spouses of one-participant retirement plans or foreign plans need to file Form 5500-EZ.

Q: What is a one-participant retirement plan?

A: A one-participant retirement plan is a retirement plan that covers only the owner (or owner and their spouse) of a business.

Q: What is a foreign plan?

A: A foreign plan is a retirement plan that is maintained outside the United States.

Q: What information is required on Form 5500-EZ?

A: Form 5500-EZ requires information regarding plan participants, contributions, investments, and distributions.

Q: When is Form 5500-EZ due?

A: Form 5500-EZ is generally due by the last day of the seventh month after the plan year ends.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form 5500-EZ. It is important to file on time to avoid these penalties.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5500-EZ through the link below or browse more documents in our library of IRS Forms.